Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Discover who started Bonk Coin and how this Solana-based meme token became a community-driven success, reshaping the ecosystem after the FTX collapse.

Many crypto enthusiasts are asking who started Bonk Coin after its explosive rise on the Solana network. This community-driven meme token quickly became a symbol of Solana’s revival. In this article, we explore its origins, creators, and the story that turned Bonk into a viral success across the crypto world.

Bonk Coin is a meme-based cryptocurrency built on the Solana blockchain, launched as a community experiment to revive enthusiasm in the ecosystem. Known for its playful branding and wide token distribution, Bonk quickly gained traction as traders embraced its lighthearted nature and community-first values.

For those wondering what is bonk crypto, it’s designed as a decentralized token where no single entity controls its supply or governance. Its main appeal lies in representing the Solana community’s resilience and humor during a period of market downturn.

With its viral mascot and community-driven mission, Bonk has evolved into one of Solana’s most recognizable meme assets, often compared to Dogecoin and Shiba Inu for its cultural influence and trading enthusiasm.

The question of who started Bonk Coin remains one of the most discussed topics in the Solana community. Bonk was created by a group of anonymous developers and NFT project leaders who wanted to bring fairness and positivity back to the ecosystem after the FTX collapse.

While the bonk coin owner name has never been officially revealed, the founding team emphasized decentralization from the start. Their goal was to ensure that no single founder or investor could dominate the token’s supply—a clear statement against insider control. This aligns with what many users associate with the original bonk meme spirit: humor, community, and inclusivity.

Bonk’s launch occurred in late December 2022, marking its bonk coin release date as a turning point for Solana. It was distributed through a massive airdrop, with 50% of tokens going directly to the community—developers, NFT creators, and traders. This transparent approach set it apart from other meme projects.

| Detail | Information |

|---|---|

| Bonk Coin Founder | Anonymous Solana community developers |

| Bonk Coin Release Date | December 25–30, 2022 |

| Is Bonk a Meme Coin? | Yes, a community-driven meme token on Solana |

| Distribution Model | 50% community airdrop, 20% ecosystem development, 20% contributors, 10% reserve |

Despite remaining anonymous, the creators’ strategy and community engagement shaped Bonk’s image as a symbol of Solana’s comeback. For many, understanding who owns bonk coin is less about identity and more about recognizing the collective power of the people behind its growth.

Bonk Coin’s rise was powered by the strength and enthusiasm of the Solana community. After the ecosystem suffered setbacks following the FTX collapse, Bonk offered a fresh narrative—hope and humor. Developers, NFT creators, and everyday traders united around the token, spreading its story across social platforms.

The project’s creators—often referred to as the anonymous bonk coin founder group—intentionally structured it to be community-first. This decentralized spirit reinforced the idea that no single bonk coin owner name mattered more than the collective movement itself. Bonk thus became more than a meme—it became a symbol of Solana’s revival.

Airdrops played a central role in Bonk’s viral success. Half of the total token supply was distributed directly to active users, NFT holders, and Solana developers, ensuring fair access and immediate engagement. This massive airdrop created instant buzz, prompting traders to explore what is bonk crypto and why it mattered.

Strategic partnerships with popular Solana NFT projects like DeGods and y00ts further boosted visibility. Integrating Bonk into NFT marketplaces and decentralized applications turned it into a usable asset instead of just a meme token.

Bonk’s tokenomics were designed to reward activity and growth rather than speculation. The distribution model favored the community and ecosystem builders, helping maintain balance between accessibility and sustainability.

| Allocation | Percentage | Purpose |

|---|---|---|

| Community Airdrop | 50% | Reward early Solana users and NFT creators |

| Ecosystem Development | 20% | Fund partnerships and integrations |

| Contributors and Team | 20% | Support developers and marketing efforts |

| Reserve | 10% | Liquidity and long-term stability |

This structure emphasized fairness and transparency, helping investors feel confident that Bonk was not another insider-controlled project. The bonk coin release date in December 2022 marked the beginning of a community-driven financial experiment unlike any other in the Solana ecosystem.

Bonk’s success demonstrates the power of community alignment and transparent economics. It reminded crypto investors that innovation doesn’t always stem from centralized leadership. Instead, collaborative effort, humor, and shared values can revive an entire ecosystem. The story of who started bonk coin and how it spread also inspired other meme coins to prioritize decentralization.

While Bonk shares playful roots with Dogecoin and Shiba Inu, it stands apart in several ways. Built on Solana, it benefits from lower transaction fees and faster settlement times. Unlike other meme tokens, Bonk’s purpose extends beyond entertainment—it was designed to restore trust in the network. This community-driven mission answers those asking is bonk a meme coin by showing it’s both a meme and a movement.

| Feature | Bonk | Dogecoin | Shiba Inu |

|---|---|---|---|

| Blockchain | Solana | Dogecoin | Ethereum |

| Launch Model | Community airdrop | Fork of Litecoin | Token creation |

| Creator Visibility | Anonymous Solana contributors | Named founders | Pseudonymous developer |

| Core Purpose | Revive Solana ecosystem | Humor and tipping | DeFi ecosystem expansion |

Bonk’s future looks promising as long as the Solana network continues to grow. Analysts suggest its community strength and integration into DeFi platforms could secure long-term relevance. Ongoing partnerships and NFT collaborations are likely to sustain its popularity.

However, volatility remains a risk. As a meme token, market sentiment heavily influences Bonk’s price. Investors curious about who owns bonk coin should remember that its decentralized nature means ownership is widely distributed. This aligns with the bonk meme original philosophy—built by everyone, owned by no one.

No, BONK is not owned by Solana. It was created independently by community developers and NFT founders within the Solana ecosystem. There’s no single bonk coin owner name or central authority behind it.

Many analysts believe BONK has potential if Solana’s ecosystem keeps expanding. Its strong community and utility in NFT and DeFi projects suggest it could remain relevant despite being a meme-based asset.

BONK originated in late 2022 when Solana developers launched it as a fair airdrop to users and NFT holders. It symbolized a community-driven comeback after the challenges following the FTX collapse.

Understanding who started Bonk Coin helps explain how a simple meme token became a community-led revolution on Solana. Built by anonymous developers with fairness and transparency in mind, Bonk continues to reflect collective ownership and creative energy that could sustain its momentum in the evolving crypto market.

Investment, Trade and Industry Minister Tengku Datuk Seri Zafrul Aziz said the US trade pact announced over the weekend has helped upgrade Malaysia to a Comprehensive Strategic Partnership, boosting the semiconductor sector's role from a regular supplier to a key supply chain partner."In other words, Malaysia's semiconductor sector — which exported RM56.2 billion worth of goods to the US in 2024, nearly 10% of total US semiconductor imports — is now treated as a critical supply chain partner, not just an ordinary vendor," he said.

This is especially important given that US President Donald Trump had previously threatened to impose a 100% tariff on semiconductor imports from countries without US-based manufacturing, pending the outcome of an ongoing investigation by the US Department of Commerce.Zafrul said that under the agreement, the US government has pledged to give due consideration to Malaysia in its ongoing investigation into the semiconductor sector, under Section 232 of the US Trade Expansion Act 1962, which is expected to conclude by end-2025.

Hel said the upgraded partnership places Malaysia among Washington's key partners and provides a "line of sight" to opportunities in high-technology investments, technology transfer, and more secure supply chain networks."This is not symbolic — it positions Malaysia within a select group of Washington's strategic partners," Zafrul told Parliament during a special briefing on Wednesday.Zafrul said the trusted supply chain partner status is expected to facilitate smoother trade flows in strategic and high-technology goods, in line with the goals of the New Industrial Master Plan 2030 (NIMP 2030).

"This will further enhance Malaysia's economic competitiveness and help realise the Madani Economic Framework's aspiration to make Malaysia one of the world's top 30 economies," he said.As a trusted partner, Malaysia is also expected to attract more investments from the US and other countries seeking to export to the US market, strengthening its position as a regional investment hub.For the first half of 2025, approved investments from the US totalled RM10.4 billion, while cumulative US investments reached RM218.2 billion as of 2024, he noted.

Zafrul said Malaysia successfully negotiated a reduction in tariffs imposed by the US on its exports — from 25% to 19% — following six months of talks, the lowest rate among Asean countries with trade surpluses with the US.Malaysia also secured exemptions from the 19% reciprocal tariff for 1,711 tariff lines, covering key export products such as palm oil, rubber-based goods, cocoa products, aircraft components and parts, and pharmaceuticals."These exempted products collectively account for RM22 billion (US$5.2 billion), or roughly 12% of Malaysia's total exports to the US in 2024. This is not a small figure — it ensures continued market access for Malaysian goods to the US," Zafrul said.

He cautioned that failure to finalise the agreement could have led the US to reinstate the 24% tariff or raise it further to between 30% and 100%, as seen in its negotiations with other countries."If the agreement had not been concluded, our exports could have faced significantly higher tariffs, undermining Malaysia's competitiveness in the US market," he said.

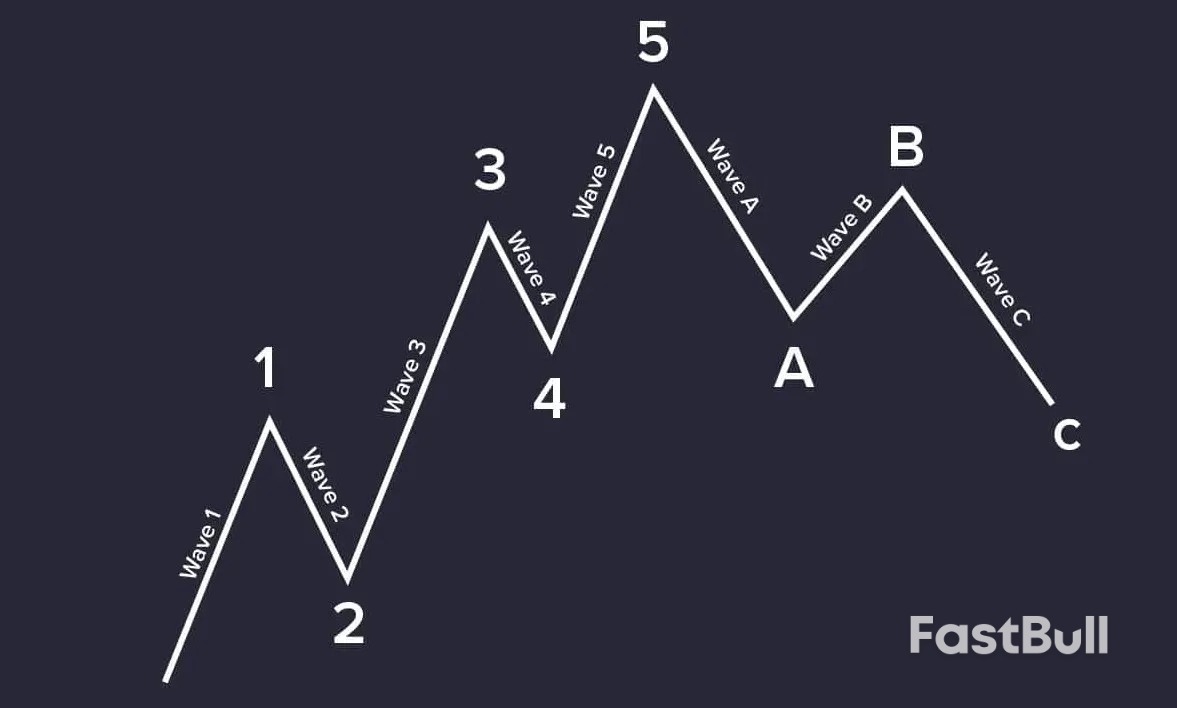

The crypto market is watching Ripple closely as analysts discuss the potential of its next Elliott Wave cycle. This analysis of xrp price prediction wave 5 explores how XRP might perform in the coming months, examining technical signals, market psychology, and key resistance levels that could define its next major move.

In Elliott Wave Theory, Wave 5 is typically the final upward movement in a five-wave sequence, representing strong optimism and high participation from retail traders. It often occurs after a period of consolidation and signals the last phase of a bullish cycle before a correction begins.

In the context of cryptocurrencies, especially XRP, Wave 5 may indicate a continuation of upward momentum as investors anticipate new highs. Through xrp price elliott wave analysis, traders seek to identify whether XRP is forming its fifth wave or completing a prior one. This phase often combines both excitement and risk as price targets become more aggressive.

Understanding the earlier stages of the XRP cycle is crucial before analyzing xrp price prediction wave 5. Each of the first four waves has built the structural foundation for the ongoing trend and helps define the potential range of the upcoming move. Below is a concise review of XRP’s previous Elliott waves.

As markets evolve, traders monitor these formations to refine the ripple target price and anticipate possible breakout levels. Combining xrp elliott wave insights with the broader ripple 2025 outlook can help identify high-probability entry zones while maintaining realistic expectations for the next market cycle.

Technical signals continue to build a strong case for a new upward phase in the XRP market. Analysts using xrp price elliott wave analysis point to consistent higher lows, increasing trading volume, and positive momentum in moving averages. These patterns suggest that XRP could be entering its fifth Elliott wave, where bullish continuation is often confirmed by both trend strength and sentiment.

Market psychology plays a key role in predicting wave continuation. During the potential formation of xrp price prediction wave 5, investor sentiment generally shifts from cautious optimism to excitement. On-chain data shows increased wallet activity and higher engagement from retail investors, aligning with the final push of the wave trading model.

Social media trends around Ripple and XRP discussions have surged, showing confidence in the ripple 2025 outlook. Institutional investors remain cautiously optimistic, with growing interest in XRP-based payment solutions and remittance corridors.

For traders analyzing potential entry and exit zones, XRP’s key resistance and support levels are crucial. Based on fibonacci extensions and historical consolidation areas, the following ranges may serve as near-term guides for xrp elliott wave projections and ripple price target discussions.

| Level Type | Price Range (USD) | Market Note |

|---|---|---|

| Major Support | 0.70 – 0.85 | Wave 4 pullback base zone, often tested before breakout |

| Key Resistance | 1.20 – 1.30 | Target eyes area for next rally confirmation |

| Extended Target | 1.80 – 2.00 | Projected upper limit for Wave 5 according to my elliott wave model |

Despite optimistic indicators, traders should remain aware of risks that could challenge the current xrp price prediction elliott wave scenario. A sudden drop in market liquidity, macroeconomic tightening, or renewed regulatory uncertainty around Ripple could delay or reverse the formation of Wave 5. Additionally, if Bitcoin fails to maintain its broader trend, correlated weakness might spill into XRP’s structure.

Risk management remains key, as overleveraged positions during heightened volatility can lead to losses even within a valid bullish setup.

Analysts assessing xrp price prediction wave 5 expect varying outcomes depending on market participation and global sentiment. The projection combines Elliott Wave theory with fundamental outlook factors such as adoption, liquidity, and Ripple’s ongoing ecosystem expansion. Below is a summarized forecast illustrating possible scenarios for the next phase.

| Scenario | Predicted Range (USD) | Key Drivers |

|---|---|---|

| Bullish Case | 1.80 – 2.50 | Full Wave 5 extension with strong institutional inflow and positive ripple xrp future outlook 2025 |

| Base Case | 1.20 – 1.50 | Gradual growth driven by steady adoption and limited speculation |

| Bearish Case | 0.75 – 0.95 | Failure to sustain momentum due to macro risks or extended consolidation |

As the market progresses into 2026, maintaining a disciplined strategy based on both technical and fundamental evaluation can help traders adjust their ripple target price expectations with more accuracy and confidence.

Based on current xrp price prediction wave 5 models, XRP could reach between $3 and $5 in five years if adoption and market sentiment remain strong, though volatility will persist.

XRP may rise during its fifth wave, but a true “skyrocket” move depends on strong volume and global demand. Analysts remain cautiously optimistic.

A $500 XRP price is unrealistic under current market conditions. Most ripple 2025 outlook forecasts suggest modest long-term gains within achievable technical levels.

The xrp price prediction wave 5 highlights both opportunity and caution. If technical signals align with market optimism, XRP could experience a final bullish surge before consolidation. However, traders should remain mindful of volatility, macroeconomic shifts, and regulatory factors that may reshape Ripple’s price trajectory in the months ahead.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up