Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump pardons Binance's Zhao; market reacts positively.BNB spikes amid renewed investor confidence.Industry optimism grows with perceived regulatory shifts.

President Donald Trump issued a pardon to Changpeng Zhao, Binance's founder, signaling a pivotal change in the U.S. government's crypto leadership stance. The pardon was announced on October 2024.

This pardon removes legal uncertainties, boosting market confidence, as shown by Binance Coin's spike, implying potential easing of regulatory constraints on the cryptocurrency industry.

Changpeng "CZ" Zhao, founder of Binance, received a pardon from President Donald Trump. This unexpected move marks a significant shift in U.S. policy toward crypto sector leaders, signaling potential changes in industry regulations.

Zhao, the former CEO of Binance, was pardoned for violations of the Banking Secrecy Act. Despite completing a federal sentence, he remains Binance's largest shareholder. The White House emphasized this decision as the end of hostile crypto regulations.

Financial markets quickly reacted to the pardon, with Binance Coin (BNB) experiencing a notable price surge. Karoline Leavitt, Press Secretary, White House, "President Trump had pardoned Zhao 'using his constitutional authority.' [...] The Biden administration's war on crypto is over." Industry sentiment leaned toward positivity, anticipating improved regulatory stances and increased market activity.

Binance and its assets, such as BNB and BTC, saw heightened trading volumes. The pardon suggests potential political support for the crypto industry, potentially encouraging broader market adoption and institutional investments.

Market participants are optimistic about the future of crypto regulation. Bitcoin and other leading cryptocurrencies exhibited positive price movements, potentially foreseeing a favorable regulatory environment.

Insights on future financial, regulatory, or technological outcomes are cautiously optimistic. The crypto community anticipates clarity on regulations, which could bolster further investment and technological advancement in the cryptocurrency sector. Changpeng "CZ" Zhao, Founder, Binance, "Thank you Charles. Great news if true. Minor correction, there were no 'fraud' charges. I believe they (the DOJ under the last administration) looked very hard for it, but didn't find any. I pleaded to a single violation of Banking Secrecy Act (BSA)."

Every time the US government has faced an existential financial crisis in its history, it has chosen to change the rules rather than honor its promises in full... usually by replacing gold or silver with paper.

From the War of 1812 when interest payments were missed, to the Lincoln's Greenbacks, to Roosevelt voiding gold clauses in 1933, the end of silver redemption in 1968, and Nixon closing the gold window in 1971, Washington has defaulted five times before—often by shifting the terms of payment rather than admitting outright failure.There's no doubt these episodes were defaults. To claim otherwise would be like trying to unilaterally change the terms of your dollar-denominated mortgage or credit card bill so that you could pay your liabilities with Argentine pesos or Zimbabwe dollars—and then pretending that somehow it wasn't a default.

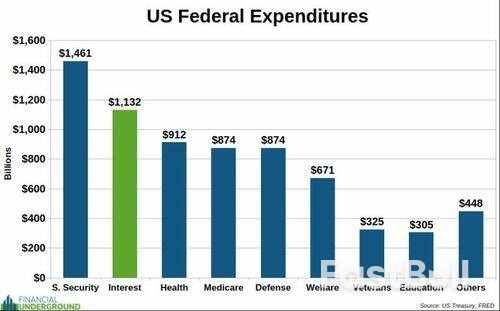

The US government is essentially telling its creditors the same thing Darth Vader once said: "I am altering the deal. Pray I don't alter it any further."Just like in Star Wars, the message is clear—Washington will change the rules whenever it needs to. Creditors may get paid, but not in the way they were promised, and certainly not in the way they expected.Today, the US government is once again in an existential financial bind. The national debt is unmanageable, federal spending is locked on an upward path, and interest on that debt has already surged past $1 trillion a year. At this pace, interest could soon overtake Social Security as the single largest item in the federal budget.

The largest expenditures are entitlements like Social Security and Medicare. No politician will cut them—in fact, they'll keep growing. Tens of millions of Baby Boomers, nearly a quarter of the population, are moving into retirement. Cutting benefits is political suicide.Defense spending, already massive, is also off-limits. With the most precarious geopolitical environment since World War 2, military spending isn't going down—it's going up.

The only way to meaningfully reduce spending would be to slash entitlements, dismantle the welfare state, shut down hundreds of foreign military bases, and repay a large portion of the national debt to lower the interest cost. That would require a leader willing to restore a limited Constitutional Republic.However, that's a completely unrealistic fantasy. It would be foolish to bet on that happening.Here's the bottom line: Washington cannot even slow the spending growth rate, let alone cut it.Expenditures have nowhere to go but up—way up.

Even if tax rates went to 100%, it would not be enough to stop the debt from growing.According to Forbes, there are around 806 billionaires in the US with a combined net worth of about $5.8 trillion.Even if Washington confiscated 100% of billionaire wealth, it would barely fund a single year of spending—and it wouldn't do a thing to stop the unstoppable trajectory of debt and deficits.That means interest expense will keep exploding. It has already surpassed the defense budget and is on track to exceed Social Security soon. At that point, interest could consume most federal tax revenue.The old accounting tricks and fiat games won't hide the reality for much longer.

In short, the skyrocketing interest bill is now an urgent threat to the US government's solvency. I have no doubt Washington will soon find itself unable to meet its obligations once again.

After the 1971 default, which cut the dollar's last tie to gold, the unspoken promise was that Washington would be a responsible steward of its fiat currency.At the core of that promise was the illusion that the Federal Reserve would act independently of political pressures. The idea was simple: without at least the appearance of independence, investors would see the Fed for what it is—a funding arm for spendthrift politicians—and confidence in the dollar would collapse.

That illusion is now shattering.

The government must issue ever-growing amounts of debt while keeping rates low to contain exploding interest costs.

That's where the Federal Reserve comes in.

Backed into a corner, Washington will force the Fed to slash rates, buy Treasuries, and launch wave after wave of monetary easing. These measures will debase the dollar while destroying the illusion of Fed independence.That's why I believe the collapse of the Fed's credibility as an independent institution will define the sixth default.

Let's be clear: central banks were never "independent." They exist to siphon wealth from the public through inflation and funnel it to the politically connected. The Fed's independence was always a mirage—and now it's disappearing fast.Trump is simply doing what any leader in his position would do. No one believes China's central bank is independent of Xi. If any nation faced a similar crisis, its central bank would fall in line with government demands.I expect Trump will get his way with the Fed. The Fed will bend to his demands, debasing the dollar to keep the debt burden from spiraling out of control. He will either force Powell to get in line or replace him outright, stacking the Fed with loyalists. The result will be money printing on a scale we've never seen before.

Trump's efforts are already starting to work. At Jackson Hole, Powell admitted that "the shifting balance of risks may warrant adjusting our policy stance," signaling that rate cuts could come soon.And that's exactly what happened. On September 17, the Fed cut rates by 25bps and indicated more to come.Further, Stephen Miran, Trump's most recent successful nominee to the Federal Reserve Board, has been pushing the idea of what he calls the Fed's "third mandate."

Traditionally, the Fed has two mandates: price stability and maximum employment. Miran's proposed third mandate would be for the Fed to "moderate long-term interest rates."What that really means is that the Fed would openly finance the federal government by creating new dollars to buy long-term debt, keeping yields artificially low. In other words, the so-called third mandate is an explicit admission that the Fed is no longer independent. It would become a political tool used to fund government spending.

Without this support, massive federal spending would flood the market with Treasuries, pushing interest rates much higher. But with the Fed stepping in, Washington can keep borrowing while holding rates down—at least for a while. The catch is that this comes at the cost of debasing the dollar. Eventually, that debasement will force investors to demand higher yields anyway, which only worsens the problem.I believe it's only a matter of time before the Fed fully capitulates, shattering the illusion of independence once and for all.Mike Wilson, CIO at Morgan Stanley, recently made it explicit:"The Fed does have an obligation to help the government fund itself."

"I'd be nervous if the Fed was totally independent. The Fed needs to help us get out of this deficit problem."

This is the essence of the sixth default.

It won't come through missed payments or rewritten contracts. It will come through the collapse of the myth that the Fed is independent. Once monetary policy is fully political, the fallout will be enormous—for the dollar, for Treasuries, and for gold.And it's not happening in isolation. As Washington sinks deeper into debt, the rest of the world sees exactly what's coming. Central banks are moving to protect themselves. I believe they know debasement is inevitable, and they don't intend to be left holding the bag. Their response has been clear: abandon paper promises and move back toward gold.

When the dollar is quietly debased and the Fed's "independence" finally cracks, it will be too late to reposition.If you've read this far, you already sense the window is closing. Do not wait for confirmation from the evening news.The question now is not if but how this crisis will unfold, and whether you'll be on the losing end of it.

Changpeng Zhao, former chief executive officer of Binance, arrives at federal court in Seattle, Washington, US, on Tuesday, April 30, 2024.

President Donald Trump has pardoned Binance founder Changpeng Zhao, who had previously pleaded guilty to enabling money laundering while heading the cryptocurrency exchange, the White House said Thursday.

"President Trump exercised his constitutional authority by issuing a pardon for Mr. Zhao, who was prosecuted by the Biden Administration in their war on cryptocurrency," White House Press Secretary Karoline Leavitt said in a statement.

Zhao in November 2023 pleaded guilty in the case and agreed to step down as Binance CEO as part of a $4.3 billion settlement by the company with the Department of Justice.

He was sentenced in April 2024 to just four months in jail.

This is breaking news. Please refresh for updates.

Brazil's central bank could delay its long-awaited interest rate cuts further into 2026 given the institution is waging a solo fight against inflation, according to economists and former policymakers.

President Luiz Inacio Lula da Silva's administration is making a stronger push to both create and expand social programs as a way to boost his popularity before next year's elections. Those initiatives, which facilitate everything from home mortgages to gas purchases, will stoke consumption, hence making it harder to tame consumer price increases, according to analysts.

"A more spendthrift fiscal policy could lead the central bank to delay the start of interest rate cuts," said Gustavo Loyola, a partner at the consultancy Tendencias who was central bank governor between 1992 and 1993. "Brazil's central bank is practically isolated in this fight against inflation."

He predicts that the Selic rate, currently at an almost two-decade high of 15%, will only begin to decline in the first quarter of 2026.

The warnings from private sector analysts come as Lula intensifies pressure for lower borrowing costs, saying this week that he is preparing Latin America's largest economy to have a "more serious" monetary policy. While inflation expectations have eased in recent weeks, they still show cost-of-living increases above the 3% target through 2028. Meanwhile, the government is rushing to find new sources of income to help plug its fiscal deficit.

"The central bank is alone, and those who should be supporting it are getting in the way," Luiz Fernando Figueiredo, chairman of the board of Jive Investimentos and a former central bank director, said on the effect of higher government spending. "You need to slow down the car, but someone is accelerating. So, the central bank has to brake more aggressively."

Brazil's government posted a primary deficit of 17.3 billion reais ($3.1 billion) in August, according to the central bank. The nominal deficit — which includes interest payments on debt — hit 91.5 billion reais on the month. While the administration is aiming for a primary surplus of 0.25% of gross domestic product next year, very few investors believe that goal could be met.

Policymakers have said keeping borrowing costs steady for the coming months is starting to deliver results. But the effects of ultra-tight monetary policy have been partly undercut by factors including a strong labor market, they say.

In August, Brazil's unemployment rate held at 5.6%, a record low level that has encouraged workers to seek higher wages. "This has kept inflation resilient, particularly in services, which is a key concern for the central bank," said Adriana Dupita, Brazil and Argentina economist at Bloomberg Economics.

Central bankers have also highlighted investor worries over the fragility of Brazil's public finances, indicating the effectiveness of monetary policy hinges partly on the government's ability to restore fiscal confidence.

"At this stage, monetary policy is the only credible anchor in the system," said Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. Ramos expects the Selic to be cut in the first quarter of 2026, though he warns the move could come later if inflation fails to converge toward the 3% target.

Brazil inflation expectations are hovering near 4.7% for the end this year and 4.27% for late 2026, according to a central bank survey published on Monday.

"Looking strictly at the numbers, although there has been an improvement in inflation and expectations, they remain above target, even over the relevant horizon," said Loyola.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up