Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Exports of U.S. crude to Asia fell to 862,000 bpd in July, the lowest since January 2019, and well below the three-month average of 1.1 million bpd, Kpler data showed.

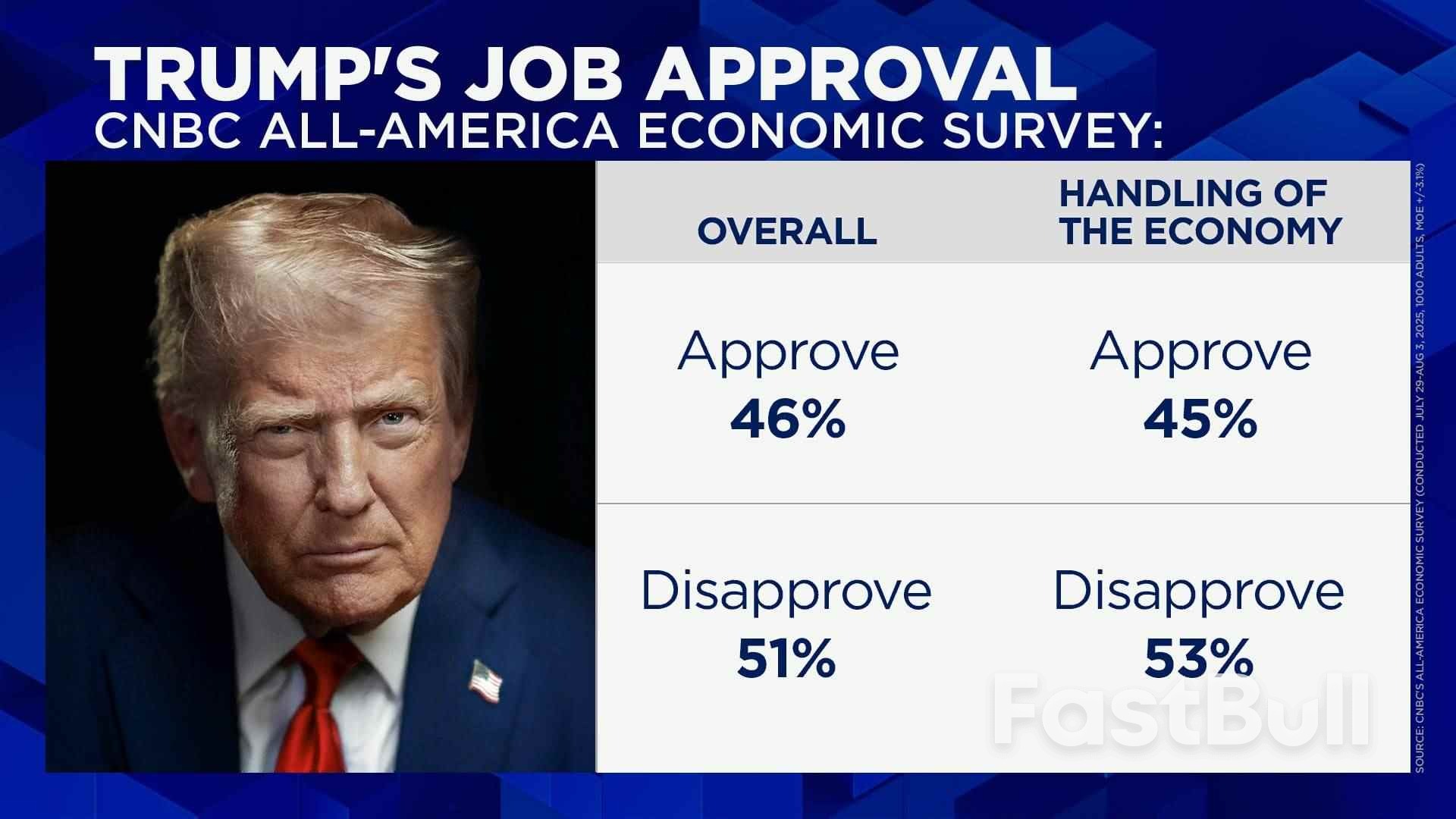

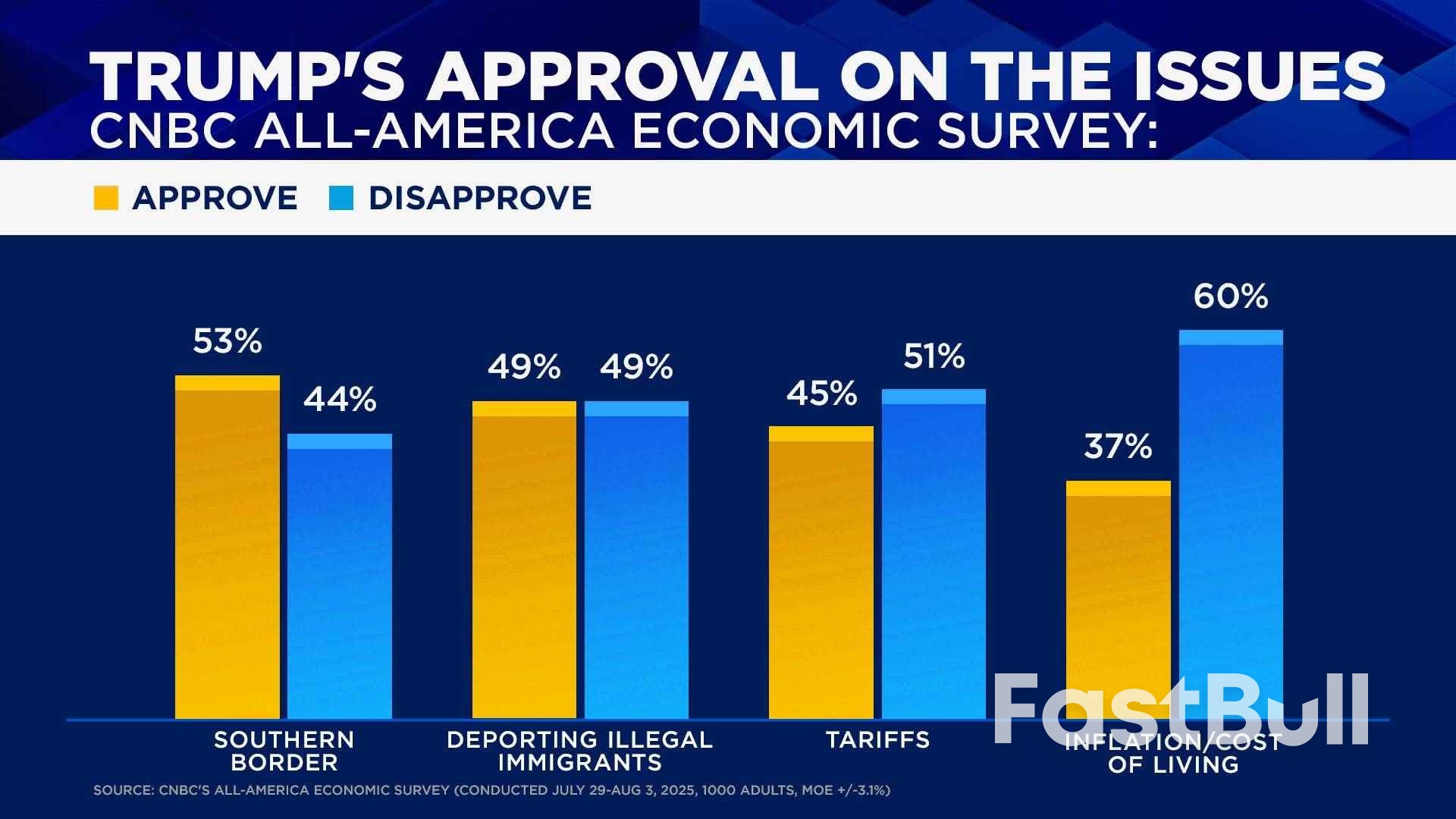

President Donald Trump's overall and economic approval ratings remain in negative territory despite a slight improvement in the latest CNBC All-America Economic Survey.

More troubling for the president, however, could be that the survey shows positive approval of only one of seven key issues, with the public holding negative views on his handling of tariffs, inflation, taxes and federal spending.

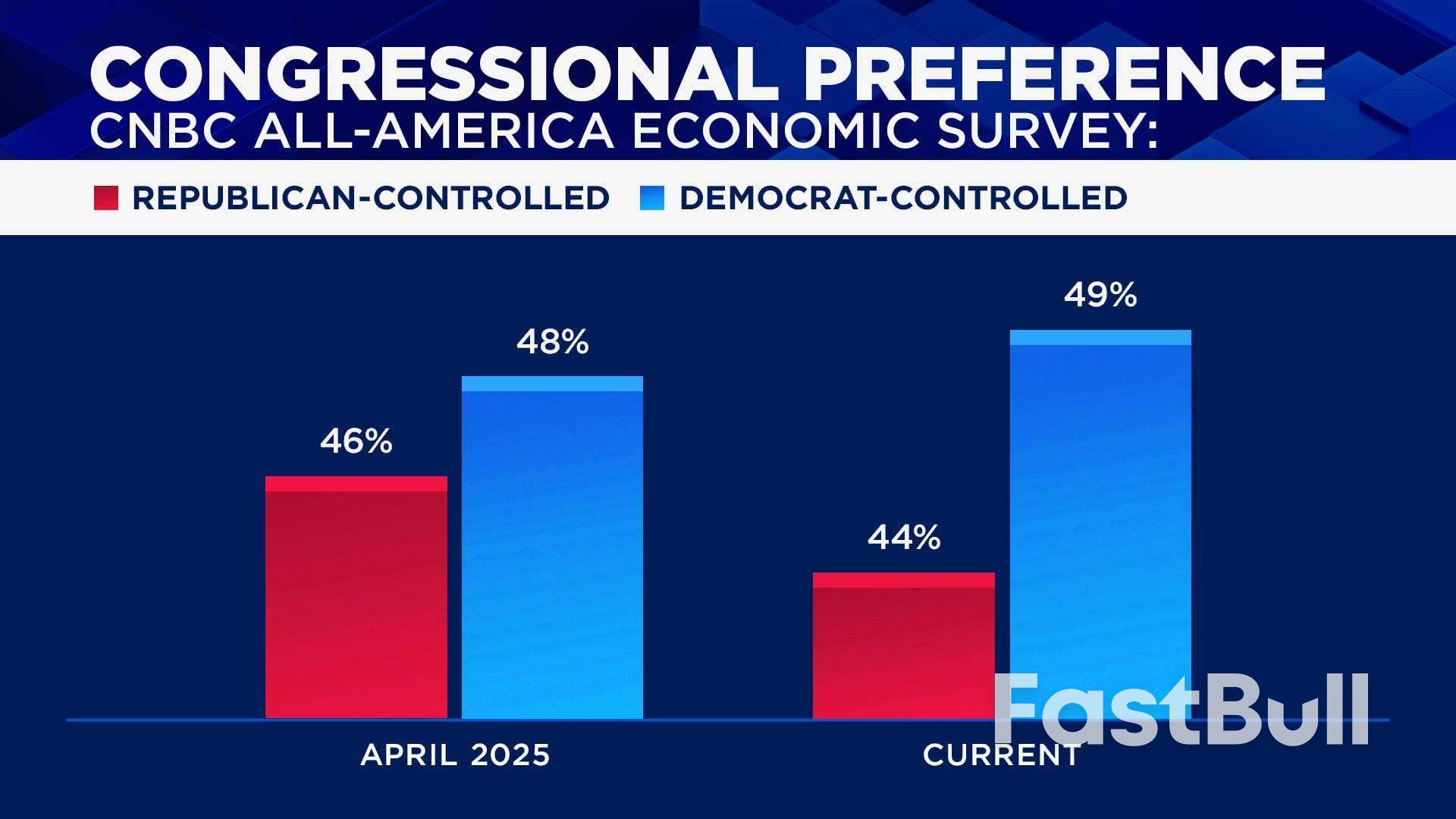

There also was a modest rise in the public's preference for the Democrats to control Congress, rising to a 49%-44% advantage from 48%-46% in April. It was the largest lead for Democrats since 2021.

At the same time, favorability of the Democratic party among registered voters sank to a net -32 percentage points, with 24% positive and 56% negative. The -32 rating appeared to be the lowest rating for either party going back to at least 1996.

The public disapproves of the job Trump is doing as president by a 51%-46% margin, up from 51%-44% in the April survey. The change is within the survey's +/-3.1 percentage point margin of error as is the gap in his approval rating.

The president's economic approval rating remains negative with 45% approving and 53% disapproving, a modest gain from 43%-55% in April. But it's the second time in a row that his economic approval was worse than his overall approval, a reversal from his first term when the president was always stronger on the economy.

"What seemed to be keeping President Trump's overall approval level from really dropping down was the strong economy and the credit that he got from the public," said Jay Campbell, partner at Hart Research, the survey's Democratic pollster. "He cannot rely on that at this point."

Overall, the survey of 1,000 people nationwide conducted July 29-Aug 3 showed a series of conflicting political and economic crosscurrents, with individuals and demographic groups offering sometimes contradictory opinions.

"Trump's approval is stable, but his individual ratings are down on issue after issue, except for tariffs," said Micah Roberts, partner with Public Opinion Strategies, which conducted the poll and served as its Republican pollster. "Economic optimism is higher, but there's been no relief in this data from inflation."

For example, just 39% of Independents approve of the president's handling of the economy, and that drops to 24% on inflation. Even Republicans are 9 points lower on inflation than their economic approval rating.

The president is underwater on inflation by 23 points, with 37% approving and 60% disapproving, unchanged from the last survey. The conflicts could be the result of the public simply having trouble keeping up with the breakneck changes to the economy, immigration, taxation and the political system issuing from the Trump administration.

But Republicans remain solidly behind the president and Democrats solidly against. Half of Independents disapprove of the president, with 36% approving.

Roberts added that the survey is "capturing a country that's in a shifting moment across all of these issues."

Views on the economy are equally conflicting.

On the current state of the economy, attitudes have improved, with 31% saying it's excellent or good and 68% calling it just fair or poor. Those are the best numbers since the early years of the Biden administration as the nation emerged from the pandemic, and an 11-point improvement from the CNBC survey in April.

The move was driven largely by growing optimism among Republicans, with some improvement among Independents. But the outlook for the economy barely budged, with 36% saying it will get better, 17% saying it will stay the same, and 46% expecting it to get worse.

Republicans became a bit less optimistic and Independents somewhat less pessimistic.

Views on the stock market also improved with 46% saying it's a good time to invest and 42% saying it's a bad time. The sharp improvement to +4 percentage points from -15 percentage points has come with a surge in stocks that followed the president backing off in from sweeping reciprocal tariffs and the passage of tax legislation.

Even 36% of those with no investments think it's a good time invest, the highest on record for a group that is typically negative on stocks.

But the survey shows some gathering areas of concern for the president on key issues.

Approval on measures taken to secure the southern border is the only one of seven that is above water with a 53% to 44% positive approval rating. The public is evenly split on deportations 49% to 49%, with sharp divides by party, age, race, gender, geography, income and education.

There are even splits within parties.

For example, 98% of MAGA Republicans, who represent 26% of the party, approve of the deportations, compared with 61% of non-MAGA Republicans. That compares with 97% of liberal Democrats disapproving of Trump's deportations and 78% of moderate Democrats.

There also is unambiguous disapproval of the President's foreign policy (-14 points), federal spending (-19 points), taxes (-13 points) and inflation (-23 points), which is unchanged from April.

In fact, 60% of the public still say their incomes are falling behind the rising cost of living, with women and those with lower incomes saying they are especially hard hit.

Tariffs could be playing a role in the inflation outlook: 49% say tariffs hurt workers compared to only 37% who say they help; 67% say they raise the cost of everyday goods. But by a 47%-37% margin, tariffs are seen helping US companies who produce in the U.S.

Still, almost three-quarters of the public say foreign trade represents an economic opportunity for the U.S., rather than a threat. The public on net disapproves of the President's tariffs by a 51%-45% margin.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up