Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

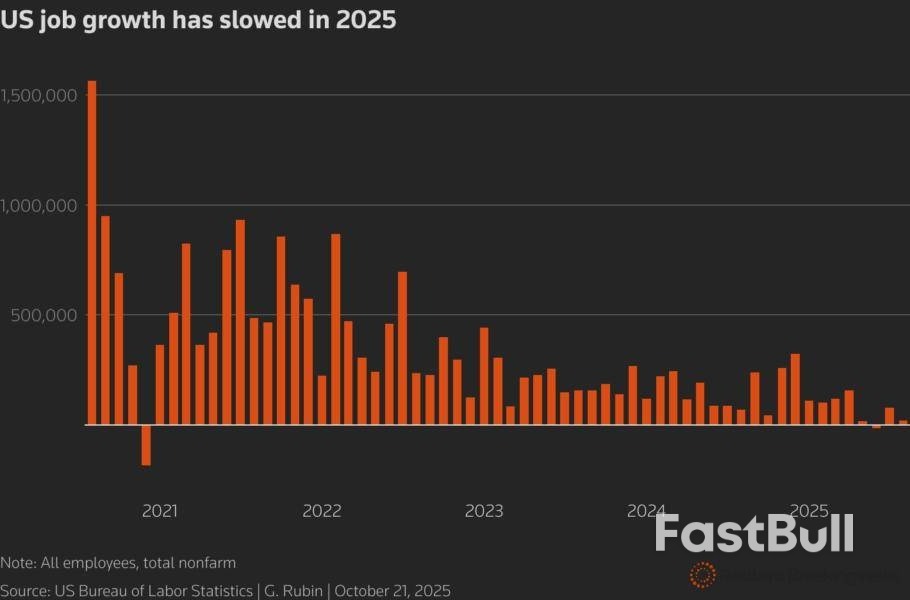

The U.S. labor market has been characterized as a 'no hire, no fire' landscape for much of the past year. But 'no hire, more fire' increasingly looks more accurate, providing further ammunition for the Federal Reserve to cut interest rates.

The U.S. labor market has been characterized as a 'no hire, no fire' landscape for much of the past year. But 'no hire, more fire' increasingly looks more accurate, providing further ammunition for the Federal Reserve to cut interest rates.

Retail giant Amazon on Tuesday announced 14,000 layoffs, with more to come next year, while delivery service UPS revealed that it has cut a whopping 48,000 employees over the past year. The reasons cited include protecting margins, employing more artificial intelligence, and reversing pandemic-era over-hiring.

These aren't the only eye-opening announcements recently: around 25,000 workers are being let go at Intel, 15,000 at Microsoft, and 11,000 at Accenture. The Trump administration is also firing swathes of government workers.

In total, U.S. employers announced almost 950,000 job cuts in the January-September period, according to global placement firm Challenger, Gray & Christmas, with the top affected sectors being government, tech and retail.

While most of that was earlier in the year, these figures suggest the labor market is truly cracking, lending credence to Fed Chair Jerome Powell's view that downside risks to employment outweigh upside risks to inflation.

The Fed resumed its interest rate-cutting cycle in September after a nine-month hiatus and is expected to continue easing into next year due to concerns about labor market weakness.

While the unemployment rate hasn't risen much, that is mainly because cooling demand for workers has been offset by shrinking labor supply, as the Trump administration has cracked down on immigration and increased deportations.

In normal times, job cuts at individual firms might not be on policymakers' radar. But these are not normal times. We're in the midst of the second-longest government shutdown in U.S. history. This has prevented the release of almost all labor market data – including monthly payrolls, the unemployment rate, job openings and labor turnover (JOLTS) and weekly jobless claims – for four weeks. Fed officials are flying blind.

With no official incoming data for guidance, specific corporate announcements could take on extra significance.

Troy Ludtka, senior U.S. economist at SMBC Nikko Securities Americas, says the Amazon and UPS announcements may not move the policy dial just yet, but they should confirm Fed officials' "anxieties" over the labor market. "The question now is, just how aggressive will other companies be in reducing headcount?"

As the Fed waits for the answer to that question, the few official economic indicators available are already ringing warning bells.

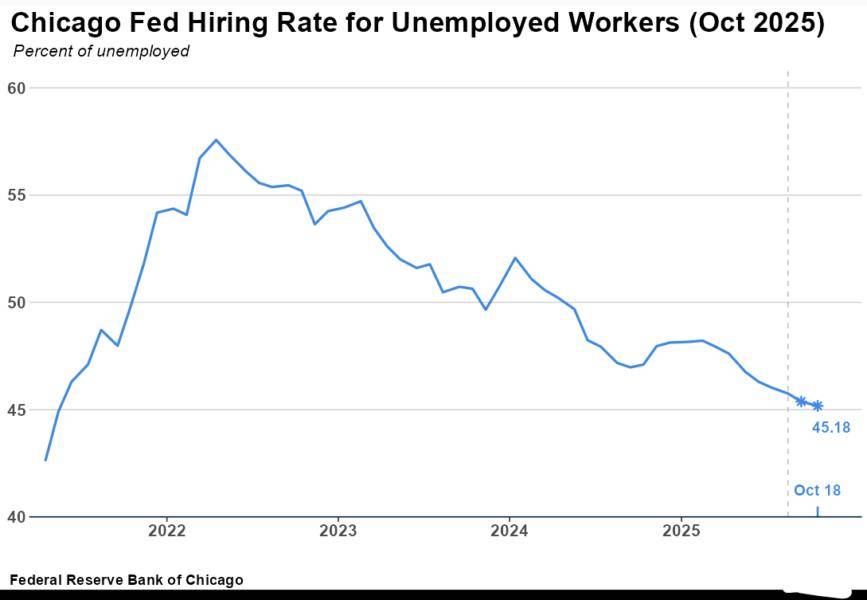

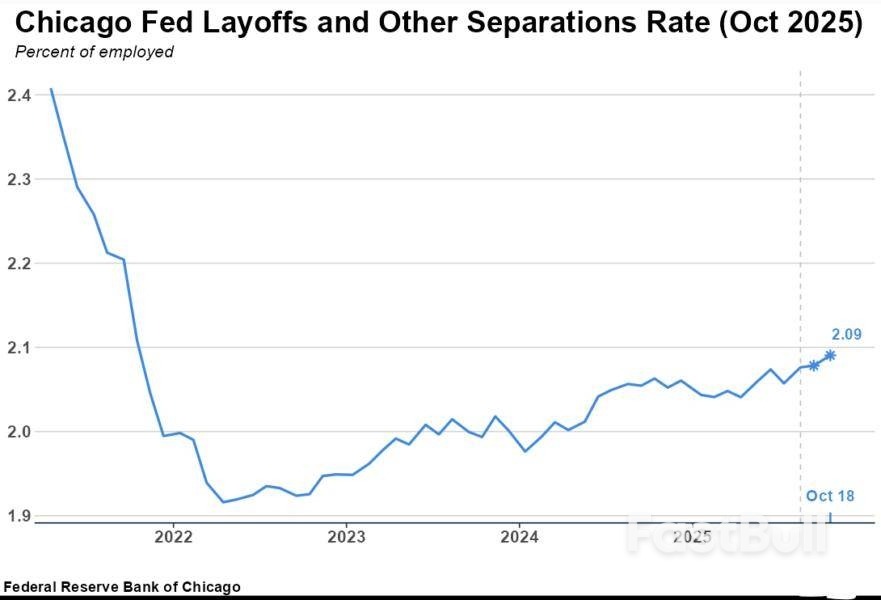

The Chicago Fed's economic model – which uses private data when official government statistics are unavailable – showed that 'Layoffs and Other Separations' as a share of employed workers are grinding higher and that the 'Hiring for Unemployed Workers' as a share of total unemployed is falling. Both of these are levels not seen for four years.

Meanwhile, U.S. private payrolls increased by an average of just 14,250 jobs in the four weeks ending October 11, the ADP National Employment Report's weekly preliminary estimate showed on Tuesday. ADP, which usually publishes monthly reports, said it will now publish weekly preliminary estimates every Tuesday, based on its high-frequency data.

That's a paltry increase, effectively signaling no job growth at all – although it is better than the 32,000 decline in ADP's last monthly report for September.

All told, the labor market picture appears to justify lower interest rates. But easier policy is not without risks. Wall Street, led by tech and AI stocks, is booming, with financial conditions the loosest in years. And inflation is still a full percentage point above the Fed's target.

Rate cuts may be well-intentioned, with the goal of protecting potentially millions of workers at risk of losing their jobs, but easing will pour fuel on the ongoing 'melt up' rally. So while it remains unclear how much these cuts will actually support the labor market, they are almost certain to boost wealthy asset holders' portfolios.

What we also know for sure is that the more companies announce sweeping layoffs, the more likely the Fed is to act.

Oil prices held on to most gains from the previous session in early trading on Thursday as investors awaited U.S.-China trade talks later in the day, hoping for signs that tensions clouding the economic growth outlook will ease.

Brent crude futures fell 3 cents, or 0.05%, to $64.89 a barrel by 0032 GMT, while U.S. West Texas Intermediate crude futures fell 11 cents, or 0.18%, to $60.37.

U.S. President Donald Trump and Chinese President Xi Jinping will meet on Thursday in Busan, South Korea, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit. Markets hope they will agree to dial down trade tensions that have hurt the outlook for global growth and fuel demand.

Trump said on Wednesday he expects to reduce U.S. tariffs on Chinese goods in exchange for Beijing's commitment to curb the flow of precursor chemicals to make the drug fentanyl.

Also boosting the economic outlook, the U.S. Federal Reserve lowered interest rates on Wednesday, in line with market expectations. However, it signaled that might be the last cut of the year as the ongoing government shutdown threatens data availability.

"The Fed's decision underscores a broader turn in its policy cycle – one that favours gradual reflation and support over restraint, providing a tailwind to commodities sensitive to economic activity," Rystad Energy's chief economist Claudio Galimberti said in a note.

Brent and WTI rose 52 cents and 33 cents, respectively, in the previous session on optimism about the trade talks and a larger than expected drawdown in U.S. crude and fuel inventories.

Crude inventories dropped by 6.86 million barrels to 416 million barrels in the week ended October 24, the EIA said, compared with analysts' expectations in a Reuters poll for a 211,000-barrel fall.

Toyota Motor does not face an immediate chip shortage from recent Chinese export restrictions related to chipmaker Nexperia, even as the Japanese automaker is carefully watching risks to production, Chief Executive Koji Sato said."I do think there's some risk, but it's not like we're facing shortages tomorrow," Sato told reporters at the Japan Mobility Show in Tokyo on Wednesday afternoon.While the issue could impact Toyota's output, the world's top-selling automaker would not be suddenly exposed to a major supply crunch, he said.

Automakers worldwide are scrambling to secure chips and review inventories as concerns mount over a deepening supply squeeze linked to Dutch chipmaker Nexperia.China banned exports of Nexperia's products after the Dutch government seized control of the firm last month, citing fears of technology transfers to its Chinese parent Wingtech, which the United States has flagged as a potential security risk.As an overall industry, Japanese automakers are working to standardise legacy chips to avoid the kind of severe shortages seen during the pandemic, when customised semiconductors left automakers vulnerable, he said.

His comments came after smaller rival Nissan said it had enough chips at the moment to last until the first week of November without disruption - just days away.Separately, Sato said that the world's biggest automaker has no plans to revise the tender offer price for Toyota Industries as part of a planned buyout, despite criticism from some shareholders.The Toyota group said in June it would take Toyota Industries private through a holding company backed by Toyota Motor, Toyota Fudosan and Toyota Chairman Akio Toyoda.

The offer of 16,300 yen ($108.10) per share represents a premium over historical averages before reports of the deal but is below the price on the day before the announcement, drawing complaints from investors who say the bid undervalues the company.The transaction, aimed at taking the forklift maker and key Toyota supplier private, is part of a broader restructuring of Toyota's group and has faced calls for greater disclosure from global asset managers.

Sato said the group will proceed with high transparency and, as a basic principle, ensure minority shareholders' interests are carefully considered. He added that the goal is to advance the plan in a way that secures broad stakeholder understanding rather than rushing it.

Mexico's banking lobby is recommending its members go beyond current regulations to fight illicit financing after the US cracked down on some banks in the country for allegedly aiding drug traffickers.Mexican lenders should commit to an 11-point plan aimed at "closing the gap" between US and Mexican regulations while also implementing stricter controls on international transfers, remittances and big cash withdrawals, Emilio Romano, the head of the Asociacion de Bancos de Mexico, or ABM, said at a press conference on Wednesday.

The initiative also sets a deadline for the end of 2025 to enroll an initial group of banks in a real-time information exchange platform to prevent money laundering and illicit financial activities that would be operational by the end of July next year."This puts us at the forefront, not only in Mexico, but internationally," Romano said.Mexican banks went on high alert after the US Treasury's Financial Crimes Enforcement Network said in June that it would cut off three local firms from the US financial system for allegedly helping fentanyl traffickers launder funds. The unprecedented orders, based on a new power granted under last year's Fend Off Fentanyl Act, crippled the designated firms before even taking effect this month. The move has led other Mexican lenders to purge clients and increase controls in an effort to avoid becoming the next US target.

The move against the Mexican banks was part of a broader US administration strategy for the "total elimination of cartels" that has included deadly military strikes on alleged drug-trafficking boats. The Trump administration launched its largest strikes yet this week, destroying four boats in the eastern Pacific and killing 14 people in an attack that has risked raising tensions with Mexico, a key trading partner.The ABM will propose to Mexican authorities that they put the lobby's recommendations into law and apply them to other financial entities, such as non-bank financial institutions, in order to create a level playing field, Romano said.

The recommendations include limiting international transfers by legal entities to account holders, with the same limitation applied to individuals by June 2027.

"This is very important because a bank account has to go through a selection process," Romano said. "This is what we call 'know your customer,' and the registration process is very regulated. And this regulation allows us to ensure that those who send or receive international transfers are perfectly identified, each and every one."For transfers paid in cash to individuals, the lobbying group recommended that users must show identification, including one biometric data point, while payments should be limited to $350 per remittance and no more than $900 per month per recipient. Cash deposits and withdrawals above 140,000 Mexican pesos (around $7,600) should also face tighter controls by July next year, the ABM said.

The organization will begin to distribute reports to banks on specific money laundering "typologies" they should be watching out for in order to alert authorities of suspicious transactions.

The Federal Reserve's policy committee won't necessarily cut interest rates in December, contrary to what financial markets had expected.

Federal Reserve Chair Jerome Powell upended financial market bets that the Fed's policy committee would lower its benchmark interest rate for a third consecutive meeting in December. Speaking at a press conference following the Fed's decision to cut rates by a quarter-point on Wednesday, Powell said that the rate-cutting campaign would not necessarily continue into December, as had been widely forecast.

"A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it," Powell said. "There were strongly different views today. And the takeaway from that is that we haven't made a decision about December."

Powell went out of his way to throw cold water on hopes in financial markets that the Fed would cut interest rates in December, leaving the future of interest rates up in the air.

Powell's comments underscored that the central bank's decision-makers are divided on how to handle its current dilemma.

Fed officials are torn between lowering the fed funds rate to boost the economy and rescue the stumbling job market, and keeping it higher for longer to slow the economy and fight inflation. To make matters trickier, the ongoing government shutdown has cut off the data from statistical agencies that the Fed usually relies on to make its decisions.

Some members of the Fed's 12-member policy committee have expressed a preference for more rapid rate cuts, while others have advocated for a more cautious approach. Those divisions came to the fore Wednesday when two voters deviated from the majority consensus for a quarter-point rate cut in opposite directions.

As of Wednesday afternoon, there was a 56% chance of a rate cut in December, down from 90% the day before, according to the CME Group's FedWatch tool, which forecasts rate movements based on fed funds futures trading data.

Stocks fell during the press conference. The benchmark S&P 500, which had reached a record intraday high before Powell began speaking, was down 0.2% by 3:45 p.m. Eastern Time.

Powell acknowledged the Fed's difficult position, where economic trends are pulling monetary policy in opposite directions.

"We have the situation where the risks are to the upside for inflation and to the downside for employment," Powell said. "We have one tool ... you can't address both those at once."

Indonesian bonds have room to rally further, according to strategists, on expectations of further interest-rate cuts by the central bank.Nomura Holdings Inc. says the benchmark 10-year yield may slide to 5.75% by year-end from the current 6%. PT Sucor Sekuritas sees it falling to as low as 5.5%, citing signals from Bank Indonesia that there's room for further easing. The nation's largest local fund manager, PT Manulife Aset Manajemen Indonesia, also anticipates lower yields ahead.

"There's still some downward pressure on yields in the front end of the bond curve, mainly coming from BI easing expectations," said Nathan Sribalasundaram, rates strategist at Nomura. Over the past few months, they've shifted their focus slightly away from FX stability toward a more pro-growth stance, he said.The central bank held rates in October after three consecutive months of cuts, though Governor Perry Warjiyo said the room to ease remains open given low inflation projections and below-capacity domestic economic growth. Local-currency 10-year government bond yields have fallen since the end of March, but steadied after falling below 6% on Oct. 16.

Sri Mulyani Indrawati's replacement as finance minister with Purbaya Yudhi Sadewa worried some in the market that the government would boost spending and remove its state budget deficit ceiling. But his signals on keeping fiscal discipline are convincing some investors to give him the benefit of the doubt."The new finance minister, he's kind of said the right things as well so far," said Sribalasundaram, though he added that it appears Purbaya wants to push some fiscal boundaries as well. Still, he said "the main and the most important focus for the market is keeping this 3% fiscal ceiling for Indonesia, which for now seems to be kept in place at least for this year and next year for the budget."

However, not everything is set to help bonds gain. Foreign funds have been decreasing their holdings on concerns over domestic fiscal discipline and the central bank's independence. Offshore investors' ownership has declined to 13.7% of the total outstanding from 14% in September, when outflows hit a record high."Investors are still open to looking at Indonesian bonds and investing, but looking at with one eye on fiscal developments," said Mitul Kotecha, head of FX and emerging markets macro strategy at Barclays Plc.

The expectation of Federal Reserve rate cuts is boosting sentiment, said Ahmad Mikail Zaini, Sucor's head of research. In the meantime, a rush of liquidity from the government's cash reserves placement in state-owned banks, as well as a lower outstanding amount of BI bills, will also push investors to long-end government bonds, he said.

Key points:

U.S. PresidentDonald Trumpand China's leader Xi Jinping were set to hold talks in South Korea on Thursday morning, seeking a return to a fragile trade war truce between the world's two largest economies.The meeting, the first between the leaders since Trump returned to office in January, is due to begin at 11 a.m. local time (0200 GMT) in the southern port city of Busan, capping off the U.S. president's whirlwind trip around Asia.Trump has repeatedly expressed optimism about reaching agreement with Xi during the summit, taking place on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit, buoyed by a breakthrough in trade talks with South Korea on Wednesday.

But with both countries increasingly willing to play hardball over areas of economic and geopolitical competition - which analysts see as a new Cold War - many questions remain about how long any trade detente may last.The trade war reignited this month after Beijing proposed dramatically expanding curbs on exports of rare-earth minerals vital for high-tech applications, a sector China dominates.Trump vowed to retaliate with additional 100% tariffs on Chinese exports, and with other steps including potential curbs on exports to China made with U.S. software - moves that could have upended the global economy.

After a weekend scramble between top trade negotiators, U.S. Treasury Secretary Scott Bessent said he expected Beijing to delay the rare earth controls for a year and revive purchases of U.S. soybeans critical to American farmers, as part of a "substantial framework" to be agreed by the leaders.Ahead of the summit, China bought its first cargoes of U.S. soybeans in several months, Reuters reported exclusively on Wednesday.The White House has signaled it hopes the summit will be the first of several between Trump and Xi in the coming year, including possible leader visits to each country, indicating a protracted negotiation process.

But Trump wants some quick progress, in talks being closely watched by businesses worldwide.Trump said on Wednesday he expects to reduce U.S. tariffs on Chinese goods in exchange for Beijing's commitment to curb the flow of precursor chemicals to make fentanyl, a deadly synthetic opioid that is the leading cause of American overdose deaths.Trump has also said he might sign a final deal with Xi on TikTok, the social media app that faces a U.S. ban unless its Chinese owners divest its U.S. operations.Beijing is willing to work together for "positive results", foreign ministry spokesperson Guo Jiakun said on Wednesday.

Previous deals, which brought down retaliatory tariffs sharply to about 55% on the U.S. side and 10% on the Chinese side and restarted the flow of rare earth magnets from China, are due to expire on November 10.Bessent said China had agreed to help curb the flow of fentanyl precursors, but did not say whether the U.S. had made any concessions in return.

Beijing has sought the lifting of 20% tariffs over fentanyl, an easing of export controls on sensitive U.S. technology, and a rollback of new U.S. port fees on Chinese vessels aimed at combating China's global dominance in shipbuilding, ocean freight and logistics.Trump's meeting with Xi comes at the end of a five-day trip to Asia in which he signed pacts with Japan and Southeast Asian nations on rare earths, seeking to blunt China's stranglehold on minerals used in everything from cars to fighter jets.

Regional strategic tensions, particularly over Beijing-claimed Taiwan, a U.S. partner and high-tech powerhouse, are an ominous backdrop to the summit.On Sunday, Chinese state media said Chinese H-6K bombers recently flew near Taiwan to practise "confrontation drills."U.S. Secretary of State Marco Rubio said Taiwan should not be concerned about the U.S.-China talks, despite some experts expressing fears that Trump might offer concessions over the island. Washington is required under U.S. law to provide Taiwan with the means to defend itself.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up