Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

Canada Manufacturing PMI (SA) (Dec)

Canada Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Dec)

U.S. IHS Markit Manufacturing PMI Final (Dec)A:--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Japan Manufacturing PMI Final (Dec)

Japan Manufacturing PMI Final (Dec)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Dec)

China, Mainland Caixin Composite PMI (Dec)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Dec)

China, Mainland Caixin Services PMI (Dec)A:--

F: --

P: --

Indonesia Trade Balance (Nov)

Indonesia Trade Balance (Nov)A:--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)A:--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Dec)

Saudi Arabia IHS Markit Composite PMI (Dec)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)--

F: --

P: --

Turkey CPI YoY (Dec)

Turkey CPI YoY (Dec)A:--

F: --

P: --

Turkey PPI YoY (Dec)

Turkey PPI YoY (Dec)A:--

F: --

P: --

U.K. Mortgage Approvals (Nov)

U.K. Mortgage Approvals (Nov)A:--

F: --

U.K. M4 Money Supply MoM (Nov)

U.K. M4 Money Supply MoM (Nov)A:--

F: --

P: --

U.K. Mortgage Lending (Nov)

U.K. Mortgage Lending (Nov)A:--

F: --

U.K. M4 Money Supply (SA) (Nov)

U.K. M4 Money Supply (SA) (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

U.K. M4 Money Supply YoY (Nov)

U.K. M4 Money Supply YoY (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. ISM Inventories Index (Dec)

U.S. ISM Inventories Index (Dec)A:--

F: --

P: --

U.S. ISM Output Index (Dec)

U.S. ISM Output Index (Dec)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Dec)

U.S. ISM Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Dec)

U.S. ISM Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Dec)

U.S. ISM Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Dec)

Japan Monetary Base YoY (SA) (Dec)A:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Dec)

U.K. BRC Shop Price Index YoY (Dec)A:--

F: --

P: --

Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

India HSBC Services PMI Final (Dec)

India HSBC Services PMI Final (Dec)--

F: --

P: --

India IHS Markit Composite PMI (Dec)

India IHS Markit Composite PMI (Dec)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Dec)

South Africa IHS Markit Composite PMI (SA) (Dec)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

Italy Composite PMI (Dec)

Italy Composite PMI (Dec)--

F: --

P: --

Italy Services PMI (SA) (Dec)

Italy Services PMI (SA) (Dec)--

F: --

P: --

Germany Composite PMI Final (SA) (Dec)

Germany Composite PMI Final (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Final (Dec)

Euro Zone Composite PMI Final (Dec)--

F: --

P: --

Euro Zone Services PMI Final (Dec)

Euro Zone Services PMI Final (Dec)--

F: --

P: --

U.K. Services PMI Final (Dec)

U.K. Services PMI Final (Dec)--

F: --

P: --

U.K. Composite PMI Final (Dec)

U.K. Composite PMI Final (Dec)--

F: --

P: --

U.K. Total Reserve Assets (Dec)

U.K. Total Reserve Assets (Dec)--

F: --

P: --

U.K. Official Reserves Changes (Dec)

U.K. Official Reserves Changes (Dec)--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

Mexico Consumer Confidence Index

Mexico Consumer Confidence Index--

F: --

P: --

Germany CPI Prelim MoM (Dec)

Germany CPI Prelim MoM (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Dec)

Germany CPI Prelim YoY (Dec)--

F: --

P: --

Brazil IHS Markit Services PMI (Dec)

Brazil IHS Markit Services PMI (Dec)--

F: --

P: --

Germany HICP Prelim MoM (Dec)

Germany HICP Prelim MoM (Dec)--

F: --

P: --

Brazil IHS Markit Composite PMI (Dec)

Brazil IHS Markit Composite PMI (Dec)--

F: --

P: --

Germany HICP Prelim YoY (Dec)

Germany HICP Prelim YoY (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. IHS Markit Services PMI Final (Dec)

U.S. IHS Markit Services PMI Final (Dec)--

F: --

P: --

U.S. IHS Markit Composite PMI Final (Dec)

U.S. IHS Markit Composite PMI Final (Dec)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Dec)

China, Mainland Foreign Exchange Reserves (Dec)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After the US's stunning capture of Venezuelan President Nicolás Maduro over the weekend the focus is turning to how quickly the country with the world's largest proven crude reserves can raise output.

After the US's stunning capture of Venezuelan President Nicolás Maduro over the weekend the focus is turning to how quickly the country with the world's largest proven crude reserves can raise output.

In the short term, it's unclear how much oil Venezuela will be able to export and whether flows to China will continue.

And while President Donald Trump has said US companies will spend billions of dollars to rebuild the country's energy infrastructure over the longer term, there are big doubts about whether the oil majors will want to invest in what is a very uncertain environment.

Here's what analysts are saying about Venezuela:

"There will undoubtedly be a segment of the market that will embrace a 'Mission Accomplished' narrative and will pencil-in an easy glide path back to 3 million barrels a day of production," analysts including Helima Croft said in a note, adding that full sanctions relief could unlock several hundred thousand barrels a day in the next 12 months assuming an orderly transition of power.

However, "the situation at the time of writing remains very fluid, but we continue to caution market observers that it will be a long road back for the country," they said.

"In theory, Venezuela could again become a major producer: it still claims to hold the world's largest proven oil reserves," Chief Economist Neil Shearing said in a note. "But theory and reality diverge sharply. If nothing else, geopolitical alignments in Venezuela remain unclear in the wake of Maduro's capture," he said.

Even if output were to rise to levels seen a decade ago, around 3 million barrels a day, that would only add about 2% to global oil supply, Shearing said.

Brent oil prices could average $2 a barrel higher than Goldman Sachs Group Inc.'s base-case forecast of $56 a barrel for Brent this year if Venezuelan crude production falls by 400,000 barrels a day by year-end, analysts including Daan Struyven said in a note. Or, they could be $2 lower if output rises by that amount.

"Along with recent Russia and US production beats, potentially higher long-run Venezuela production further increases the downside risks to our oil price forecast for 2027 and beyond," Goldman said. "We estimate $4 a barrel of downside to 2030 oil prices in a scenario where Venezuela crude production rises to 2 million barrels a day in 2030," compared with 900,000 barrels a day in the bank's earlier base case.

A limited market reaction is likely as there's ample oil supply globally, said Chief Analyst Arne Lohmann Rasmussen. "Venezuela is known for having the world's largest proven oil reserves, exceeding 300 billion barrels," he said in a note. "However, reserves are one thing, production another. Venezuela's oil production today is around 1 million barrels per day."

Given Venezuelan crude is heavy and sulfur-rich, only refineries in the US and some in China can process the oil, Rasmussen said, adding that a potential loss of this type of oil is not particularly problematic for the global market.

Key Points:

The US fueled geopolitical tensions over the weekend, capturing Venezuelan President Nicolas Maduro, influencing demand for safe-haven assets, and USD/JPY trends.

Traders had the opportunity to react to the weekend events on Monday, January 5. US control of Venezuela is likely to have ramifications on supply-demand dynamics for crude oil and Bitcoin (BTC). The news sent USD/JPY higher in early trading.

While market reaction to President Maduro's capture was key, finalized manufacturing sector PMI data supported a tighter monetary policy environment, affirming the bearish medium-term outlook for USD/JPY.

Below, I'll discuss the macro backdrop, the near-term price catalysts, and technical levels traders should closely watch.

The S&P Global Japan Manufacturing PMI increased from 48.7 in November to 50.0 in December, hovering at the 50 neutral level. Several components supported the BoJ's Summary of Opinions and statements that US tariff risks to the economy had cooled. According to the finalized December PMI survey:

Tighter labor market conditions, rising prices, and an improving demand backdrop support further BoJ rate hikes. Rising employment would likely boost wage growth, fueling demand-driven inflation, affirming the cautiously bearish short- and bearish medium-term outlook for USD/JPY.

Notably, the manufacturing sector accounts for approximately 20% of Japan's GDP, limiting the influence of the headline PMI on the BoJ's policy stance. However, weakness in the Japanese yen pushed import prices higher, leading goods producers to increase selling prices due to rising input prices. The BoJ has frequently cited concerns about the weak yen eroding households' disposable incomes.

December's PMI data would give the hawks a stronger footing. However, the Services PMI figures will be crucial for USD/JPY, given that the sector accounts for roughly 70% of Japan's GDP and is a key inflation driver. The S&P Global Services PMI will be out on Wednesday, January 7.

USD/JPY briefly climbed from 157.119 to 157.250 before falling to a low of 157.086 after the release of the finalized Manufacturing PMI.

USDJPY – 5 Minute Chart – 050126

USDJPY – 5 Minute Chart – 050126Later on Monday, US private sector PMI figures are likely to influence demand for the US dollar and the USD/JPY pair. Economists forecast the ISM Manufacturing PMI to increase from 48.2 in November to 48.3 in December.

Typically, a less pronounced contraction, rising employment, and higher prices support a less dovish Fed policy stance, which would lift demand for the US dollar. While the sector accounts for around 10% of the US GDP, the underlying PMI data provide insights into the effect of tariffs and the higher interest rate backdrop on prices.

Last week, the less influential S&P Global US Manufacturing PMI revealed that tariffs continued to drive prices higher, suggesting a more hawkish Fed policy stance. However, the ISM Services PMI, due out on January 7, will be key, given that the sector accounts for roughly 80% of US GDP and is the key inflation contributor.

While the PMI data will influence US dollar demand, Fed commentary remains key for USD/JPY trends. Increased calls to cut rates to bolster the labor market would dampen demand for the US dollar, pushing USD/JPY lower.

According to the CME FedWatch Tool, the probability of a March Fed rate cut increased from 51.1% on January 2 to 54.0% on January 3.

Looking ahead, expectations of further BoJ rate hikes, a new Fed Chair, potentially favoring lower rates, and a cooling US labor market remain key drivers. These scenarios continue to support a bearish short- to medium-term outlook for USD/JPY.

For USD/JPY price trends, technicals, and fundamentals will continue to require close monitoring.

Looking at the daily chart, USD/JPY traded above its 50-day and 200-day Exponential Moving Averages (EMAs), signaling a bullish bias. While technicals remained bullish, bearish fundamentals are developing, outweighing the technical structure.

A break below the 155 support level and the 50-day EMA would indicate a bearish near-term trend reversal. A sustained fall through the 50-day EMA would expose the 200-day EMA. If breached, 150 would be the next key support level.

Crucially, a sustained fall through the 50-day and 200-day EMAs would reinforce the bearish price outlooks for USD/JPY.

USDJPY – Daily Chart – 050126 – EMAs

USDJPY – Daily Chart – 050126 – EMAsIn my view, expectations of narrower US-Japan rate differentials and threats of yen intervention signal a negative price outlook. However, the BoJ neutral interest rate and incoming US economic data will be key.

A higher neutral interest rate level would indicate multiple BoJ rate hikes and a narrower US-Japan interest rate differential. A narrower rate differential would reverse yen carry trades into US assets, pushing USD/JPY toward 140 over the longer term.

However, upside risks to the bearish outlook include:

These scenarios would send USD/JPY higher. However, the ever-present threat of yen interventions is likely to cap the upside at around the 158 level, based on the latest communication.

Read the full USD/JPY forecast, including chart setups and trade ideas.

In summary, the USD/JPY trends reflect expectations of narrowing rate differentials. Market focus will remain on the BoJ's neutral rate, economic data, and the Fed's forward guidance on rate cuts.

A neutral rate in the range of 1.5% to 2.5% would indicate a more aggressive BoJ rate path. Expectations of multiple BoJ rate hikes reaffirm the cautiously bearish short- and bearish medium-term bias for USD/JPY. Additionally, dovish Fed chatter and a potential unwinding of yen carry trades. A yen carry trade unwind would likely send USD/JPY toward 140 over the longer 6-12 month time horizon.

Top US officials have been eager to capitalize on the Trump-ordered military raid on Caracas, which saw the Venezuelan capital bombed and its longtime socialist leader Nicolás Maduro captured without major incident and transferred to US soil where's facing federal drug charges related to narco-trafficking and gun-running.

Hawkish pundits are already clamoring for more muscular action targeting Tehran (and other supposed 'rogue' actors) at a moment of ongoing economic protests in Iran pressuring Islamic Republic leaders. Trump is issuing veiled threats to the governments of Cuba, Colombia, and Mexico - but many are asking: is Iran next? Various open source intelligence channels (OSINT) on Sunday have highlighted some unusual American military activity in the UK and Europe, for example...

It's hard to know if this constitutes the usual Pentagon logistical operations in Europe, but it does indeed raise questions regarding Washington's force posture vis-a-vis Iran.

One theme of the last several months of Trump's military build-up in the southern Caribbean has been that in sending so many warships to Venezuelan waters, including at least one nuclear-powered submarine and the USS Gerald R. Ford carrier group, is that this level of military asset concentration in Latin America means less deadly or long-range assets in the Middle East (CENTCOM) area of operation.

There are various things to consider when it comes to potential White House discussions on the matter. First, it must be recalled that Trump wisely declared mission accomplished when US bombers 'obliterated' (in the US estimation) Iran's three most important nuclear development sites at the tail-end of the June Israel-Iran war, which lasted just 12 days. There was no sustained American bombing campaign against Iran, also as Trump knows that "doing another Iraq" would be hugely unpopular at home.

There's another difficult reality when it comes to US actions targeting Iran, which behind Venezuela also possesses among the world's biggest proven reserves of crude oil. Iran is a country of over 90 million people, has a large military overseen by the elite IRGC, has long been 'military tested' (the 1980's Iran-Iraq war comes to mind), and has one of the world's premier arsenals of mid and long-range ballistic missiles. It even posses hypersonic capabilities (which the Israelis also learned). Because of this, last June Israeli warplanes were careful to operate largely outside Iranian airspace, and even though many anti-air missile sites were allegedly destroyed, this threat remains strong.

Reports of more IRGC missile tests over Iran Sunday night into Monday...

Trump will of course leave people guessing in his 'shoot from the hip' fashion. After all, the operation to topple Maduro was held as a tightly guarded secret even from many top Pentagon officials (in terms of the timing and "need to know" details just before it was launched). Here's what one Conservative, anti-Iran pundit has to say:

First Venezuela, next Iran. These military flights signify a barrel of whoop-ass, not just a can. Likely, these show deployments of the 101st Airborne AND the 1st Battalion, 75th Ranger Regiment.

The US Navy Fleet Tracker is oddly dark as well. We have 11 Aircraft Carriers, look at the 12/29/25 update compared to the 03/17/25 update. We are no longer posturing, we are in OPSEC mode. In Kuwait, the USA maintains roughly 13,500 troops at any given time. These troops serve as a Middle East response force (among other missions).

So why are the 1/75 Rangers and 101st Airborne deployments significant? The 75th Ranger Regiment's primary mission is airfield seizures. The 101st is an Air Assault unit. The USA just moved a huge strategic asset designed to open the gates of hell into whatever country we choose.

And as for keeping people guessing, there was this remark from Trump just days ahead of the operation to kidnap Maduro. "If Iran shots [sic] and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue. We are locked and loaded and ready to go," Trump posted on Truth Social last Monday.

Would Russia comes to Iran's defense if it is threatened with large-scale military action? Certainly the vehement condemnations would fly from Moscow, but Russia's military is obviously busy doing other things...

Regardless of if the US deescalates ongoing tensions with Tehran, or if Trump chooses to soon escalate, the Ayatollah and Islamic Republic leaders just got a lot more nervous and uncomfortable as they helplessly watch their longtime ally Maduro being hauled before a US federal court on American soil.

For now the most likely scenario is that Trump will be content to see where the now weeklong protests inside Iran go, as they threaten societal stability, and as the US-led sanctions regimen continues to wreak devastation. It is also likely that he would unleash Israel first, and not send US troops for direct action - akin to what happened in the last June bombing raids.

U.S. President Donald Trump on Sunday threatened military action against Colombia's government, telling reporters that such an operation "sounds good to me."

"Colombia is very sick, too, run by a sick man, who likes making cocaine and selling it to the United States, and he's not going to be doing it very long," Trump told reporters aboard Air Force One, in an apparent reference to Colombia's President Gustavo Petro.

Asked directly whether the U.S. would pursue a military operation against the country, Trump answered, "It sounds good to me."

The comments came after the United States captured Venezuelan President Nicolas Maduro in an audacious raid and whisked him to New York to face drug-trafficking charges.

Japan's manufacturing activity stalled in December as demand declined at a slower pace from the previous month, a private-sector survey showed, ending a five-month streak of deterioration.

The S&P Global Japan Manufacturing Purchasing Managers' Index (PMI) was flat at 50.0 in December, improving from 48.7 in November and hitting the break-even point separating expansion from contraction.

"Japan's manufacturing industry saw conditions stabilise at the end of the year," said Annabel Fiddes, an economics associate director at S&P Global Market Intelligence.

The decline in new orders in December was the softest since May 2024, the survey showed. Although many firms noted subdued demand, some saw sales had improved, underpinned by new projects and stronger-than-expected customer spending.

While consumer and investment goods sectors reported improvement in business conditions, intermediate goods makers said they were weak.

New export orders declined at a slightly softer pace in December from November, partly affected by weaker demand in Asia, particularly for semiconductors, according to the survey.

Looking ahead to the next 12 months, overall business sentiment eased from November but remained above the survey's long-run average, the survey said.

"New product releases and greater demand across key industries such as autos and semiconductors were anticipated to boost the sector's performance in 2026," Fiddes said.

Some downside risks mentioned by firms were sluggish global economy, an ageing population and rising costs, she said.

Staffing levels in the manufacturing sector rose for the 13th consecutive month, while the rate of input prices accelerated to its highest since April, battered by a combination of increases in raw material, labour and transportation costs, as well as the weaker yen.

The Bank of Japan in December raised interest rates to levels unseen in 30 years and signalled its readiness to continue raising rates.

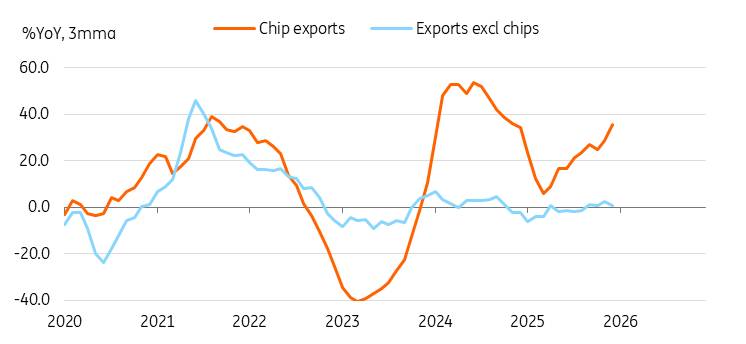

South Korean exports rose a greater-than-expected 13.4% year-on-year in December (vs 8.4% in November, 8.5% market consensus). Of the 15 main export products, six increased. IT exports were particularly strong. Semiconductors rose the most -- by 43.2% -- thanks to robust demand for AI data centres and strong pricing. Other IT products, such as mobile devices (24.7%), computers (36.7%), and displays (0.8%), all increased. Yet autos, petrochemicals, steel, home appliances, and batteries declined. Automotive exports declined by 1.5% due to increased overseas production and temporary product cuts during line maintenance. Steel and petrochemicals continued to decline due to global oversupply and soft prices. Though not major export categories, newly emerging sectors -- primarily K-culture-related products such as food, bio-health, and cosmetics -- posted steady increases.

We expect IT- and K-culture-related products to remain the key drivers of exports in 2026. Despite recent concerns about AI overvaluation, global tech capex is expected to increase. Export items facing global oversupply are expected to undergo industry consolidation and are unlikely to rebound anytime soon.

Meanwhile, imports rose 4.6% YoY in December. Energy imports declined by 6.8% while non-energy imports rose firmly by 7.3%. We believe that increased capital goods imports will boost equipment investment in the current quarter. The trade surplus widened to $12.2 billion in December, likely boosting fourth-quarter 2025 GDP growth.

Source: CEIC and ING estimates

Source: CEIC and ING estimatesThe consumer confidence index slipped to 109.9 from 112.4, but remained above the long-term average. We believe recent KRW depreciation and a sudden stock market correction dampened sentiment. Inflation expectations remain steady at 2.6% for the third consecutive month, indicating no immediate concerns. Yet if the KRW remains around 1,450, both sentiment and activity will likely be affected.

Meanwhile, expectations on housing prices rebounded again. This should concern policymakers. Although strict macroprudential regulations are in place, housing demand in Seoul remains strong, resulting in a K-shaped housing market.

Recent business surveys similarly point to a K-shaped recovery, with manufacturing improving and non-manufacturing deteriorating. The manufacturing purchasing managers' index rose to 50.1, while the business survey index (BSI) outlook also advanced to 95.3 from 93.9 in November. Korean manufacturers are mostly export-oriented. As such, a de-escalation of trade tensions and weaker KRW may work in favour of sentiment. However, the domestically oriented non-manufacturing outlook declined substantially to 87.8 from 91.7. This likely reflects a slowdown in domestic demand as the impact of fiscal stimulus dissipates.

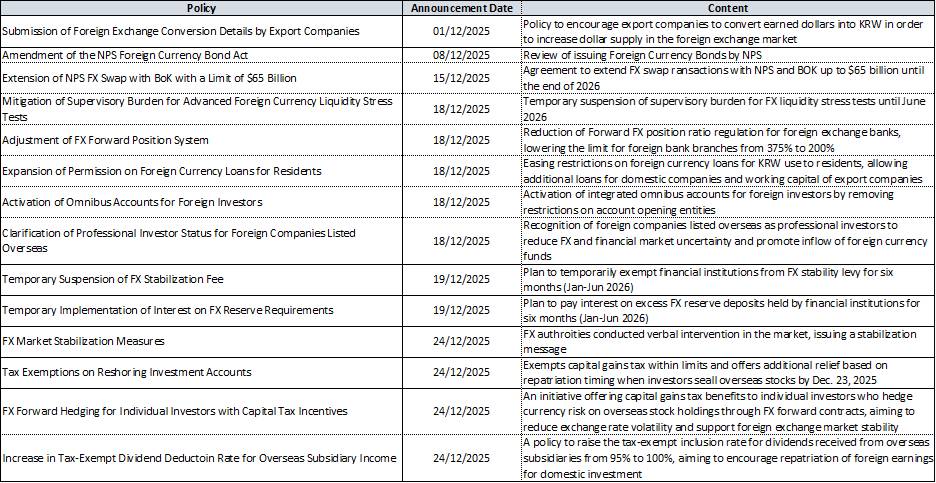

Throughout December, the FX authorities implemented nearly fifteen measures aimed at stabilizing the Korean won. The USDKRW is significantly lower following verbal intervention and smoothing operations in the last week of the year. We don't think it has altered the underlying trend of the KRW weakness. While the upside remains limited by intervention concerns, strong USD funding needs should keep USDKRW above 1,425.

FX relief measures announced in December

Source: BoK, FSC, FSS, MoEF, etc.

Source: BoK, FSC, FSS, MoEF, etc.Recent measures to cool Seoul's property market include tightening loan limits, designating the city a speculative zone with residency conditions, and accelerating urban renewal to increase supply. Since the steps taken on 15 October, housing transactions have declined overall, except in high-activity areas like Gangnam and southern Seoul. We believe stricter rules may temporarily slow down activity, but upward price pressures persist. Although some favour higher property taxes to curb demand, such measures are unlikely to be implemented before June's local government elections. Instead, the government might relax redevelopment rules and lower transaction taxes.

Source: CEIC

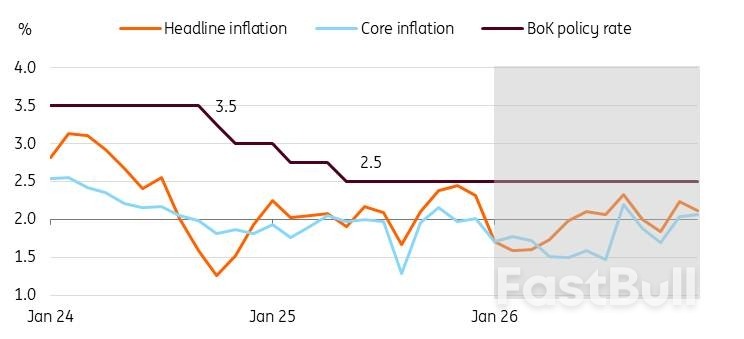

Source: CEICKorea's consumer price inflation eased slightly to 2.3% YoY in December (vs 2.4% in November, 2.3% market consensus). Weak fresh food prices lowered overall inflation, but petrol prices rose meaningfully, mainly due to higher import costs.

Going forward, we expect CPI to drop below 2% in the first half of 2026 mainly due to a high base last year. Still, the Bank of Korea is likely to keep policy rates unchanged at 2.5% in 2026 amid expectations of rising property prices in the Seoul area and the continued weakness of the KRW. Instead, the BoK will seek to expand the role of the Bank Intermediated Lending Support Facility as its favoured monetary policy instrument.

Source: CEIC and ING estimates

Source: CEIC and ING estimatesJapan's manufacturing activity stalled in December as demand declined at a slower pace from the previous month, a private-sector survey showed, ending a five-month streak of deterioration.

The S&P Global Japan Manufacturing Purchasing Managers' Index (PMI) was flat at 50.0 in December, improving from 48.7 in November and hitting the break-even point separating expansion from contraction.

"Japan's manufacturing industry saw conditions stabilise at the end of the year," said Annabel Fiddes, an economics associate director at S&P Global Market Intelligence.

The decline in new orders in December was the softest since May 2024, the survey showed. Although many firms noted subdued demand, some saw sales had improved, underpinned by new projects and stronger-than-expected customer spending.

While consumer and investment goods sectors reported improvement in business conditions, intermediate goods makers said they were weak.

New export orders declined at a slightly softer pace in December from November, partly affected by weaker demand in Asia, particularly for semiconductors, according to the survey.

Looking ahead to the next 12 months, overall business sentiment eased from November but remained above the survey's long-run average, the survey said.

"New product releases and greater demand across key industries such as autos and semiconductors were anticipated to boost the sector's performance in 2026," Fiddes said.

Some downside risks mentioned by firms were sluggish global economy, an ageing population and rising costs, she said.

Staffing levels in the manufacturing sector rose for the 13th consecutive month, while the rate of input prices accelerated to its highest since April, battered by a combination of increases in raw material, labour and transportation costs as well as the weaker yen.

The Bank of Japan in December raised interest rates to levels unseen in 30 years and signalled its readiness to continue raising rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up