Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Trump pressed oil executives to revitalize Venezuela's crude output for U.S. benefit, yet firms remain cautious over instability.

U.S. President Donald Trump met with executives from the world's largest oil companies on Friday, January 9, to outline a strategy for Venezuela, stating that boosting the nation's crude production would directly benefit the United States.

The high-stakes meeting at the White House follows the seizure of Venezuelan leader Nicolas Maduro by U.S. forces during a raid on the capital on January 3, underscoring oil's central role in the administration's plan for the OPEC member.

President Trump opened the meeting by framing the objective clearly: leveraging American corporate power to quickly rebuild Venezuela’s failing oil industry. The goal, he stated, is to restore millions of barrels of production to the global market, benefiting the U.S., Venezuela, and the world.

"We're going to be making the decision as to which oil companies are going to go in, that we're going to allow to go in," Trump announced.

Administration officials have emphasized the need to control Venezuela's oil sales and revenue streams indefinitely to ensure the country's alignment with American interests. Central to this strategy is the expectation that major oil companies will inject billions of dollars into rehabilitating the nation's oilfields.

Despite the administration's clear intentions, a significant gap exists between Washington's ambitions and the risk appetite of major energy firms. Investors remain skeptical about committing to large-scale, long-term projects in Venezuela.

Key sources of hesitation for oil majors include:

• Political Instability: The uncertain political future of the country poses a major risk to long-term capital investments.

• High Costs: Rebuilding Venezuela's dilapidated energy infrastructure would require massive financial outlays.

While firms like Chevron, Vitol, and Trafigura are reportedly competing for U.S. licenses to market Venezuela's existing crude oil, this short-term opportunism does not extend to the deeper commitments the White House is seeking. According to sources, industry giants like Chevron and ConocoPhillips are cautious about rushing into major investments.

The meeting's guest list highlighted the administration's focus on mobilizing the entire U.S. energy sector. Attendees included not only industry leaders like Chevron, Exxon Mobil, and ConocoPhillips but also several smaller independent and private equity-backed players.

Notably, some of these smaller firms have connections to Colorado, the home state of Energy Secretary Chris Wright, suggesting a broad-based effort to bring American oil expertise to bear on Venezuela's future.

U.S. President Donald Trump is taking a measured stance on the mass protests in Iran, pairing strong verbal warnings with a cautious, wait-and-see policy. While threatening severe consequences for a violent crackdown, his administration is holding back from deeper involvement as U.S. intelligence suggests the unrest does not yet pose a threat to Tehran's clerical leadership.

In recent days, Trump has warned Iranian leaders there will be "hell to pay" if they use force against the protest movement. "I have let them know that if they start killing people, which they tend to do during their riots… we're going to hit them very hard," Trump told radio host Hugh Hewitt on Thursday.

Human rights groups report that security forces have already killed and injured demonstrators. However, in a Fox News interview, Trump referenced past crackdowns, noting security forces have previously "stomped on" people in crowds and were "shooting the hell out of people."

A key indicator of Trump's cautious strategy is his decision to hold off on meeting with Reza Pahlavi, the exiled son of the late Shah of Iran. This move signals that the White House is waiting to see how the crisis develops before officially backing any opposition figure.

"I think that we should let everybody go out there and see who emerges," Trump said. "I'm not sure necessarily that it would be an appropriate thing to do."

Pahlavi, who resides near Washington, has been using social media to encourage the demonstrations. On Friday, he urged Trump to increase his involvement with "attention, support and action."

"You have proven and I know you are a man of peace and a man of your word. Please be prepared to intervene to help the people of Iran," he posted.

According to a source familiar with U.S. intelligence reports, an assessment from the intelligence community earlier this week concluded that the protests are not yet large enough to challenge Supreme Leader Ali Khamenei's hold on power.

However, U.S. analysts are monitoring the situation closely. The source noted a critical shift: "Prior to the last 24 hours the protests were broadly concentrated in cities where opposition to the regime has always been a thing. Moving to strongholds (like the Supreme Leader's hometown of Mashad) is the significant development."

A White House spokesperson declined to comment on intelligence matters but reiterated the president's position. "As the President has stated repeatedly, if Iran shoots and violently kills peaceful protesters, 'They will get hit very hard,'" the spokesperson said. The CIA also declined to comment.

The unrest in Iran comes as Trump's attention is divided, with active foreign policy focus on Venezuela's President Nicolas Maduro and discussions about acquiring Greenland. This follows a tense period last June when Trump ordered, then called off, U.S.-led bombing raids on Iranian nuclear facilities, warning he would do so again if Tehran restarted its program.

When asked for his message to the Iranian people, Trump said, "All I can say is you should feel strongly about freedom. There's nothing like freedom. You're brave people. It's a shame what's happened to your country."

Alex Vatanka, director of the Iran program at the Middle East Institute, suggests Trump is waiting to see if the protests can destabilize Iran's ruling clerics before committing to intervention.

"Trump wants to be on the winning side, but he prefers a quick win, not a win that requires a lot of investment and holding hands, certainly not in the Middle East," Vatanka explained. "To him, that's just against everything he stood for as a politician, going back to when he first ran."

The European Union has greenlit a landmark trade deal with the South American Mercosur bloc, concluding over 25 years of complex negotiations. The agreement, the largest in the EU's history, secured the necessary support from member states despite fierce opposition and widespread farmer protests.

At least 15 countries, representing 65% of the bloc's population, voted in favor of the deal with Mercosur, which includes Argentina, Brazil, Paraguay, and Uruguay. Some EU diplomats reported that the number of supporters was as high as 21 nations.

France, the EU's largest agricultural producer, led the charge against the agreement, ultimately voting no. The French government argues that the deal will flood the European market with cheaper food imports like beef, poultry, and sugar, directly harming its domestic farmers. Austria, Hungary, Ireland, and Poland joined France in opposition, while Belgium abstained.

This political resistance is amplified by massive protests on the ground. Farmers have blockaded highways in France and Belgium and marched in Poland, demonstrating their deep-seated anger over the deal's potential impact on their livelihoods.

The backlash in France has been particularly severe. Mathilde Panot, a leader of the far-left France Unbowed party, claimed France had been "humiliated" by Brussels. Both far-right and far-left parties are now planning to file no-confidence motions against the government over the agreement's expected approval.

French Agriculture Minister Annie Genevard insisted the fight is not over, vowing to rally opposition ahead of a crucial vote in the EU assembly.

Proponents, including Germany and Spain, view the Mercosur agreement as a critical strategic move. They contend it will help offset business losses from U.S. tariffs and reduce the EU's economic dependence on China by securing access to vital minerals.

German Chancellor Friedrich Merz hailed the vote as a "milestone" for Germany and Europe, though he criticized the lengthy negotiation process. "25 years of negotiations is too long," he stated. "It's vital that the next free trade agreements are concluded swiftly."

The economic stakes are high. The agreement is projected to eliminate €4 billion ($4.66 billion) in tariffs on EU exports. Mercosur nations currently impose steep duties on European goods, including:

• 35% on car parts

• 28% on dairy products

• 27% on wines

The EU and Mercosur aim to boost their goods trade, which was valued at €111 billion in 2024. While the EU primarily exports machinery, chemicals, and transport equipment, Mercosur's exports are dominated by agricultural products, minerals, and paper goods.

To win over wavering countries, the European Commission introduced several key concessions. These include safeguards to halt imports of sensitive agricultural products if markets are disrupted, stricter import controls for pesticide residues, and a new crisis fund for farmers.

These measures proved decisive in swaying Italy, which shifted from a "no" vote in December to a "yes." Italian Prime Minister Giorgia Meloni described the revised terms as a "sustainable" balance.

Beyond agricultural and economic concerns, the deal faces strong opposition from environmental groups. Organizations like Greenpeace argue that the agreement will fuel deforestation in the Amazon rainforest as commodities are produced for the European market.

"This unpopular deal is a disaster for the Amazon rainforest," said Greenpeace EU campaigner Lis Cunha, urging progressive members of the European Parliament to reject it.

Before the trade deal can take effect, it must be formally signed and then pass a final vote in the European Parliament. Bernd Lange, chair of the parliament's trade committee, anticipates that the deal will ultimately pass, with a final vote likely scheduled for April or May.

Ukrainian President Volodymyr Zelenskiy announced Friday that he is in discussions with the United States about a potential free-trade agreement, a cornerstone of a wider prosperity package designed to fuel the nation's recovery after the war.

In a phone interview with Bloomberg, Zelenskiy explained the deal would establish zero tariffs on trade with the U.S. and would apply to certain industrialized regions of Ukraine. He argued this would provide the country with "very serious cards" against neighboring states, potentially attracting significant investment and new businesses.

The Ukrainian leader emphasized that he needs to discuss the proposal's details directly with President Donald Trump. He also framed the agreement as an additional guarantee for Ukraine's economic security.

Zelenskiy's comments followed a report from his top negotiator, Rustem Umerov, who held a call with Trump's special envoys, Steve Witkoff and Jared Kushner. According to Zelenskiy, the U.S. representatives have recently been in contact with Russia in "some kind of format," though he did not know if they planned to travel to Russia for in-person meetings.

The diplomatic process involves Ukraine submitting feedback on territorial proposals to the U.S. team. These proposals are then relayed to Russian officials for their input before a response is delivered back to Kyiv.

Zelenskiy expressed hope of receiving Russia’s response to a 20-point framework by the end of this month. This timeline would coincide with his efforts to finalize a recovery plan and security guarantees with Trump. He expects to meet Trump either in the U.S. or at the World Economic Forum in Davos, Switzerland.

Demand for Concrete Security Guarantees

A key focus for Zelenskiy is securing specific U.S. commitments in the event of renewed Russian aggression.

"I don't want everything to end up in them merely promising to react," Zelenskiy said. "I really want something more concrete."

While talks on security guarantees with allies have progressed, territorial disputes remain the primary obstacle in negotiations to end the invasion. Earlier this year, Trump stated he was "not thrilled" with Russian President Vladimir Putin but has not yet publicly committed to new measures to support Ukraine.

To address the military stalemate, Ukraine is considering two distinct plans, including one proposed by the United States to create a special economic zone.

1. The Free Economic Zone

This proposal, separate from the broader free-trade deal, is a localized plan for the battlefield area. If a truce is reached, a buffer area would be established as troops pull back. This zone would allow businesses to operate and people to live under a special legal and tax regime.

"The format is difficult but fair," Zelenskiy noted. He added that the plan would require Russia to "mirror" Ukraine's actions and would need domestic discussion. The zone could be created in parts of the Donbas region, serving as a compromise that requires both sides to withdraw their forces.

2. Freezing the Contact Line

A second option involves halting the fighting while leaving forces in their current positions, with unresolved issues addressed through diplomacy.

"It's about freezing the contact line, not the conflict," Zelenskiy clarified, adding that this arrangement would be easier for Ukraine's foreign allies to implement and monitor.

Zelenskiy reiterated that Russia’s actions indicate it is not prepared for genuine diplomacy. He affirmed that Ukraine will never recognize its occupied territories as Russian, though it expects to restore full sovereignty in the future.

In this context, he urged the U.S. to provide a more systematic response to Russian aggression, noting that Ukraine has still not received all pledged Patriot air-defense systems and ammunition. His call came as Russia launched a major air attack on Kyiv early Friday, leaving large parts of the capital without power, heat, and water.

While Kyiv's mayor urged residents to leave the city to avoid freezing, Zelenskiy criticized the call as alarmist, stating that efforts should focus on restoring normal operations.

Regarding recent calls from European leaders for renewed dialogue with Moscow, Zelenskiy said he was not opposed, as long as Putin understands the discussions are serious. "We are moving toward the final stage, even if we don't yet know what it will look like," he concluded.

Atlanta Fed President Raphael Bostic has identified inflation as his primary economic concern, describing the current job market as being in a state of "low-hire, no-fire" amid ongoing uncertainty.

In a radio interview on Friday with WLRN in Florida, Bostic stressed that the central bank must remain sharply focused on taming price pressures.

Bostic stated that "inflation is still too high," arguing that the Federal Reserve's effort to manage prices is currently a more significant challenge than its employment mandate.

"You've got to get it under control, and we need to be laser-focused on making sure that everything we do is contributing to that," he explained.

He warned that persistent high prices are squeezing consumers and could ultimately weaken the economy in ways that become more difficult for the Fed to manage. "We still have this big concern around inflation, and we know that consumers across the spectrum are feeling the pressure of high prices," Bostic added.

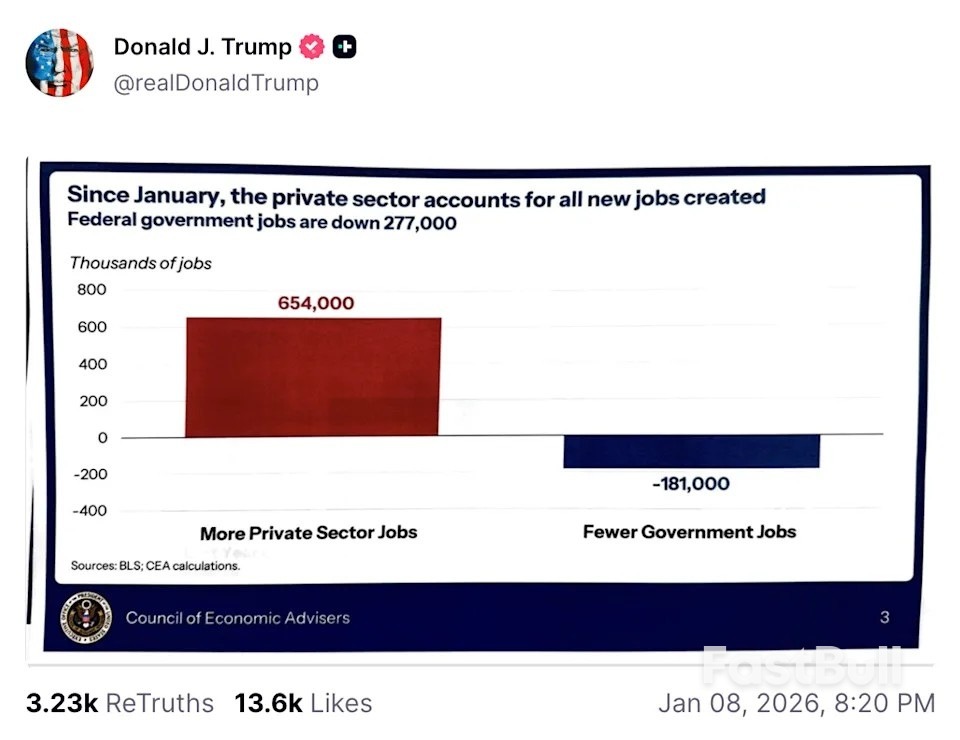

Bostic's comments followed the release of December's employment data, which provided new context on the state of the labor market. The report showed:

• A modest payroll gain of 50,000 jobs.

• A decline in the unemployment rate to 4.4%, down from 4.5% the previous month.

While acknowledging that labor markets have cooled, Bostic expressed some doubt that they are on a path toward significant weakness. This relative stability in hiring gives the Federal Reserve more time to deliberate before making a decision on interest rates, according to many economists.

The Fed's three-quarters of a percentage point in rate cuts last year was intended to support the job market while maintaining enough policy restraint to guide inflation back toward the 2% target.

Many economists still anticipate that the Fed will cut interest rates this year as price pressures ease and the effects of tariffs diminish. However, the steady employment figures reduce the immediate pressure on the central bank to act.

When asked about a plan by President Donald Trump to direct $200 billion from government-sponsored housing companies to buy mortgage bonds, Bostic did not comment on the specific proposal.

Instead, he pointed to more fundamental issues driving housing costs. "I do think that a lot of the housing affordability challenges are about more than just financing," Bostic noted. "There's a supply and demand issue that has persisted in many major markets."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up