Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Donald Trump said on Monday that the August 1 deadline for imposing reciprocal tariffs is "not 100% firm,” adding that he’s open to alternate proposals if trade partners request changes.

U.S. President Donald Trump said on Monday that the August 1 deadline for imposing reciprocal tariffs is "not 100% firm,” adding that he’s open to alternate proposals if trade partners request changes.

"I would say firm, but not 100% firm. If they call up and they say we’d like to do something a different way, we’re going to be open to that,” Trump told reporters when asked if the deadline for the tariffs was firm.

Earlier in the day, Trump signed an executive order extending the July 9 deadline to Aug. 1.

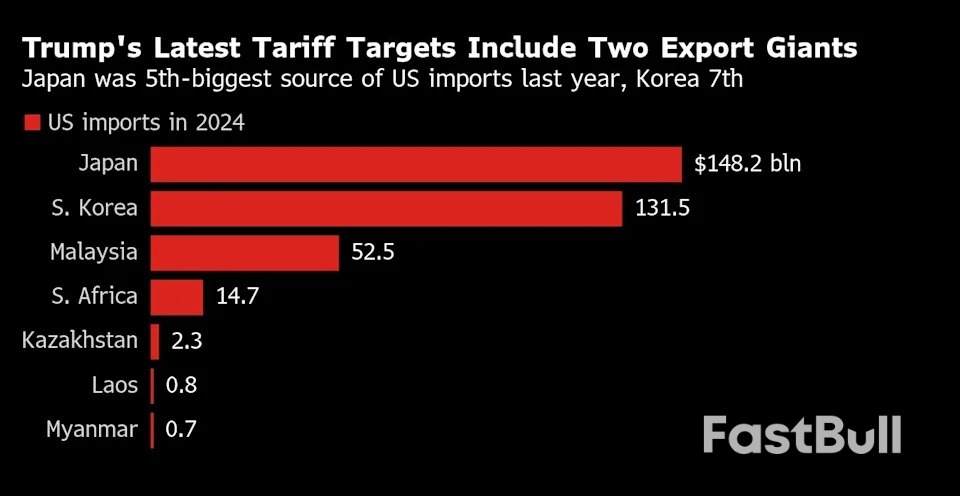

He also announced new tariff rates on 14 nations, including Japan, Indonesia, South Korea, Serbia, and Tunisia, warning that duties of 25% on key allies such as Japan and South Korea will take effect if no deals are struck.

Notably, the higher tariffs will not combine with previously announced sector tariffs such as those on automobiles, steel, and aluminum.

U.S. President Donald Trump on Monday began telling trade partners – from powerhouse suppliers like Japan and South Korea to minor players – that sharply higher U.S. tariffs will start August 1, marking a new phase in the trade war he launched earlier this year.

The 14 countries sent letters so far, which included smaller U.S. exporters like Serbia, Thailand and Tunisia, hinted at opportunities for additional negotiations while at the same time warning that any reprisal steps would be met with a like-for-like response.

"If for any reason you decide to raise your Tariffs, then, whatever the number you choose to raise them by, will be added onto the 25% that we charge," Trump said in letters, released on his Truth Social platform, to Japan and South Korea.

The higher tariffs, levied on U.S. importers of foreign goods, take effect August 1, and notably will not combine with previously announced sector tariffs such as those on automobiles and steel and aluminum.

That means, for instance, that Japanese vehicle tariffs will remain at 25%, rather than the existing 25% auto sector tariff climbing to 50% with the new reciprocal rate as has occurred with some of Trump's tariffs.

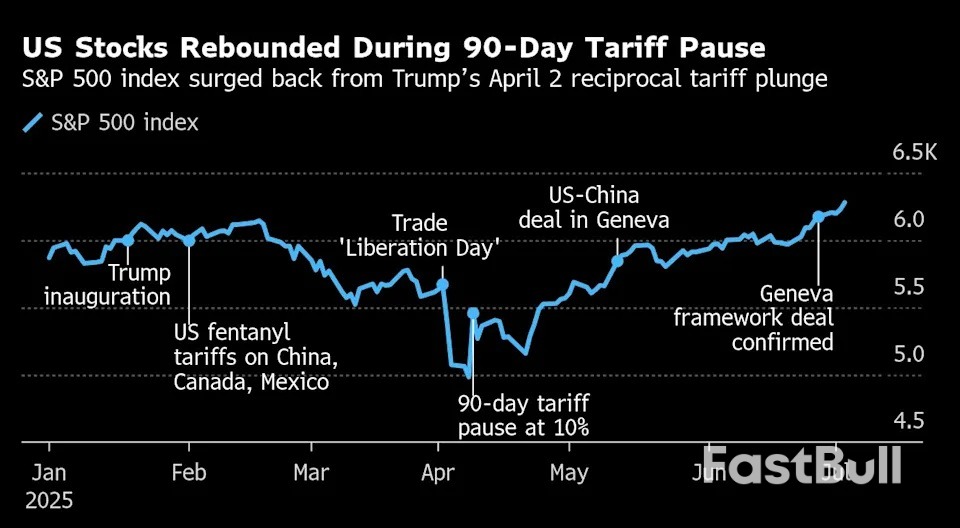

The clock has been ticking for countries to conclude deals with the U.S. after Trump unleashed a global trade war in April that has roiled financial markets and sent policymakers scrambling to protect their economies.

Trading partners got another reprieve as Trump signed an executive order on Monday extending the Wednesday deadline for negotiations to August 1.

Trump has kept much of the world guessing on the outcome of months of talks with countries hoping to avoid the hefty tariff hikes he has threatened.

The rate for South Korea is the same as Trump initially announced, while the rate for Japan is 1 point higher than the one announced on April 2. A week later, he capped all of the so-called reciprocal tariffs at 10% until Wednesday. Only two agreements have so far been reached, with Britain and Vietnam.

Wendy Cutler, vice president of the Asia Society Policy Institute, said it was unfortunate Trump was hiking tariffs on imports from two of the closest U.S. allies, but there was still time for a breakthrough in negotiations.

"While the news is disappointing, it does not mean the game is over," Cutler said.

Trump said later Monday that the United States would impose 25% tariffs on goods from Tunisia, Malaysia and Kazakhstan; 30% on South Africa, Bosnia and Herzegovina; 32% on Indonesia; 35% on Serbia and Bangladesh; 36% on Cambodia and Thailand and 40% on Laos and Myanmar.

South Korea said it planned to intensify U.S. trade talks and considers Trump's plan for a 25% tariff from August 1 as effectively extending a grace period on implementing reciprocal tariffs.

"We will step up negotiations during the remaining period to reach a mutually beneficial result to quickly resolve the uncertainties from tariffs," the country's Industry Ministry said.

There was no response from the Japanese embassy in Washington.

U.S. stocks fell in response, the latest market turmoil as Trump's trade moves have repeatedly whipsawed financial markets and sent policymakers scrambling to protect their economies.

U.S. stocks were driven to near bear-market territory by his cascade of tariff announcements through the early spring but quickly rebounded to record highs in the weeks after he put the stiffest levies on hold on April 9.

The S&P 500 closed down about 0.8%, its biggest drop in three weeks. U.S.-listed shares of Japanese automotive companies fell, with Toyota Motor closing down 4.0% and Honda Motor off by 3.9%. The dollar surged against both the Japanese yen and the South Korean won.

"Tariff talk has sucked the wind out of the sails of the market," said Brian Jacobsen, chief economist at Annex Wealth Management. Most of the announced tariff rates have been rounded down, he added, and the letters come across as "take it or leave it" offers.

U.S. Treasury Secretary Scott Bessent said earlier on Monday he expected several trade announcements in the next 48 hours, adding that his inbox was full of countries' last-ditch offers.

The European Union will not be receiving a letter setting out higher tariffs, EU sources familiar with the matter told Reuters on Monday.

The EU still aims to reach a trade deal by July 9 after European Commission President Ursula von der Leyen and Trump had a "good exchange," a commission spokesperson said.

It was not clear, however, whether there had been a meaningful breakthrough in talks to stave off tariff hikes on the United States' largest trading partner.

The EU has been torn over whether to push for a quick and light trade deal or leverage its economic clout to negotiate a better outcome. It had already given up hopes for a comprehensive trade agreement before the July deadline.

Trump has also said he could impose a 17% tariff on EU food and agriculture exports.

The president also threatened leaders of developing nations in the BRICS group, who are meeting in Brazil, with an additional 10% tariff if they adopt "anti-American" policies.

The group includes Brazil, Russia, India and China among others.

President Donald Trump hosted Israeli Prime Minister Benjamin Netanyahu for White House talks on Monday, while Israeli officials held indirect negotiations with Hamas aimed at securing a U.S.-brokered Gaza ceasefire and hostage-release deal.

Netanyahu's visit follows Trump's prediction, on the eve of their meeting, that such an agreement could be reached this week. Before heading to Washington, the right-wing Israeli leader said his discussions with Trump could help advance negotiations under way in Qatar between Israel and the Palestinian militant group.

It was Trump's third face-to-face encounter with Netanyahu since returning to office in January, and came just over two weeks after the president ordered the bombing of Iranian nuclear sites in support of Israeli air strikes. Trump then helped arrange a ceasefire in the 12-day Israel-Iran war.

Trump and his aides appeared to be trying to seize on any momentum created by the weakening of Iran, which backs Hamas, to push both sides for a breakthrough in the 21-month Gaza war. He said he also wants to discuss with Netanyahu the prospects for a "permanent deal" with Iran, Israel's regional arch-foe.

The two leaders were scheduled to have a private dinner instead of formal talks in the Oval Office, where the president usually greets visiting dignitaries. It was not immediately clear why Trump was taking a lower-key approach with Netanyahu this time.

After arriving overnight in Washington, Netanyahu met earlier on Monday with Trump’s Middle East special envoy Steve Witkoff and Secretary of State Marco Rubio in preparation for his talks with the president. He planned to visit the U.S. Capitol on Tuesday to see congressional leaders.

Ahead of the visit, Netanyahu told reporters he would thank Trump for the U.S. air strikes on Iranian nuclear sites, and said Israeli negotiators were driving for a deal on Gaza in Doha, Qatar's capital.

Israeli officials also hope the outcome of the conflict with Iran will pave the way for normalisation of relations with more of its neighbors such as Lebanon, Syria and Saudi Arabia, another issue expected to be on the agenda with Trump.

Witkoff, who played a major role in crafting the 60-day ceasefire proposal at the centre of the Qatar negotiations, will travel to Doha this week to join discussions there, White House press secretary Karoline Leavitt told reporters on Monday.

In a sign of continued gaps between the two sides, Palestinian sources said Israel's refusal to allow the free and safe entry of humanitarian aid into Gaza remains the main obstacle to progress in the indirect talks. Israel insists it is taking steps to get food into Gaza but seeks to prevent militants from diverting supplies.

On the second day of negotiations, mediators hosted one round and talks were expected to resume in the evening, the Palestinian sources told Reuters.

The U.S.-backed proposal envisages a phased release of hostages, Israeli troop withdrawals from parts of Gaza and discussions on ending the war entirely.

Hamas has long demanded a final end to the war before it would free remaining hostages; Israel has insisted it would not agree to halt fighting until all hostages are released and Hamas dismantled.

Trump told reporters last week that he would be “very firm” with Netanyahu on the need for a speedy Gaza deal and that the Israeli leader also wanted to end the war.

Some of Netanyahu's hardline coalition partners oppose halting military operations but, with Israelis having become increasingly weary of the Gaza war, his government is expected to back a ceasefire if he can secure acceptable terms.

A ceasefire at the start of this year collapsed in March, and talks to revive it have so far been fruitless. Meanwhile, Israel has intensified its military campaign in Gaza and sharply restricted food distribution.

Gazans were watching closely for any sign of a breakthrough. “I ask God almighty that the negotiating delegation or the mediators pressure with all their strength to solve this issue, because it has totally became unbearable,”said Abu Suleiman Qadoum, a displaced resident of Gaza city.

The Gaza war erupted when Hamas attacked southern Israel in October 2023, killing around 1,200 people and taking 251 hostages. Some 50 hostages remain in Gaza, with 20 believed to be alive.

Israel's retaliatory war in Gaza has killed over 57,000 Palestinians, according to the enclave's health ministry. Most of Gaza's population has been displaced by the war and nearly half a million people are facing famine within months, according to United Nations estimates.

Trump has been strongly supportive of Netanyahu, even wading into domestic Israeli politics last month by lashing out at prosecutors over a corruption trial against the Israeli leader on bribery, fraud and breach-of-trust charges that Netanyahu denies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up