Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Colombia Central Bank Technical Team Revises 2026 Economic Growth Projection To 2.6% From Previous 2.9%

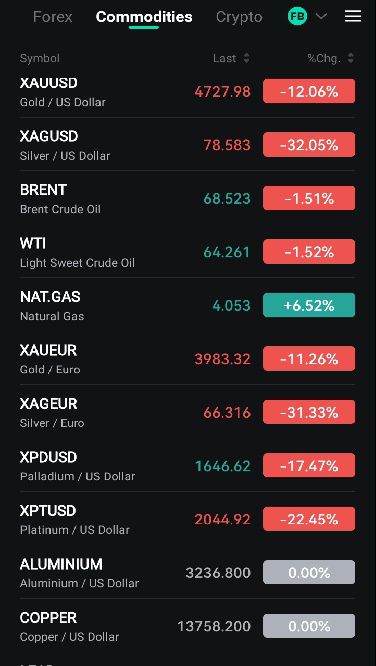

Spot Gold Fell 12.0% On The Day, To $4,725.64 Per Ounce. Spot Silver Fell 34.5% On The Day, To $75.25 Per Ounce

Spot Silver Fell 30.0% On The Day, Closing At $80.64 Per Ounce. New York Silver Fell 29.5% On The Day, Closing At $80.65 Per Ounce

Equipo Técnico Del Banco Central De Colombia Revisa Pronóstico De Crecimiento Económico Para 2025 A 2,9% Desde Previo De 2,6%

Colombia's Central Bank Hikes Interest Rate By 100 Basis Points To 10.25%, Surprising The Market

Baker Hughes - US Oil Drilling Rig Count Unchanged At 411 (Down 68 Versus Year Ago) In Week To Jan 30

Spot Gold Fell 10.5% On The Day, Its Biggest Drop In Decades, To $4,807.99 Per Ounce. New York Gold Fell 9.5% To $4,838.1 Per Ounce. Spot Silver Fell 26.0% To $85.06 Per Ounce. New York Silver Fell 25.5% To $85.17 Per Ounce

LME Copper Futures Closed Down $460 At $13,158 Per Tonne. LME Aluminum Futures Closed Down $74 At $3,144 Per Tonne. LME Zinc Futures Closed Down $10 At $3,402 Per Tonne. LME Lead Futures Closed Down $5 At $2,009 Per Tonne. LME Nickel Futures Closed Down $415 At $17,954 Per Tonne. LME Tin Futures Closed Down $3,129 At $51,955 Per Tonne. LME Cobalt Futures Closed Unchanged At $56,290 Per Tonne

Ukrainian Prime Minister Svyrydenko Says Russia Is Attacking Logistics, Launched Seven Attacks On Rail Facilities In Past 24 Hours

Ukraine President Zelenskiy: Ukraine Conducted No Strikes On Russian Energy Infrastructure On Friday

[German 10-year Bond Yields Fell More Than 6 Basis Points This Week And More Than 1 Basis Point In January] On Friday (January 30), In Late European Trading, The Yield On 10-year German Government Bonds Rose 0.3 Basis Points To 2.843%, A Cumulative Drop Of 6.3 Basis Points This Week, Continuing Its Overall Downward Trend. In January, It Fell 1.2 Basis Points, With An Overall Trading Range Of 2.910%-2.792%. The Yield On 2-year German Bonds Rose 0.5 Basis Points To 2.089%, A Cumulative Drop Of 4.1 Basis Points This Week And 3.2 Basis Points In January, Trading Within A Range Of 2.156%-2.048%. The Yield On 30-year German Bonds Rose 0.5 Basis Points To 3.494%, A Cumulative Increase Of 1.9 Basis Points In January. The Spread Between The 2-year And 10-year German Bond Yields Fell 0.163 Basis Points To +75.288 Basis Points, Down 2.147 Basis Points This Week And Up 2.142 Basis Points In January

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Guterres warns of UN's "imminent financial collapse" from record unpaid dues and a 'Kafkaesque' budget rule.

United Nations Secretary-General Antonio Guterres has issued his most urgent warning to date, telling member states that the 79-year-old global body is at risk of "imminent financial collapse." The crisis stems from a record amount of unpaid fees and a dysfunctional budget rule that forces the organization to return money it doesn't have.

In a stark letter to ambassadors, Guterres warned that the situation is worsening and threatens the UN's ability to deliver its programs. He projects the organization could completely run out of cash by July.

The UN's liquidity crisis has been deepening, culminating in a record $1.57 billion in outstanding dues by the end of 2025. This shortfall cripples the organization's operational capacity, which spans everything from peacekeeping and humanitarian aid to promoting human rights and economic development.

The funding crisis is amplified as key member states back away from their financial commitments. The United States, the UN's largest contributor at 22% of the core budget, has been retreating from multilateralism. Under President Donald Trump, the U.S. has slashed voluntary funding to UN agencies and refused to make mandatory payments for the regular and peacekeeping budgets.

Guterres noted that "decisions not to honour assessed contributions" have been formally announced, though he did not name the specific countries. The funding structure, based on the size of each member's economy, places China as the second-largest contributor at 20%.

Compounding the problem of unpaid dues is an antiquated financial regulation that Guterres described as a "Kafkaesque cycle." Under this rule, the UN is required to credit back hundreds of millions of dollars in unspent funds to member states each year.

The fatal flaw is that these credits must be returned even if the initial dues were never paid, forcing the organization to give back cash it never received. "In other words, we are trapped in a Kafkaesque cycle expected to give back cash that does not exist," Guterres explained.

Faced with this dual threat, the Secretary-General presented member states with a clear choice: either honor their financial obligations in full and on time, or agree to a fundamental overhaul of the UN's financial rules to prevent a collapse.

Efforts to improve efficiency are already underway. Guterres launched a reform task force, UN80, to cut costs, and member states agreed to reduce the 2026 budget by approximately 7% to $3.45 billion. However, these measures alone appear insufficient to solve a crisis rooted in massive funding gaps and broken internal processes.

U.S. producer prices recorded their largest monthly gain in five months in December, a development that suggests underlying inflation could be accelerating. This uptick, driven by a sharp rise in the cost of services, may give the Federal Reserve reason to keep interest rates steady in the coming months.

The Labor Department reported on Friday that the Producer Price Index (PPI) for final demand jumped 0.5% last month, beating the 0.2% increase forecast by economists polled by Reuters. This followed an unrevised 0.2% gain in November.

On a year-over-year basis, the PPI rose 3.0% through December, matching the previous month's pace. For the full year, producer prices advanced 3.0% in 2025, following a 3.5% increase in 2024.

The primary driver behind the unexpectedly strong PPI reading was a 0.7% increase in the prices for services, while goods prices remained flat. The surge in services accounted for the entirety of the headline increase.

A key factor was a 1.7% jump in margins for final demand trade services, which measures the change in margins for wholesalers and retailers. This component alone was responsible for two-thirds of the overall services increase.

Other notable price hikes in the services sector included:

• Hotel and motel rooms: Surged 7.3%

• Airline fares: Soared 2.9%

• Portfolio management fees: Increased 2.0%

These components are significant as they feed into the Personal Consumption Expenditures (PCE) price indexes, which are the Federal Reserve's preferred measures for tracking its 2% inflation target.

Economists suggest that the effects of import tariffs are starting to filter through the supply chain, though the impact remains uneven.

"Tariff impacts continued to flow through producer costs unevenly in December," noted Ben Ayers, a senior economist at Nationwide. "At a broad level, costs associated with tariffs remain muted... but localized effects can be pronounced."

Ayers added that the spike in trade services likely reflects "producers looking to recoup some of the losses caused by higher production costs over 2025."

The latest inflation data supports the Federal Reserve's current policy stance. The U.S. central bank recently left its benchmark interest rate unchanged in a range of 3.50% to 3.75%.

Fed Chair Jerome Powell acknowledged that tariffs had contributed to an overshoot in inflation but said he expected that pressure to peak around the middle of the year.

The report reinforces the central bank's shifting focus, according to Carl Weinberg, chief economist at High Frequency Economics. "This report validates the pivot of the Fed away from labor market risks back toward price stability," he said.

Economists now estimate that core PCE inflation for December could rise by 0.3% to 0.4%, which would bring the annual rate to 3.0%.

In sharp contrast to services, producer prices for goods were unchanged in December after rising 0.8% in the prior month.

A 1.4% drop in energy prices, driven by lower gasoline costs, weighed on the goods index. Food prices also declined by 0.3%, partly due to a 20.4% plunge in the cost of fresh and dry vegetables.

However, when volatile food and energy components are excluded, producer goods prices advanced 0.4%, up from a 0.2% rise in November.

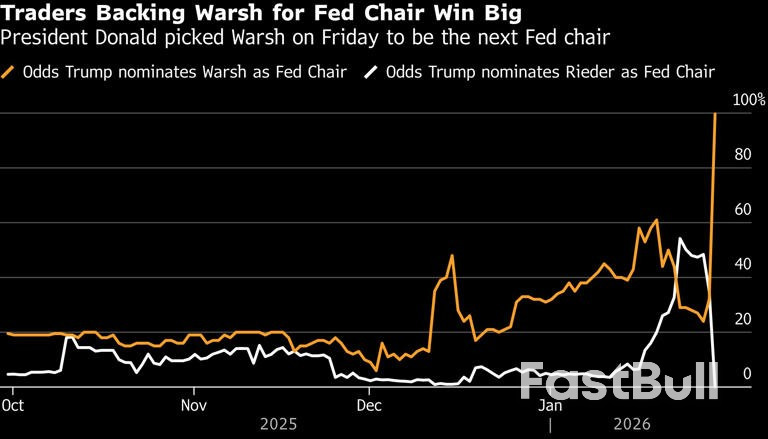

The stronger-than-expected PPI data overshadowed President Trump's nomination of Kevin Warsh, a former Fed governor, to replace Powell as head of the central bank.

Following the report, U.S. stocks opened lower, the dollar strengthened against a basket of other currencies, and U.S. Treasury yields rose.

The data release also comes as the Bureau of Labor Statistics (BLS) works to catch up on reports delayed by a 43-day federal government shutdown. Lawmakers were working on Friday to avoid another shutdown that could postpone future data releases.

President Donald Trump plans to nominate former Federal Reserve governor Kevin Warsh to be the next chair of the central bank, a move that could usher in a new era for U.S. monetary policy.

Warsh, an experienced Wall Street veteran and former Fed official, has recently advocated for lower interest rates and a smaller central bank balance sheet. Analysts broadly see him as a credible candidate who will likely secure Senate confirmation, but they are closely watching to see how he would balance political pressure with the Fed's mandate.

The nomination arrives at a turbulent time for the Federal Reserve. The institution is grappling with internal policy divisions amid a complex economic outlook, as some members push for lower rates to boost growth while others want to hold firm to contain inflation.

This internal debate is amplified by external challenges to the Fed's independence and credibility. President Trump has repeatedly criticized current chair Jerome Powell and the Federal Open Market Committee (FOMC) for not cutting interest rates more aggressively.

Simultaneously, the central bank faces legal scrutiny. The Supreme Court recently heard arguments on whether President Trump has the authority to remove Governor Lisa Cook. The Department of Justice has also issued subpoenas to the Fed and Powell related to renovations at the bank's offices, a move widely seen by analysts as an assertion of executive power.

Kevin Warsh is currently a fellow at Stanford University's Hoover Institution. His career began on Wall Street at Morgan Stanley before he served in the George W. Bush administration on the National Economic Council and as a Federal Reserve governor.

Historically known as a policy "hawk"—an official who favors tighter monetary policy to fight inflation—Warsh's public stance has recently shifted to align more closely with President Trump's views.

He has publicly supported calls for lower interest rates, telling Fox News that Trump's frustration with Powell's policies was justified. In a Wall Street Journal op-ed last fall, Warsh described the Fed's track record under Powell as one of "unwise choices" and argued for reducing the central bank's balance sheet. He has also warned against "mission creep," suggesting the Fed has expanded its role too far.

Analysts expect Warsh to be viewed as a reliable choice by financial markets and anticipate a smooth confirmation process.

"Warsh's experience on the Fed, where he developed a reputation as a very competent crisis fighter with a good understanding of financial markets, and his long track record of independent thought about monetary policy mean he is a credible nomination," said Luke Bartholomew, deputy chief economist at Aberdeen Investments.

Christopher Hodge, chief economist at Natixis, noted that Warsh "should have no problem being confirmed by the Senate" and would likely be seen as "fairly credible by the markets."

While Warsh has recently pushed for lower rates and a reduced Fed balance sheet, analysts are divided on how his leadership would translate into policy decisions once he is in the role. The key question is whether he would prioritize short-term stimulus or revert to his long-held hawkish principles.

The Case for Lower Rates

Hodge identifies Warsh as a supply-side optimist, meaning he believes that policies like tax cuts and deregulation can boost long-term economic productivity. This view, Hodge writes, could serve as a "justification to rapidly lower rates."

However, James Angel, an associate professor of finance at Georgetown University, voiced a common concern. He noted that Warsh "has the background and experience that we expect for a Fed Chair" but added, "My only concern with any Trump appointee is whether he promised Trump that he would bow down to him and lower interest rates too much to try to make things look good at election time."

Will His Hawkish Instincts Return?

Several analysts believe Warsh’s hawkish past could re-emerge, especially if inflation persists.

"It's reasonable to assume that he told the President he favors reducing interest rates today, otherwise he would not have been nominated," wrote Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics. "But Mr. Warsh's hawkish instincts might return once he has secured the Chairmanship."

Tombs pointed out that during his previous tenure at the Fed, Warsh prioritized controlling inflation over employment during a crisis. He concluded that if inflation remains near 3%, Warsh would likely focus more on his historical legacy than on pleasing the president, making "easier-than-otherwise policy under Mr. Warsh... not a given."

Hodge echoed this, stating that if productivity gains from deregulation don't appear and inflation remains "sticky," Warsh would "likely pivot to a more hawkish stance."

The Limits of a Chair's Power

Even as chair, Warsh would be just one of 12 voting members on the FOMC.

Bartholomew of Aberdeen Investments projects that Warsh "will almost certainly push for lower interest rates," consistent with a forecast of two 0.25% cuts later this year. However, he added that Warsh "is unlikely to make much progress in shifting the Fed's operating framework and shrinking its balance sheet" on his own.

Following its January meeting, the Federal Reserve held interest rates steady. Chair Powell described the current policy rate as being "within plausible estimates of neutral," meaning it is neither stimulating nor restricting the economy.

Trump's announcement to nominate Warsh has not significantly altered market expectations for a rate cut. According to the CME FedWatch Tool, bond futures traders are pricing in a 48.5% probability of a rate cut in June, up slightly from 47% before the news.

Traders' Opinions

Russia-Ukraine Conflict

Economic

Political

Central Bank

Data Interpretation

Forex

Remarks of Officials

A Reuters poll of 15 analysts projects the Russian rouble will trade at approximately 88.3 to the U.S. dollar within the next 12 months. This forecast suggests a 14% decline from its current value but marks an 8.7% upward revision from last month’s predictions.

The rouble has already gained 3.5% since the beginning of the year, following a surprising 45% rally in 2025. While a stronger currency helps the central bank manage inflation, it also puts pressure on state budget revenues and exporters.

Changing market dynamics have prompted some analysts to revise their forecasts significantly. Sberbank, for instance, has adjusted its projection from 100 roubles per dollar to 90. The bank attributes this shift to a rally in gold and other metals, as well as evolving geopolitical factors that could support the currency throughout the year.

"Negotiations between Russia, the United States, and Ukraine may extend throughout the year, which could support demand for rouble-denominated assets," Sberbank analysts noted in a report.

Negotiators from Ukraine and Russia met in Abu Dhabi last weekend to discuss territorial issues and are expected to resume talks on Sunday. Moscow's core demand remains that Kyiv cedes the entire Donbas industrial region.

Beyond geopolitics, several core economic factors are underpinning the rouble's stability. Mikhail Vasilyev of Sovkombank highlighted a combination of drivers supporting the currency:

• A consistent trade surplus

• Subdued demand for imports

• The high key interest rate set by the central bank

• Sales of yuan from state reserves under budget rules

• General optimism for an improving geopolitical situation

Looking at the broader economy, analysts have slightly downgraded their forecast for Russia's GDP growth in 2026 to a median of 1%, down from 1.1% in the previous month's estimate. Concurrently, the 2026 inflation forecast has been revised upward from 5.2% to 5.3%.

These figures are influencing expectations for monetary policy. Analysts now anticipate a more conservative approach from the central bank, forecasting a half-percentage-point cut in the key interest rate to 15.5% in the first quarter of 2026. This is a more cautious view than last month's expectation of a cut to 15%.

The central bank has two rate-setting meetings scheduled for the first quarter. Following a recent spike in inflation, analysts expect policymakers to hold the rate steady at the first meeting on February 13.

"Macroeconomic data so far does not provide a clear indication that the Bank of Russia is ready to cut the key rate," said Nikolai Dudchenko, an analyst at Finam brokerage.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up