Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. CPI MoM (Dec)

U.K. CPI MoM (Dec)A:--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Dec)

U.K. Input PPI MoM (Not SA) (Dec)A:--

F: --

U.K. Core CPI MoM (Dec)

U.K. Core CPI MoM (Dec)A:--

F: --

P: --

U.K. Retail Prices Index MoM (Dec)

U.K. Retail Prices Index MoM (Dec)A:--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Dec)

U.K. Input PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. CPI YoY (Dec)

U.K. CPI YoY (Dec)A:--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Dec)

U.K. Output PPI MoM (Not SA) (Dec)A:--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Dec)

U.K. Output PPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.K. Core Retail Prices Index YoY (Dec)

U.K. Core Retail Prices Index YoY (Dec)A:--

F: --

P: --

U.K. Core CPI YoY (Dec)

U.K. Core CPI YoY (Dec)A:--

F: --

P: --

U.K. Retail Prices Index YoY (Dec)

U.K. Retail Prices Index YoY (Dec)A:--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo RateA:--

F: --

P: --

Indonesia Loan Growth YoY (Dec)

Indonesia Loan Growth YoY (Dec)A:--

F: --

P: --

Indonesia Deposit Facility Rate (Jan)

Indonesia Deposit Facility Rate (Jan)A:--

F: --

P: --

Indonesia Lending Facility Rate (Jan)

Indonesia Lending Facility Rate (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Dec)

South Africa Core CPI YoY (Dec)A:--

F: --

P: --

South Africa CPI YoY (Dec)

South Africa CPI YoY (Dec)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report U.K. CBI Industrial Output Expectations (Jan)

U.K. CBI Industrial Output Expectations (Jan)A:--

F: --

U.K. CBI Industrial Prices Expectations (Jan)

U.K. CBI Industrial Prices Expectations (Jan)A:--

F: --

P: --

South Africa Retail Sales YoY (Nov)

South Africa Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Jan)

U.K. CBI Industrial Trends - Orders (Jan)A:--

F: --

P: --

Mexico Retail Sales MoM (Nov)

Mexico Retail Sales MoM (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Industrial Product Price Index YoY (Dec)

Canada Industrial Product Price Index YoY (Dec)A:--

F: --

Canada Industrial Product Price Index MoM (Dec)

Canada Industrial Product Price Index MoM (Dec)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Pending Home Sales Index YoY (Dec)

U.S. Pending Home Sales Index YoY (Dec)A:--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Dec)

U.S. Pending Home Sales Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. Construction Spending MoM (Oct)

U.S. Construction Spending MoM (Oct)A:--

F: --

U.S. Pending Home Sales Index (Dec)

U.S. Pending Home Sales Index (Dec)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

South Korea GDP Prelim YoY (SA) (Q4)

South Korea GDP Prelim YoY (SA) (Q4)--

F: --

P: --

South Korea GDP Prelim QoQ (SA) (Q4)

South Korea GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Japan Imports YoY (Dec)

Japan Imports YoY (Dec)--

F: --

P: --

Japan Exports YoY (Dec)

Japan Exports YoY (Dec)--

F: --

P: --

Japan Goods Trade Balance (SA) (Dec)

Japan Goods Trade Balance (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Not SA) (Dec)

Japan Trade Balance (Not SA) (Dec)--

F: --

Australia Employment (Dec)

Australia Employment (Dec)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Dec)

Australia Labor Force Participation Rate (SA) (Dec)--

F: --

P: --

Australia Unemployment Rate (SA) (Dec)

Australia Unemployment Rate (SA) (Dec)--

F: --

P: --

Australia Full-time Employment (SA) (Dec)

Australia Full-time Employment (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Capacity Utilization (Jan)

Turkey Capacity Utilization (Jan)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Jan)

Turkey Late Liquidity Window Rate (LON) (Jan)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Jan)

Turkey Overnight Lending Rate (O/N) (Jan)--

F: --

P: --

Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

U.K. CBI Distributive Trades (Jan)

U.K. CBI Distributive Trades (Jan)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Jan)

U.K. CBI Retail Sales Expectations Index (Jan)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

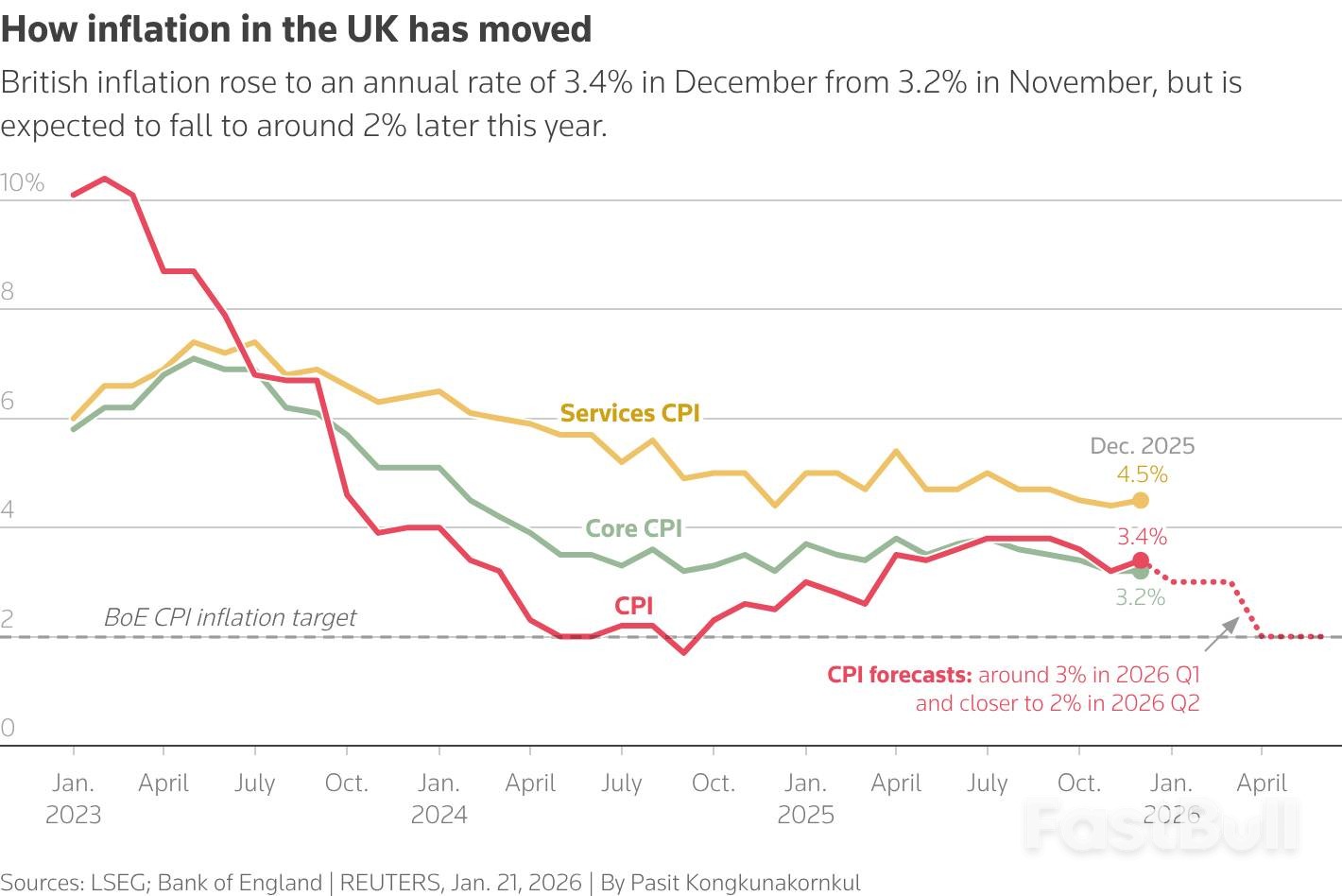

UK inflation unexpectedly rose to 3.4%, but rate cuts remain likely despite external geopolitical threats.

UK inflation unexpectedly climbed for the first time since July, hitting 3.4% in December and complicating the path toward price stability. Despite the increase, investors and economists largely believe the upward blip won't derail the Bank of England's plan to cut interest rates later this year.

Official data shows the Consumer Price Index (CPI) rose from 3.2% in November, surpassing the 3.3% that economists had forecasted.

Key takeaways from the latest report include:

• Headline Inflation: Reached 3.4% in December.

• Primary Drivers: Price hikes were mainly caused by increased tobacco duties and seasonal airfare costs.

• Market Reaction: Financial markets remained steady, with expectations for 2026 rate cuts unchanged.

• Services Inflation: A crucial metric for the central bank, services price inflation edged up to 4.5% from 4.4%, aligning perfectly with forecasts.

The primary forces behind the December inflation increase were higher prices for tobacco products, following a rise in duties, and the typical surge in airfares around the Christmas holiday period.

While the headline number was higher than expected, Adam Deasy, an economist at PwC, described the event as a "speed-bump, rather than an indication we are veering off course on the road to price stability."

This sentiment is shared across the market, as the underlying drivers are seen as temporary rather than a sign of persistent inflationary pressure.

Despite the uptick, the Bank of England (BoE) is widely expected to proceed with interest rate cuts in 2026. The central bank is focused on the broader trend, which still points toward a significant slowdown in price growth over the coming months.

BoE Governor Andrew Bailey has previously stated that he expects inflation to fall close to the bank's 2% target by April or May. Consequently, the latest data did little to move the pound or alter market bets on future monetary policy.

"The Bank of England will... not be worried by these numbers," noted Nicholas Crittenden, an economist from the National Institute of Economic and Social Research. He added, "We still predict one cut in Bank Rate in the first half of this year."

Financial markets are currently pricing in one or possibly two quarter-point rate cuts by the BoE in 2026. This reflects confidence that the disinflationary trend will overcome short-term volatility.

While the domestic inflation picture appears manageable, external factors pose a significant risk. Governor Bailey recently highlighted that the BoE is worried about how markets are reacting to geopolitical developments.

These concerns are materializing in energy markets. British natural gas futures have surged by approximately 25% in the last two weeks, partly due to deteriorating relations with the United States, a key supplier of liquefied natural gas. The tensions stem from President Donald Trump's threats of tariffs on European allies who oppose his Greenland takeover plan. An escalation could disrupt supply chains and push energy costs higher, complicating the BoE's inflation fight.

Even with the December surprise, Britain's consumer price and services inflation rates are running slightly below the BoE's own projections from its November forecasts. However, the UK continues to have the highest inflation rate in the Group of Seven, paired with sluggish economic growth.

Data on producer prices, which can be a leading indicator for consumer inflation, showed a sharp increase in the services sector during the fourth quarter, rising to 2.9% from 2.0%. Meanwhile, output price inflation for manufacturers remained stable.

The BoE's Monetary Policy Committee last cut the Bank Rate to 3.75% in December, but the decision was not unanimous. Nearly half of its members voted to hold rates steady, citing concerns about persistent inflation, a signal that the debate over policy easing is far from over.

Global markets appeared to stabilize somewhat today after the sharp U.S. selloff overnight, which saw the DOW suffer its worst one-day loss since October. That said, the underlying source of stress has not faded. Greenland-related tensions remain unresolved, with no visible path toward de-escalation. The current stabilization looks more like position-squaring, rather than renewed confidence.

For now, markets are simply catching their breath, awaiting the next catalyst. Attention has shifted to World Economic Forum, where US President Donald Trump is due to deliver a closely watched address later today. Trump's speech comes amid soaring tensions between the U.S. and Europe over Danish territory Greenland, which Trump wants the U.S. to acquire. Markets are watching closely for any signal of escalation, moderation, or strategic ambiguity.

On Tuesday, Trump declined to specify how far he is prepared to go to achieve that objective, telling reporters bluntly, "You'll find out." He has previously refused to rule out military action and has threatened new tariffs on multiple European countries if they block the takeover bid.

Those threats have already left their mark on markets this week. The renewed risk of a transatlantic trade war pushed U.S. Treasuries sharply lower, while Gold surged to new record highs.

U.S. 10-year yield briefly breached 4.3% overnight, before settling around 4.295%. Speaking in Davos, Scott Bessent sought to play down concerns about the bond selloff. He said he was not worried about Treasuries, dismissing speculation that European investors were pulling back.

Asked specifically about Denmark, Bessent said its holdings were "irrelevant," noting they amounted to less than USD 100 million, and added that Denmark has been selling Treasuries for years. He emphasized that the U.S. has seen record foreign investment in Treasuries overall.

Instead, Bessent pointed to Japan, arguing that the recent Japanese bond selloff following a snap election announcement had spilled over into global markets. He dismissed talk of European liquidation as originating from a single analyst at Deutsche Bank. Bessent added that Deutsche Bank's CEO had personally contacted him to say the bank did not stand by the analyst report, accusing "fake news media" of amplifying unfounded fears.

Meanwhile, Gold climbed above 4,800, extending a powerful rally driven by tariff threats, geopolitical instability, falling real rates, and ongoing diversification away from the dollar. After a record 2025, Gold has entered 2026 with momentum firmly intact. According to analysts surveyed by the London Bullion Market Association, prices are increasingly expected to rise above 5,000 this year, citing lower U.S. real yields, continued Fed easing, and sustained central-bank diversification.

In FX performance terms this week so far, Dollar sits at the bottom, followed by Yen and Sterling, while Kiwi leads, followed by Swiss Franc and Aussie, with Euro and Loonie in the middle.

In Asia, Nikkei fell -0.41%. Hong Kong HSI rose 0.37%. China Shanghai SSE rose 0.08%. Singapore Strait Times is down -0.46%. Japan 10-year JGB yield stabilized and fell -0.056 to 2.288. Overnight, DOW fell -1.76%. S&P 500 fell -2.06%. NADSAQ fell -2.39%. 10-year yield rose 0.064 to 4.295.

ECB President Christine Lagarde said she expects only a "minimal" inflationary impact from additional U.S. tariffs, arguing that Eurozone price pressures remain firmly under control. Speaking to RTL, Lagarde noted that inflation is currently around 1.9%, leaving little scope for tariffs to materially disrupt the ECB's inflation outlook.

Though, she acknowledged that the impact would not be evenly distributed, with Germany likely more exposed than France given its export-heavy manufacturing base. However, Lagarde argued that Europe would be far more resilient if it focused on removing non-tariff trade barriers within the EU, strengthening internal trade and competitiveness rather than reacting defensively to external shocks.

Lagarde's sharper warning was reserved for uncertainty, not tariffs themselves. Referring to renewed threats from US President Donald Trump, who has vowed to impose escalating tariffs on several European countries over Greenland, she said the "constant reversals" and unpredictability pose a more serious risk. Trump, she added, often takes a transactional approach, setting demands at "sometimes completely unrealistic" levels.

UK inflation firmed at the end of 2025, with headline pressure coming in slightly hotter than expected. CPI rose to 3.4% yoy in December, up from 3.2% and above expectations of 3.3%, while prices increased 0.4% mom, pointing to ongoing near-term inflation momentum.

The upside in headline inflation, however, masked relative stability in underlying pressures. Core CPI—excluding energy, food, alcohol and tobacco—was unchanged at 3.2% yoy, undershooting expectations of 3.3%, and marking the joint-lowest reading since December 2024. Core inflation was last lower in September 2021, reinforcing the view that underlying disinflation progress, while slow, remains intact.

By component, services inflation edged up to 4.5% yoy from 4.4%, keeping the sector firmly in focus for the BoE, while goods inflation rose to 2.2% from 2.1%.

NZD/USD has surged sharply this week and is now pressing key near-term resistance at 0.5852, as shifting global risk dynamics unexpectedly favor the Kiwi. With Dollar and Euro under pressure from Greenland-related geopolitical tensions, both New Zealand dollar and Australian Dollar have surprisingly emerged as relative safe havens, benefiting from stable domestic backdrops and distance from the dispute.

At the same, Yen remains under pressure, weighed down by an aggressive selloff in Japanese government bonds as markets price in post-election fiscal expansion. That divergence has left antipodean currencies unusually well-bid, along with Swiss Franc.

For Kiwi, attention now turns to New Zealand Q4 CPI, due Friday in Asia. The annual rate is expected to hold at 3.0%, right at the top of the RBNZ's 2–3% target band. With the Official Cash Rate at 2.25%, markets broadly agree the RBNZ has completed its easing cycle. The open question is timing of the next hike, not whether one eventually comes. CPI overshoot would sharply pull forward expectations and offer fresh support to NZD.

That focus will intensify at the February 18 OCR review, the first major policy decision under new Governor Anna Breman. Markets will be listening closely to the tone of the post-meeting press conference for clues on whether Breman leans hawkish, dovish, or neither.

Technically, NZD/USD's dip to 0.5710 earlier this month was a little deeper than expected. But that didn't alter the overall structure. The corrective down trend from 0.6119 (2025 high) should have completed with three waves down to 0.5580.

Firm break of 0.5852 will resume the whole rally from 0.5580 and target 100% projection of 0.5580 to 0.5852 from 0.5710 at 0.6015. Decisive break of 0.6015 will solidify that NZD/USD is in an impulsive move that should be resuming whole rise from 0.5484 (2025 low) through 0.6119. In any case, outlook will now stay bullish as long as 0.5710 support holds.

Daily Pivots: (S1) 184.33; (P) 184.90; (R1) 186.02;

EUR/JPY retreated ahead of 185.55 resistance as range trading continues. Intraday bias remains neutral for the moment. With 182.60 support intact, further rally is expected. On the upside, break of 185.55 will resume larger up trend to 186.31 projection level. Firm break there will target 138.2% projection of 151.06 to 173.87 from 172.24 at 189.94. However, sustained break of 182.60 will confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 181.83) and below.

In the bigger picture, up trend from 114.42 (2020 low) is in progress and should target 61.8% projection of 124.37 to 175.41 from 154.77 at 186.31. Considering bearish divergence condition in D MACD, upside could be capped by 186.31 on first attempt. Still, outlook will stay bullish as long as 55 W EMA (now at 172.58) holds, even in case of deep pullback. Sustained break of 186.31 will pave the way to 78.6% projection at 194.88 next.

| GMT | CCY | EVENTS | Act | Cons | Prev | Rev |

|---|---|---|---|---|---|---|

| 07:00 | GBP | CPI M/M Dec | 0.40% | 0.40% | -0.20% | |

| 07:00 | GBP | CPI Y/Y Dec | 3.40% | 3.30% | 3.20% | |

| 07:00 | GBP | Core CPI Y/Y Dec | 3.20% | 3.30% | 3.20% | |

| 07:00 | GBP | RPI M/M Dec | 0.70% | 0.50% | -0.40% | |

| 07:00 | GBP | RPI Y/Y Dec | 4.20% | 4.10% | 3.80% | |

| 07:00 | GBP | PPI Input M/M Dec | -0.20% | -0.10% | 0.30% | 0.50% |

| 07:00 | GBP | PPI Input Y/Y Dec | 0.80% | 1.10% | ||

| 07:00 | GBP | PPI Output M/M Dec | 0.00% | 0.10% | 0.10% | |

| 07:00 | GBP | PPI Output Y/Y Dec | 3.40% | 3.40% | ||

| 07:00 | GBP | PPI Core Output M/M Dec | -0.10% | 0.00% | 0.10% | |

| 07:00 | GBP | PPI Core Output Y/Y Dec | 3.20% | 3.50% | 3.60% | |

| 13:30 | CAD | Raw Material Price Index Dec | 0.30% | |||

| 13:30 | CAD | Industrial Product Price M/M Dec | 0.90% | |||

| 15:00 | USD | Pending Homeles M/M Dec | 3.30% |

The conflict over the U.S. Federal Reserve's independence has intensified, with Treasury Secretary Scott Bessent openly criticizing Fed Chair Jerome Powell's decision to attend a high-stakes Supreme Court hearing. The case centers on President Donald Trump's attempt to fire a sitting central bank governor, a move that could reshape the Fed's political autonomy.

Bessent argued that Powell's presence at the court proceedings would be a "real mistake" that could further politicize the central bank. The controversy is escalating just as the Trump administration prepares to announce its nominee to lead the Fed, with a decision expected as early as next week.

In an interview with CNBC, Bessent was direct in his assessment of Powell's plan to attend the Supreme Court's oral arguments.

"If you're trying not to politicize the Fed, for the Fed chair to be sitting there, trying to put his thumb on the scale, is a real mistake," Bessent said.

Powell’s planned attendance is widely seen as a symbolic gesture amid an ongoing clash with the administration. The U.S. Department of Justice has previously threatened a criminal investigation against him, which Powell labeled a "pretext" to influence monetary policy.

The Supreme Court is set to hear arguments on Wednesday regarding the legality of President Trump's effort to remove Federal Reserve Governor Lisa Cook. While the case proceeds, lower courts have allowed Cook to remain in her position.

The attempt to fire Cook, based on alleged misstatements on mortgage documents from before her time at the Fed, has been criticized as a thinly veiled effort to pressure the central bank into lowering interest rates or to open up board seats for Trump to fill. Cook has not been charged with any violations related to the mortgages.

This case tests the legal standard for removing a Fed governor, who serves a 14-year term and can only be dismissed "for cause." This protection is designed to shield the central bank from short-term political influence, and the "for cause" standard has never been tested in court.

The situation has also drawn scrutiny from Congress. Democratic senators Elizabeth Warren and Dick Durbin have called on the Trump administration to release all records related to the probe into the Fed. Their request includes any communications between the Justice Department, the Treasury, and the White House concerning Powell, Cook, and the Fed's interest-rate decisions.

Critics of the president worry that the administration's actions and rhetoric are a direct threat to the U.S. central bank's long-held independence. The ongoing tension is particularly significant as President Trump's choice to succeed Powell, whose term ends in May, is imminent.

Democratic senators Elizabeth Warren and Dick Durbin are demanding the Trump administration release all records connected to a criminal investigation into Federal Reserve Chair Jerome Powell. The lawmakers allege the probe is a politically motivated attack on the central bank's independence.

In letters addressed to Attorney General Pam Bondi and Federal Housing Finance Agency Director Bill Pulte, the senators described the investigation as a "serious misuse of power." They claim it is part of a broader campaign by President Trump to "seize control of the Federal Reserve by any means necessary."

The Justice Department's investigation centers on comments Powell made to Congress last summer regarding renovations at two Federal Reserve buildings in Washington. Earlier this month, Powell confirmed he had received subpoenas related to those remarks.

Powell has characterized the probe as a pretext designed to pressure the Federal Reserve into cutting interest rates—a move President Trump has repeatedly demanded. In contrast, White House adviser Kevin Hassett recently attempted to play down the significance of the federal criminal investigation.

The senators' demands extend beyond the Powell probe. Their letters also request all administration communications related to Fed Governor Lisa Cook "and any other Fed official," signaling deep concern about political interference.

This development comes as the Supreme Court prepares to hear arguments on President Trump's attempt to fire Governor Cook, an unprecedented move for a U.S. president.

Warren and Durbin framed these events as part of a dangerous pattern. "The Trump Administration's apparent efforts to seize control of the Fed by criminally prosecuting its Chair and its board members when they fail to acquiesce to the President are dangerous, authoritarian, and unprecedented," they wrote.

Bitcoin price failed to settle above $95,000 against the US Dollar. BTC started a fresh decline below $93,500 and $92,000.

Looking at the 4-hour chart, the price traded below a bullish trend line with support at $92,000. There was a move below the 50% Fib retracement level of the upward move from the $89,161 swing low to the $97,944 high.

The price even settled below the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour). Immediate support sits at $88,200.

A downside break below $88,2000 might start another decline. The next major support is $87,500, below which BTC could decline toward $86,000. If there is a recovery wave, the price could face resistance at $90,500.

The first key hurdle is $92,000 and the same trend line. A close above $92,000 and then the 100 simple moving average (red, 4-hour) could start a steady increase. In the stated case, the price may perhaps rise toward the $95,000 level. Any more gains might call for a test of $97,000.

Looking at Ethereum, the price also reacted to the downside below $3,000. The bears might now aim for a drop below $2,880.

In the UK, focus turns to the December inflation print. While price pressures have eased recently, paving the way for potential Bank of England rate cuts, core inflation remains elevated at 3.2% y/y.

In Denmark, November payroll data will be released. Payrolls rose by 3,500 in October, slightly lower than September's increase but still indicating solid progress in the Danish labour market.

In the US, the Supreme Court will hear arguments on whether President Trump can remove Fed Governor Lisa Cook for cause over alleged mortgage fraud. The case has reignited tensions around Fed independence, particularly after last week's issuance of grand jury subpoenas to the Fed related to Fed Chair Powell. Oral arguments begin at 16.00 CET, with the timing of the ruling uncertain, potentially arriving in February or as late as the end of the term in June.

We will also look to developments from the World Economic Forum in Davos. Among the speakers are ECB's Lagarde and President Trump. Trump is scheduled to deliver a special address from 14.30-15.15 CET and has plans to discuss the Greenland dispute with various parties at the forum.

What happened overnight

In the US, President Trump signed an executive order aimed at boosting home-ownership by restricting large institutional investors from purchasing single-family homes. The order also directs federal agencies, including the DOJ and FTC, to review investor acquisitions for anti-competitive practices in the single-family rental market, while promoting home sales to individual buyers. These measures come as Trump faces pressure to address housing affordability ahead of congressional elections.

What happened yesterday

In Germany, the January ZEW index rose more than expected, with the assessment of the current situation at -72.7 (cons: -76.0, prior: -81.0) and expectations at 59.6 (cons: 50.0, prior: 45.8). This marks the highest levels since August and summer 2021, respectively. With the infrastructure package now "live," we expect the growth momentum from Q4 2025 to continue into 2026, forecasting a 1.2% y/y rise in GDP as consumers also benefit from an increase in real incomes. However, President Trump's recent tariff threats pose a clear downside risk if implemented, as Germany's economy is more exposed to the US than other major euro area countries, with exports accounting for 4% of GDP.

In France, PM Lecornu invoked Article 49.3 of the French constitution to pass the revenue side of the 2026 budget without a parliamentary vote, exposing his government to no-confidence motions on Friday. Socialist Party leader Olivier Faure confirmed his party would not back efforts by far-left and far-right parties to topple the government, ensuring Lecornu's survival and increasing the likelihood of the budget passing before February. Following the vote on Friday, Lecornu is expected to trigger Article 49.3 immediately again to pass the spending side of the budget, triggering another vote next week, and finally a third activation and vote to pass the full budget. The new budget aims to cut France's deficit to 5% of GDP, which, all else equal, should be supportive for French government bonds.

In the UK, the December/November labour market report came in close to expectations. Payrolls declined by 43K in December, indicating a renewed acceleration in job losses. However, revisions to the October/November job loss makes up for the poorer December. Private sector wage growth (3M rolling average) slowed to 3.6% y/y in November (prior: 3.9%). Average earnings excluding bonus were 4.5%, as expected. The unemployment rate held steady at 5.1% in November.

Equities: Global equities sold off sharply yesterday, led by the US and cyclicals. However, the internal market dynamics are more nuanced than the headline suggests. Small caps outperformed large caps, value outperformed growth, and in Europe there was virtually no difference between cyclical and defensive performance. This is a key point for the current investment narrative. The rotation away from US growth/tech/AI leadership started well before the Greenland headlines and the renewed tariff threats against eight countries. What has changed more recently is the framing. As geopolitical tensions escalate, the story is increasingly morphing into a sell-America/de-dollarization narrative. We flagged this already in yesterday's Morning Espresso, but it became materially clearer throughout the session. This dynamic is also politically relevant: it does little to strengthen the US president's leverage in his Greenland project. Overnight, Asian equities are lower. European futures point down, while US futures are marginally higher.

FI and FX: After a violent, record sell-off in Japanese bonds yesterday that weighed also on global fixed income markets, things have stabilised somewhat overnight with 30Y Japanese yields coming 6-7bp lower. This has contributed to improving global risk appetite with the large equity futures modestly in green this morning. In FX markets the JPY has been remarkably stable despite both higher Japanese yields and risk-off. The GBP and USD have done poorly with market attention returning to the "Sell US"-narrative while the SEK and CHF have made for a quite unusual pair of winners in Majors space. This likely reflects the CHF safe-haven status on the one hand and the SEK's reverse "Sell US" properties. The NOK FX price action has mirrored global risk appetite closely while EUR/DKK declined yesterday likely reflecting rebalancing flows countering the usual upward pressure on the cross during periods of equity sell-offs. Finally, EUR/USD xCCY basis markets exhibited a slight widening pressure yesterday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up