Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

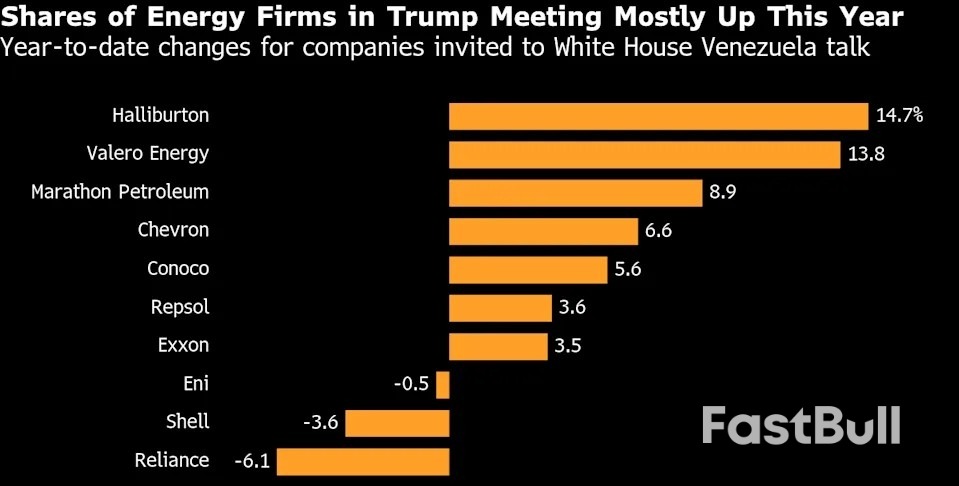

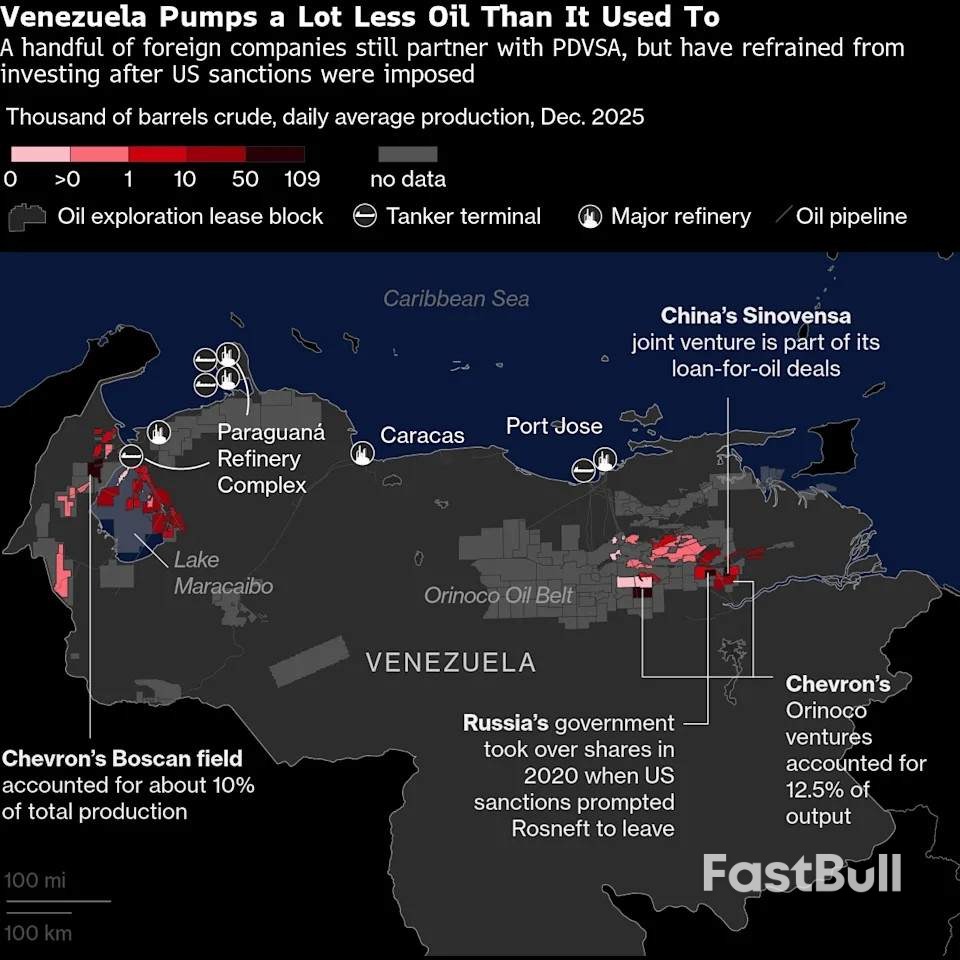

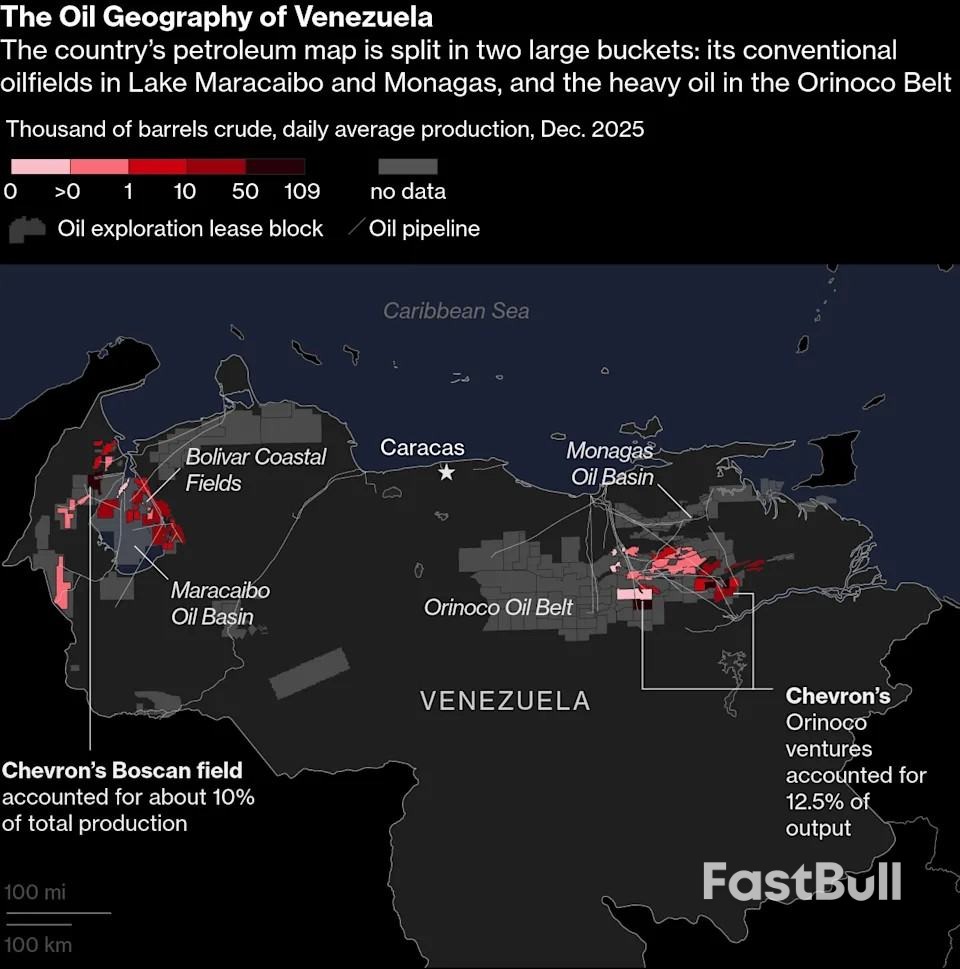

Citgo, a well-known brand in the U.S. with a logo overlooking Kenmore Square in Boston, is the seventh largest refiner in the country.

U.S. President Donald Trump has confirmed he will meet with Venezuelan opposition leader Maria Corina Machado next week, a pivotal discussion that comes as the U.S. navigates a complex power transition in Caracas.

The meeting is scheduled for January 13 or 14 in Washington, D.C. Speaking to U.S. oil executives on Friday about plans to rebuild Venezuela's oil industry, Trump noted Machado's upcoming visit.

"She's going to come in and pay her regards to our country, really to me, but I'm a representative of the country, nothing else," Trump said. He added that he would also meet with other "various representatives of Venezuela," though these meetings are still being arranged.

The meeting occurs against the backdrop of a significant shift in U.S. policy toward Venezuela. Trump and other officials have signaled they will allow Delcy Rodriguez, the former vice president, to remain as the country's interim president for at least 90 days after she took the oath of office this week.

This decision effectively sidelines Machado, whose opposition movement is widely considered the winner of Venezuela's 2025 presidential election over Nicolas Maduro. U.S. Secretary of State Marco Rubio explained the rationale, stating that much of Machado's movement "is no longer present inside of Venezuela."

The political maneuvering follows a dramatic U.S. operation on January 3, when special forces arrested former president Nicolas Maduro and his wife, transporting them to New York to face drug charges. Trump described his current relationship with the remaining officials in Venezuela as "very good."

The United States is actively rolling out a plan for heavy intervention in Venezuela's government and its critical oil sector.

Recent activity suggests a ramp-up of U.S. presence on the ground. Vehicle traffic has notably increased at the site of the U.S. embassy in Caracas, which has been officially suspended since 2019. A former embassy contractor reported being told the facility could reopen as early as next week.

Currently, U.S. diplomatic relations with Venezuela are being managed from Bogota, Colombia, by charge d'affaires John McNamara.

Anti-government protests are escalating across Iran, met by a severe state crackdown that includes an internet blackout and lethal force. As videos of the unrest continue to emerge, U.S. President Donald Trump has issued a stark warning to Tehran's leadership, while Iran's Supreme Leader has accused demonstrators of acting on behalf of the United States.

The growing unrest presents the most significant internal challenge to Iran's clerical rulers in at least three years. The government's response has been swift and severe, cutting off communications and deploying security forces as the death toll continues to rise.

To curb the spread of information and organize protests, Iranian authorities have shut down internet access across the country. The Ministry of Information and Communications Technology confirmed the decision was made by "competent security authorities" in response to the protests.

The communications blockade has had a widespread impact:

• Phone calls into the country are failing to connect.

• At least 17 flights between Dubai and Iranian cities have been canceled.

• The flow of information out of Iran has been drastically reduced.

Iranian state television has broadcast images of burning buses, cars, and banks, while the semi-official Tasnim news agency reported that several police officers were killed overnight in clashes.

The human cost of the crackdown is severe. Iranian rights group HRANA reported on Friday that at least 62 people have been killed since the demonstrations began on December 28, a figure that includes 48 protesters and 14 security personnel.

While the protests initially erupted over a dire economic situation—the rial lost half its value last year and inflation topped 40% in December—they have since evolved. Demonstrators are now chanting political slogans aimed directly at the government, with some verified videos capturing calls of "Death to Khamenei!"

The escalating crisis has drawn sharp words from both Washington and Tehran. On Friday, President Trump delivered a direct threat to the Iranian government. "You better not start shooting because we'll start shooting too," he stated, adding, "I just hope the protesters in Iran are going to be safe, because that's a very dangerous place right now."

In a televised address, Iran's Supreme Leader Ayatollah Ali Khamenei offered a defiant response. He vowed not to back down and accused the demonstrators of being agents for the United States and opposition groups based abroad.

"The Islamic Republic came to power through the blood of hundreds of thousands of honourable people. It will not back down in the face of vandals," Khamenei said. This hardline stance was reinforced by Tehran's public prosecutor, who threatened that anyone committing sabotage or clashing with security forces would face the death penalty.

The violence has triggered condemnation from world leaders. France, Britain, and Germany issued a joint statement condemning the killing of protesters and urging Iranian authorities to show restraint. Similarly, a spokesperson for the United Nations said the organization was "very disturbed by the loss of life," reaffirming the universal right to peaceful demonstration.

Despite his strong rhetoric, Trump has shown caution regarding Iran's fragmented opposition. He indicated on Thursday that he was not inclined to meet with Reza Pahlavi, the U.S.-based son of the late Shah of Iran, suggesting a wait-and-see approach before backing any specific leader.

Alex Vatanka of the Middle East Institute in Washington noted the deep-seated anger fueling the protests. "The sense of hopelessness in Iranian society is something today that we haven't seen before," he said. "That sense of anger has just deepened over the years."

Iran has weathered multiple waves of major unrest in recent decades, including protests in 1999, 2009, 2019, and the "Woman, Life, Freedom" movement in 2022. While authorities suppressed the 2022 protests, which resulted in hundreds of deaths, they have since ceded some ground on public dress codes for women. The current crisis, however, sees the government once again pairing acknowledgments of economic hardship with a violent crackdown on what it labels subversive acts.

Former President Donald Trump has announced that the United States plans to launch direct strikes against drug cartels inside Mexico, signaling a significant shift in counternarcotics strategy from sea to land operations.

In an interview aired on January 8, Trump told Sean Hannity of Fox News that after successfully interdicting most maritime drug routes, the focus must now turn to land. "We knocked out 97 percent of the drugs coming in by water, and we are going to start now hitting land with regard with the cartels," he said.

Trump asserted that cartels now control Mexico and are responsible for hundreds of thousands of deaths in the United States annually. "They're killing 250,000, 300,000 in our country every single year," he stated.

The announcement came just five days after Trump ordered an operation to capture Venezuelan leader Nicolás Maduro and bring him to the U.S. on narco-terrorism charges. Following that action, Trump issued warnings to several Latin American countries, including Mexico.

He urged Mexico to "get its act together," telling reporters that while he would prefer Mexico to handle the problem, the U.S. may be forced to intervene. "We're going to have to do something. We'd love Mexico to do it; they're capable of doing it, but unfortunately, the cartels are very strong in Mexico," Trump said.

He also noted that he has spoken with Mexican President Claudia Sheinbaum multiple times and offered to send in U.S. troops, an offer she has declined. Trump described her as "afraid" and claimed "the cartels are running Mexico," not her administration.

Mexico has consistently opposed proposals for U.S. military action on its soil. Responding to the pressure, President Sheinbaum firmly rejected the idea of foreign interference.

"We categorically reject intervention in the internal affairs of other countries," Sheinbaum stated during a press conference. "The history of Latin America is clear and compelling: Intervention has never brought democracy, never generated well-being, nor lasting stability."

This potential escalation is part of a broader intensification of anti-cartel policy under Trump's administration, which includes designating Mexican syndicates as terrorist organizations. Officials maintain that with sea-based trafficking nearly halted, land operations are the logical next step.

Trump has previously indicated that a formal declaration of war is not a prerequisite for taking military action. "I think we're just going to kill people that are bringing drugs into our country," he said on October 23, 2025.

While U.S. officials link the cartels to tens of thousands of American overdose deaths each year, Trump did not provide a specific timeline for when the announced land strikes might begin.

American workers are taking home the smallest portion of the country’s economic output since federal records began in 1947, according to new data that highlights a growing disconnect between economic growth and employee compensation.

Figures from the Bureau of Labor Statistics (BLS) reveal that the share of GDP paid to workers through wages and salaries fell to 53.8% in the third quarter of last year. This marks the lowest level ever recorded in the modern data series.

The figure represents a sharp decline from 54.6% in the previous quarter and sits well below the 55.6% average recorded so far in the 2020s. This trend has emerged even as the overall economy expands and many companies report some of their strongest profit margins in decades, raising fresh questions about income distribution.

The labor share metric, tracked since 1947, briefly spiked in 2020 during the pandemic but has been on a steady downward trajectory since. Over the same period, corporate profits have climbed, suggesting that the benefits of GDP expansion are not being shared proportionally with the workforce.

The BLS defines labor share as "the percentage of economic output that accrues to workers in the form of compensation." This includes not only wages and salaries but also bonuses and pension contributions. Despite solid GDP growth, this percentage has continued to fall.

The same BLS report that detailed the shrinking labor share also showed a significant jump in U.S. labor productivity, which rose at its fastest pace in two years during the third quarter. Economists suggest this gain may be partly linked to the increasing adoption of artificial intelligence.

This creates a complex economic picture:

• On one hand, higher productivity allows for faster GDP growth without triggering higher inflation.

• On the other, it enables companies to increase their output while hiring fewer workers, putting downward pressure on overall wage growth relative to GDP.

More data is needed to fully understand AI's long-term impact on jobs and pay, but the current trend points toward a scenario where efficiency gains are not translating into a larger slice of the economic pie for employees.

Federal Reserve officials are closely monitoring these dynamics. Tom Barkin, President of the Federal Reserve Bank of Richmond, characterized the current situation as a "low-hiring environment" with modest job growth.

Recent BLS figures support this view, showing employers added 50,000 jobs last month. The unemployment rate edged down to 4.4%, but the pace of hiring has slowed considerably.

"This fine balance between a modest job growth environment with a modest labor-supply growth environment seems to be continuing, and that was encouraging," Barkin told reporters.

Businesses Prioritize Efficiency

According to Barkin, businesses are remaining cautious, choosing to rely on productivity gains to operate with fewer workers rather than expanding their payrolls. This strategic choice is a key factor shaping hiring decisions and contributing to the suppressed labor share, even as GDP continues to grow.

He stressed that Federal Reserve officials must remain vigilant about the dual risks of rising unemployment and persistent inflation.

Uncertainty Clouds Future Rate Cuts

While policymakers cut the benchmark interest rate for a third consecutive meeting last month, they are divided on the path forward. Uncertainty surrounding inflation and the labor market has tempered expectations for further cuts.

Investors are currently pricing in two quarter-point rate cuts this year, with the first move not anticipated until April or June.

Barkin noted that while inflation has improved, the fight is not over. "Inflation has been above our target now for almost five years," he said. "It's in a lot better shape than it was two or three years ago, but it's certainly not all the way there."

He concluded that policymakers must keep a close eye on both sides of their mandate. "The unemployment rate has ticked up in the last year, and job growth is modest," Barkin said. "So I think you've got to watch both of them."

President Donald Trump has escalated his campaign to acquire Greenland, stating he is prepared to secure the Danish territory "the hard way" if a deal cannot be reached.

“I would like to make a deal, you know, the easy way. But if we don't do it the easy way, we're going to do it the hard way,” Trump told reporters at the White House on Friday.

The president's focus on Greenland, which he frames as a national security imperative, has sharpened following a recent U.S. raid targeting Venezuelan leader Nicolas Maduro. The move has heightened concerns among allies about the potential use of U.S. military force to achieve foreign policy objectives.

When asked about a potential financial offer for the island, Trump dismissed the idea for now.

"I'm not talking about money for Greenland yet," he said. "I might talk about that, but right now, we are going to do something on Greenland, whether they like it or not."

The president justified his stance by pointing to geopolitical competition with Russia and China, arguing that U.S. action is necessary to prevent them from establishing a presence in the region. “We’re not going to have Russia or China as a neighbor,” Trump stated.

The comments have strained relations with Denmark, a key NATO member. Danish Prime Minister Mette Frederiksen issued a stark warning, stating that a U.S. attack on Greenland would signify the end of the NATO alliance.

Other European leaders echoed this sentiment, calling on Trump to respect the island’s territorial integrity and affirming that it is protected under the bloc's collective security framework.

While the president has not ruled out using military force, the official U.S. position appears to be focused on a transaction.

On Tuesday, U.S. Secretary of State Marco Rubio told lawmakers that the administration’s goal is to buy the island. Rubio is scheduled to meet with Danish officials next week to discuss the matter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up