Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)A:--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)A:--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Donald Trump said people were "starting to learn" the benefits of his tariff regime as he sought to convince voters his administration was moving to address affordability concerns, taking to the road in hopes of countering a mounting political vulnerability.

President Donald Trump said people were "starting to learn" the benefits of his tariff regime as he sought to convince voters his administration was moving to address affordability concerns, taking to the road in hopes of countering a mounting political vulnerability.

Trump, who is resuming domestic political travel after months without holding a rally, allowed that he "got a lot of heat" over his sweeping levies on foreign imports, with political opponents seizing on the program to argue tariffs have increased consumer prices and inflation.

But on Tuesday evening, he argued that the tariffs had enabled him to provide aid to farmers and forced manufacturers to build plants and data centers in the US.

"It's amazing," Trump said of tariffs at a campaign-style rally in Mount Pocono, Pennsylvania. "It's the smart people understand it. Other people are starting to learn, but the smart people really understand it."

The president and his aides have acknowledged the need to sharpen their economic messaging, a tacit acknowledgment of how voter sentiment on the economy has become a challenge for the president. He told supporters that his chief of staff, Susie Wiles, had told him in recent days he needed to "start campaigning" again in order to prevail in the midterms.

Those new pressures were highlighted in elections last month in which Republicans suffered a number of high-profile defeats and cost of living issues figured prominently. Trump returned to power by seizing on public discontent over high prices and lack of job growth but now risks running into the same economic headwinds that vexed his predecessor, Joe Biden.

Consumer sentiment, while somewhat improved, remains near the lowest on record, data from the University of Michigan show, and people's views of their personal finances are the dimmest since 2009. Unemployment has ticked higher, and US companies shed payrolls in November by the most since early 2023, according to data from ADP Research.

Earlier: Trump Resumes Domestic Travel Hoping to Calm Inflation Worry

Trump and allies have moved to assuage those concerns in recent weeks, drafting new agricultural exemptions to his tariff agenda, providing aid for farmers and investigating the meatpacking industry. Trump has also sought to roll back fuel efficiency standards to lower the price of cars and reduce prescription drug costs.

Yet those efforts have failed to break through with voters with the president also juggling other priorities including a sweeping immigration crackdown, a push to bring an end to Russia's war in Ukraine, and pet projects such as building a new White House ballroom.

Trump has expressed anger when asked about affordability issues, accusing Democrats and the media of a "hoax" since inflation grew at a higher rate under Biden.

"That's our message: they gave you high prices, they give you the highest inflation in history, and we're bringing those prices down rapidly," Trump said in Mount Pocono.

Aides insist Trump's economic agenda has helped blunt the effects of high prices of everyday essentials, and his advisers have publicly pleaded with voters to be more patient, maintaining that their policies are working. US job openings picked up in October to the highest level in five months.

Still, Republicans face questions about rising health care costs for millions of Americans who receive subsidies under the Affordable Care Act that are set to expire at year's end. Trump has also continued to threaten new tariffs that risk exacerbating price growth.

It's also unclear if Trump's attacks on Democratic lawmakers will resonate in the same way now that his party controls the government. The president nevertheless rehashed familiar attacks against Biden over his age, while slamming Minnesota Democrats over a burgeoning fraud scandal.

The independence of central banks is essential for monetary stability, Bank of Italy Governor Fabio Panetta said on Tuesday, amid a spat between the Italian government and the European Central Bank over the country's gold reserves.

The ECB urged Rome on Monday to reconsider a proposed amendment to its 2026 budget law that would state that the Bank of Italy's gold reserves belong to "the Italian people," warning the move could jeopardise the central bank's independence.

Without mentioning specifically the issue of the gold reserves, Panetta said in a speech that monetary stability rests on "the authority of the State and the credibility of an independent central bank."

Italian Economy Minister Giancarlo Giorgetti intends to send a letter to ECB head Christine Lagarde to clarify that Rome has no plans to undermine the independence of the Bank of Italy, sources familiar with the matter told Reuters on Tuesday.

In his speech in Dublin at an event organised by Ireland's central bank, Panetta said the transformation of the international monetary system, with accelerating digitalisation and growing multipolarity, carried a number of risks.

"When structural forces move inch by inch, while technology advances in leaps and bounds, the outcome is not just linear change or fresh opportunities; it may also turn turbulent," he said.

Panetta expressed concern about the increasing use of stablecoins in cross-border payments, saying their circulation was opaque and they suffered from operational vulnerabilities.

"During the transition to a digital monetary order, their growing use could add a layer of volatility – or even instability – to an already uncertain international environment," he said.

Managing these risks will require clear rules, credible public anchors and sustained international cooperation, Panetta added.

The Bank of Italy chief also noted "the weakening of some of the dollar's traditional pillars," while China's yuan and the euro both have the potential to become more global currencies but are not currently in a position to match the greenback.

"Multipolarity could increase diversification, spreading the burden of global liquidity provision and reducing global dependence on the US policy cycle. But it could also amplify volatility and contagion risks," he warned.

Canadian travel provider Transat AT Inc. reached a tentative agreement with the Air Line Pilots Association, preventing a disruptive strike one day before it could have started.

The Montreal-based company, which operates the airline Air Transat, said in a statement Tuesday on its website that operations would return to normal. The labor deal will be submitted to more than 750 pilots for a ratification vote in the coming days, after "more than 11 months of intensive negotiations," according to ALPA.

"Our pilots have been frustrated flying under a decade-old, outdated collective agreement," Bradley Small, chair of Air Transat's ALPA master executive council, said in a statement. "We believe this new agreement meets the needs of today's profession, consistent with collective agreements other ALPA-represented pilot groups are signing with their employers."

The parties did not share details of the arrangement. Air Transat had canceled some flights to wind down operations before the possible walkout. Canceled flights will not be reinstated, according to the airline's frequently asked questions page.

EVERY December, Malaysia's university convocation halls are filled with celebration. Parents weep with pride as their children cross the stage, certificates in hand, proof of years of sacrifice and hope. Yet once the photographs are taken and the robes returned, a quieter anxiety sets in. For a growing number of graduates, the question is no longer simply where to work, but whether the economy they are entering can still deliver meaningful upward mobility.

To understand Malaysia's predicament, one must look beyond national borders. Malaysia does not compete in isolation. It is positioned in a demanding regional triangle defined by Singapore, Vietnam and South Korea—three economies with sharply different labour-market models. Together, they illuminate the uncomfortable middle ground that Malaysia now occupies.

Wages offer the first stark comparison. Malaysia's median monthly wage in the formal sector is around RM3,000. Nearly half of formal workers earn below this level, with the largest concentration clustered between RM1,500 and RM1,999. It is an income structure that sits uneasily with the rising cost of living in urban Malaysia and offers limited room for wealth accumulation among young professionals. Across the Causeway, Singapore's median monthly income exceeds S$5,700—several times Malaysia's level. In Korea, the median monthly wage approaches RM10,000. Vietnam, by contrast, remains far cheaper, with average earnings at roughly one-tenth of Singapore's level.

On wages alone, Malaysia is caught in the middle: no longer cheap enough to compete purely on labour cost, yet nowhere near wealthy enough to command the premium of a high-skill economy. But the more consequential story lies beneath the surface — in the type of jobs each economy is creating.

Singapore has spent two decades engineering a deliberate upward shift in job structure. Today, nearly two-thirds of employed residents are professionals, managers, executives and technicians. These high-skill jobs anchor the city-state's wage structure, support strong household incomes, and feed continuous reinvestment into innovation, finance, technology and advanced services. Even Singapore's challenges — inequality, work pressure, reliance on foreign talent — stem from the intensity of its high-productivity growth model, not from a failure to create skilled employment.

Vietnam offers the opposite contrast. Only a minority of its workforce has tertiary or formal vocational training, yet this very structure underpins its appeal as one of Asia's most competitive manufacturing hubs. Factory wages remain low but are rising steadily. Multinational firms relocate assembly lines, packaging operations and light manufacturing to Vietnam not because it is sophisticated, but because it is scalable, disciplined and cost-efficient. Vietnam is still playing the classic industrialising latecomer strategy — pulling millions into formal employment through labour-intensive manufacturing while slowly upgrading its skills base.

Korea represents a third model: already a high-income, technology-driven economy with world-class electronics, automotive and digital industries. Its labour market, however, is deeply dualistic. Permanent workers in large firms are well paid and highly protected; younger and irregular workers face insecurity and weaker wage progression. Youth unemployment remains persistently elevated, and elderly poverty is among the highest in the OECD (Organisation for Economic Co-operation and Development). Korea shows both the rewards and frictions of a fully industrialised, innovation-dependent economy.

Malaysia, uncomfortably, resembles none of these models fully.

More than half of Malaysia's workforce is concentrated in semi-skilled occupations. When new jobs are created, the pattern reinforces itself: roughly two-thirds of recent job creation has been semi-skilled, while the share of skilled jobs has fallen sharply — from about 45% in 2018 to just 27% in 2024. This is not the structure of a high-income labour market. At the same time, Malaysia produces graduates at near-advanced-economy scale — about 300,000 annually.

The result is structural graduate underemployment. An estimated two million Malaysians with tertiary qualifications are now working in jobs that do not match their education level. Official unemployment remains low, hovering around 3%, but this headline figure masks a deeper fragility. The real issue is no longer joblessness; it is the erosion of job quality and the weakening of education as a reliable pathway to income progression.

This structural imbalance explains Malaysia's wage stagnation. As graduates are absorbed into semi-skilled roles, downward wage competition intensifies in the middle of the labour market. Median wages become trapped near the RM3,000 mark even as GDP (gross domestic product) grows. Meanwhile, the upper tier of high-income professional jobs remains too thin to pull the overall wage structure upward. It is a labour market generating quantity without quality.

In regional terms, this leaves Malaysia squeezed from both sides. Vietnam is rapidly improving its industrial depth while retaining a decisive cost advantage. Singapore and Korea dominate at the high end of skills, technology, finance and innovation. Malaysia, by contrast, is drifting in the "missing middle" — too expensive to beat Vietnam on cost, yet insufficiently specialised to rival Singapore or Korea on skill.

The strategic risk is clear. Multinational firms seeking large-scale, cost-efficient production will favour Vietnam. Firms requiring frontier technology, deep research ecosystems and advanced services will gravitate towards Singapore and Korea. Malaysia is increasingly left with semi-skilled, mid-value activities that face both price pressure from below and technological pressure from above.

This is not a story of national failure. Each of these countries carries its own vulnerabilities. Singapore struggles with inequality and foreign-labour dependence. Vietnam must grapple with informality, weak social protection and limited high-skill capacity. Korea faces demographic decline, labour dualism and youth disillusionment. Yet all three have something Malaysia increasingly lacks: a coherent labour-market development thesis. Their outcomes, for better or worse, reflect deliberate strategic choices.

Malaysia's labour market, by contrast, reflects hesitation.

The nation has not fully committed to being a high-skill innovation hub, yet it has also moved decisively beyond being a low-cost manufacturing base. That hesitation is now visible in wages that no longer rise in line with productivity aspirations, in graduates struggling to find appropriate work, and in a middle class whose purchasing power grows ever more fragile.

This drift carries broader economic consequences. An economy dominated by semi-skilled jobs cannot sustain strong productivity growth. Domestic consumption remains constrained, fiscal capacity weakens, and the social contract between education and opportunity begins to fray. For young Malaysians burdened with education loans and urban living costs, delayed career progression translates into delayed marriage, delayed home ownership and intensified interest in migration.

Malaysia deserves credit for its achievements. Extreme poverty has been pushed close to zero. Unemployment remains low. Infrastructure is extensive, and the economy remains diversified. But the development challenge has evolved. The central question now is no longer survival, but direction. It is not whether Malaysia can create jobs, but whether it can create enough high-quality jobs to sustain a confident middle-income society.

The answer lies in a decisive recalibration of growth strategy. Malaysia must pivot from labour absorption to skill deepening, from volume-driven employment to productivity-led job creation. This requires far tighter alignment between university curricula, industrial policy, technology investment and private-sector hiring practices. It also requires confronting uncomfortable trade-offs: moving away from certain low-value labour-intensive activities even if they create short-term employment, in order to unlock higher-wage trajectories over time.

The regional context leaves little room for ambiguity. In a world of supply-chain fragmentation, friend-shoring and technological rivalry, countries are being sorted by what they can do best. Vietnam is becoming indispensable to cost-efficient manufacturing. Singapore and Korea are indispensable to high-skill innovation systems. Malaysia must now define its own indispensable role — or risk being permanently compressed between the two.

As Noor Azlan Ghazali, who heads the Malaysian Inclusive Development and Advancement Institute (Minda-UKM), has observed, the convocation photographs taken today will sit on family walls for decades. Whether they mark the beginning of true upward mobility or the start of quiet disappointment will depend on how Malaysia responds to this regional reality. In a neighbourhood shaped by Singapore, Vietnam and Korea, muddling through the middle is no longer a viable strategy.

Samirul Ariff Othman is an analyst of global politics, business and economics. He is an adjunct lecturer at Universiti Teknologi PETRONAS (UTP) and a senior consultant with Global Asia Consulting.

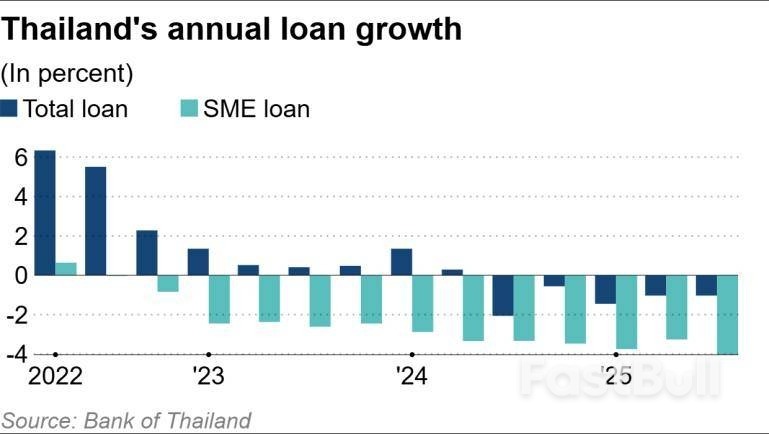

The Bank of Thailand, the country's central bank, is planning a new credit guarantee measure to help small and medium enterprises access loans more easily to help them recover from a liquidity crunch amid a weak economic outlook.

A persistent trade war, geopolitical tensions and other external negative factors have raised uncertainty in the Thai financial market, pushing credit risk higher and forcing commercial banks to tighten credit policy. This has become a structural problem, making it harder for Thai SMEs to be granted loans to boost their liquidity.

As a result, total bank amount in baht of loans in Thailand contracted for the fifth consecutive quarter in 2025, while amount of loans to SMEs fell for the 13th quarter in a row.

"That's why we need to help SMEs first as they play a key role in the Thai economy," Bank of Thailand governor Vitai Ratanakorn told Nikkei Asia in the sideline of a press event in Bangkok. "We are raising funds [to use as] credit guarantees for SMEs, to make it easier for commercial banks to extend loans to them."

SMEs generate total economic value that in 2022 was equivalent to around 35% of the country's gross domestic product and account for about 71% of total employment nationwide, according to the Thailand Development and Research Institute. Thailand's GDP in the July-September period grew 1.2% from a year earlier, hitting the lowest level since 2021, when the economy was still heavily affected by the COVID-19 pandemic.

According to the central bank's plan, it will set aside 100 billion baht ($3 billion) from the country's Financial Institutions Development Fund, which the Bank of Thailand collects from commercial banks at a rate of 0.23% of total deposits every year.

The fund will guarantee loans granted to SMEs by paying 20-30% to banks if there is a repayment default. Loans will be limited to 100 million baht per business.

"This guarantee could help cut credit risk and make commercial banks feel more confident about extending loans to SMEs," said Vitai, who took office in October.

He added that to be eligible for the guarantee, companies must be in targeted industries classified by the government as high-value and able to drive the digital economy, such as food processing, medical and wellness, robotics and bio-chemicals.

The central bank is working in collaboration with the Finance Ministry and the Thai Bankers' Association on the details of the project which is due to be implemented by early next year.

Vitai said the credit guarantee measure to SMEs should boost the economy within a few years.

Eileen Higgins won Miami's mayoral runoff, beating a candidate backed by President Donald Trump while becoming the first woman ever and the first Democrat in nearly three decades to lead the city.

Higgins led Republican Emilio Gonzalez by more than 18 percentage points, with all precincts reporting. The Associated Press and election website Decision Desk both projected her as the winner.

"Tonight, the people of Miami made history," Higgins said in a statement on Tuesday evening. "Together, we turned the page on years of chaos and corruption and opened the door to a new era for our city."

The mayor's race drew outsized national attention, with political figures weighing into a race that's technically nonpartisan. Along with Trump, Florida Governor Ron DeSantis and Senator Rick Scott endorsed Gonzalez. Higgins received support from the Democratic National Committee and won the backing of former Transportation Secretary Pete Buttigieg.

Higgins' victory adds to a recent stretch of Democratic gains, including last month's wins in New Jersey and Virginia and Zohran Mamdani's victory as New York mayor — results widely seen as a warning sign for the GOP going into the 2026 midterms. While the city of Miami boasts a population of just 480,000 people, a Democratic win in a deeply red state offers the party another lift going to next year.

Higgins, a former Miami-Dade County commissioner, ran on promises to cut corruption and red tape at Miami city hall, while improving housing affordability and public transit.

Her pledge for more development and less cumbersome permitting processes won the support of Miami's real estate developers. She also racked up endorsements from labor unions, including for local police and firefighters.

The mayor-elect was born in Ohio, grew up in New Mexico and moved to Miami in the early 2000s. She has previously worked for the State Department in Mexico.

Higgins, who has an engineering degree and an MBA from Cornell University, is the first non-Hispanic to hold the job in nearly 30 years though she speaks fluent Spanish.

Higgins, 61, will succeed Francis Suarez, a Republican who used the part-time mayor position to boost his national profile, rub elbows with Miami's ultra wealthy, create inroads with the Saudi royal family and multiply his personal wealth while in office.

Higgins' rival Gonzalez had a long military career before pivoting to roles that included head of US Citizenship and Immigration Services, director of Miami International Airport and Miami city manager.

The Cuban-born Gonzalez pushed for the abolishing of property taxes as part of his campaign platform, echoing proposals by governor DeSantis.

The role is often described as more ceremonial given that the mayor doesn't have a vote on the city commission and far more power is concentrated with the mayor of Miami-Dade County, who oversees a $13 billion budget for a region of 2.8 million people.

Still, the win is a shot in the arm for Democrats in Miami, who have been losing their grip on South Florida — previously a Democratic stronghold that Trump won by 11 points last year. In Miami-Dade County, the number of registered Republicans surpassed Democrats earlier this year.

Trump has made South Florida central to his presidency and legacy — state officials recently gifted him a valuable piece of waterfront land in downtown Miami for his future presidential library, where the Trump family plans to build "an icon on the Miami skyline." He'll also host Group of 20 leaders next year at his golf club in west Miami.

Key Points:

Japanese producer prices fueled speculation about a December Bank of Japan rate hike on Wednesday, December 10. Producer prices signaled sticky consumer price inflation midway through the fourth quarter. USD/JPY dropped in response to the uptick in producer prices, partially reversing the previous day's 0.63% loss on the hot US JOLTs Job Openings report.

While the November figures bolstered bets about a December BoJ rate hike, traders faced a higher degree of uncertainty on the Fed's monetary policy outlook. Market bets on a December Fed rate cut remained firm despite solid overnight US jobs data.

However, the absence of October inflation and labor market data, canceled because of the US government shutdown, has left the Fed flying blind on crucial reports needed to make an informed interest rate decision and offer meaningful economic projections.

Given these dynamics and USD/JPY's return to 156, the short-term outlook looks cautiously bullish, while the medium-term outlook remains bearish, hinged on the Fed cutting and the BoJ raising rates.

Below, I'll discuss the macro backdrop, the near-term price catalysts, and technical levels traders should closely watch.

Producer prices increased 2.7% year-on-year in November, mirroring October's trend, lifting demand for the Japanese yen. November's producer prices indicated rising import prices, forcing producers to pass higher costs on to consumers. Higher prices may also signal stronger demand, enabling producers to raise prices and fuel demand-driven inflation.

The BoJ has raised previously concerns about the weaker yen pushing import prices higher, adversely affecting household purchasing power. Rising producer prices will give the BoJ hawks a stronger argument to raise interest rates on December 19.

USD/JPY responded, briefly falling from 156.840 to 156.795 after the data.

USDJPY – One Minute Chart – 101225

USDJPY – One Minute Chart – 101225The November data followed BoJ Governor Kazuo Ueda's optimistic economic outlook. He stated that the economy will return to growth in the fourth quarter and beyond, reinforcing his recent bullish pivot. Last week, Governor Ueda supported a rate hike, citing strong wage growth, fading US tariff risks, and FX weakness.

While expectations of a BoJ rate hike are strengthening yen demand, the FOMC interest rate decision, FOMC Economic Projections, and Fed Chair Powell's press conference will dictate buyer appetite for the US dollar.

Later on Wednesday, the Fed will take center stage as investors await its highly anticipated interest rate decision and Economic Projections. Economists expect the Fed to lower interest rates by 25 basis points, with the CME FedWatch Tool giving an 87.6% chance of a rate cut.

Barring an unexpected hold or a surprise 50-basis-point cut, the market focus will be on the Economic Projections and the dot plot on rate expectations. Notably, the chances of a Q1 2026 rate cut declined overnight.

The FOMC Committee has divided into two camps in recent months. On one side, members support further policy easing to bolster a cooling labor market, while on the other, voters view sticky inflation as a reason to pause further cuts. Given the division among voting members, a hawkish cut looks likely, where the Fed downplays further easing in the near-term, but remains data dependent.

The Economic Projections and dot plot will provide the crucial insights into the Fed's outlook and potential rate path. For context, the September dot plot projected a 3.25%-3.50% Fed Funds Rate (FFR) by the end of 2026.

A 25-basis-point rate cut today would leave two further rate cuts to align with the September dot plot, the baseline for traders. A dovish Fed rate cut would be a lower FFR by the end of 2026, while a hawkish cut would be a higher 2026 FFR forecast.

Notably, the projections will be based on outdated inflation and jobs data, given the cancellation of October data. The absence of October's government reports may downplay the influence of inflation, unemployment, and GDP projections on US dollar demand. However, given the USD/JPY sensitivity to September's JOLTs job openings, the pair will be exposed to heightened volatility.

Meanwhile, there is also a potential announcement on bond purchases (quantitative easing).

With increased uncertainty about the post-December Fed rate path, the short- and medium-term outlook hinges on the Fed and the BoJ's interest rate decisions and policy outlooks. Despite the uncertainty, the Fed's easing and the BoJ's tightening support a bearish medium-term outlook for USD/JPY.

Looking at the daily chart, USD/JPY traded above the 50-day and 200-day Exponential Moving Averages (EMAs), signaling a bullish bias. However, fundamentals have begun to shift from the technical trend, supporting a bearish medium-term outlook.

A break below the 155 support level would bring the 50-day EMA into play. If breached, the 153 support level would be the next key support. Significantly, a sustained fall below the 50-day EMA would signal a bearish trend reversal, supporting a near-term drop toward 150.

USDJPY – Daily Chart – 101225

USDJPY – Daily Chart – 101225In my view, a narrow US-Japan rate differential supports a bearish medium-term outlook. A sustained USD/JPY drop below the 50-day EMA would signal a fall toward the 200-day EMA. Breaching the 200-day EMA would affirm a bearish trend reversal.

However, upside risks could derail the bearish momentum. These risks include:

Nevertheless, yen intervention warnings are likely to cap the upside around the November 20 high of 157.893, based on past communication.

Read the full USD/JPY forecast, including chart setups and trade ideas.

In summary, the BoJ's support for a December rate hike leaves the Fed in the driving seat. A dovish Fed rate cut, projecting two to three policy adjustments in 2026, and QE would align with the bearish medium-term outlook for USD/JPY. Furthermore, a dovish Fed rate cut could pave the way toward 130 over the 6-12 month time horizon.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up