Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. producer prices unexpectedly fell in August amid a compression in trade services margins and mild increase in the cost of goods, suggesting that domestic businesses were probably absorbing some of the tariffs on imports.

U.S. producer prices unexpectedly fell in August amid a compression in trade services margins and mild increase in the cost of goods, suggesting that domestic businesses were probably absorbing some of the tariffs on imports.

The lack of strong producer price pressures, despite import duties, could also be signaling softening domestic demand against the backdrop of a struggling labor market. The Federal Reserve is expected to cut interest rates next Wednesday, with a quarter-percentage-point reduction fully priced in, after pausing its easing cycle in January because of uncertainty over the impact of President Donald Trump's sweeping tariffs."Inflation barely has a heartbeat at the producer level which shows the tariff effect is not boosting across-the-board price pressures yet," said Christopher Rupkey, chief economist at FWDBONDS. "As time goes on one has to wonder if there are slow-growth reasons and weak economic demand that is keeping inflation in check. There is almost nothing to stop an interest rate cut from coming now."

The Producer Price Index for final demand dipped 0.1% last month after a downwardly revised 0.7% jump in July, the Labor Department's Bureau of Labor Statistics said on Wednesday. Economists polled by Reuters had forecast the PPI would advance 0.3% after a previously reported 0.9% surge in July.A 0.2% drop in the prices of services accounted for the fall in the PPI. That followed a 0.7% rebound in July. Services were last month held down by a 1.7% decline in margins for trade services, reflecting a 3.9% decrease in margins for machinery and vehicle wholesaling.

But the cost of services less trade, transportation and warehousing increased 0.3% while prices for transportation and warehousing services shot up 0.9%.

Portfolio management fees increased 2.0%. Airline fares rose 1.0% while the cost of hotel and motel rooms increased 0.9%. Prices for dental services accelerated 0.6%.

Goods prices edged up 0.1% after increasing 0.6% in the prior month. Food prices gained 0.1%, with declines in the costs of eggs and fresh fruits partially offsetting more expensive beef and coffee because of tariffs. Wholesale beef prices surged 6.0% while those for coffee vaulted 6.9%.

Energy prices fell 0.4%. Excluding the volatile food and energy components, producer goods prices rose 0.3% after climbing 0.4% in July, indicating some pass through from tariffs. In the 12 months through August, the PPI increased 2.6% after climbing 3.1% in July.

Economists are expecting price pressures from tariffs to lift consumer inflation in August.

U.S. stocks opened higher. The dollar eased against a basket of currencies. U.S. Treasury yields fell.

Labor market weakness has raised concerns that the economy was stagnating. The government estimated on Tuesday that the economy likely created 911,000 fewer jobs in the 12 months through March than previously estimated.

That data followed the release last Friday of the monthly employment report, which showed job growth almost stalled in August and the economy shed jobs in June for the first time in four and a half years.

The Labor Department's Office of Inspector General said Wednesday it is reviewing the "challenges" that the Bureau of Labor Statistics is facing in its data-collection efforts.

The internal watchdog, in a letter, said it was initiating that probe in light of BLS announcing a reduction in its data collection for two key inflation metrics.

The probe also comes in light of BLS recently issuing a "large downward revision of its estimate of new jobs in the monthly Employment Situation Report," assistant inspector general for audit Laura Nicolosi wrote.

The letter was addressed to William Wiatrowski, who has served as BLS' acting commissioner since President Donald Trump fired the agency's former head in early August in response to a weak monthly jobs report.

BEIJING — Nearly half of U.S. businesses have redirected planned China investments to other regions over the past year — the highest on record — the American Chamber of Commerce in Shanghai said Wednesday.The business chamber's survey of members from May 19 to June 20 came shortly after an escalation in U.S.-China trade tensions and a temporary rollback of some tariffs from mid-May. The two countries last month agreed to extend the trade truce by another 90 days, to mid-November.

"For a company, 90 days, that's just way too short," Eric Zheng, President of AmCham Shanghai, told reporters, pointing out that the supply chain planning is far longer term."At least we don't need to deal with even higher tariffs [for now], but the issue is not going away, it's still here," Zheng said.As many as 47% of the survey respondents said that they had diverted investments planned for China, primarily to Southeast Asia. That's the highest share since the survey first asked the question about plans to shift investments away from China in 2017.

The Indian subcontinent, which includes Bangladesh, was the second-most popular destination for redirected investments, while the U.S. and Mexico ranked far lower.U.S. President Donald Trump has sought to encourage businesses to bring manufacturing back to America, with Trump criticizing Apple's plans to expand production in India. A few companies, especially in advanced technology, have made high-profile announcements to invest in the U.S.AmCham Shanghai's members include Apple, Ford, Honeywell, Meta and Tesla. Jeffrey Lehman, the business group's chair, pointed out that members are affected not just by U.S. tariffs on China, but Beijing's retaliatory duties, since materials needed to build the product often come from the U.S.

U.S. tariffs on Chinese goods stand at nearly 58%, while China's are around 33%, according to the U.S.-based Peterson Institute for International Economics. Tariff rates can vary by product.Competition in China's domestic market is also increasing, while confidence about the five-year local business outlook hit a record low for a fourth-straight year, the AmCham Shanghai study found.

Only 28% of respondents said that their China operating margins in 2024 were higher than that of their global business, while 33% said their China performance was actually worse.U.S. companies also said their Chinese competitors were more advanced in six out of eight categories, especially speed to market and adoption of artificial intelligence. The survey found 41% of respondents said Chinese companies were more advanced in adopting AI, with the share rising to 62% in the retail and consumer industry.AmCham Shanghai members only saw overwhelming advantages over their Chinese competition in product quality and development.

While trade tensions and worries about China's economic slowdown weighed on the near-term outlook, the survey respondents indicated significant improvement in the local regulatory environment.Nearly half, or 48%, said that the regulatory environment was transparent for their industry, a large jump from just 35% in 2024. The share of businesses saying that lack of transparency was hindering operations fell by 12 percentage points to 16%.The share of respondents indicating that foreign and local companies were treated equally rose by 5 percentage points to 37%.

Beijing in recent years has ramped up its efforts to attract and retain foreign investment, with increased engagement and friendlier policy announcements. Earlier this year, China released an "action plan" that included measures for making it easier for foreign businesses to invest in biotechnology, while clarifying standards for government procurement.However, the AmCham Shanghai survey still found that 14% of the respondents reported a worsening environment for foreign business in China, with the tech sector seeing the highest level of challenges at 31% of industry respondents.

Key takeaways:

Bitcoin broke $114,000 as data showed PPI inflation cooled sharply in August.

Traders believe the data could push the Federal Reserve to cut rates in September.

Long-term onchain trends show short-term turbulence occurring after Fed rate cuts, then longer-term upside.

Bitcoin (BTC) surged above $114,000 for the first time since Aug. 24, extending its recent recovery as US inflation data came in far cooler than expected. The move follows the release of the August Producer Price Index (PPI), which dropped to 2.6% year-over-year versus forecasts of 3.3%. Core PPI, which strips out food and energy, fell to 2.8%, well below the 3.5% consensus.

Source: Cointelegraph/TradingView

Source: Cointelegraph/TradingViewOn a monthly basis, PPI even turned negative, marking only the second contraction since March 2024, according to the Kobeissi newsletter. Adding to the dovish tone, inflation figures from July were revised lower as well, with headline PPI adjusted to 3.1% from 3.4% and core PPI to 3.4% from 3.7%. In addition to the historic US jobs data revision earlier this week, which erased 911,000 jobs from the past 12 months, markets are viewing interest rate cuts as increasingly imminent.

Market analyst Skew noted that producer inflation trends often lag behind those of the Consumer Price Index (CPI) by one to three months. This means sticky CPI readings could still appear in the short run, though the broader trajectory points to cooling inflation into Q4. While the PPI slowdown is encouraging, hedge flows may continue until CPI confirms the easing trend.

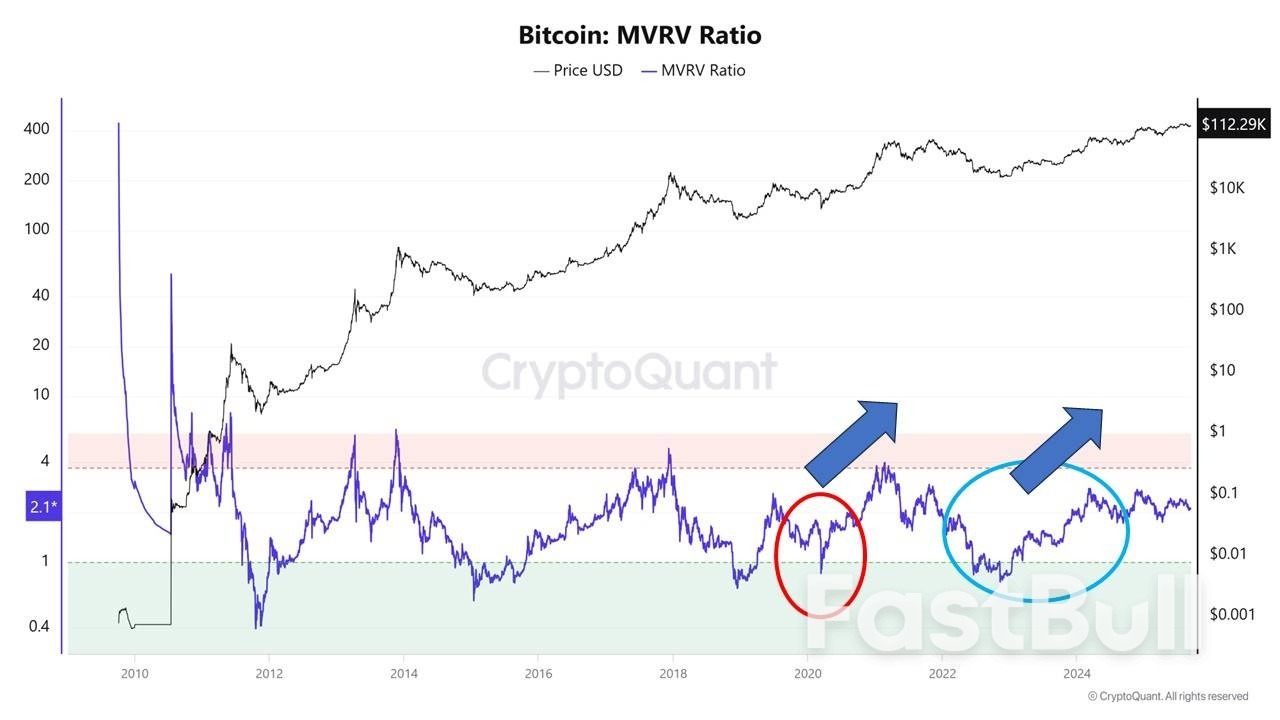

With Federal Reserve interest rate cuts looking extremely likely, Bitcoin’s history shows a consistent pattern of turbulence followed by upside. Two onchain metrics, Market Value to Realized Value (MVRV) and Whale Ratio, shed further light.

MVRV compares Bitcoin’s market capitalization to its realized capitalization (the aggregate value at which coins last moved). When MVRV hovers near 1, BTC is typically undervalued, and levels near 3–4 suggest overheated valuations.

Meanwhile, Whale Ratio measures the share of large holder transactions in exchange flows, showing when whales are sending coins to sell or pulling them back for storage.

Source: CryptoQuant

Source: CryptoQuantData from CryptoQuant highlights that in March 2020, interest rate cuts sent MVRV collapsing toward 1 as panic wiped out investors’ speculative gains, while the Whale Ratio spiked on heavy whale selling.

As liquidity flooded in, the MVRV rebounded, and whales shifted to accumulation, fueling Bitcoin’s 2020–2021 bull run. A similar pattern repeated during the late 2024 easing cycle, when both indicators reflected short-term selling before stabilizing into another rally.

If history rhymes, Fed easing in 2025 could again bring initial volatility, but overall provide the liquidity backdrop for Bitcoin to approach new highs.

Daily E-mini S&P 500 Index

Daily E-mini S&P 500 Index Daily Oracle Corporation

Daily Oracle CorporationWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up