Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

JPMorgan Chase (JPM -0.99%) is a sprawling financial services titan. This mega-bank has produced a total return of 208% in the past five years. It's difficult for anyone to complain about that type of gain.

JPMorgan Chase (JPM -0.99%) is a sprawling financial services titan. This mega-bank has produced a total return of 208% in the past five years. It's difficult for anyone to complain about that type of gain.

As of this writing, shares of JPMorgan Chase trade just 5% off of their all-time high. Investors might have their eyes on the business if they're looking to gain more exposure to the industry in their portfolio, but where will this top bank stock be in five years?

JPMorgan's impressive stock performance in the past five years has been driven, unsurprisingly, by strong financial gains. In 2024, the company reported revenue of $178 billion, which was 54% higher than in 2019. What's more, diluted earnings per share soared 84% during that time.

The momentum has continued into 2025, despite recent economic challenges. In Q1, total deposits were up 2% year over year, providing low-cost funding to power loan growth. Net interest income rose 1%, with non-interest income jumping 17%.

This doesn't mean there aren't risks to be mindful of. Since banks in general are so exposed to the economy and credit cycle, a potential cause for concern is the chance of a recession happening. Even CEO Jamie Dimon isn't exactly the most optimistic. On the Q1 2025 earnings call, he agreed with JPMorgan's chief U.S. economist, putting the chance of a recession at 50-50.

As of March 31, JPMorgan Chase had a whopping $2.5 trillion in total assets on the balance sheet. What's more, it carries a massive market cap of $736 billion. And in the last 12 months, it raked in $181 billion in net revenue. This is a truly colossal organization.

This business is the clear leader in the financial services sector, with its hands in numerous different areas. Not only does JPMorgan have a significant presence in capital markets and investment banking activities, but it's also a strong player in asset and wealth management, as well as in consumer banking. This diversity presents a favorable setup. Weakness in one area can be more than offset by robustness in another.

Investors can rest assured knowing that this company won't be disrupted anytime soon, if ever. It has built up durable competitive advantages that support its staying power.

There are cost advantages that stem from the company's huge scale. It's able to leverage expenses and investments in many areas, such as technology and marketing efforts.

Then there are switching costs, both for corporate customers and individual consumers. Because JPMorgan Chase can essentially offer any financial product or service its customers need, the more ingrained it becomes, the harder it is for customers to leave.

It also helps to have industry veteran Jamie Dimon at the helm, who many agree is one of the best CEOs. He successfully navigated the Great Recession, making JPMorgan an even better bank.

The stock has done remarkably well in the past. And given the factors just mentioned, investors are probably wondering why they don't own JPMorgan Chase.

Despite a positive view of the company, I don't believe future returns will resemble the past. The main reason why comes down to valuation. Shares trade at a steep price-to-earnings ratio of 13, which is above the trailing five- and 10-year averages.

Investors familiar with the banking industry might be more inclined to look at the price-to-book ratio. As of this writing, this metric stands at 2.2, near the highest it has been in the past 20 years. Consequently, I wouldn't be surprised if this stock lags the broader market between now and 2030.

Britain's financial regulator is to remove a ban on consumers buying crypto exchange-traded notes (ETNs), ditching its previous position of wanting to keep them out of the hands of retail investors.

The Financial Conduct Authority said on Friday that allowing retail investors to buy ETNs would support growth and competitiveness, in the latest sign that the UK is shifting its approach to crypto as the government seeks to grow the economy and support a digital assets industry.

Last year the FCA had approved the launch of crypto ETNs for professional traders but banned retail investors from access, calling the products "ill-suited" because of "the harm they pose".

"We want to rebalance our approach to risk and lifting the ban would allow people to make the choice on whether such a high-risk investment is right for them given they could lose all their money," David Geale, executive director of payments and digital assets at the FCA, said in a statement on Friday. The proposal will now go out for consultation.

Britain in April published draft laws for bringing cryptocurrencies under compulsory regulation for the first time, aligning it with the United States' approach, rather than the European Union, which has built rules tailored to the industry.

To be sold to individual consumers, the ETNs will need to be traded on an FCA-approved investment exchange, the regulator said.

A ban on retail investors trading cryptoasset derivatives would remain, the watchdog added.

German Chancellor Friedrich Merz's meeting with U.S. President Donald Trump was dramatically overshadowed by the U.S. leader's spat with Elon Musk. But it was still seen as a win for Merz.

"Being sidelined is not necessarily always a bad thing," Carsten Brzeski, global head of macro at ING, told CNBC on Friday. "In fact, it might have even helped Merz as the Musk distraction was also deviating attention away from more controversial topics.

It was a high-stakes trip for Merz, who is just a few weeks into his chancellorship, especially given the treatment other leaders have gotten from Trump in the Oval Office in recent months.

As such, Merz is unlikely to be disappointed about the outcome — especially given the potential downsides.

"Having avoided an escalation in the Oval Office is already an achievement these days," Brzeski added.

Merz arrived in D.C. with a full agenda that ranged from strengthening relations between the U.S. and Germany, to tariffs — which could significantly impact key German industries — as well as U.S. support for Ukraine in its war with Russia and higher NATO defense spending.

While we don't know what was discussed behind closed doors, Merz was seemingly able to address most of these points with Trump, political strategist Julius van de Laar told CNBC's "Squawk Box Europe" on Friday.

"I think what Friedrich Merz got across is that he hopes that the U.S. president will continue to support Ukraine," he said, noting that the issue had gathered momentum recently given several significant attacks. Merz was able to pick up on this, and draw links to the anniversary of D-Day a day after their meeting.

"And he said the United States played a great role in ... freeing Europe from the Nazi regime back then, and so he's hoping that Donald Trump will ... say we're going to get engaged again and help Europe become free of dictatorship," van de Laar said.

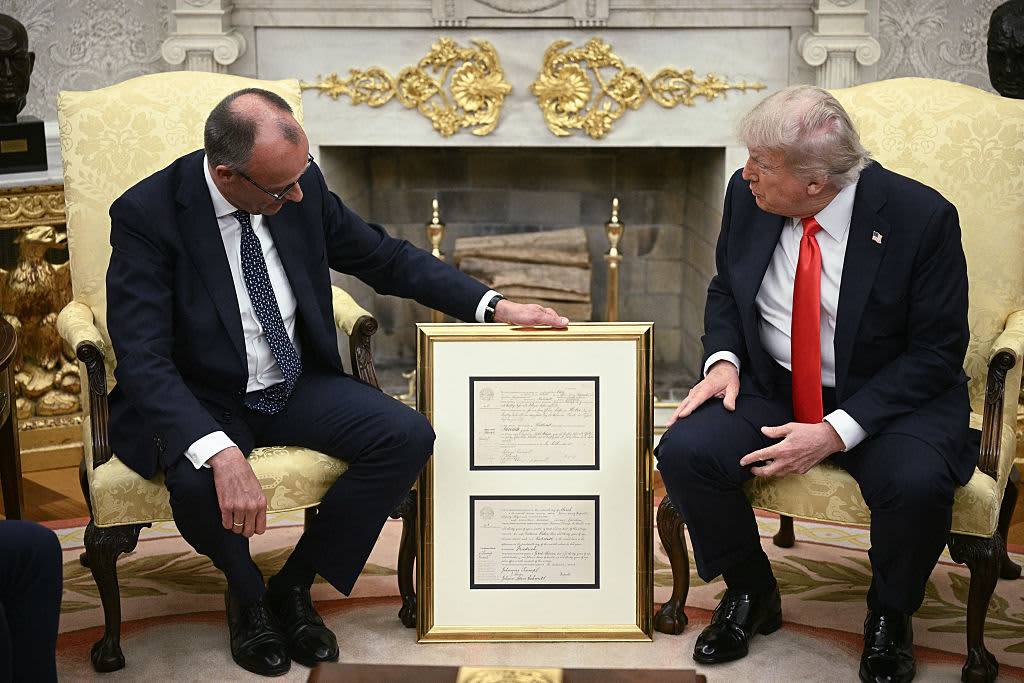

Merz making this point was important in the context of highlighting the U.S-German relationship, according to Jackson Janes, senior resident fellow at the German Marshall Fund. Speaking to CNBC's "Squawk Box Europe," he also pointed out that Trump was gifted his grandfather's birth certificate by Merz, "making the point 'you have a relationship with Germany in your own family.'"

German Chancellor Friedrich Merz presents US President Donald Trump with what Merz said was the birth certificate of Trump's grandfather, who was born in 1869, during a bilateral meeting in the Oval Office of the White House in Washington, DC, on June 5, 2025.

Janes also noted that Merz highlighting Germany's plans for higher defense spending would have marked a positive note in the discussion.

Germany recently changed its fiscal rules to allow for higher defense spending, and Merz's government seems to be making it a priority. The chancellor has promised a financial push to boost the German military, and the country's foreign minister has suggested support for Trump's proposal that NATO members spend 5% of their gross domestic product on defense.

Meanwhile, the sensitive topic of Germany's far-right party, the Alternative fuer Deutschland, was seemingly avoided. Officials in the Trump administration have in recent weeks come out in support of the party after German intelligence services classified it as a "proven right-wing extremist organization."

This led to clapbacks from German politicians, with Merz himself warning the U.S. not to get involved. The classification of the AfD is currently on hold amid a legal challenge.

All in all, Merz's visit to D.C. was seen as "a home run or a hole in one," van de Laar said.

ING's Brzeski also suggested that the trip laid good foundations between the leaders. "There seems to be some common grounds between Trump and Merz, which could be the seeds for a more constructive relationship," he said.

Merz even appeared to get some compliments from Trump, with the president commending him for his English skills and saying that while "difficult," the German leader was a "very good man to deal with."

Following the meeting, Merz appeared satisfied, saying in a social media post that the atmosphere was "really good," and that the two have much in common. "I am coming back with the feeling that we can speak on the phone any time," he said, according to a CNBC translation.

But even an in-person reunion might not be too far off: a Trump trip to Berlin is already being planned, Merz told German media.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up