Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Trump Administration To Propose Lower Fuel Economy Standards For Heavy Duty Pickup Trucks, Vans — NHTSA

Mexico Finance Ministry: In 2025, The Budget Deficit Stood At 3.9% Of GDP, Lower Than The 5.0% Observed In 2024

EU Industry Associations: China Has Proposed Final Anti-Subsidy Duties On EU Dairy Products At Lower Levels Than In Provisional Duties

Canada Transport Minister Says His Officials Are In Communication With Their USA Counterparts, Says Government 'Is Actively Working On This Situation'

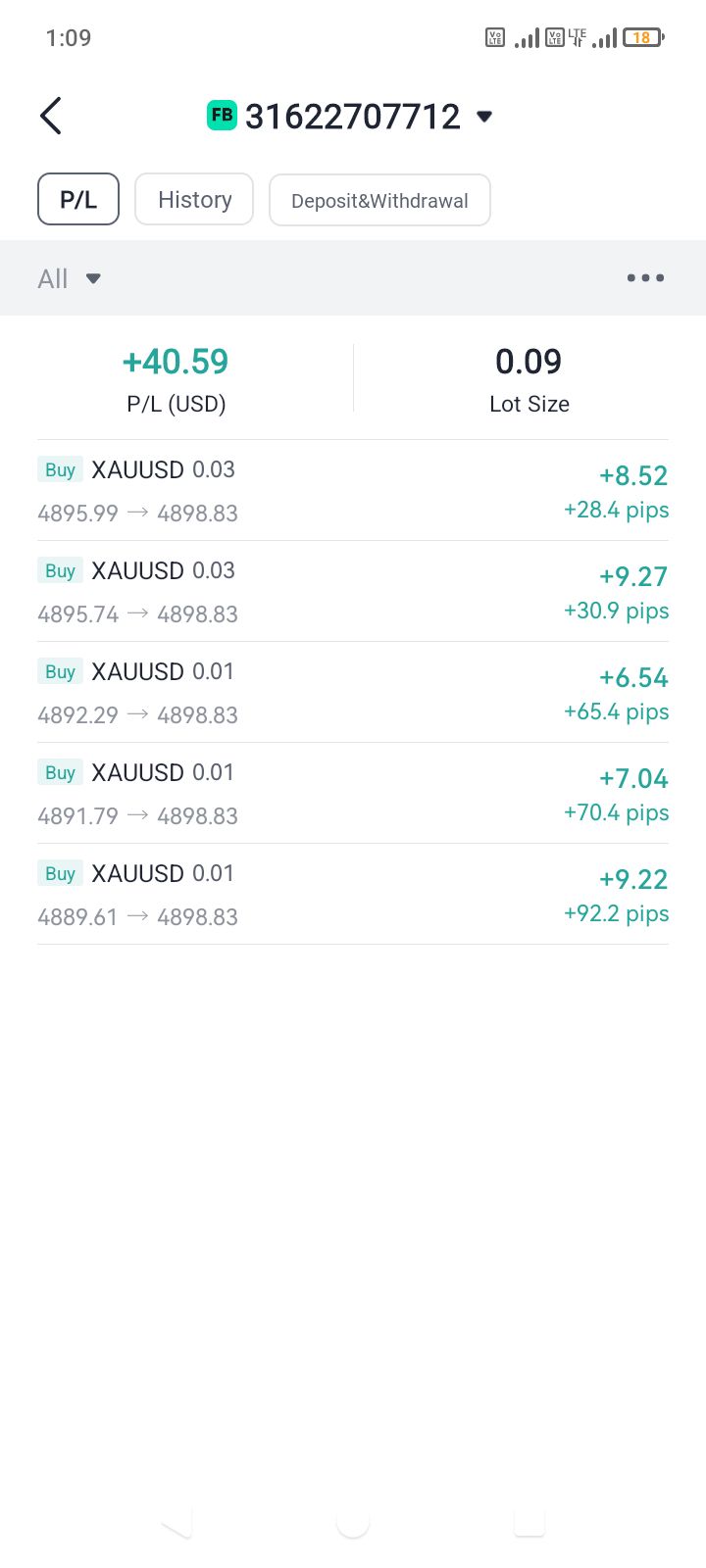

[Spot Gold Rebounds Above $4900/Ounce, Surges Over $200 From Daily Low] January 31St, According To Bitget Market Data, Spot Gold Returned To $4900 Per Ounce, Rebounding Over $200 From The Daily Low

St. Louis Federal Reserve President Musalem: Warsh Is Fully Qualified To Serve As Chairman Of The Federal Reserve

St. Louis Federal Reserve President Musalem: Tariffs Account For About Half Of The Current Inflation Exceeding The Target

[Survey Shows Calls For Rate Hikes This Year Weaken; ECB May Keep Rates Unchanged Until End Of Next Year] With Calls For A 2026 Rate Hike Waning, The European Central Bank (ECB) Is Expected To Keep Interest Rates Unchanged Until At Least The End Of Next Year. Economists Surveyed Unanimously Predict That The ECB Governing Council Will Maintain The Deposit Rate At 2% When It Meets In Frankfurt On February 4-5. While The Percentage Of Those Expecting One Or More Rate Hikes Before 2028 Has Risen From About A Quarter In The Previous Survey To A Third, Fewer Believe Such Action Will Be Taken This Year

IMF: Bangladesh's Inflation Projected To Remain Elevated At 8.9% In Fy26 Before Subsiding To Around 6% In Fy27

ICE - Brent Crude Speculators Raise Net Long Positions By 29947 Contracts To 246917 In Week To January 27

ICE - Gasoil Speculators Raise Net Long Positions By 7479 Contracts To 74062 In Week To January 27

ICE Futures Europe - Robusta Coffee Speculators Raise Net Long Position By 7124 Lots To 14057 Lots As Of Jan 27 - Exchange Cot Data

ICE Futures Europe - Cocoa Speculators Trim Net Short Position By 1653 Lots To 23192 Lots As Of Jan 27 - Exchange Cot Data

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Before meeting President Joe Biden in Washington D.C., Japanese Prime Minister Fumio Kishida visited Italy, France, Britain and Canada, in part to forge security ties that could help it fend off China, North Korea and Russia.

ONS data suggests that's partly down to already-inactive or unemployed people being reclassified, but there's still been an impact on employment, particularly in lower-paid, consumer-facing industries. A fall in inward migration of EU workers through the pandemic has also likely contributed to worker shortages.

ONS data suggests that's partly down to already-inactive or unemployed people being reclassified, but there's still been an impact on employment, particularly in lower-paid, consumer-facing industries. A fall in inward migration of EU workers through the pandemic has also likely contributed to worker shortages. Second, it could prompt a more aggressive response from the Bank of England. More persistent labour shortages risk keeping core inflation higher for longer, and BoE hawks may see that as a reason to hit economic demand more aggressively. This was roughly the argument being put forward by BoE Chief Economist Huw Pill in a recent speech.

Second, it could prompt a more aggressive response from the Bank of England. More persistent labour shortages risk keeping core inflation higher for longer, and BoE hawks may see that as a reason to hit economic demand more aggressively. This was roughly the argument being put forward by BoE Chief Economist Huw Pill in a recent speech. A little more than a quarter of UK households have a mortgage, which puts the UK in the middle of the pack among OECD countries, and there are now more UK dwellings owned outright than mortgaged. Similarly, the UK doesn't stand out when looking at changes in price-to-income ratios since 2015.

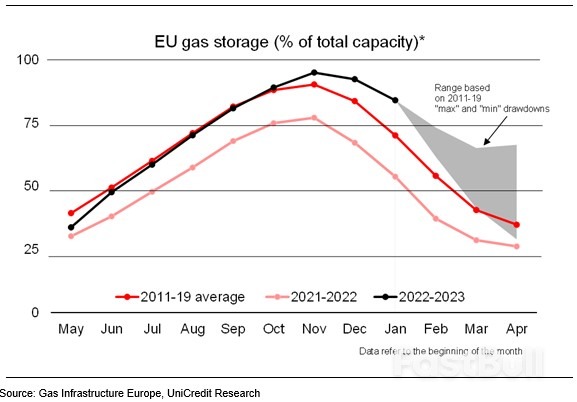

A little more than a quarter of UK households have a mortgage, which puts the UK in the middle of the pack among OECD countries, and there are now more UK dwellings owned outright than mortgaged. Similarly, the UK doesn't stand out when looking at changes in price-to-income ratios since 2015. Britain's exposure to Europe's energy crisis

Britain's exposure to Europe's energy crisis Short-term disruption aside, there's no clear reason why the UK should benefit less from the recent fall in gas prices – and instead, it will come down to relative support from the government.

Short-term disruption aside, there's no clear reason why the UK should benefit less from the recent fall in gas prices – and instead, it will come down to relative support from the government. Where 2022 had initially been shaping up as a brighter year, investment intentions have unsurprisingly turned lower. That's partly because higher interest rates are hitting businesses much more rapidly than consumers, a function of 70% of outstanding small and medium-sized enterprise lending being on a floating rate product.

Where 2022 had initially been shaping up as a brighter year, investment intentions have unsurprisingly turned lower. That's partly because higher interest rates are hitting businesses much more rapidly than consumers, a function of 70% of outstanding small and medium-sized enterprise lending being on a floating rate product. Where does that leave the UK outlook?

Where does that leave the UK outlook?

Source: Reuters

Source: ReutersWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up