Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Trump Media filed to launch a Bitcoin and Ethereum ETF, marking a shift toward digital finance. The fund will allocate 75% to Bitcoin, 25% to Ethereum, and partner with Crypto.com.

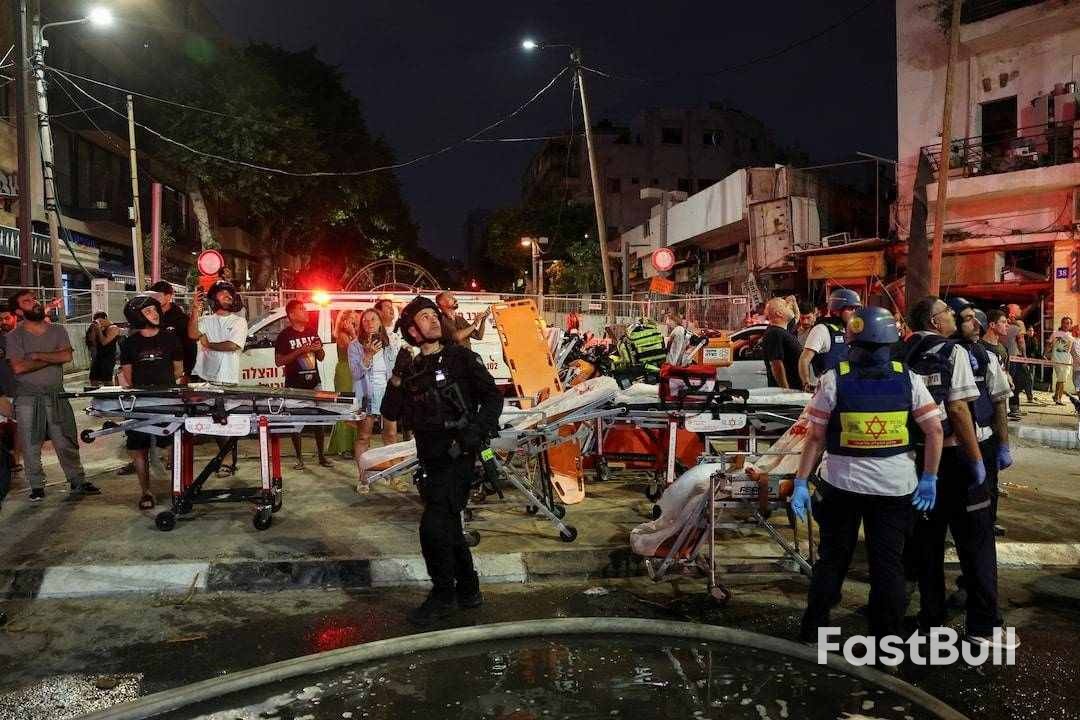

An Israeli strike hit Iran's state broadcaster on Monday as Iran called on U.S. President Donald Trump to force a ceasefire in the four-day-old aerial war, while Israel's prime minister said his country was on the "path to victory".

Israeli forces stepped up their bombardment of Iranian cities, while Iran proved capable of piercing Israeli air defences with one of its most successful volleys yet of retaliatory missile strikes.

"If President Trump is genuine about diplomacy and interested in stopping this war, next steps are consequential," Iran's Foreign Minister Abbas Araqchi said on X.

"Israel must halt its aggression, and absent a total cessation of military aggression against us, our responses will continue. It takes one phone call from Washington to muzzle someone like Netanyahu. That may pave the way for a return to diplomacy."

Sources told Reuters that Tehran had asked Qatar, Saudi Arabia and Oman to press Trump to use his influence on Israel to push for an immediate ceasefire. In return, Iran would show flexibility in nuclear negotiations, said the two Iranian and three regional sources.

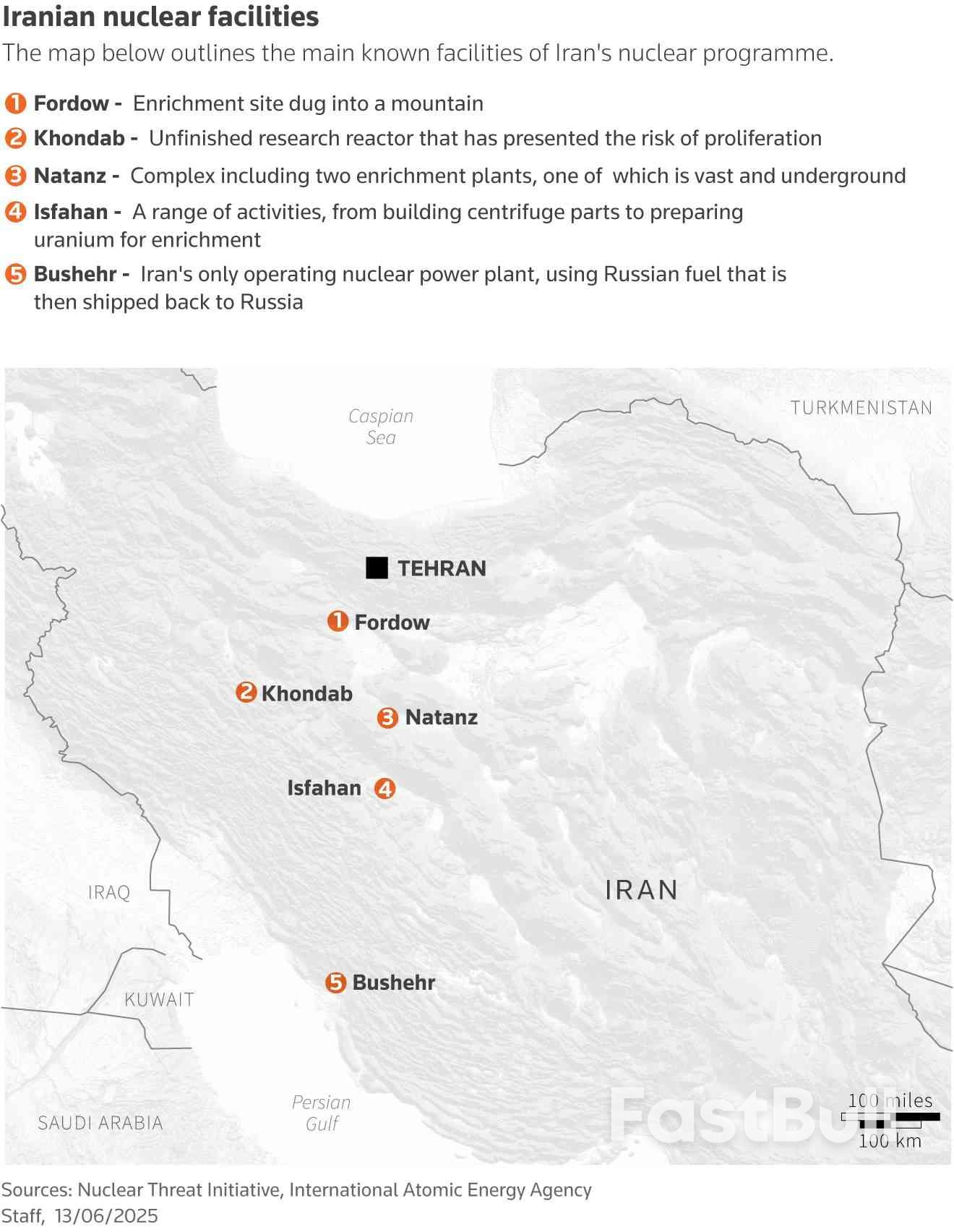

Israeli Prime Minister Benjamin Netanyahu told troops at an air base that Israel was on its way to achieving its two main aims: wiping out Iran's nuclear programme and destroying its missiles.

"We are on the path to victory," he said. "We are telling the citizens of Tehran: ‘Evacuate’ — and we are taking action."

Late on Monday, Israel said it had hit Iran's broadcasting authority, and footage showed a newsreader hurrying from her seat as a blast struck. Iran's State News Agency also reported the strike.

Israel's defence minister said Israel had attacked the broadcaster after the evacuation of local residents.

Meanwhile, Iranian state media reported that Iran was preparing for the "largest and most intense missile attack" yet against Israel.

Israel launched its air war on Friday with a surprise attack that killed nearly the entire top echelon of Iran's military commanders and its leading nuclear scientists. It says it now has control of Iranian airspace and intends to escalate the campaign in coming days.

Tehran's retaliation is the first time in decades of shadow war and proxy conflict that missiles fired from Iran have pierced Israeli defences in significant numbers and killed Israelis in their homes.

Iran says more than 224 Iranians have been killed, most of them civilians. Media published images of wounded children, women, and the elderly from cities across the country.

State TV broadcast scenes of collapsed presidential buildings, burned-out cars, and shattered streets in Tehran. Many residents were trying to flee the capital, describing queues for petrol and bank machines that were out of cash.

"I am desperate. My two children are scared and cannot sleep at night because of the sound of air defence and attacks, explosions. But we have nowhere to go. We hid under our dining table," Gholamreza Mohammadi, 48, a civil servant, told Reuters by phone from Tehran.

In Israel, 24 people have been killed so far in Iran's missile attacks, all of them civilians. Round-the-clock television images showed rescuers working in ruins of flattened homes.

[1/17]A drone photo shows the damage over residential homes and a school at the impact site following a missile attack from Iran on Israel, in Bnei Brak, Israel June 16, 2025. REUTERS/Chen Kalifa Purchase Licensing Rights, opens new tab

"It's terrifying because it's so unknown," said Guydo Tetelbaum, 31, a chef in Tel Aviv who was in his apartment when the alerts came in shortly after 4 a.m. (0100 GMT). He tried to reach a shelter but his door was blown in.

Trump has consistently said the Israeli assault could end quickly if Iran agrees to U.S. demands that it accept strict curbs to its nuclear programme.

Talks between the United States and Iran, hosted by Oman, had been scheduled for Sunday but were scrapped, with Tehran saying it could not negotiate while under attack.

On Monday, Iranian lawmakers floated the idea of quitting the nuclear non-proliferation treaty, a move bound to be seen as a setback for any negotiations.

'TEHRAN WILL PAY THE PRICE'

Before dawn on Monday, Iranian missiles struck Tel Aviv and Haifa, killing at least eight people and destroying homes. Israeli authorities said seven of the missiles fired overnight had landed in Israel. At least 100 people were wounded.

Iran's Revolutionary Guards said the latest attack employed a new method that caused Israel's multi-layered defence systems to target each other so missiles could get through.

"The arrogant dictator of Tehran has become a cowardly murderer who targets the civilian home front in Israel to deter the IDF," Israeli Defence Minister Israel Katz said.

"The residents of Tehran will pay the price, and soon."

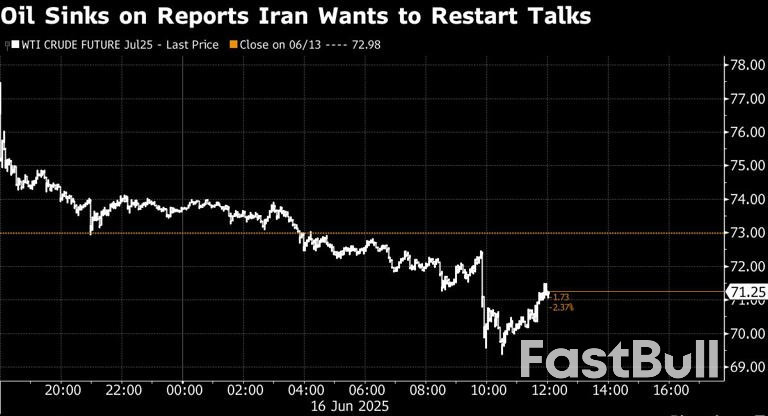

Global oil prices shot up on Friday at the prospect of conflict disrupting supplies from the Gulf. Prices eased on Monday, suggesting traders think exports could be spared despite Israeli attacks that hit domestic Iranian oil and gas targets.

The sudden killing of so many Iranian military commanders and the apparent loss of control of airspace could prove to be the biggest test of the stability of Iran's system of clerical rule since the 1979 Islamic Revolution.

Iran's network of regional allies who could once have been expected to rain rockets on Israel - Hamas in Gaza and Hezbollah in Lebanon - have been decimated by Israeli forces since the start of the Gaza war.

Netanyahu has said that, while toppling the Iranian government is not Israel's primary aim, it believes that could be the outcome.

Iran's currency has lost at least 10% of its value against the U.S. dollar since the start of Israel's attack.

Art teacher Arshia, 29, told Reuters his family was leaving Tehran for the town of Damavand, around 50 km (30 miles) to the east, until the conflict was over.

"My parents are scared. Every night there are attacks. No air raid sirens, and no shelters to go to. Why are we paying the price for the Islamic Republic's hostile policies?" said Arshia, who withheld his surname for fear of reprisal from authorities.

the main known facilities of Iran's nuclear programme.

US president Donald Trump kicked off his first meeting at the G7 leaders summit in Alberta, Canada, by suggesting that Russia should be invited to rejoin the group from which it was expelled following the invasion of Crimea in 2014.

The European members of the group have prepared a wide portfolio of subjects to address at the summit, including proposals to toughen G7 sanctions on Russia. European Commission president Ursula von der Leyen has proposed lowering the G7 price cap on Russian crude to $45/bl and banning imports of refined products made from Russian oil.

But Trump, at the beginning of his meeting with Canadian prime minister Mark Carney today, said that "you spend so much time talking about Russia, and [Russian president Vladimir Putin] is no longer at the table, so it makes life more complicated."

Expelling Russia was a mistake, Trump said, blaming the decision on former US president Barack Obama and former Canadian prime minister Justin Trudeau.

The broader political background is in some ways similar to the G7 summit in 2018, also hosted by Canada, when Trump first told his fellow western leaders they should not have expelled Russia from the group.

Now as then, sanctions against Russia are on the G7 agenda and the US Congress is advancing legislation to target Russia's energy exports.

The key difference is that Trump in 2025 has sufficient control over the Republican majority in both chambers of Congress to block any legislation he does not like. "They'll be guided by me" on the Russia sanctions legislation, he said earlier this month, calling it a "harsh bill".

"At the right time, I'll do what I want to do. But they're waiting for me to decide on what to do," Trump said.

Trump has argued that imposing new economic penalties against Russia would derail the ongoing Russia-Ukrainian peace talks, even though he has acknowledged the negotiations have made no progress.

Trump is scheduled to meet with Ukrainian president Volodymyr Zelenskiy on the sidelines of the G7 summit, the White House said.

Trump's fellow leaders were hoping to push him to roll back the unilateral tariffs he imposed on nearly all US trading partners, but Trump's public comments at the start of his meeting with Carney indicated no willingness to compromise on this issue as well.

"I think we have different concepts," Trump said. "I have a tariff concept. Mark has a different concept, which is something that some people like, but we're going to see if we can get to the bottom of it today. I am a tariff person."

Canada's strong response to Trump's tariffs made him roll back the broad tariffs he imposed on the US' North American neighbors at the beginning of his second term. The bulk of US imports from Canada and Mexico remains duty-free, but Trump's tariffs on steel, aluminum, cars and auto parts do not make an exemption for Canada and Mexico.

The effective US tariff rate on imports from Canada and Mexico — the amount of duties collected from all imported goods divided by their value — rose in April to 2.3pc and 4.1pc respectively, up from nearly zero in January, according to US Department of Commerce data.

Trump is separately meeting with Mexico president Claudia Sheinbaum later today.

Despite a busy pace of meetings with fellow leaders, Trump extended the customary press gaggle at the beginning of his meeting with Carney to take questions on US domestic politics, including his directive Sunday night to the US immigration authorities to carry out massive raids in the largest US cities.

Carney in the end had to cut Trump off, asking him to carry on with their meeting.

"We have a few more minutes with the president and his team, and then we actually have to start the [G7] meeting to address some of these big issues," Carney said.

U.S. stock indexes climbed and oil fell from last week's highs on Monday after conflict between Israel and Iran left crude production and exports unaffected, while investors stayed braced for a week packed with central bank meetings.

Geopolitics loomed large as Group of Seven leaders began annual talks in Canada. Iranian strikes on Israel and a promise of retaliation were followed by a Wall Street Journal report that Tehran was seeking an end to hostilities, against a backdrop of existing international strains prompted in part by Donald Trump's tariff policy.

Markets took comfort after a torrid session on Friday saw oil surge 7% and Wall Street indexes lose more than 1%.

At 10:48 a.m. the Dow Jones Industrial Average (.DJI), was 1.17% higher, the S&P 500 (.SPX), gained 1.16% and the Nasdaq Composite (.IXIC), was also up 1.51%.

U.S. crude fell 3.44% to $70.47 a barrel and Brent fell to $71.63 per barrel, down 3.5% on the day.

"Markets came to the conclusion that for now, the Israeli/Iranian conflict is localized," Andy Brenner, Head of International Fixed Income at National Alliance Securities, said in a note to clients.

Any sustained inflationary impact from the oil price outlook could make the Federal Reserve more nervous about giving too many hints at its Wednesday meeting about interest rate cuts later in the year.

Investors still expect two cuts by December, with a first move in September seen as most likely.

"The key is how much flexibility the Fed thinks it has. We've been pleasantly surprised we've not yet seen inflationary pass-through from the tariffs," said Ben Laidler, head of equity strategy at Bradesco BBI.

U.S. Treasury yields fell after the report of Iran's outreach to Israel, with the 10-year notes yielding 0.9 basis points to 4.415%, from 4.424% late on Friday.

MSCI's gauge of stocks across the globe (.MIWD00000PUS), marched 1.09% higher after the U.S. open.

Earlier in the trading day, Europe's STOXX 600 (.STOXX), had been boosted by a rebound in travel stocks (.SXTP), and Gulf stocks also recovered.

Chinese blue chips (.CSI300), gained after data showed rising retail sales and industrial output in line with expectations. SS

U.S. retail sales data is due on Tuesday and may show a pullback in autos dragging the headline number down even as core sales edge higher. A market holiday on Thursday means weekly jobless claims figures are out on Wednesday.

Central banks in Norway and Sweden also meet this week, with the latter expected to trim rates.

The Swiss National Bank meets on Thursday and is considered certain to cut by at least a quarter point to take rates to zero, with some chance it may go negative given the strength of the Swiss franc.

The Bank of Japan holds a policy meeting on Tuesday and is widely expected to hold rates at 0.5%, while leaving open the possibility of tightening later in the year.

There is also speculation it could consider slowing the rundown of its government bond holdings from next fiscal year.

German government bond yields fell on Monday, with the benchmark 10-year Bunds yielding 2.52%, from 2.536% late on Friday.

The calmer mood across markets saw some of gold's safe-haven bid reverse and it was down 1.04% to $3,396.59 an ounce. .

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up