Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)A:--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)A:--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)A:--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)A:--

F: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)A:--

F: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)A:--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)A:--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)A:--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)A:--

F: --

P: --

U.S. Exports (Oct)

U.S. Exports (Oct)A:--

F: --

P: --

U.S. Trade Balance (Oct)

U.S. Trade Balance (Oct)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)A:--

F: --

Canada Trade Balance (SA) (Oct)

Canada Trade Balance (SA) (Oct)A:--

F: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)A:--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Oct)

U.S. Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Consumer Credit (SA) (Nov)

U.S. Consumer Credit (SA) (Nov)A:--

F: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

China, Mainland CPI YoY (Dec)

China, Mainland CPI YoY (Dec)--

F: --

P: --

China, Mainland PPI YoY (Dec)

China, Mainland PPI YoY (Dec)--

F: --

P: --

China, Mainland CPI MoM (Dec)

China, Mainland CPI MoM (Dec)--

F: --

P: --

Japan Leading Indicators Prelim (Nov)

Japan Leading Indicators Prelim (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Nov)

Germany Industrial Output MoM (SA) (Nov)--

F: --

P: --

Germany Exports MoM (SA) (Nov)

Germany Exports MoM (SA) (Nov)--

F: --

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)--

F: --

P: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Sept)

U.S. Building Permits Revised YoY (SA) (Sept)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Sept)

U.S. Building Permits Revised MoM (SA) (Sept)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)--

F: --

P: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)--

F: --

P: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US has already begun marketing Venezuelan crude, White House Press Secretary Karoline Leavitt said during a briefing Wednesday.

President Donald Trump's suggestion of military action to annex Greenland is being framed by his Republican allies on Capitol Hill as a hardball negotiation tactic, echoing the deal-making style he championed in his 1987 book. This defense comes as Trump refuses to rule out force, a stance that has alarmed European leaders and many in Washington.

The GOP has largely supported Trump following a recent strike he ordered to capture Venezuelan leader Nicolas Maduro without congressional approval. Now, as attention shifts to Greenland, some Republicans argue the president's aggressive posture is merely a bluff to secure greater U.S. influence over the strategic Arctic island.

Supporters of the former president claim his threats are part of a calculated strategy to bring Denmark to the negotiating table.

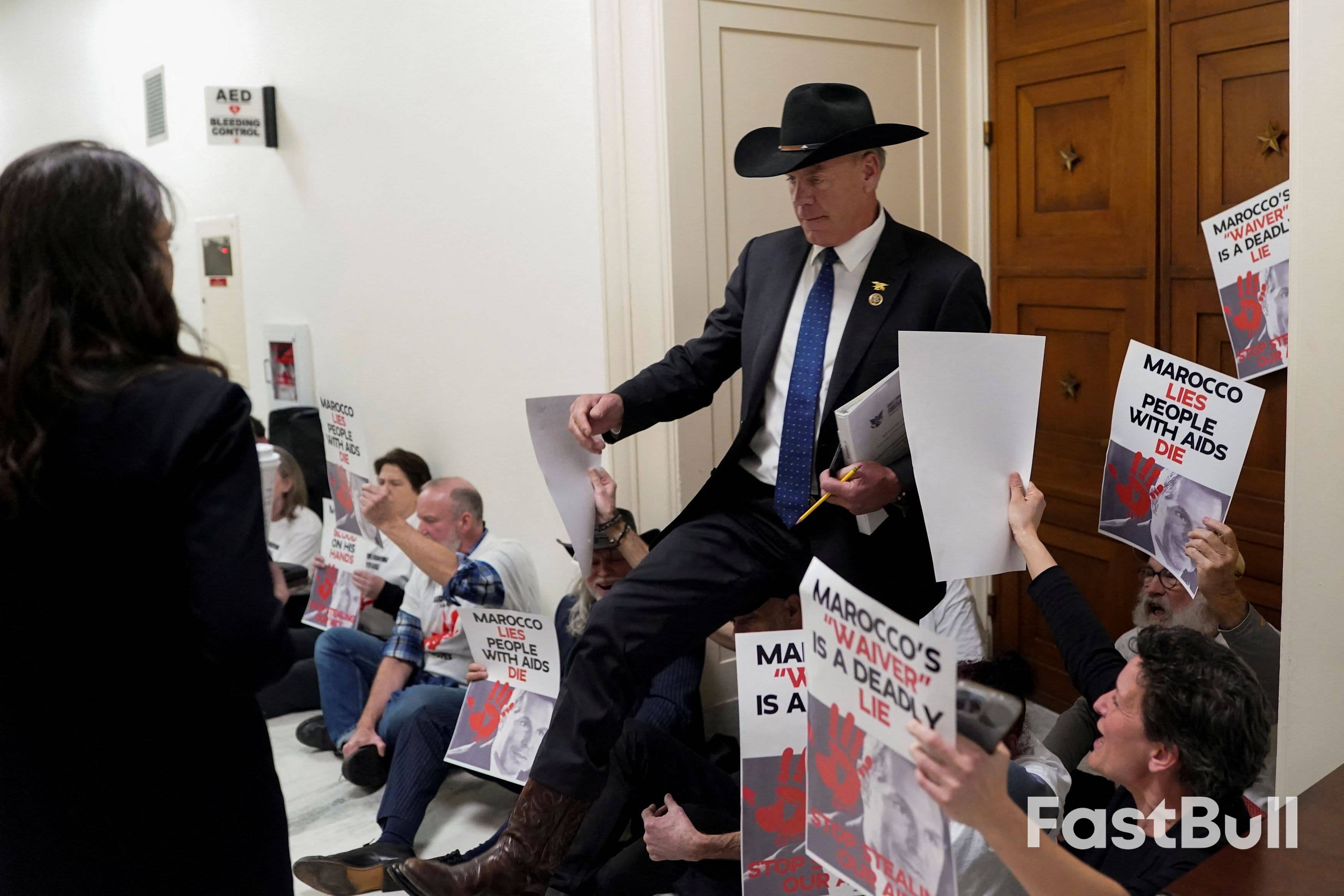

"He's from New York, he's one of the best negotiators and how he negotiates sometimes is everything is on the table," Rep. Ryan Zinke, a Montana Republican who served as Trump's first-term Secretary of the Interior, told CNBC.

Zinke added that he believes Secretary of State Marco Rubio is correct to downplay the idea of a military invasion. "I'd be supportive of negotiating a deal with Denmark to make sure that it stays influenced in the West," he said.

This perspective is shared by other Republicans who believe Trump's rhetoric is primarily about leverage.

"To Trump, everything is a deal, everything is a negotiation, a lot of things come down to leverage," said Rep. Nick LaLota, a New York Republican. "I think his administration is comfortable with the term about not taking any options off the table, I hope we don't read too much into that."

Rep. Mike Lawler, another New York Republican, acknowledged the island's importance but drew a clear line against military action. "Obviously there is strategic national security importance to it with respect to the Arctic, with respect to NATO, with respect to combating Russia," he said. "If you can enter into negotiations with Denmark, with Greenland, great. The idea of taking it by force, no... there is strong bipartisan opposition to any use of force with respect to Greenland."

Trump has long expressed interest in Greenland, a self-governing territory of Denmark, a NATO ally. He argues that U.S. control is a national security imperative for countering Russian and Chinese ambitions in the Arctic. His focus on the island has intensified following the raid that captured Maduro, who now faces drug charges in New York.

The White House has not dismissed the possibility of using force.

"The President and his team are discussing a range of options to pursue this important foreign policy goal, and of course, utilizing the U.S. Military is always an option at the Commander in Chief's disposal," White House Press Secretary Karoline Leavitt said in a statement Tuesday.

The administration's stance has rattled European leaders and angered Denmark, which, along with Greenland, has consistently rejected Trump's proposals.

"Greenland belongs to its people. It is for Denmark and Greenland, and them only, to decide on matters concerning Denmark and Greenland," Danish Prime Minister Mette Frederiksen, French President Emmanuel Macron, German Chancellor Friedrich Merz, British Prime Minister Keir Starmer, and the leaders of Italy, Spain, and Poland declared in a joint statement.

In Washington, Democrats have warned that an invasion of Greenland would shatter the NATO alliance.

• Sen. Ruben Gallego (D-AZ) announced he plans to introduce a War Powers Resolution to block Trump from ordering military action.

• Rep. Jim McGovern (D-MA) stated he is working on a similar resolution in the House, telling CNBC, "The people around him need to stage an intervention... He wants to destroy and blow up our NATO alliances."

Some Republicans have joined Democrats in condemning the rhetoric.

• Rep. Don Bacon (R-NE) called Trump's actions "appalling," adding, "It's creating a lot of long-term anger and hurt with our friends in Europe. I feel like we have a bunch of high school kids playing Risk."

• Sen. Thom Tillis (R-NC) and Sen. Jeanne Shaheen (D-NH) issued a joint statement affirming that any suggestion of coercion against a NATO ally "undermines the very principles of self-determination that our Alliance exists to defend."

Even Trump's allies concede that military action against Greenland would require congressional approval, unlike the Venezuela operation, which they characterized as a law enforcement function. "This would require congressional authorization," Zinke said.

Trump himself cast doubt on the alliance's value in a Truth Social post on Wednesday, writing, "RUSSIA AND CHINA HAVE ZERO FEAR OF NATO WITHOUT THE UNITED STATES, AND I DOUBT NATO WOULD BE THERE FOR US IF WE REALLY NEEDED THEM." He added, "We will always be there for NATO, even if they won't be there for us."

For now, influential House Republicans are standing by the president, maintaining that his threats are a means to an end. House Foreign Affairs Committee Chair Rep. Brian Mast, R-Fla., insisted the "post World War 2 order is not over in any way whatsoever."

"There's not a goal to break up NATO right now," Mast said. "There's looking to say, is there a good deal that can be made for what is a very strategic location, not just for the United States of America, but for others."

A long-standing debate over Canada's oil export strategy has taken a sharp turn. British Columbia Premier David Eby recently argued that Ottawa should focus on building domestic refineries instead of new export pipelines, reframing a conversation that has dominated the nation's energy politics for years.

Eby’s proposal comes as U.S. policy shifts regarding Venezuela create new uncertainties in global oil markets, highlighting Canada's heavy reliance on the United States as its primary customer for crude. The premier suggests that rather than simply shipping raw oil to the coast for export, Canada should invest in its own refining capacity to capture more value and reduce its dependence on foreign fuel processors.

Currently, Canada is not self-sufficient in refined fuels. The country exports most of its oil as raw crude while importing much of the fuel consumed in Eastern Canada and British Columbia. Building new refineries, Eby argues, would keep more jobs and revenue within Canada and make its energy system more resilient to external disruptions.

This push for domestic refining clashes with ongoing efforts by Ottawa and Alberta to develop a privately financed pipeline to the Pacific Coast. This plan, introduced late last year, aims to diversify Canada's trade away from the U.S. but has struggled to gain traction.

So far, no private company has committed to building the pipeline. Furthermore, opposition from Indigenous groups and coastal communities remains a significant obstacle, particularly concerning the potential increase in oil tanker traffic.

Globally, refining has become more profitable. Margins in North America, Europe, and Asia have climbed as refinery closures, outages, and sanctions have tightened the supply of processed fuels. While crude oil supply is expected to be sufficient into 2026, the availability of gasoline and diesel is much tighter, boosting the value of refining capacity.

However, Canada's existing refining infrastructure is aging and primarily designed to serve the domestic market, not global exports.

Building new refineries presents its own set of substantial challenges:

• High Upfront Costs: New facilities would require billions in initial investment.

• Regulatory Hurdles: The permitting process would likely take years and involve navigating complex regulations.

• Political Coordination: Such projects demand a level of political alignment rarely seen in Canadian energy policy.

• Market Risk: Critics warn that Canada could invest heavily only to face weaker-than-expected demand or intense competition from newer, low-cost refineries in the Middle East and Asia.

The situation is further complicated by U.S. policy toward Venezuela. The Trump administration has signaled its intention to help revive Venezuelan oil production, with much of that volume potentially heading to U.S. refiners.

Many of these American facilities, particularly on the Gulf Coast, are already configured to process heavy crude—the same type produced in Canada's oil sands. A flood of Venezuelan oil into this market would directly compete with Canadian exports, potentially putting downward pressure on prices and sales volumes.

Federal officials in Canada have downplayed this risk, expressing confidence that Canadian oil will stay competitive even if Venezuelan output recovers. Ottawa continues to support the oil sands industry through initiatives like carbon capture projects and regulatory adjustments, all while maintaining its commitment to climate targets.

Ultimately, Canada faces a decision that goes beyond a simple choice between pipelines and refineries. The core question is whether the country can successfully move up the energy value chain in a way that withstands political shifts, market cycles, and trade volatility.

With refining markets tight, U.S. trade policy unpredictable, and Venezuelan oil potentially re-entering the picture, Canada's next move will be critical. It will determine not only its economic future but also its long-term position in the global energy system.

Jan 7 (Reuters) - Russia said on Wednesday that the U.S. seizure of a Russian-flagged oil tanker in the Atlantic was a violation of maritime law, and a senior lawmaker described it as "outright piracy".

Russia's Transport Ministry said contact with the vessel, the Marinera, had been lost after U.S. naval forces boarded it near Iceland as part of efforts to block oil exports from Venezuela.

"In accordance with the 1982 U.N. Convention on the Law of the Sea, freedom of navigation applies in the high seas, and no state has the right to use force against vessels duly registered in the jurisdictions of other states," the ministry said in a statement.

Russia is demanding that the United States ensure humane and decent treatment of the Russian crew members and their swift return home, state news agency TASS quoted the Foreign Ministry as saying.

The Marinera, originally known as the Bella-1, had previously slipped through a U.S. maritime blockade of sanctioned tankers in the Caribbean.

U.S. WAGING PRESSURE CAMPAIGN AGAINST VENEZUELA

The blockade was part of a U.S. pressure campaign against Venezuela that culminated when President Donald Trump sent in U.S. special forces on January 3 to capture Venezuelan President Nicolas Maduro and bring him to New York to face drug trafficking charges, which he has denied.

"After a 'law enforcement operation' that killed several dozen people in Venezuela, the U.S. has engaged in outright piracy on the high seas," Andrei Klishas, a lawmaker from the ruling United Russia party, posted on Telegram.

Two U.S. officials, speaking on condition of anonymity, told Reuters that Wednesday's operation was carried out by the Coast Guard and U.S. military.

They said Russian military vessels, including a submarine, were in the general vicinity. There were no indications of any confrontation between U.S. and Russian military forces.

Relations between Moscow and Washington plunged to their worst state since the Cold War after Russia invaded Ukraine in February 2022, though they have become more cordial since Trump began his second term last year and started engaging with President Vladimir Putin to seek an end to the conflict.

Military incidents between the nuclear-armed powers are rare. In March 2023, a U.S military surveillance drone crashed into the Black Sea after being intercepted by Russian fighter jets, prompting Washington to protest and warn of the risk of an escalation.

Venezuelan leader Maduro was the second close ally of Russia to be ousted in just over a year, following the toppling of Syrian President Bashar al-Assad in December 2024.

Russia has said it backs Delcy Rodriguez, sworn in on Monday as interim president, and will continue to support Venezuela in the face of what Moscow has called "blatant neocolonial threats and foreign armed aggression".

With Russians still in the midst of an extended New Year holiday period, Putin has yet to comment publicly on the U.S. action to remove Maduro.

Japan has sharply criticized new Chinese export restrictions targeting its industries, a move widely seen as retaliation for Tokyo's recent comments on Taiwan's security. Beijing's measures focus on dual-use goods, which are items that have both civilian and military applications.

"A measure such as this, targeting only our country, differs significantly from international practice, is absolutely unacceptable and deeply regrettable," stated Minoru Kihara, Japan's Chief Cabinet Secretary and top government spokesman.

The trade restrictions apply to a range of goods, software, and technologies classified as dual-use. This category can include critical materials like rare earths, which are essential for manufacturing advanced products such as computer chips and drones.

China followed up its initial announcement by launching an investigation into imported dichlorosilane, a chemical gas vital for semiconductor production. The probe came after China's domestic industry complained that the price of the chemical imported from Japan had fallen by 31% between 2022 and 2024.

China's Commerce Ministry alleged on Wednesday that "the dumping of imported products from Japan has damaged the production and operation of our domestic industry."

The trade friction follows growing displeasure in Beijing over recent statements from Japan’s new government regarding Taiwan.

On November 7, just weeks after taking office, Japanese Prime Minister Sanae Takaichi suggested to parliament that a Chinese attack on Taiwan would represent an existential threat to Japan. She hinted that Japan's military might even mobilize to support the United States if it acted to protect Taipei. This comes as Japan increases its defense budget and redefines its military's role away from a purely defensive force.

Beijing, which views Taiwan as its own territory, has demanded Takaichi retract her comments. While she has not done so, she stated on Monday that her government remains "open to various opportunities for dialogue with China and has never closed the door."

Tensions escalated further on Tuesday when Japanese lawmaker Hei Seki visited Taipei and declared Taiwan an independent country. Seki, who was sanctioned by China last year for "spreading fallacies," said his visit was intended to show that China and Taiwan were "different countries."

When asked about the visit, Chinese Foreign Ministry spokesman Mao Ning dismissed the lawmaker, stating, "The nasty words of a petty villain like him are not worth commenting on."

Officially, Japan, like the U.S. and many Western nations, adheres to the "One China" principle, which does not formally recognize Taiwan as an independent state. However, it simultaneously provides support to the island and opposes any forceful change to the status quo.

China's actions against Japan stand in stark contrast to its warming ties with South Korea. The trade restrictions coincided with the first state visit by a South Korean president since the COVID-19 pandemic.

President Lee Jae Myung concluded a four-day trip on Wednesday, during which he and Chinese President Xi Jinping signed several cooperation agreements covering technology, trade, transportation, and environmental protection.

Crucially, Lee’s government did not join Japan in condemning China's military drills near Taiwan in late December, signaling a different diplomatic strategy.

Mexican President Claudia Sheinbaum confirmed that the country will continue to supply Cuba with crude oil, framing the shipments as essential humanitarian aid. The announcement comes after the U.S. seizure of Venezuelan leader Nicolas Maduro, a development that puts Cuba's traditional energy supply at risk.

Sheinbaum stressed Mexico's heightened importance as a supplier in light of the situation in Venezuela. "With the current situation in Venezuela, Mexico has become an important supplier," she told reporters. "Previously it was Venezuela, but it's part of what has historically been sent."

Mexico's state-owned oil company, Petroleos Mexicanos (Pemex), has been shipping oil to Cuba for decades. In 2024, these shipments grew by nearly 20%, reaching an average of approximately 20,000 barrels per day. This policy finds support within segments of Sheinbaum's Morena party, which sympathizes with Cuba's government as it grapples with severe energy shortages.

Sheinbaum clarified that the oil exports are driven by a mix of factors, not just political goodwill. "For many years, oil has been sent to Cuba for various reasons, some of which are contracts, some of which are humanitarian aid," she explained. She also pointed out that the administration of former President Enrique Peña Nieto used oil to settle outstanding debts owed by the Mexican government to Cuba.

When asked about the scale of the oil exports, President Sheinbaum denied that shipments had increased in recent months. She also declined to comment on whether Mexico plans to send more or larger oil deliveries in the future.

Shipping data tracked by Bloomberg aligns with the president's statement on recent volumes. According to vessel-tracking reports, Mexico's oil shipments to Cuba have not risen since last September, when Pemex sent 400,000 barrels. Another shipment of the same size is expected this month.

Venezuela has historically been a key ally for Cuba, providing oil in exchange for services from Cuban doctors and security personnel. With potential U.S. control over Venezuelan oil, it remains uncertain if Cuba will lose access to this vital supply line entirely.

Mexico has also deepened its relationship with Cuba through other means. In recent years, including during the pandemic, Mexico has welcomed Cuban doctors to work in its healthcare system. According to a report from the newspaper El Universal, the Mexican government paid over 2 billion pesos ($111 million) for Cuban physicians between 2022 and 2025.

Kim Jong Un’s New Year's address on December 31 offered few clues about North Korea's policy direction for 2026. In a notable departure from tradition, his speech made no mention of either South Korea or the United States, focusing instead on domestic themes of patriotism, loyalty, and economic growth.

More detailed domestic and foreign policy objectives are expected to be unveiled at the Ninth Party Congress of the Workers' Party of Korea, which is scheduled for early this year. In the meantime, two critical questions are set to define North Korea's trajectory in 2026.

The first major uncertainty revolves around who will eventually succeed Kim Jong Un. His 13-year-old daughter, Kim Ju Ae, has made increasingly frequent public appearances, fueling speculation that she is being positioned as his heir. However, it remains far too early to draw any firm conclusions about a future leadership transition.

The second key question is whether Pyongyang will restart dialogue with Seoul and Washington. Both South Korean President Lee Jae-myung and US President Donald Trump have expressed a desire to revive talks. Yet, Kim has drawn a clear red line, stating he will not return to the negotiating table unless the US abandons its "obsession with denuclearization."

The prospects for productive talks between the US and North Korea appear significantly lower than they were during the first Trump administration. Pyongyang also shows far less interest in engaging with Seoul than with Washington, a stance reinforced by its decision in December 2023 to remove the peaceful reunification of the Korean peninsula as an official policy goal.

The new US national security strategy, published in December 2025, signals a significant pivot in Washington's priorities. Unlike the 2017 strategy from the first Trump administration, which heavily emphasized the threat from North Korea and the US alliance with South Korea, the new document omits North Korea entirely.

Instead, the strategy mentions China 21 times. It calls for greater burden-sharing from allies, explicitly stating that South Korea and Japan must increase their defense spending "to deter adversaries and protect the First Island Chain," which includes Japan, Taiwan, the Philippines, and Borneo.

While the US is not disengaging from East Asia, its primary focus has clearly shifted from deterring Pyongyang to countering Beijing, particularly on the economic front. The omission of North Korea could also be a strategic move to avoid antagonizing Kim, given President Trump's stated goal of resuming dialogue.

This shift did not go unnoticed in Pyongyang. A pro-North Korean newspaper in Japan with close ties to the regime commented that "mentioning North Korea would mean the US is admitting a complete failure in its policy to denuclearize the Korean peninsula."

North Korea's own strategic calculus has evolved, driven by a growing alignment with Moscow and the failure of the 2019 Hanoi summit with Trump. Since then, Pyongyang's interest in diplomacy has waned while its nuclear program has accelerated.

In late December 2025, North Korean state media reported that Kim had inspected a new 8,700-tonne nuclear-powered submarine. He described the vessel as an "epoch-making crucial change" in the country's deterrence capabilities. Although details about the submarine are scarce, its existence underscores Pyongyang’s unwavering commitment to advancing its nuclear and missile technologies.

This development follows a key decision made in November when Presidents Lee and Trump met, and the US gave its approval for South Korea to build its own nuclear-powered submarines. On December 19, Seoul and Washington finalized a standalone agreement to advance this cooperation. The deal allows South Korea to enrich low-enriched uranium for submarine fuel and permits the US to transfer nuclear materials for military use—a framework similar to the AUKUS security pact with Australia.

Kim Jong Un responded sharply, declaring that any such cooperation between the US and South Korea would be viewed as "an aggressive act" and a "security threat that must be countered." China has also weighed in, urging Seoul to "handle the matter with prudence."

While the submarine agreement strengthens the US–South Korea alliance, it also raises questions about Washington's long-term commitment. Allowing Seoul to develop this capability could be part of a broader US strategy to shift the burden of deterring Pyongyang onto its ally, freeing up American resources to focus on Beijing.

Against this backdrop, President Lee is currently in Beijing for a four-day state visit. In talks with Chinese President Xi Jinping, Lee hailed a "new phase" in relations and asked Xi to act as a mediator on the Korean peninsula, including on the nuclear issue.

Pyongyang, however, appears unimpressed. Just before Lee’s arrival in Beijing, North Korea test-fired several missiles, including hypersonic ones, in response to what it termed the "recent geopolitical crisis," an apparent reference to the US attack on Venezuela.

President Trump is also scheduled to visit Beijing in 2026. It remains uncertain whether either leader can persuade China to apply pressure on North Korea, especially after Beijing reaffirmed its "friendly" relationship with Pyongyang last year.

If dialogue with North Korea is revived, Kim Jong Un will demand tangible concessions. These could include:

• The easing of international sanctions.

• A halt to US–South Korea joint military exercises.

• Official recognition of North Korea as a nuclear-armed state.

Even if talks do not materialize, Washington and Seoul must maintain a strong, unified front to deter Pyongyang. This requires continued joint military exercises, including trilateral drills with Japan, robust enforcement of sanctions, and a refusal to offer unconditional dialogue. As North Korea strengthens its ties with China and Russia, the US and South Korea must not lose sight of the threat it poses, even as Beijing emerges as a more pressing challenge.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up