Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

In The Past 24 Hours, The Marketvector™ Digital Asset 100 Small Cap Index Fell 2.57% To 2912.23 Points. The Marketvector™ Digital Asset 100 Mid Cap Index Fell 2.11% To 2961.65 Points. The Marketvector™ Digital Asset 100 Index Fell 3.70% To 14801.19 Points

The U.S. Bureau Of Labor Statistics Announced That It Will Postpone The Release Of The January Employment Report To February 11 And The January CPI Report To February 13

Spot Silver Fell Nearly $2 In The Short Term, Last Trading At $84.96 Per Ounce, After Previously Reaching A High Of $92 Per Ounce

Market News: A Survey Shows That OPEC's Output Declined Last Month Due To The Unrest In Venezuela

The Main Shanghai Gold Futures Contract Fell By 2.00% During The Day, Currently Trading At 1098.00 Yuan/gram

Bessent: Cap On Credit Card Interest At 10% For One Year Would Help Allow Americans To Recover From Past Inflation

The Survey Results Show That OPEC Oil Production Declined In January, With Venezuela Experiencing Significant Fluctuations

U.S. Treasury Secretary Bessant Stated That The U.S. Will Not "go To Any Lengths" To Loosen Financial Regulations

A Senior Iranian Source Said The Outcome Of The Negotiations Depends On Whether The United States Changes Its Current Approach. Consultations Are Currently Underway Regarding The Final Arrangements For Friday's Talks And Whether Direct Negotiations Can Take Place

U.S. Treasury Secretary Bessenter: The Federal Reserve’s Involvement In Other Areas Would Damage Its Independence

[Italian Banking Sector Continues To Hit Record Closing Highs] Germany's DAX 30 Index Preliminarily Closed Down 0.54% At 24,647.18 Points. France's Stock Index Preliminarily Closed Up 1.22%, Italy's Stock Index Preliminarily Closed Up 0.69% With Its Banking Index Up 0.36%, And The UK Stock Index Preliminarily Closed Up 1.22%

The STOXX Europe 600 Index Closed Up 0.27% At 619.57 Points, A Record Closing High. The Eurozone STOXX 50 Index Closed Down 0.17% At 5984.95 Points. The FTSE Eurotop 300 Index Closed Up 0.21% At 2468.84 Points

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

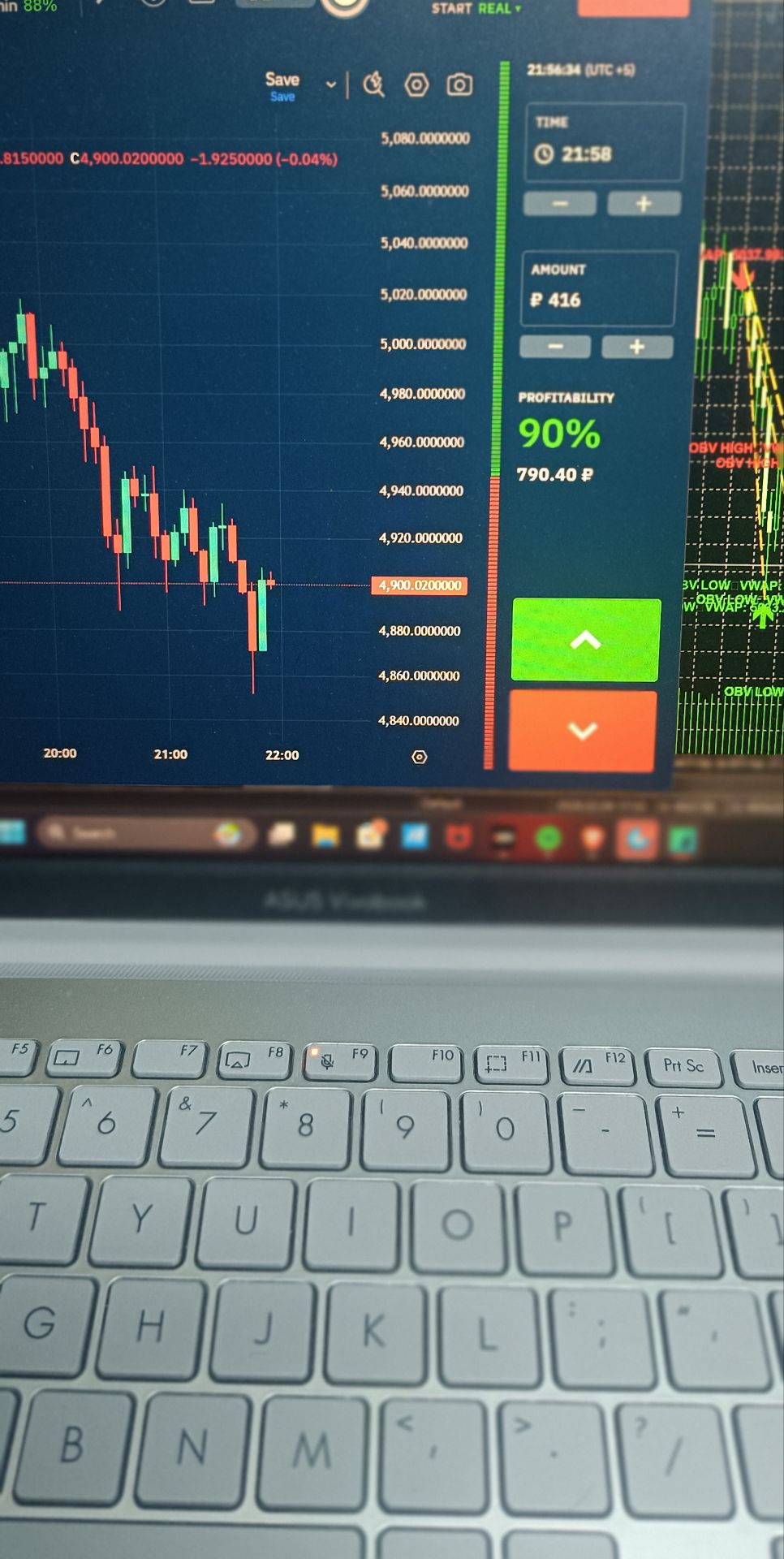

cos i saw you typed it - Anyways i am glad it worked out, i will be adding below 4870 though, if that happens to set up nicely!

cos i saw you typed it - Anyways i am glad it worked out, i will be adding below 4870 though, if that happens to set up nicely!

No matching data

View All

No data

A Trump-brokered Ukraine ceasefire ended with Russia's largest 2026 air assault, sparking demands for sanctions.

President Trump stated that Russian President Vladimir Putin honored a temporary ceasefire agreement, a deal that came to a close just as a major new wave of air strikes hit Ukraine.

Speaking to reporters on Tuesday, Trump confirmed that a one-week pause in attacks, which he personally requested from Putin, had expired on Sunday. "It was Sunday to Sunday, and it opened up and he hit them hard last night," Trump said. "He kept his word on that… we'll take anything, because it's really, really cold over there."

The agreement was first announced by Trump on Thursday, January 29. He explained that he had asked Putin to refrain from firing on Kyiv and other cities for a week due to the extreme cold weather, a request to which the Russian president reportedly agreed.

Despite the brief pause, Russia launched what Ukraine's largest private energy company, DTEK, has called the biggest air attack since the beginning of 2026. The overnight assault on Tuesday targeted power generation and distribution facilities, leaving thousands of people without electricity.

The attack involved over 70 missiles and several hundred drones, which damaged power and thermal plants already undergoing slow and costly repairs.

This escalation coincides with a new round of trilateral peace talks. American, Ukrainian, and Russian representatives gathered in the United Arab Emirates on Wednesday for discussions expected to continue until Thursday in Abu Dhabi.

Ukrainian President Volodymyr Zelenskyy challenged the timeline of the truce, stating it only began last Friday, a day after Trump's public announcement, and therefore did not last a full week.

In a statement Tuesday night, Zelenskyy directly addressed the renewed attacks. "We await the reaction of America to the Russian strikes," he said. "It was the U.S. proposal to halt strikes on energy during diplomacy and severe winter weather. The president of the United States made the request personally. Russia responded with a record number of ballistic missiles."

Zelenskyy urged international partners to impose further consequences on Russia:

• U.S. Action: He called for progress on a new sanctions bill currently being worked on by the U.S. Congress.

• European Measures: He pushed for European partners to take "decisive steps" regarding the earnings Russia generates from its oil tankers.

"Russia must feel pressure so that it moves in negotiations toward peace," he added.

The latest assault has intensified the humanitarian crisis, with Ukrainian officials describing it as a "winter genocide." The strikes occurred as temperatures in the capital dropped to -20°C (-4°F).

In the aftermath of the attack, more than 1,000 residential tower blocks in Kyiv were left without heating, marking a severe end to the short-lived truce negotiated by Trump and Putin.

Syria's state-owned petroleum company has signed a memorandum of understanding with U.S. energy firm Chevron and Qatar-based Power International Holding to develop the nation's first offshore oil and gas field.

The deal was finalized on Wednesday in Damascus, with U.S. Special Envoy to Syria, Tom Barrack, in attendance. This agreement marks Syria's first official move into offshore energy exploration as its new government works to expand hydrocarbon production and attract foreign investment.

According to Syria's state news agency, SANA, the agreement is designed to build strategic partnerships within the energy sector. The cooperation will focus on several key areas:

• Offshore exploration and development of oil and gas resources within Syria's territorial waters.

• Broader initiatives to support investment and growth in the country's energy infrastructure.

This pact represents a significant step for Syria as it seeks to leverage international partnerships to unlock its untapped offshore potential.

Syria's oil and gas sectors were severely damaged during the country's nearly 15-year conflict, which resulted in widespread destruction and the loss of half a million lives.

Before the conflict began in March 2011, the oil sector was a cornerstone of the Syrian economy. In 2010, the country produced approximately 380,000 barrels of oil per day, with exports, primarily to Europe, generating over $3 billion. At the time, oil revenue accounted for about a quarter of the government's budget.

The country's new authorities, which came to power after removing President Bashar Assad in December 2024, are prioritizing economic recovery.

This energy deal follows recent developments on the ground. Last month, Syrian government forces captured large areas of the oil-rich northeast and eastern regions from Kurdish-led fighters. This strategic gain could open up some of the country's largest oil fields for further exploration and development, aligning with the new government's economic agenda.

Chinese President Xi Jinping and U.S. President Donald Trump held a phone conversation on Wednesday, as reported by China's state-run Xinhua News Agency.

The official report confirmed the discussion took place but did not provide any specific details about its content. The call occurred just hours after President Xi had also spoken with his Russian counterpart, Vladimir Putin.

The high-level communication comes during a period of relative calm between the world's two largest economies. Relations have largely stabilized since Xi and Trump agreed to a one-year trade truce in South Korea last year.

Looking ahead, the two leaders are slated to meet four times this year. A potential summit could be scheduled as soon as April, continuing the dialogue established by the temporary trade agreement.

Despite the recent calm, ongoing geopolitical tensions threaten this fragile peace. President Trump's actions related to countries allied with China, including Venezuela and Iran, are testing the limits of the current understanding.

Further complicating the relationship, the U.S. president has criticized Canada for its trade agreements with Beijing. In a move aimed at reducing economic dependency on China, the Trump administration has also begun efforts to secure alternative supplies of rare earths, seeking to loosen China's control over the critical mineral market.

Indian refiners are facing a critical decision as sellers offer Russia's flagship Urals crude at an increasingly steep discount to Brent, a move that directly challenges a new trade agreement with the United States designed to limit Russian oil purchases.

Sellers are now marketing Urals crude at an $11 per barrel discount, a significant increase from the $9 discount seen just ten days ago, according to traders familiar with the matter.

Under normal circumstances, such a favorable price difference would trigger a wave of buying from Indian refineries eager to lock in cheaper supply. However, the current market dynamics are far from typical.

The primary complication is a new trade deal announced by U.S. President Donald Trump. This agreement ties lower U.S. tariffs on Indian products to a commitment from New Delhi to significantly reduce its imports of Russian crude oil.

The deal explicitly pushes India to increase its purchases of American oil and other commodities. In exchange for cutting ties with Russian supply, the U.S. has also suggested that Indian buyers could gain access to crude from Venezuela and potentially even Iran, offering alternative sources.

Refiners Pause and Await Government Clarity

In response to the deal, Indian refiners are reportedly halting new purchases of Russian oil as they seek official guidance from their government. Sources indicate that companies are preemptively pausing transactions until they receive clarification on how to navigate the new trade relationship with the U.S.

The situation marks a potential turning point for India, the world's third-largest oil importer. Following Russia's invasion of Ukraine in early 2022, India dramatically ramped up its intake of discounted Russian crude.

For nearly four years, this strategy made Russia its single largest oil supplier, accounting for approximately one-third of the nation's total crude imports. Now, refiners must weigh the immediate benefit of cheap Russian oil against the broader economic implications of the U.S. trade agreement.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up