Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold holds near $4,200 as U.S. debt fears replace shutdown worries. Rising deficits, Trump’s new spending pledges, and weak Treasury demand fuel safe-haven demand, supporting expectations for further upside in gold and silver.

Kansas City Federal Reserve President Jeffrey Schmid indicated Friday that he might dissent again at the Fed's December meeting if policymakers decide to cut interest rates further, citing persistent inflation concerns that extend beyond tariff impacts.

Schmid was one of two officials who opposed the Fed's October decision to lower the policy rate by a quarter percentage point to the 3.75%-4.00% range. In his remarks at an energy conference in Denver co-hosted by the Dallas and Kansas City Fed banks, he explained his position.

"I view the current stance of monetary policy as being only modestly restrictive, which is about where I think it should be," Schmid said, reiterating his belief that cooling in the U.S. job market stems from structural changes that lower interest rates cannot address.

The Kansas City Fed president expressed concern that additional rate cuts could undermine the Fed's 2% inflation target. "This was my rationale for dissenting against the rate cut at the last meeting and one that continues to guide my thoughts as I head into the meeting in December," he stated, while noting his final decision would depend on upcoming economic data.

Schmid emphasized that his inflation worries go beyond tariffs. "Though tariffs are likely contributing to higher prices, my concerns are much broader than tariffs alone," he said, pointing to uncertainty about when and how businesses will pass higher costs to consumers.

Several Fed policymakers have voiced similar inflation concerns since the October meeting, creating tension with those who fear the labor market could deteriorate without further rate cuts. This division suggests the December 9-10 meeting will involve intense debate.

Schmid also warned about inflation expectations, saying the Fed has "no room to be complacent" and that "persistent inflation can shift the psychology around price-setting, and inflation can become ingrained." He cautioned, "It is unlikely that we will still be talking about soft landings in that situation."

When the White House makes a promise about distributing benefits to Americans, it's hard to remove politics from the equation, regardless of who is president. So when President Donald Trump recently promised a $2,000 "dividend" for most Americans, analysts and journalists immediately began parsing out exactly what that meant, and why he said it.

Although details are still sketchy, the $2,000 dividend could potentially affect your 2026 tax return in a number of different ways. Here's a look at exactly what the president said, how the dividend may play out and what it could mean for your taxes.

Beginning on Nov. 9, President Trump made a series of posts on social media platform Truth Social regarding the dividend. Specifically, Trump declared, "People that are against Tariffs are FOOLS! We are now the Richest, Most Respected Country In the World, With Almost No Inflation, and A Record Stock Market Price. 401k's are Highest EVER … A dividend of at least $2000 a person (not including high income people!) will be paid to everyone."

While this might sound great on paper, Trump offered little by way of detail. As of Nov. 13, there still has been no clarification of who counts as "high income," which Americans would qualify for this "dividend," and how or when it would be paid.

Treasury Secretary Scott Bessent seemed to walk back the thought of distributing actual dividend checks when he told ABC News' "This Week" that "It could be just the tax decreases that we are seeing on the president's agenda. No tax on tips, no tax on overtime, no tax on Social Security, deductibility on auto loans. Those are substantial deductions that are being financed in the tax bill."

According to ABC News, on Nov. 12, White House press secretary Karoline Leavitt told reporters at the White House, "The president made it clear he wants to make it happen. So his team of economic advisers are looking into it."

Put it all together, and as of Nov. 13, it's not at all clear how or even if the $2,000 dividend will come about.

According a post from Erica York, vice president of federal tax policy at the Tax Foundation, handing out $2,000 cash to the bulk of the U.S. population could cost $300 billion or more — an amount that would exceed the net revenue brought in so far from Trump's new tariffs. And it's entirely possible that the tariffs could go away, or even be retroactively deemed illegal, by the Supreme Court of the United States, according to AP News.

This is likely the reason Bessent sidestepped the idea of actual dividend checks going to Americans. If the $2,000 is cloaked in other deductions or tax breaks as he suggested, the administration could likely sidestep cash payouts.

If everything falls into place and Americans actually receive some form of $2,000 dividend, here are some of the ways it could play out for your taxes.

If paid in the form of a "stimulus check," like the ones issued during the pandemic, they will likely be nontaxable. This means your tax liability will not increase, and the money paid to you will not push you into a higher tax bracket.

If issued as a tax credit, it will reduce your tax liability by the amount of the payout, potentially $2,000. If you don't owe $2,000 in taxes, any excess amount would come in the form of a tax refund. This amount would also be nontaxable.

If used as some type of deduction or exemption from taxes, whatever benefit you receive would also be nontaxable. For example, if the $2,000 comes in the form of an exemption from auto loan interest, it simply means you won't have to pay as much on your car loan.

Overall, President Trump's offer of a $2,000 dividend to low- and middle-income Americans certainly sounds attractive on the surface. But as of mid-November, there's still no real clarity on where the money will come from, who it will go to or whether it will actually happen. The best course of action right now is to keep an eye on the news to see when — or if — the policy is actually implemented.

Editor's note on political coverage: GOBankingRates is nonpartisan and strives to cover all aspects of the economy objectively and present balanced reports on politically focused finance stories. You can find more coverage of this topic on GOBankingRates.com.

Canada plans to buy stakes in projects that will produce and process key minerals, the country's natural resources minister said, as part of a broader effort to secure supplies of materials that are controlled by China.

Tim Hodgson said the government has already started studying projects that will receive these equity investments, including mining operations and processing facilities. Those entities would be "deemed in the national interest, but for some reason they aren't able to find the equity," he said in an interview with Bloomberg News.

"For example, some of the rare-earths processing facilities that are being talked about — unless they receive equity-like support, given the stranglehold that certain countries have on those markets, they're unlikely to happen."

Critical minerals like lithium and graphite, along with rare earth metals like terbium and dysprosium, are essential to motor engines, consumer electronics and weapons manufacturing. But the bulk of the mining and processing of these materials is controlled by China.

It's an unusual move for the Canadian government to make equity investments, but it follows the Trump administration's decision to buy stakes in miners including MP Materials Corp., Lithium Americas Corp. and Trilogy Metals Inc. this year to expand production of rare earth minerals and other metals on domestic soil. The latter two of those companies are headquartered in Canadian mining hub of Vancouver.

Canada has unveiled a suite of measures to shore up access to critical minerals, including fast-tracking mining projects deemed to have national importance. The government said Thursday it will try to accelerate the approval of projects including the Nouveau Monde Graphite Inc. phase 2 project in Quebec, Canada Nickel Co.'s Crawford project in Ontario and a tungsten and molybdenum mine in New Brunswick.

Shares of Nouveau Monde jumped nearly 12% on Wednesday after a report of the government's plan, while Canada Nickel has surged 48% this week.

Prime Minister Mark Carney's government also introduced a C$2 billion ($1.4 billion) "critical minerals sovereign fund" in its latest budget that will provide the money for equity investments, loan guarantees and offtake agreements to support mining projects. Hodgson said the Canada Growth Fund, a separate investment vehicle, has started studying projects eligible for equity investments.

The minister said the government will look to expand stockpiling of minerals to support producers of niche metals dominated by China. Canada has already begun stockpiling scandium and graphite, he said, and is now looking at other minerals. Group of Seven allies last month announced measures aimed at securing mineral supplies outside of China.

"We're doing a whole mapping exercise, looking at what Canada's needs are relative to what Canada's production and sourcing capability is," Hodgson said. "Where we see a significant deficit, we will absolutely look at stockpiling as a way to protect Canadian industries and the economy."

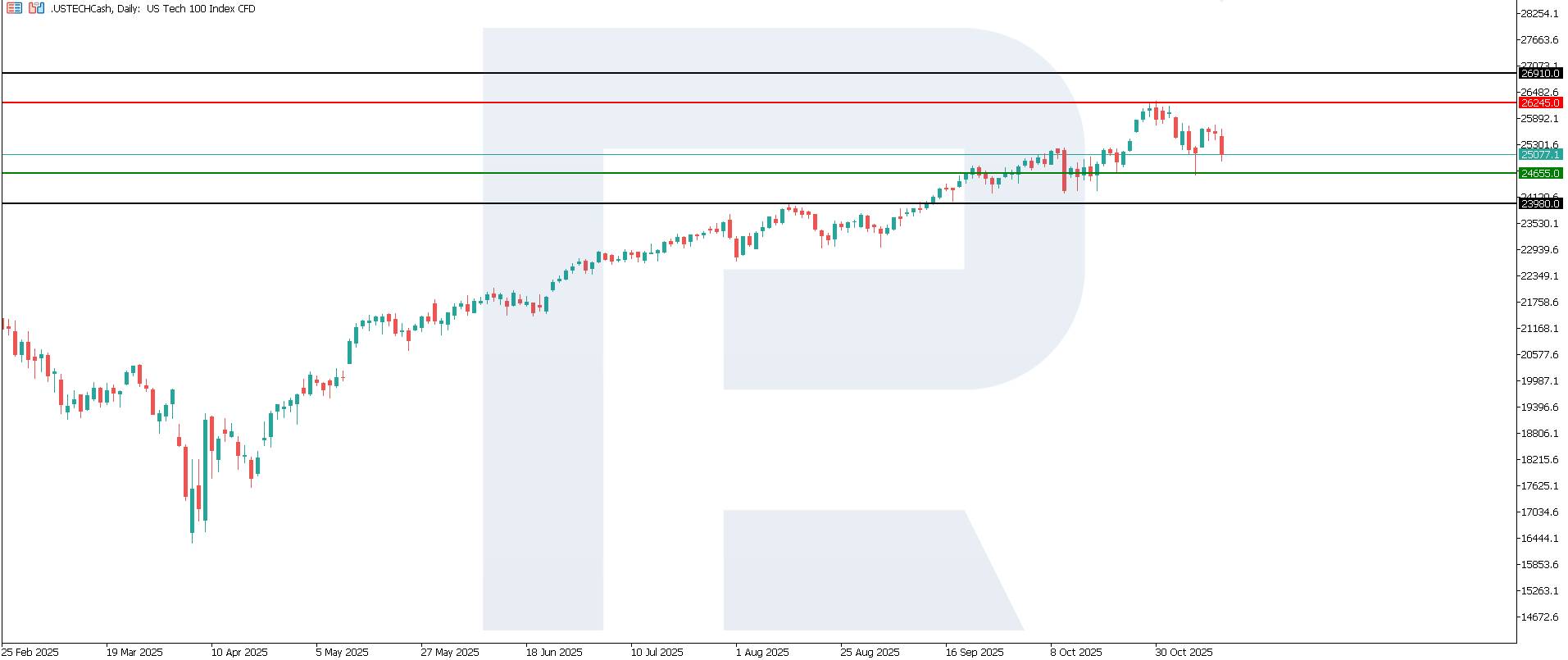

The correction in the US Tech index has intensified. The US Tech forecast for the upcoming week is negative.

The US ISM non-manufacturing PMI came in at 52.4, above the forecast of 50.7 and the previous reading of 50.0. This indicates that the services sector not only remains in expansion territory (readings above 50.0 signal growth) but is also accelerating compared with the previous month, beating analysts' expectations. As services represent the largest part of the US economy, the data indicates stable domestic demand and suggests that businesses are more confident than anticipated.

On the other hand, stronger employment metrics compared with consensus forecasts raise concerns that the disinflation process might proceed more slowly than desired by the Federal Reserve. For the Fed, this is a signal for caution when considering further rate cuts. For the US stock market, the overall impact tends to be positive. Stronger service sector activity suggests potential revenue and profit growth for companies focused on domestic consumption – retail, transport, hospitality, restaurants, and financial services. At the same time, recession fears are reduced: since services usually weaken before an economic downturn, the rebound above stagnation levels indicates a resilient economy.

For the US Tech index, the effect is moderately positive. A robust services sector supports demand for digital infrastructure, cloud computing, software, online advertising, and e-commerce. Many tech companies derive a significant portion of their income from corporate and consumer services. When services in the economy are growing, IT budgets are cut less frequently, and in some segments, they are even expanded. This strengthens expectations for tech companies' revenue and profits and, in theory, should support the US Tech index.

The US Tech index continues to decline within its ongoing correction, while the broader uptrend remains intact. The nearest resistance level is located at 26,245.0, and a new support zone has formed around 24,655.0. The next potential upside target is 26,910.0.

The US Tech price forecast outlines the following scenarios:

The expected increase in tech-sector revenues and demand may partly offset the pressure from higher or prolonged interest rates. In the medium term, the direction of the US Tech index will depend on what investors consider more important: the sustained business growth of tech companies or the potential persistence of high borrowing costs and bond yields. From a technical perspective, the next upside target for the US Tech index could be 26,910.0.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up