Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The White House said Donald Trump’s decision on a successor for Federal Reserve Chair Jerome Powell is not near, after the Wall

The White House said Donald Trump’s decision on a successor for Federal Reserve Chair Jerome Powell is not near, after the Wall Street Journal reported the president could make a pick as soon as the summer.

No decisions are imminent, although the president has the right to change his mind, a White House official said on Thursday. Trump has many good options to nominate as the next central bank chief, according to the official.

The dollar fell and US Treasuries rallied after the paper reported that Trump has considered naming Powell’s replacement by September or October, citing anonymous sources. One unnamed person said Trump’s ire toward Powell could prompt an even earlier choice this summer.

Earlier: Trump Says Three or Four People on List to Replace Fed’s Powell

Powell’s term as chair does not expire until May 2026, and choosing a replacement that early would be unusual.

Trump has repeatedly bashed the Fed chair over the bank’s position to hold interest rates steady, calling for cuts and arguing its policy is keeping US government borrowing costs high.

Trump said Wednesday that he has “three or four people” on his list of potential replacements for Powell. Earlier this month, the president said he was considering nominees and that they would come out “very soon.”

Recently, the president has intensified his personal criticisms of Powell. During a Wednesday press conference at the NATO summit, Trump called the bank chief “terrible” and an “average mentally person” with “low IQ.”

The number of Americans filing new applications for jobless benefits fell last week, but work opportunities are becoming scarce as businesses remain hesitant to hire because of an uncertain economic outlook, raising the risk of the unemployment rate increasing in June.

The weekly jobless claims report from the Labor Department on Thursday, the most timely data on the economy's health, also showed state unemployment benefit rolls in mid-June increasing to the highest level in 3-1/2 years. Though layoffs remain historically low, hiring has been tepid, with economists saying President DonaldTrump'sbroad import tariffs are making it difficult for businesses to plan ahead.

But the pace of labor market slowdown is unlikely to prompt the Federal Reserve to resume cutting interest rates before September, they said. Fed Chair Jerome Powell told lawmakers this week the U.S. central bank needed more time to gauge if tariffs raised inflation before considering lowering rates.

"The data are consistent with softening of labor market conditions, particularly on the hiring side of the labor market equation," said Nancy Vanden Houten, lead economist at Oxford Economics. "For now, we don't think the labor market is weak enough to prompt the Fed to cut rates before December, but the risk is increasing that once the Fed starts to lower rates, it will have some catching up to do."

Initial claims for state unemployment benefits dropped 10,000 to a seasonally adjusted 236,000 for the week ended June 21, the Labor Department said. Economists polled by Reuters had forecast 245,000 claims for the latest week.

The data included last week's Juneteenth National Independence Day holiday, which likely injected a downward bias.

Cutting through the technical distortions, layoffs have picked up amid the economic uncertainty that has seen the Fed pausing its monetary policy easing cycle. The U.S. central bank last week left its benchmark overnight interest rate in the 4.25%-4.50% range where it has been since December.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, jumped 37,000 to a seasonally adjusted 1.974 million during the week ending June 14, the highest level since November 2021, the claims report showed.

The so-called continuing claims covered the week during which the government surveyed households for June's unemployment rate. Continuing claims increased between the May and June survey week, leading economists to expect that the unemployment rate rose to 4.3% in June from 4.2% in May.

A survey from the Conference Board this week showed the share of consumers who viewed jobs as being "plentiful" dropped to the lowest level in more than four years in June.

Stocks on Wall Street opened higher. The dollar slipped to a three-year low against a basket of currencies. U.S. Treasury yields fell.

The Trump administration's tariffs are distorting the economic picture and this was evident in other data on Thursday.

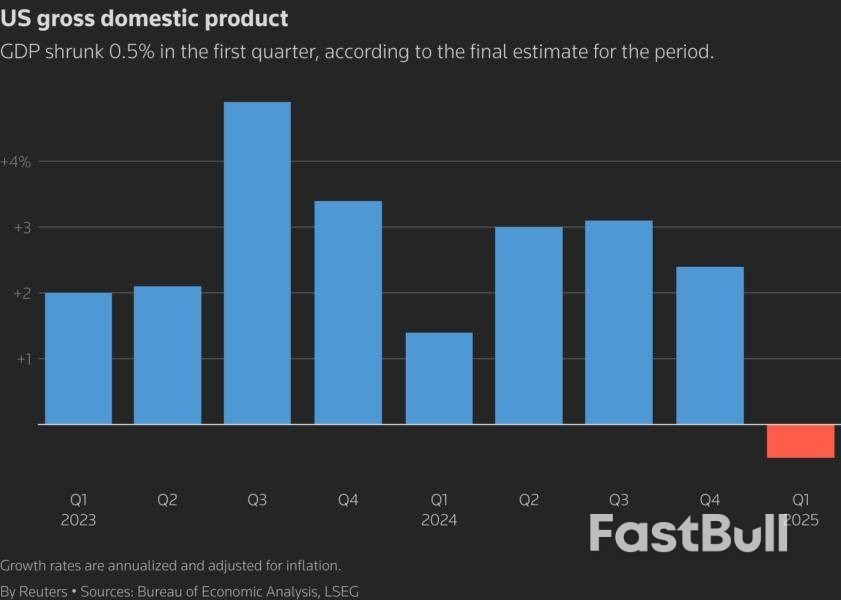

Gross domestic product decreased at a downwardly revised 0.5% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis (BEA) said in its third estimate of GDP.

The economy was previously reported to have contracted at a 0.2% pace. The revision reflected a sharp downgrade to consumer spending, which is now estimated to have increased at only a 0.5% pace instead of previously reported 1.2% rate.

The economy grew at a 2.4% rate in the fourth quarter.

Domestic demand growth was slashed to a 1.9% rate from the previously reported 2.5% pace.

A flood of imports as businesses rushed to bring in goods before the sweeping tariffs kicked in accounted for the bulk of the decrease in GDP. Consumer spending also slowed as the boost from pre-emptive buying of goods, especially motor vehicles, ahead of the import duties faded.

While the flow of imports has since subsided, exports are taking a hit from the trade tensions. A third report from the Census Bureau showed the goods trade deficit widened 11.1% to $96.6 billion in May, with exports dropping $9.7 billion to $179.2 billion. But goods imports were little changed at $275.8 billion, positioning GDP for a sharp rebound this quarter.

The Atlanta Federal Reserve is forecasting GDP accelerating at a 3.4% rate in the second quarter. Given the gyrations from imports, economists cautioned against interpreting the anticipated bounce back in GDP as a sign of economic strength.

Data on retail sales, the housing and labor markets have suggested economic activity is softening.

"The difficulty of accurately capturing the extraordinary foreign-trade and inventory gymnastics that companies undertook to avoid U.S. tariffs created serious measurement challenges that will linger for some time to come," said Lou Crandall, chief economist at Wrightson ICAP.

While a fourth report from the Census Bureau showed orders for long-lasting manufactured goods rebounded sharply in May because of strength in commercial aircraft bookings, the uncertain economic environment remained a constraint for business spending.

Orders for durable goods, items ranging from toasters to aircraft meant to last three years or more, jumped 16.4% last month after a 6.6% decline in April. Transportation equipment orders soared 48.3%, driven by a 230.8% surge in commercial aircraft orders, which are extremely volatile.

Boeingreported on its website that it had received 303 aircraft orders, including 150 from Qatar Airways placed during Trump's visit to the Gulf Arab country in May. That compared to only eight orders in April.

Non-defense capital goods orders accelerated 49.4% after plunging 19.1% in April. Shipments of these goods were unchanged after advancing 3.6% in April.

Outside the transportation industry, orders were moderate. Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, rebounded 1.7% in May after a 1.4% decline in April. Shipments of core capital goods rose 0.5% after being unchanged in the prior month. Business spending on equipment accelerated sharply in the first quarter.

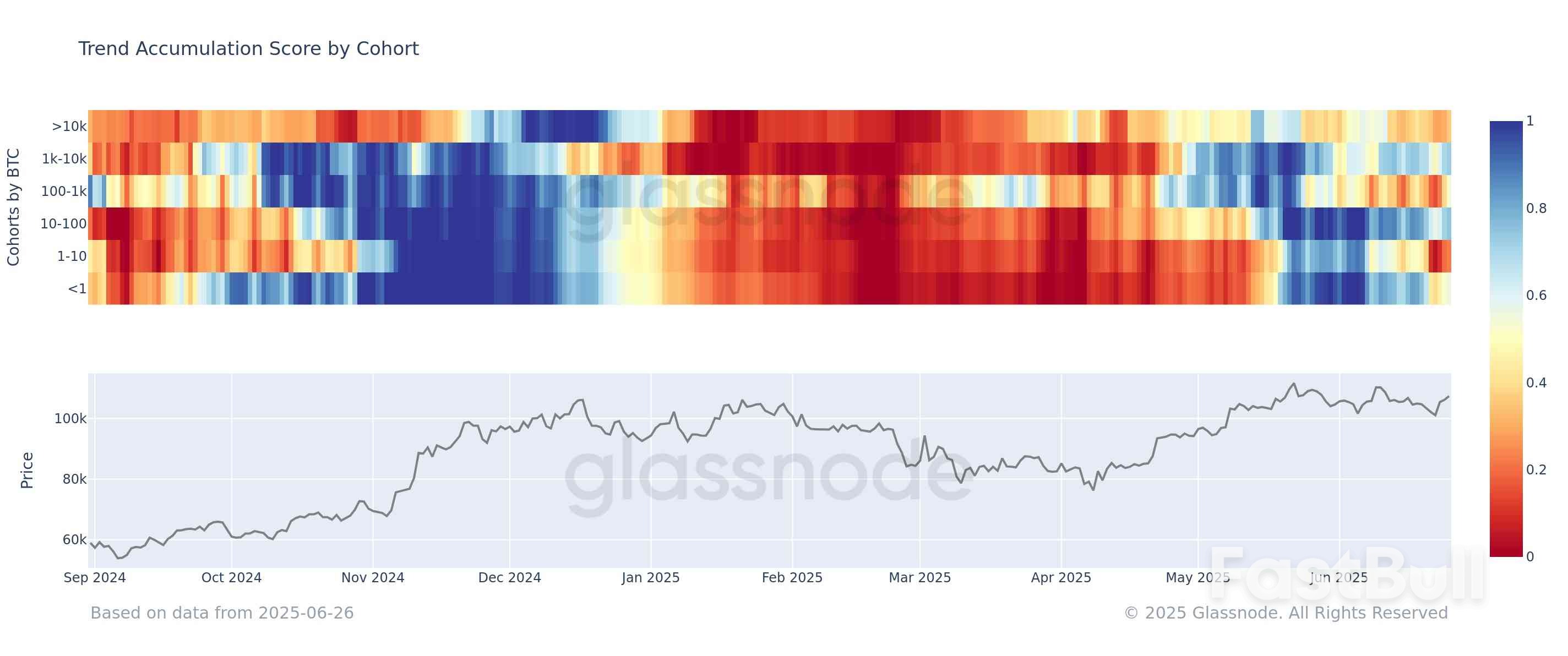

Bitcoin Trend Accumulation Score chart. Source: Glassnode/X

Bitcoin Trend Accumulation Score chart. Source: Glassnode/X

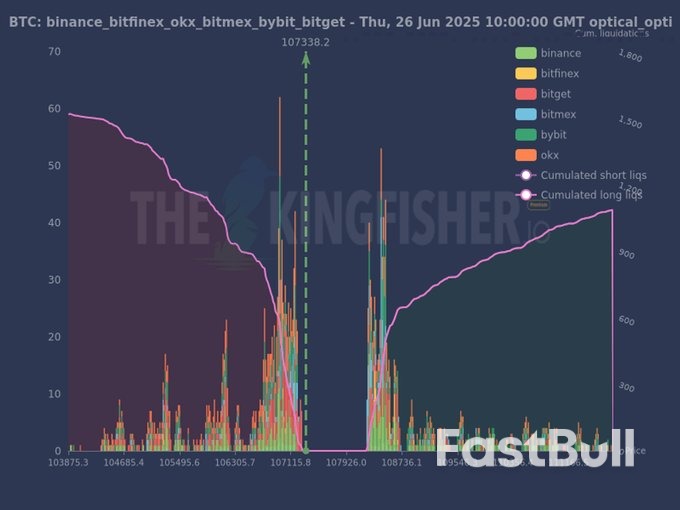

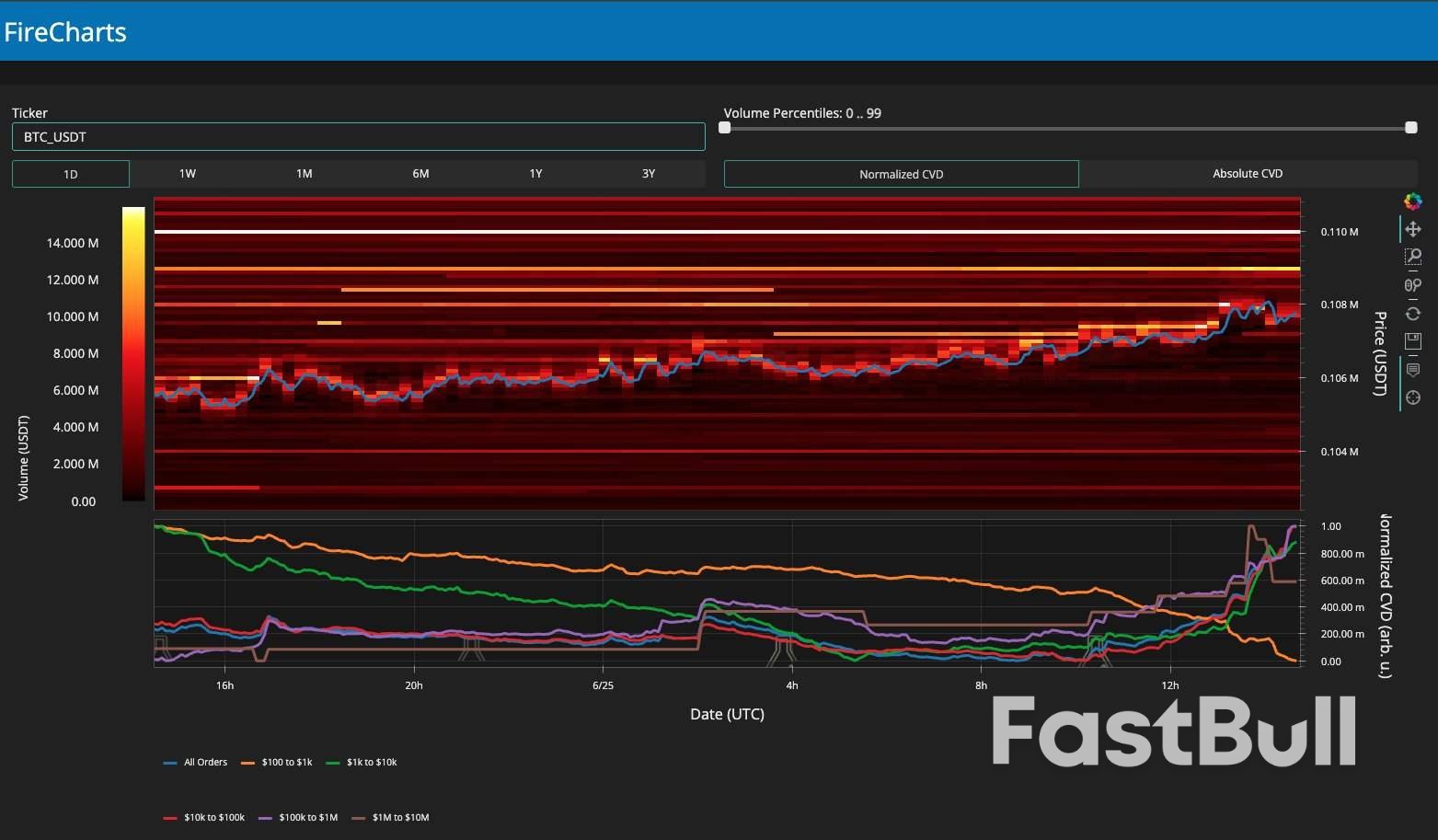

BTC/USDT order book liquidity data as of June 25. Source: Material Indicators/X

BTC/USDT order book liquidity data as of June 25. Source: Material Indicators/X

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up