Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Dec)

China, Mainland Urban Area Unemployment Rate (Dec)A:--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)A:--

F: --

P: --

China, Mainland GDP (Q4)

China, Mainland GDP (Q4)A:--

F: --

P: --

China, Mainland GDP QoQ (SA) (Q4)

China, Mainland GDP QoQ (SA) (Q4)A:--

F: --

P: --

China, Mainland Annual GDP

China, Mainland Annual GDPA:--

F: --

P: --

China, Mainland Annual GDP Growth

China, Mainland Annual GDP GrowthA:--

F: --

P: --

China, Mainland GDP YoY (Q4)

China, Mainland GDP YoY (Q4)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)A:--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Nov)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Nov)--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. Unemployment Rate (Dec)

U.K. Unemployment Rate (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Nov)

U.K. 3-Month ILO Employment Change (Nov)--

F: --

P: --

U.K. Unemployment Claimant Count (Dec)

U.K. Unemployment Claimant Count (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ukraine-U.S. talks on war resolution and recovery proceed in Davos, shadowed by Russia’s disruptive attacks.

High-level talks between Ukraine and the United States aimed at resolving the nearly four-year-long war with Russia are set to continue at the World Economic Forum in Davos, Switzerland, this week.

Ukraine's top negotiator, Rustem Umerov, confirmed the plan on Sunday following two days of discussions in Florida.

The recent meeting in Florida involved a U.S. team that included envoy Steve Witkoff and Jared Kushner, son-in-law of President Donald Trump. According to Umerov, the discussions centered on two primary topics: long-term security guarantees for Ukraine and a comprehensive post-war recovery plan.

While Umerov described the talks as an in-depth discussion of "practical mechanisms," he gave no indication that any firm agreements were reached.

The Ukrainian delegation, which included Kyrylo Budanov, head of President Volodymyr Zelenskiy’s office, and Davyd Arakhamia, head of Zelenskiy's parliamentary faction, also used the meeting to report on recent Russian strikes that severely damaged the nation's energy infrastructure.

"We agreed to continue work at the team level during the next phase of consultations in Davos," Umerov stated in a Telegram post.

A key objective for Kyiv is to gain clarity from Washington regarding Russia's position on the U.S.-backed diplomatic initiatives. Washington has been encouraging Ukraine to agree to a peace framework that could then be presented to Moscow. Meanwhile, Ukraine and its European allies are focused on establishing safeguards against future Russian aggression.

President Zelenskiy argued that Russia's recent military actions demonstrate a lack of genuine interest in a diplomatic solution. "If the Russians were seriously interested in ending the war, they would have focused on diplomacy," he said in his nightly video address.

Zelenskiy highlighted the widespread damage from the strikes, which left hundreds of apartment buildings without heating or electricity, as evidence of Moscow's intentions.

The humanitarian impact of the attacks is severe, with nighttime temperatures dropping to minus 16 degrees Celsius (3 degrees Fahrenheit). According to Zelenskiy, nearly 58,000 repair personnel are working to restore the nation's heating networks.

Deputy Prime Minister Oleksiy Kuleba reported that 30 apartment buildings in the capital, Kyiv, remained without heat following the recent attacks.

Adding to the concerns, Ukrainian intelligence suggests Russia is actively conducting reconnaissance for potential new strikes. Foreign Minister Andrii Sybiha warned on Saturday that there is evidence Russia may be considering attacks on power substations that supply the country's nuclear power plants. Russian officials did not immediately respond to requests for comment on these claims.

China's economy likely saw its growth slow to a three-year low in the final quarter of 2025 as domestic demand softened, creating a challenging outlook despite full-year performance meeting official targets. While the economy demonstrated notable resilience throughout the year, underlying structural problems and persistent trade tensions pose significant risks ahead.

A Reuters poll forecasts that gross domestic product (GDP) expanded by 4.4% year-on-year in the fourth quarter, a deceleration from the 4.8% recorded in the third quarter. If confirmed, this would mark the weakest pace of growth since the fourth quarter of 2022.

Despite the quarterly slowdown, the full-year economic expansion for 2025 is expected to reach 4.9%. This figure aligns with Beijing's official target of "around 5%" and is only slightly below the 5.0% growth seen in 2024. The data for Q4 and the full year is scheduled for release on Monday.

A key driver of China's 2025 performance was its powerful manufacturing sector, which fueled a record trade surplus of nearly $1.2 trillion. Exporters successfully diversified away from the United States, offsetting tariff pressures and helping the economy withstand headwinds better than anticipated. This export boom allowed policymakers to maintain a relatively modest level of stimulus.

However, this heavy reliance on external demand highlights critical vulnerabilities. The strength in exports stands in stark contrast to sluggish activity at home, where the economy is grappling with a prolonged property slump, weak domestic spending, and persistent deflationary pressures.

On a quarter-on-quarter basis, the economy is projected to have grown 1.0% in the fourth quarter, a slight easing from the 1.1% pace seen between July and September.

The economic picture for 2026 appears clouded. Forecasters see China's growth slowing further to 4.5% as it confronts rising global trade protectionism and the unpredictability of U.S. economic policy under President Donald Trump, who has threatened a 25% tariff on countries trading with Iran.

This downbeat forecast increases the pressure on policymakers to deliver more stimulus. In a move to boost demand, China's central bank announced sector-specific interest rate cuts on Thursday and signaled that further reductions in bank reserve requirements or broader rate cuts could follow.

However, some analysts remain skeptical about the immediate impact of these measures. "Growth is likely to stay weak in Q1 2026, as the policy package offers limited economic support," noted analysts at ANZ.

Deeper economic imbalances continue to impede long-term development. ANZ analysts estimate that China's nominal GDP grew by about 4.0% in 2025, the slowest rate since 1976, excluding the pandemic year of 2020. Furthermore, the GDP deflator, a broad measure of prices, has remained negative since 2023, underscoring the severe mismatch between excess supply and weak demand.

"China is facing a macroeconomic problem currently: excess supply. Overall domestic demand lags supply," said Louis Kuijs, chief Asia economist at S&P Global Ratings. "That weighs on growth and is leading to downward pressures on prices and profits. It also causes friction internationally as many companies are resorting to exports to escape 'involution' conditions at home."

At a key economic meeting in December, Chinese leaders pledged to maintain a "proactive" fiscal policy to support growth. They also vowed to "significantly" increase the share of household consumption in the economy over the next five years. To achieve this, several obstacles must be overcome:

• Slowing Income Growth: Household incomes need a substantial boost.

• Weak Social Safety Net: A stronger welfare system is required to reduce high precautionary savings.

• Falling Asset Prices: The decline in property values has eroded household wealth, discouraging spending.

The struggles of ordinary citizens highlight these policy challenges. Fang Ying, a 54-year-old delivery worker in Beijing, said his monthly income of 8,000 yuan barely covers his family's expenses. A failed restaurant business also cost him around 100,000 yuan. "It's not easy… I cannot compete with young people," Fang said. "There are many opportunities in Beijing, but not for people like me."

For years, institutions like the World Bank and the IMF have urged China to rebalance its economy toward consumption-led growth and rely less on investment and exports. While Beijing has taken steps to address excess industrial capacity, economists believe more fundamental reforms are needed.

Separate data for December, set to be released alongside the GDP figures, is expected to reinforce the narrative of a two-speed economy.

• Retail sales, a key indicator of consumption, are forecast to grow just 1.2% year-on-year, down from 1.3% in November and the weakest reading since December 2022.

• Factory output, in contrast, is expected to have grown by 5.0%, an acceleration from November's 4.8% rise.

This divergence clearly illustrates the central challenge facing China: an industrial engine that continues to fire while the domestic consumer remains on the sidelines.

UK Prime Minister Keir Starmer is preparing to publicly defend Britain's commitment to NATO on Monday following a direct threat from US President Donald Trump. The president has warned he will impose tariffs on the UK and other European allies if his bid to purchase Greenland from Denmark is not successful.

According to a Number 10 source, Starmer will use a press conference to stress "the importance of maintaining our alliances for our national interest." This follows his Saturday statement where he labeled Trump's tariff threat "completely wrong."

The diplomatic friction escalated after President Trump announced on Truth Social that he would levy a 10% tariff on eight European nations, including the UK and Denmark, starting February 1. He warned the tariffs would rise to 25% in June unless a deal over Greenland was reached.

Trump’s justification centers on his view that recent commitments by European nations to conduct NATO military exercises in Greenland amount to a "dangerous game." He has repeatedly insisted that US control of Greenland is essential for national security, specifically citing threats from Russia and China.

The strategic importance of Greenland is underscored by its rich deposits of critical minerals and its location along new shipping routes opening up as Arctic ice melts.

In response to the threat, Prime Minister Starmer has engaged in a series of high-level calls. A Downing Street spokeswoman confirmed he spoke with Trump on Sunday afternoon, following conversations with Danish Prime Minister Mette Frederiksen, European Commission President Ursula von der Leyen, and NATO Secretary-General Mark Rutte.

Starmer's message has been consistent: Greenland's future is a matter for its people and the Danish government. "He said that security in the High North is a priority for all NATO allies in order to protect Euro-Atlantic interests," the spokeswoman stated. "He also said that applying tariffs on allies for pursuing the collective security of NATO allies is wrong."

The standoff presents a significant challenge for Starmer, who has so far avoided the most severe tariffs imposed by the Trump administration, which began in 2025. During his Monday press conference, the prime minister is expected to state that the UK's foreign policy will be guided by its core values in working with allies.

Any new tariffs on UK goods could severely hamper the government's efforts to stimulate the country's anemic economic growth. The United States is the UK's single-largest trading partner, making any disruption to trade a serious economic risk.

Global markets opened the week on a cautious note after U.S. President Donald Trump proposed new tariffs on eight European nations, immediately dampening risk appetite and sending investors toward safe-haven assets.

Early Monday trading saw currencies like the pound and euro decline against the U.S. dollar, while the Japanese yen and Swiss franc gained ground. Equity futures signaled a lower open for markets in Japan and Hong Kong, with Australian shares expected to see little change. The negative sentiment followed a modest dip in U.S. stocks on Friday.

The market jitters stem from President Trump's weekend announcement of a potential 10% tariff on goods from eight European countries, slated to begin February 1. He stated the tariff could rise to 25% in June unless a deal is reached for a "purchase of Greenland."

The proposal was met with swift condemnation from European officials, who are now prepared to block the approval of a trade agreement finalized last year. Bloomberg reported that French President Emmanuel Macron might seek to activate the EU's anti-coercion instrument, the bloc's strongest tool for retaliation.

Analysts at ING Bank, including global head of macro Carsten Brzeski, noted the growing uncertainty. "The outcome of these new trade tensions is unclear, but what has long been evident is that there is no such thing as trade or tariff certainty anymore," they wrote. "What is clear is that a full-blown trade war between the EU and the US would leave only losers."

Market strategists are now focused on the European open, where regional equities are expected to bear the brunt of the selloff. However, not all analysis points to sustained damage. Deutsche Bank suggested the impact on the euro might be limited, as the U.S. depends on Europe for capital.

Others interpret the move as a strategic ploy ahead of this week's World Economic Forum in Davos.

"My working assumption is that an 'off ramp' from these threats will soon be found, and that this turns into yet another 'TACO moment'," wrote Michael Brown, a strategist at Pepperstone Group, referring to a tactical, aggressive, chaotic, and over-the-top negotiating style. He added, "I would view equity dips as buying opportunities for now and wouldn't be surprised to see the week's initial FX moves fade relatively rapidly."

The new tariff tensions add to existing market headwinds. On Friday, U.S. stocks lost earlier gains to close 0.1% lower after Trump's comments about a potential successor to Fed Chair Jerome Powell. His remarks, which pointed away from Kevin Hassett, raised the odds of former Fed Governor Kevin Warsh being nominated, prompting traders to scale back expectations for interest rate cuts and sending Treasury yields higher.

Meanwhile, upcoming economic data from China is expected to show continued softness. According to a Bloomberg survey, gross domestic product for the fourth quarter is forecast to rise 4.5% year-on-year, down from 4.8% in the previous quarter. The release may show the economy capped 2025 with its weakest quarterly expansion in three years.

In commodity markets, oil prices edged higher Friday to close near $60 a barrel as traders monitored ongoing tensions in Iran. Gold, however, experienced its largest decline in two weeks.

Just as Ursula von der Leyen was set to celebrate a major victory in Paraguay—a landmark trade pact with South America's largest economies—Donald Trump abruptly changed the narrative. The US president announced a new wave of tariffs on Europe over its support for Greenland, hijacking the moment.

As the European Union's chief executive, von der Leyen found herself in a difficult position. Officials and diplomats waited for a strong rebuke of Trump's latest move to disrupt long-standing alliances. It never came. When a statement was finally released later that night, many in Brussels privately called it "weak."

The incident highlights a deep-seated frustration with von der Leyen's leadership that is now bubbling to the surface. According to numerous officials, her strategy of offering trade concessions to avoid confrontation with Trump has failed to protect the EU's interests or deter Washington's aggressive tactics.

Criticism of the European Commission President's approach is growing louder. "European appeasement strategy has failed," stated Arancha Gonzalez Laya, Spain's former foreign minister, using a term several other senior officials have echoed in private conversations.

This assessment is based on discussions with over a dozen officials and diplomats who have worked closely with von der Leyen. They argue that her focus on conciliation has left the EU more exposed to US pressure.

Meanwhile, a promised economic revival plan for Europe has stalled, further weakening the bloc's position. This economic vulnerability and a perceived weakness on trade are now converging on the Greenland issue, pushing the US and EU toward a potential economic conflict. How von der Leyen navigates this crisis could have existential implications for the EU, affecting its ability to support Ukraine and adapt to a new global order dominated by powers like the US and China.

"What Europe needs is an intelligent deterrence capacity to deal with predators," added Gonzalez Laya.

Paula Pinho, chief spokesperson for the European Commission, defended the president, stating, "President von der Leyen takes all decisions with one objective in mind: serving the best interests of the EU and its citizens."

Von der Leyen's 2024 reelection campaign was built on a pledge to bolster the EU's economic competitiveness and security. She was armed with a 400-page plan from Mario Draghi, the highly respected former head of the European Central Bank. The strategy was to leverage the EU's massive €20 trillion single market and 450 million people to project geopolitical power.

However, more than a year later, much of that blueprint remains on the shelf. The EU now faces the dual threat of being economically overshadowed by the US and China while Russia continues its aggression on the bloc's eastern border.

Centralized Control and Delays

Some officials suggest von der Leyen is more drawn to high-profile meetings with world leaders than to the complex details of domestic economic policy. Her team is also accused of maintaining tight control over the EU's executive branch, drafting proposals that would normally fall to other departments and micromanaging decisions down to minor job appointments. This centralized approach, they claim, has created delays at a critical time.

Pinho rejected these claims as "completely unfounded," insisting the commission uses "an inclusive decision process" and that its "urgency mindset... is blatantly clear." She pointed to the South American trade deal and ongoing negotiations with India as proof of von der Leyen's focus on economic files.

Draghi himself voiced concern in September, warning that the EU was moving too slowly. "To carry on as usual is to resign ourselves to falling behind," he said, with von der Leyen in the audience. He dismissed arguments that the EU's complex structure was an excuse for inaction, calling it "complacency."

Even von der Leyen's critics acknowledge her successes in leading Europe through unprecedented crises. During her first term, she spearheaded the EU's coordinated vaccine procurement program and persuaded member states to take on joint debt to mitigate the economic impact of the pandemic.

When Russia invaded Ukraine, her team worked closely with US President Joe Biden to implement tough sanctions against Moscow. She also pushed Europe to end its dependency on Russian energy and ensured a steady flow of financial aid to Ukraine, even after Trump halted US support. On the economic front, she imposed tariffs on Chinese electric vehicles, overcoming strong lobbying from Germany.

The trade deal with the Mercosur bloc of South American nations, which took 25 years to finalize, also stands as one of the EU's largest-ever free-trade agreements and a significant achievement of her leadership.

Von der Leyen began her second term just weeks before Trump returned to the White House, immediately reviving fears of a transatlantic trade war. Guided by the consensus among many EU countries, she moved quickly to secure a trade accord with the US, even if it meant making significant compromises.

In July, she flew to Trump's golf resort in Scotland, where she signed a deal accepting a 15% tariff on EU exports. In return, the EU removed all tariffs on US industrial goods and some agricultural products. At the time, von der Leyen said the agreement "creates certainty in uncertain times."

But that certainty never materialized. Trump's position on Ukraine remains unpredictable, and Washington has since expanded a 50% metals tariff to hundreds of other products while demanding changes to EU tech regulations.

A group of officials had warned from the beginning that the EU was giving up too much and that the US would only come back with more demands. Their warnings proved correct. The trade pact is now on life support, with European Parliament leaders withholding final approval.

There is now a growing internal consensus that the EU's current approach toward the US is not working. The European Central Bank recently noted that barriers within the EU's own single market are higher than those imposed by the US, equivalent to tariffs of 67% for goods and 95% for services. This finding reinforces the view that von der Leyen has not done enough to strengthen the EU from within.

The fact that Trump's pronouncements completely overshadowed the announcement of the Mercosur deal—an agreement intended to showcase Europe's ability to forge partnerships beyond the US—was telling. Attention snapped back to Trump and the unresolved question of how to handle a US president who openly scorns Europe.

One senior EU diplomat suggested that Europe may soon have to accept that its relationship with the US is, for now, broken. Greenland, they added, could be the final straw.

Discussions about Donald Trump's presidential performance are often dominated by politics, but two key metrics offer a clear verdict on his administration's economic policies: international trade and the federal budget. An analysis of the data reveals significant shortcomings in both areas.

A central pillar of Trump's economic agenda was to reshape global trade by imposing heavy tariffs on other nations, particularly China. The stated goal was to revive American factories and generate a new stream of revenue for the U.S. government.

However, the results have run counter to these expectations. After a year of this tariff-focused approach, China reported the largest trade surplus in history, reaching nearly $1.8 trillion. This figure caught most analysts by surprise, underscoring China's continued dominance as the world's leading supplier of goods like electric cars, electronics, and basic AI chips.

Instead of being crippled by the tariffs, China successfully pivoted by finding new customers for products no longer destined for the U.S. and developed strategies to work around the trade barriers.

Evidence of a Lasting Trend

This trade performance doesn't appear to be a one-time event. In December, China's outbound shipments across all categories increased by 6.6%, suggesting that its record-breaking trade surplus is likely to grow even larger in the coming year.

While China's exports directly to the U.S. did fall by 20%, this number can be misleading. China managed to circumvent some of the tariff impact by routing goods through other countries that have lower tariffs with the United States. Meanwhile, its exports to Asia, Africa, and even Europe saw booming growth.

The second area of concern is the rapidly expanding U.S. budget deficit. Despite high-profile efforts to cut government spending, the deficit has continued to climb.

In December alone, the deficit hit a record $145 billion, a 67% increase ($58 billion) from the same month a year earlier. While officials pointed to explanations like calendar-driven shifts in benefit payments, the underlying trend remains one of inexorable growth in the deficit.

Record Spending and Crushing Debt Costs

The federal government's spending reached a new high in the first three months of fiscal year 2026, hitting $1.827 trillion. This represents a $33 billion, or 2%, increase over the same period in the prior year.

At the same time, revenue from tariffs—the supposed solution—is showing signs of flattening out. New trade deals with nations like Korea have reduced some tariffs, and a pending Supreme Court ruling on the legality of the tariffs could further reduce customs receipts.

A significant driver of the deficit is the mounting interest on government debt, which places a heavy burden on taxpayers. Key figures highlight the severity of the problem:

• Interest Payments: The cost to service U.S. Treasury public debt grew by 15% ($46 billion) to $355 billion.

• Rising Rates: This increase was driven by both a larger overall debt load and a higher weighted average interest rate, which rose to 3.32% in December from 3.28% a year earlier.

• National Debt: With the U.S. federal debt-to-GDP ratio approaching 125% and debt per taxpayer exceeding $355,000, the nation's fiscal health is on a precarious footing.

Given these conditions, even a small increase in interest rates could escalate this already worrying financial situation into a more alarming one.

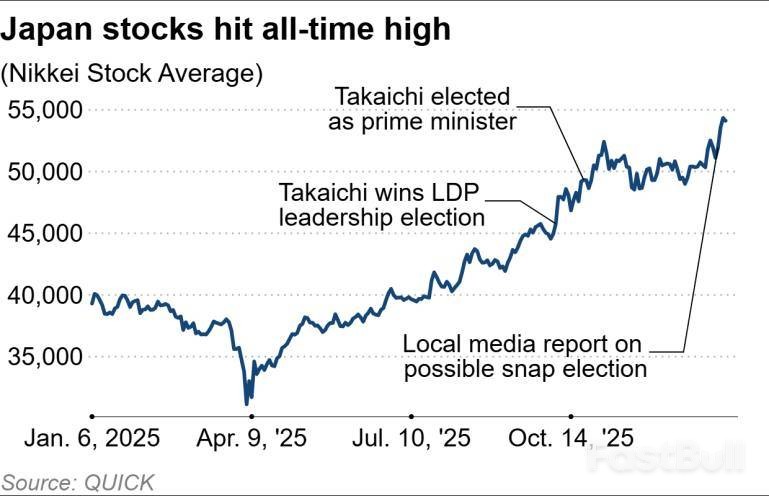

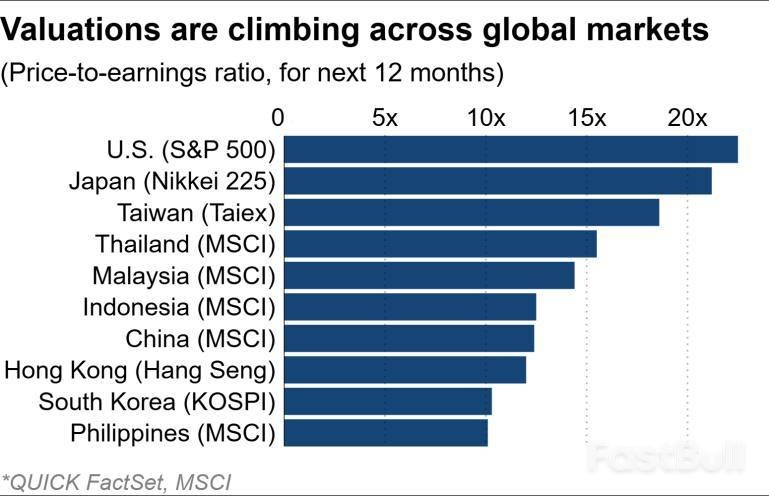

Japanese stocks have surged to unprecedented levels, driven by expectations of more aggressive fiscal policy and growing confidence in corporate fundamentals. The rally has pushed valuations in the Tokyo market above regional peers like South Korea, Taiwan, and Hong Kong, yet many analysts believe there's still room for capital to flow in.

Last week, the benchmark Nikkei Stock Average touched 54,341.23, while the broader Topix index climbed past 3,600. This explosive growth has largely been fueled by political developments and a positive outlook on corporate profits.

The primary catalyst for the market's ascent is Prime Minister Sanae Takaichi, whose rise to power in October and promise of a loose fiscal stance have ignited investor enthusiasm. Takaichi is now seeking to consolidate her power by dissolving the lower house of parliament on January 23, triggering a snap election.

A victory would give her ruling Liberal Democratic Party (LDP) a stronger mandate, making it easier to pass budgets and implement economic policies. While the ruling coalition's lack of a majority in the upper chamber remains a challenge, the current environment points to further gains.

"The path of least resistance for now is higher Nikkei, weaker yen and JGBs on a classic backdrop of the Takaichi trade," said Masahiko Loo, senior fixed income strategist at State Street Investment Management.

In just over three months, the Nikkei average has climbed more than 9,000 points, a jump of about 20%. This has pushed the index's price-to-earnings (P/E) multiple toward the 20x range.

In comparison, Taiwan's Taiex has a forward P/E ratio above 18x, while South Korea and Hong Kong remain relatively inexpensive at around 10x to 11x, despite their own market jumps in 2025.

However, Japanese valuations are still below those in the United States, where an artificial intelligence boom has propelled the S&P 500's forward P/E ratio to around 22x.

"Japan's valuation is a little high compared to past ranges, but when looking globally, it remains a reasonable place to diversify risk," said Hisashi Arakawa, head of Japan equities at Aberdeen Investments.

A recovery in corporate earnings provides a significant tailwind for Japanese equities. The market consensus predicts double-digit profit growth for the fiscal year beginning in April.

"Inflation has led to top-line growth for many companies," noted Ryota Sakagami, a strategist at Citigroup in Tokyo. He added that for non-manufacturers, inflation has also helped improve profit margins. "Overall, inflation has become a positive factor for corporate Japan and that will drive equities higher."

Analysts predict that earnings in the next fiscal year will be supported by a robust non-manufacturing sector and a recovery among tariff-hit automakers and steelmakers.

Furthermore, structural reforms, including revisions to the Corporate Governance Code and a greater focus on share buybacks and capital efficiency, are expected to continue attracting investor interest in the Tokyo market.

Despite the optimism, some analysts urge caution. HSBC pointed out that Japan has "limited room for valuations to expand," arguing that return-on-equity (ROE) figures "have not shown meaningful improvements."

While a P/E ratio helps measure if a stock is overvalued, ROE measures a company's profitability. High P/E multiples are common for companies with strong growth expectations, but low ROE can signal poor profit efficiency.

Japanese companies have historically struggled to surpass the 10% mark in ROE. In contrast, U.S. companies have seen their ROE rise from 15% in 2015 to 21% recently, according to a report from UBS SuMi TRUST Wealth Management. During that same period, U.S. P/E multiples rose from the 15-17x range to around 22x.

UBS suggested that "2026 could be a turning point for Japan" to adopt a market structure more like the U.S., where stocks benefit from both earnings and valuation expansion. "If Japan's ROE breaks above its current range, the market may anticipate a re-rating, attracting overseas investor inflows," the report added.

Across Asia, equity valuations remain at comfortable levels, according to Lorraine Tan, director of Asia equity research at Morningstar. She noted that Asian equities "are trading around fair value" and are "not too extensive, not too overvalued," suggesting there is still upside potential. However, with some stocks in sectors like AI and materials becoming expensive, she advised investors to anticipate "a little bit more volatility and probably a bit more sector rotation."

This environment is pushing investors to be more selective. Hong Kong-based asset manager Value Partners plans to maintain its emphasis on equity, seeing attractive potential in North Asia and "alpha opportunities from ASEAN." The firm noted that ASEAN markets lagged in 2025, but their "comparatively low valuations...warrant closer attention" in 2026.

Citigroup's Sakagami argued that while South Korea and Taiwan have lower valuations than Japan, their markets are heavily concentrated in technology. "If the tech rally continues, South Korea and Taiwan's equity performance will likely be better," he said, "but in terms of global investors' asset allocation strategy, it will be difficult to only buy those markets." He concluded that there is still ample room for investors to buy Japanese equities as part of a diversified portfolio.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up