Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

While Wall Street indexes had fallen on trade jitters on Monday, they have steadied since then, with analysts noting that investors have become used to Trump's pattern of saber-rattling on tariffs.

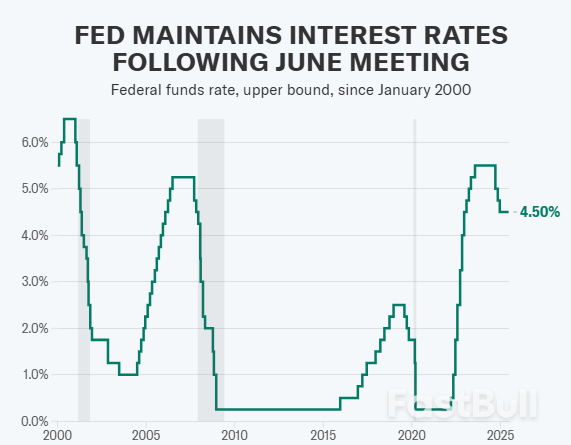

Markets are once again high on ‘hopium’. Despite a still-strong labour market, sticky inflation, and an economy that refuses to roll over, rate cut bets have surged back into vogue. The Federal Reserve might be saying “higher for longer,” but investors are dancing to a different beat.

Why is the market so convinced cuts are coming when the data tells a different story?

Let’s start with the basics. The US economy continues to defy gravity:

Unemployment is near historic lows.

Core inflation remains above the Fed’s 2% target.

Consumer spending is showing resilience, even if cracks are emerging.

Wages are still growing, and the services sector refuses to cool.

Risk assets are elevated (credit spreads are tight and equities are at highs).

The Atlanta GDP estimate is now at 2.8% in real terms.

Although tariffs have been meaningfully reduced, the net effective tariff has increased from approximately 2% to 12%, and the impact of this change is yet to be felt.

And yet, futures markets are entertaining the idea of 150 basis points in cuts by the end of 2026. You’d be forgiven for thinking a recession was imminent, but the data simply doesn’t support it. There is no clear and present danger requiring immediate monetary easing. It appears as though an asymmetry is creeping into the market.

A caveat on the impact of this monumental change in tariffs is that they will impact both inflation and growth going forward, muddying the waters and making the Fed’s job even more challenging.

The Fed’s traditional response function (think Taylor rule) is simple: respond to inflation and unemployment.

But what if that framework is breaking down? What if the central bank is now facing a third variable it can’t ignore: government debt sustainability?

Public debt-to-GDP has ballooned. Servicing costs are rising fast. Higher rates have doubled (or more) the cost of new borrowing.

The question is no longer just “is inflation too high?” or “is growth slowing?”, it’s becoming: “can we afford to keep rates this high?”

Is the Fed becoming politicised, and having its hand forced by the high debt load?

There’s a growing theory that debt sustainability is starting to influence monetary policy, if not overtly, then tacitly:

Net interest costs are now the second largest expenditure item after social security.

The higher rates go, the higher the interest expense becomes. Let’s not forget that the US government needs to roll c.$10 trillion in debt over 2025 and 2026 (see chart below). This amount is significant, possibly more so as US exceptionalism is increasingly being questioned.

There’s political pressure to “do something”, and cutting rates is perceived as easier than raising taxes or slashing spending. Given the US’s exposure to rollover risk1, the government will benefit significantly from lower administered rates.

Donald J. Trump has heaped schoolground pressure on ‘too late Powell’, threatening to fire him: “I can do a better job, perhaps I should”, “he’s a loser, not very smart”.

Lining up a ‘shadow Fed chair’ will likely render Powell’s final months redundant, or at the very least, make his job more difficult. With Powell’s position of Fed chair coming to an end in May 2026, much more weight will be placed on his successor. In fact, some hopefuls have been dusting off their CVs and calling for rate cuts despite the data, no doubt raising their standing in Trump’s eyes.

While the Fed remains technically independent, the economic reality is putting it in a box. Rate hikes were politically feasible when inflation was the villain, but as that narrative softens, so too does the Fed’s room to manoeuvre.

This raises a disturbing possibility: maybe the market isn’t mispricing rate cuts, maybe it is betting on fiscal dominance and a more politicised Fed. That is, central banks may eventually bow to the needs of the government balance sheet and the wants of an incumbent government, rather than to strict macro fundamentals.

What The Fed does next may no longer be about data alone. It may be about debt. If so, we’re entering a new regime: one where traditional models of inflation and employment lose their predictive power, and monetary policy becomes a servant, not a master.

So when the market prices in cuts against a backdrop of strong economic data, maybe it’s not madness. Maybe it’s a grim kind of foresight: the Fed is trapped, and the old playbook has been thrown out.

One thing’s for sure: if the Fed is no longer fighting inflation, but instead grappling with the math of Treasury auctions, then it’s not just rates that need re-pricing, it’s the entire framework we’ve relied on to understand monetary policy for the last 40 years.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up