Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Economist: Fed Could Further Shrink Balance Sheet If It Uses Term Open Market Operations (Tomos)] Bill Nelson, Chief Economist And Head Of Research At The Bank Policy Institute (Bpi), Believes The Federal Reserve's Reluctance To Restart Term Open Market Operations (Tomos) Is Hindering Further Reduction In Its Balance Sheet, And This Resistance Is Based On Misunderstanding. Nelson Writes, "Without Term Open Market Operations, The Fed Simply Cannot Achieve Meaningful Balance Sheet Reduction. To Reduce Its Balance Sheet, The Fed Must Raise Money Market Rates To A Level Slightly Above The Interest Rate On Reserves (IOR) So That Banks Have An Incentive To Shift Funds From Reserves To Other Liquid Assets."

U.S. Treasury Yields Rose Further As Data Showed That The U.S. ISM Manufacturing Sector Expanded At Its Fastest Pace Since February 2022 In January

The US ISM Manufacturing New Orders Index For January Was 57.1, Compared To 47.7 In The Previous Month

Ism USA Manufacturing Prices Paid Index 59.0 In January (Consensus 59.0) Versus 58.5 In December

Gold Volatility Hits Highest Level Since 2008, Dwarfing Even Bitcoin's Rollercoaster Ride. Gold's Volatility Has Surpassed That Of Bitcoin, Highlighting The Metal's Dramatic Price Swings, Comparable To The Most Volatile Periods Of The Past Two Decades, Following A Rapid Price Surge. Bloomberg Data Shows That Gold's 30-day Volatility Has Climbed To Over 44%, The Highest Since The 2008 Financial Crisis. This Level Exceeds Bitcoin's Volatility Of Approximately 39%—the Original Cryptocurrency Often Referred To As "digital Gold."

The Final Reading Of The S&P Global Manufacturing PMI Output Sub-index For January Rose To 55.2, A New High Since August, Marking The Eighth Consecutive Month Of Expansion. The Final Reading Of The Employment Sub-index Fell, Reaching A New Low Since October

A White House Official Said U.S. Middle East Envoy Witkov Will Travel To Abu Dhabi On Wednesday And Thursday For Talks With Russia And Ukraine

A White House Official Said U.S. Middle East Envoy Witkov Will Arrive In Israel On Tuesday And Meet With Israeli Prime Minister Netanyahu

The Final Reading Of The S&P Global Manufacturing PMI For January In The United States Was 52.4, In Line With Expectations Of 52 And The Preliminary Reading Of 51.9

Spokesman: US Treasury Has Not Pledged Funds To African Development Bank's Adf 2025 Financing Round

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Raymond James warns Trump's Iran military options lack a "quick win," risking prolonged conflict.

Analysts at Raymond James are cautioning that President Donald Trump's potential military options against Iran lack the possibility of a "quick win," elevating the risk of a prolonged and complex conflict.

In a recent note, analysts including Ellen Ehrnrooth and Ed Mills stated that a U.S. strike on Iran is "more likely than not" unless a diplomatic breakthrough occurs soon. This assessment comes as officials from Turkey, Egypt, and Qatar attempt to mediate a meeting between Washington and Tehran.

The diplomatic push follows Trump's threat to attack Iran if it refuses to negotiate a deal on its nuclear weapons program. The president, who has already sent what he termed an "armada" to the region, has also demanded Iran halt its nuclear activities and its crackdown on anti-government protestors.

According to the Raymond James analysis, the White House is contemplating several escalatory actions. These potential operations include:

• Targeted strikes on Iranian security forces or senior officials.

• Commando missions or further strikes to degrade nuclear infrastructure.

• Attacks on Iran's ballistic missile programs or related facilities.

These aggressive postures are consistent with Trump's approach since returning to office in January 2025.

President Trump has demonstrated a willingness to use military force in specific situations. Last year, the U.S. executed airstrikes against Iran's nuclear infrastructure. In a separate operation in early January, American forces captured Venezuelan leader Nicolas Maduro. While both events increased geopolitical tensions, neither resulted in sustained fighting.

However, the Raymond James analysts argue that the current options for Iran are fundamentally different. "The operations for Iran now being considered do not present a 'quick win' like those the administration was able to obtain" previously, they wrote, highlighting the increased "complexity and risk of entering into prolonged conflict."

Despite the escalating military rhetoric, Trump has also suggested that progress is being made on the diplomatic front. He recently stated that Iran was "seriously talking" with Washington and that arrangements for negotiations were in progress.

His comments prompted a drop in oil prices on Monday, as investors eased their concerns about potential supply disruptions from Iran, an OPEC member. Analysts at ING, including Ewa Manthey and Warren Patterson, noted that the downward move in oil was also influenced by "a broader correction across financial markets."

The bond market is bracing for the U.S. Treasury's upcoming debt issuance announcement on Wednesday, with most participants expecting no major changes. However, the Trump administration's recent aggressive financial interventions have put investors on high alert for a surprise move designed to cap rising yields.

Current consensus points to the Treasury maintaining its quarterly refunding auctions at $125 billion, a level held since May 2024. This marks the longest period of unchanged sales since the mid-to-late 2010s, when auction totals were less than half of today's figures.

The department may also reaffirm its previous guidance to keep sales of interest-bearing securities stable for "at least the next several quarters." This approach contrasts with earlier suggestions from Treasury Secretary Scott Bessent, who had signaled a preference for issuing more long-dated securities before taking office. That strategy now appears unattractive, as the yield on the 10-year Treasury note—a key metric for Bessent—hovers around 4.25%, a full 80 basis points higher than 12-month bills.

Despite the expected stability, persistent federal budget deficits mean the Treasury will eventually need to increase its auctions of securities with maturities longer than one year. The central debate among investors is whether this move will be delayed until 2027.

There is also growing speculation that the Treasury might scale back issuance of its longest-dated debt to temper yields. This follows a global trend, with governments in Europe and Japan reducing their sales of 30-year bonds in response to weakening investor demand.

"The real focus will be whether they are looking to adjust coupon sizes lower in light of high bill demand," said Guneet Dhingra, head of U.S. interest-rate strategy at BNP Paribas. While he anticipates unchanged auction sizes this quarter, Dhingra has floated the idea that the government could eliminate the 20-year bond, which was revived in 2020 to a lukewarm reception.

The Treasury has gained some flexibility thanks to the Federal Reserve. In December, the Fed announced it would purchase $40 billion in T-bills per month until April. While this move is tied to managing bank reserves and not monetary policy, it effectively reduces the amount of short-term debt the Treasury needs to sell to private investors.

The Fed's future role in the bond market gained new attention following President Trump's nomination of Kevin Warsh to lead the central bank in May. Warsh, a former Fed governor, has advocated for a "new accord" with the Treasury to clarify the strategy for managing its massive bond portfolio, though he has not yet detailed his plans.

Any hint of a cut in bond sales on Wednesday would be a surprise, especially after the Treasury's November statement indicated it had "begun to preliminarily consider future increases" to coupon-bearing debt sales. At the time, the department noted it was "evaluating trends in structural demand."

Since then, the Trump administration has taken extraordinary steps to address voter concerns about affordability, including ordering large-scale purchases of mortgage bonds and attempting to cap credit-card rates. These actions have led analysts to question if a more activist approach to debt management is coming.

"Investors have naturally asked whether Treasury could be considering a more activist shift in its debt management strategy in order to help facilitate the administration's goals of lower long-term yields," wrote JPMorgan Chase & Co. strategists led by Jay Barry.

This sentiment is echoed by traders. Ben Jeffery at BMO Capital Markets noted, "we've even heard chatter around the potential for calling off 20s entirely, or even reducing 30-year issuance in favor of boosting bill auction or 2-year auction sizes instead."

A sudden change would conflict with the Treasury’s long-held philosophy of being "regular and predictable" in its issuance strategy—a principle Secretary Bessent publicly endorsed at a conference in November.

Looking ahead, if the Treasury does increase coupon sales, many expect the focus to be on the 2- to 7-year part of the curve, often called the "belly" by investors.

"They can increase pro-rata across the board, or they can say the market is demanding these sort of belly securities," explained Amar Reganti, a fixed income strategist at Hartford Funds and a former official at the Treasury's Office of Debt Management. "Our model is telling us that that's a place where we've had historically the best issuance."

Market participants will also watch for any adjustments to two other areas:

• The Treasury's program for buying back older, outstanding securities.

• Sales of Treasury Inflation-Protected Securities (TIPS).

Several banks are forecasting an increase in at least one of the three upcoming TIPS auctions. After a series of increases, the Treasury paused the pattern last year, but stronger demand for the 5-year TIPS could lead to a $1 billion increase in its new issue, bringing the total to $27 billion.

Steven Zeng, an interest-rate strategist at Deutsche Bank, suggested that with the TIPS share of total debt still trending down, "there may be just enough for Treasury to eke out one more increase. It is a close call though."

Iran is evaluating the terms for restarting negotiations with the United States, a foreign ministry official confirmed Monday. The statement comes as both sides signal a readiness to revive diplomatic efforts to resolve the long-standing nuclear dispute and ease fears of a new regional conflict.

The potential for renewed talks unfolds against a backdrop of high tension. A recent U.S. Navy military buildup near Iran has heightened concerns, following a deadly crackdown on anti-government protests last month—the most severe domestic unrest in Iran since the 1979 revolution.

U.S. President Donald Trump, who threatened but ultimately did not intervene in the protests, has since demanded nuclear concessions from Tehran and dispatched a naval flotilla to its coast. Last week, Trump stated that Iran was "seriously talking." Echoing this, Tehran's top security official, Ali Larijani, posted on X that arrangements for negotiations were underway.

Iranian sources reported last week that President Trump has laid out three core preconditions for resuming talks:

• Zero enrichment of uranium in Iran.

• Strict limits on Tehran's ballistic missile program.

• An end to its support for regional proxies.

Tehran has historically rejected all three demands as infringements on its sovereignty. However, two Iranian officials told Reuters that the country's clerical leadership views the ballistic missile program as a more significant obstacle to a deal than its uranium enrichment activities.

Foreign Ministry spokesperson Esmaeil Baghaei noted that Tehran was considering "the various dimensions and aspects of the talks," adding that "time is of the essence for Iran as it wants lifting of unjust sanctions sooner."

A potential meeting between U.S. Special Envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi could take place in Turkey in the coming days, according to a senior Iranian official and a Western diplomat. A Turkish ruling party official confirmed to Reuters that both Tehran and Washington have agreed to focus this week's discussions on diplomacy, potentially averting U.S. military action.

An Iranian official stated that "diplomacy is ongoing." He elaborated on Tehran's stance: "For talks to resume, Iran says there should not be preconditions and that it is ready to show flexibility on uranium enrichment, including handing over 400 kg of highly enriched uranium (HEU), accepting zero enrichment under a consortium arrangement as a solution."

However, Tehran has its own condition for starting talks: the removal of U.S. military assets from its vicinity. "Now the ball is in Trump's court," the official added.

Tehran's regional influence has been diminished by Israeli attacks on its proxies—including Hamas in Gaza, Hezbollah in Lebanon, the Houthis in Yemen, and various militias in Iraq. The ousting of Syria's Bashar al-Assad, a close ally of Iran, has also weakened its position. Last year, the United States joined a 12-day Israeli bombing campaign by striking Iranian nuclear targets.

Previous talks, which stalled in May 2023 after five rounds, left several critical issues unresolved. These included Iran's insistence on maintaining uranium enrichment on its own soil and its refusal to ship its entire stockpile of highly enriched uranium abroad.

Since the U.S. strikes on three of its nuclear sites in June, Tehran claims its uranium enrichment has ceased. The U.N.'s nuclear watchdog has repeatedly asked Iran to clarify the status of its HEU stock since the attacks. Western nations remain concerned that Iran's enrichment activities could produce material for a nuclear warhead, though Iran maintains its program is solely for civilian energy and other peaceful uses.

Iranian sources suggest Tehran could agree to ship its highly enriched uranium abroad and pause enrichment activities as part of a comprehensive deal that would also include the lifting of economic sanctions.

The Bank of England is widely expected to keep interest rates on hold this week, but the key question for markets is whether policymakers will signal an earlier-than-expected rate cut.

Based on the Bank's surprisingly hawkish tone in December, such a signal seems unlikely for now. While officials did cut rates, they hinted that the "cadence of rate cuts" could slow down—a cautious message for a central bank that was already moving slowly.

As interest rates approach a neutral level, the decision to cut further becomes more complex. With UK inflation at 3.4% in December, well above the target, hawks on the committee remain concerned that easing policy too soon could trigger a new wave of price pressures, mindful of the inflation spike in 2022.

Since the last meeting, economic data has not provided a clear direction. A single round of data showed weak jobs numbers offset by stronger Purchasing Managers' Indices (PMIs). Inflation in December also came in slightly higher than anticipated.

A crucial metric for the Bank, the 'Decision Maker Panel' survey, revealed that corporate wage growth expectations are holding steady at 3.7%. This survey was cited multiple times in the previous meeting's minutes as a key reason for the Bank's cautious approach.

Given this backdrop, a 7-2 vote to keep rates unchanged is the most probable outcome. Known doves Alan Taylor and Swati Dhingra are almost certain to vote for a rate cut. Fellow dove Dave Ramsden might join them, although his comments after the December meeting suggested he was prepared to pause.

Despite the current hesitation, there are compelling reasons to believe the Bank’s tightening cycle is over and rate cuts are approaching.

• Weakening Labor Market: Hiring surveys continue to deteriorate, suggesting last year's 1% decline in private sector employment will extend into 2026.

• Cooling Wage Growth: Private sector pay growth has already fallen from 6% at the start of 2025 to 3.6%. Forecasts indicate it will soon hit 3%, aligning with pre-COVID averages when the job market was strong but interest rates were much lower.

• Falling Inflation: Headline inflation is projected to drop dramatically from 3.4% in December to 1.8% by April. This is largely driven by lower food and water inflation, with food prices already running nearly a full percentage point below the Bank’s November forecast.

Core services inflation is also expected to moderate. While the most significant drops will appear in April's data, released in May, upcoming releases before the March meeting should provide early evidence of cooling prices, especially in key areas like restaurants and cafés.

In December, the Bank of England acknowledged that upside risks to inflation were diminishing. By the time policymakers meet in March, they will have two more rounds of data to confirm this trend.

A rate cut next month remains a distinct possibility—certainly higher than the 20% probability currently priced in by markets.

However, it is doubtful the Bank will explicitly open the door to a March cut this week. Officials are unlikely to alter their forward guidance, which emphasizes that decisions become more balanced as rates near neutral. In the subsequent press conference, Governor Andrew Bailey is not expected to talk up a March cut, despite his recent alignment with the doves. The Bank of England generally avoids commenting on market pricing unless it significantly deviates from its own thinking, which is not the case at present.

This week's mantra will likely be to keep all options on the table and let the incoming data guide future decisions.

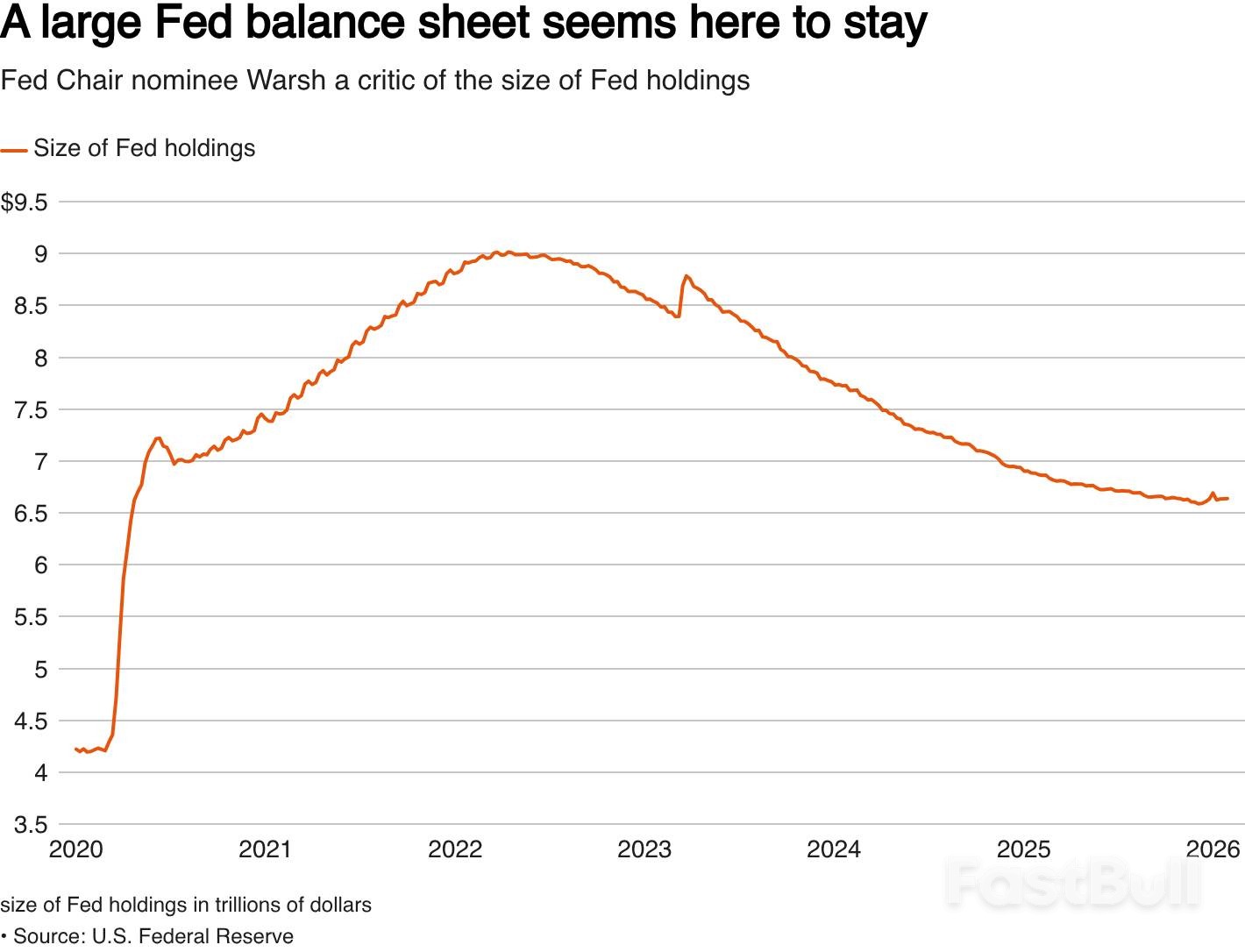

Kevin Warsh, tapped to be the next Federal Reserve chair, has a bold vision: to dramatically shrink the central bank's massive balance sheet. But while the goal is clear, market experts warn that financial reality makes this a difficult, slow, and potentially impossible task.

The core issue is that the modern financial system has grown accustomed to the high levels of liquidity provided by the Fed. Attempting a rapid wind-down could destabilize markets and undermine the very monetary policy goals a new chair would be tasked with achieving. This challenge is even greater for a leader who may also want to lower short-term borrowing costs, as shrinking the balance sheet inherently tightens financial conditions.

Warsh, who served as a Fed governor from 2006 to 2011, has been a vocal critic of the Fed's large-scale asset holdings. He argues they distort the economy and that the current balance sheet should be significantly reduced.

In a November Wall Street Journal opinion piece, he stated, "the Fed's bloated balance sheet, designed to support the biggest firms in a bygone crisis era, can be reduced significantly." He proposed that the proceeds could be redeployed "in the form of lower interest rates to support households and small and medium-sized businesses."

This call for contraction came as the Fed was concluding a three-year effort to trim bond holdings acquired during the COVID-19 pandemic. These aggressive purchases, initially meant to stabilize markets, later evolved into a form of economic stimulus. The buying spree doubled the Fed's holdings to a $9 trillion peak in mid-2022 before a process known as quantitative tightening (QT) brought the total down to $6.6 trillion by late 2025.

However, in December 2025, the central bank reversed course slightly, beginning technical purchases of Treasury bills to ensure the financial system had enough liquidity for the Fed to maintain control over its target interest rate.

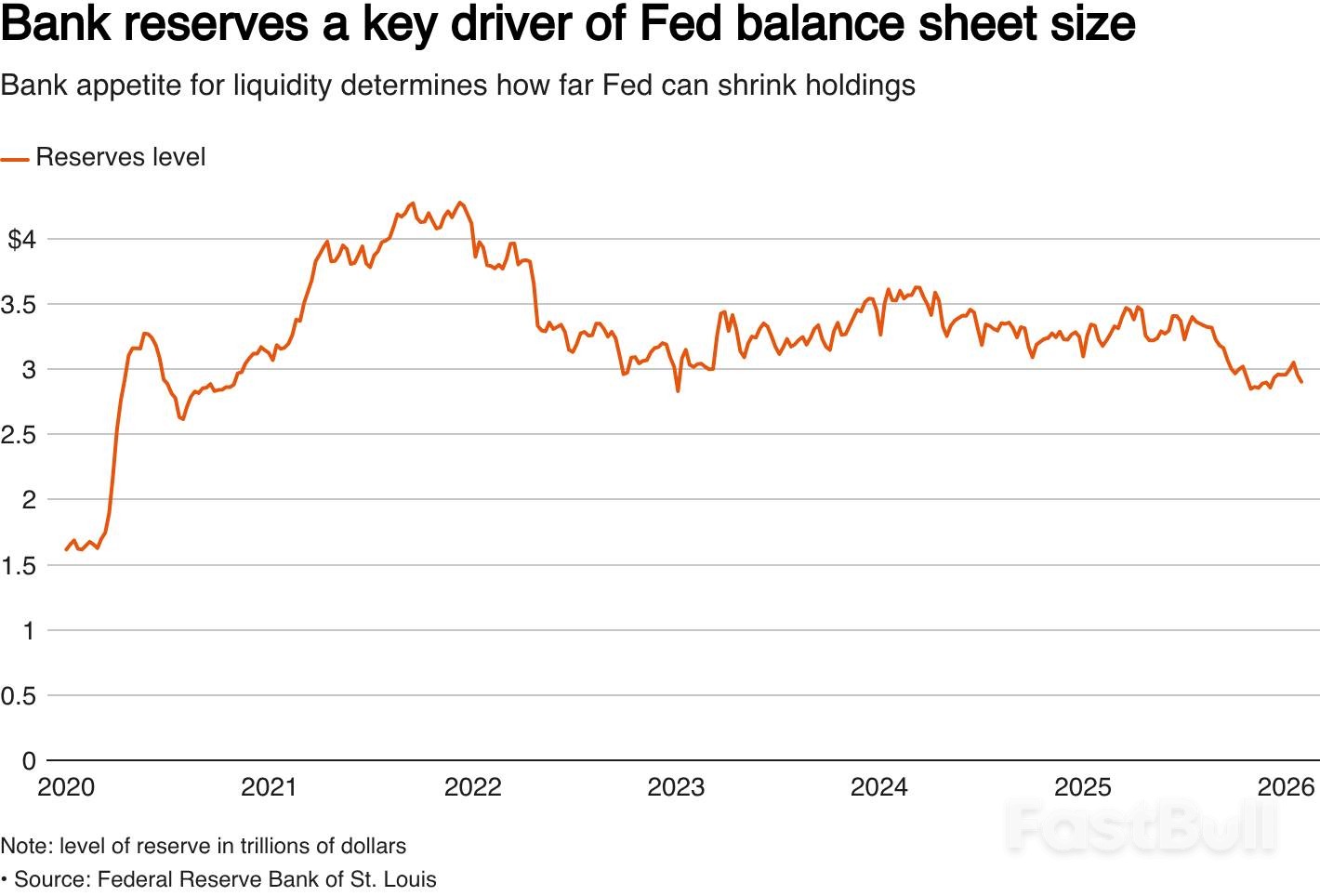

Using the balance sheet has become a standard and critical tool in the Fed's monetary policy arsenal, especially when short-term interest rates are near zero. The central bank has built an entire system to manage rates in this high-liquidity environment, making it incredibly difficult to unwind without causing market chaos.

"He may want a smaller balance sheet and smaller Fed footprint in financial markets," said Joe Abate, a U.S. rates strategist at SMBC Capital Markets, Inc. "But, actually reducing the size of the balance sheet is a nonstarter… Banks want this level of reserves."

Abate's point highlights the primary obstacle: when reserves in the banking system fall to around the $3 trillion mark, significant volatility tends to appear in money markets. This instability directly threatens the Fed's ability to control its benchmark interest rate, effectively creating a floor for how much the central bank can shrink its holdings.

Beyond market mechanics, any major policy shift would require consensus from other Fed policymakers, who have generally supported using the balance sheet as a key policy lever.

Given these constraints, how could Warsh achieve his goal? Analysts suggest a gradual approach is the only viable path. This could involve several coordinated actions:

• Regulatory Easing: Loosening some regulations on how banks manage liquidity could reduce their appetite for holding vast reserves.

• Enhancing Fed Facilities: Making tools like the Discount Window and standing repo operations more attractive could also lower banks' demand for reserves.

• Strategic Reviews: David Beckworth of the Mercatus Center at George Mason University notes that Warsh could initiate a framework review to formally reconsider how the Fed uses its balance sheet.

• Treasury Coordination: Beckworth also suggested potential coordination between the Fed and the Treasury, possibly through bond swaps.

Ultimately, any changes would likely be slow and cautious. "The Fed's like a ship that slowly turns, that's probably a good thing, because you don't want to be so disruptive to the financial system," Beckworth said.

Analysts at Evercore ISI share this view, expecting Warsh to be more pragmatic than his public statements suggest. "We think he will promise no abrupt changes to Fed balance sheet policy and a Fed-Treasury accord to provide a framework for closer cooperation," the firm wrote. They predict that such a move would effectively give Treasury Secretary Scott Bessent influence over QT plans, an outcome Warsh would likely accept.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up