Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In recent developments in the United States, the Bureau of Labor Statistics (BLS), responsible for publishing crucial employment and other economic data, has been the focus of discussions.

In recent developments in the United States, the Bureau of Labor Statistics (BLS), responsible for publishing crucial employment and other economic data, has been the focus of discussions. The catalyst for this attention was the dismissal of BLS Commissioner Erika McEntarfer by President Donald Trump, who replaced her with his nominee EJ Antoni. Although no official reasoning was provided for McEntarfer’s removal, the decision is speculated to be linked to ongoing debates regarding the reliability of economic data released by BLS. This move has led to varied reactions within political and economic circles.

The issue highlights concerns in the economic realm over the accuracy and reliability of BLS’s data, which affects confidence among business and market players. Ray Dalio, founder and former CEO of Bridgewater Associates, criticized the outdated and error-prone forecasting processes of the BLS. Dalio pointed to significant downward revisions of employment figures for May and June in the July report as indicators of deeper structural issues within the organization. He also suggested that employment forecasts from the private sector could be more current and reliable.

EJ Antoni, Trump’s appointee to BLS leadership, expressed harsh criticism of the agency’s data, previously deeming it “fabricated.” Until substantial improvements are made, he proposes suspending monthly employment reports in favor of quarterly releases. Besides employment data, the BLS is also responsible for reporting critical metrics such as the Consumer Price Index (CPI), used to measure inflation in the U.S. This data too has come under scrutiny, with critiques pointing out discrepancies between official figures and the actual inflation experienced by American households.

As confidence in BLS data wanes, investors and business leaders adopt more cautious approaches regarding capital allocation and investment decisions. A series of rapid-fire data revisions have stoked discussions about data accuracy in financial markets. Given that BLS data serves as fundamental indicators for both public and private sectors, the leadership change at the organization may have implications for data production processes and economic decision-making.

It remains to be seen whether BLS will implement updates to its data collection and presentation methods under its new leadership. Additionally, the potential impact on pivotal U.S. economic indicators like employment and inflation will be closely observed in the coming months. Institutional criticisms and suggestions concerning BLS continue to fuel discussions about economic governance and transparency. There is speculation that the new leadership may lean toward releasing data that supports Trump’s political agenda, especially after previous revisions adversely impacted interest rate reductions and Trump’s political standing. Ultimately, this evolving scenario could favor cryptocurrency markets due to anticipated interest rate cuts.

Asian stocks were poised for a mainly positive open on Thursday as investors continued to ramp up bets that the Federal Reserve will cut interest rates next month.Equity-index futures pointed to gains in Australia and Hong Kong, while contracts for Japan declined. A gauge of US-listed Chinese shares rose for a second session, and the S&P 500 advanced as Apple Inc and Amazon.com Inc climbed. Treasury yields fell alongside the dollar.

The bond rally marked a sharp shift from two weeks ago, when markets saw less than a 50% chance of a September rate cut. Traders now fully expect a quarter-point move, with some betting on a larger reduction, as Treasury Secretary Scott Bessent said “we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September.”“As the labor market continues to weaken, we think the US central bank will resume interest rate cuts next month, with 25-basis-point cuts at each meeting through January 2026 for a total of 100 basis points,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

Fed policymakers last month kept their benchmark at a target range of 4.25% to 4.5%. Bessent said officials might have cut rates if they’d been aware of the revised data on the labor market that came out a couple of days after the latest meeting.President Donald Trump said he may name the next Fed chair “a little bit early” and added that he was down to three or four potential candidates as he looks for a successor to Jerome Powell.

“As the market continues to digest the shift in the trajectory of the real economy following the combination of July’s inflation and employment data, it follows intuitively that the question has become: how large of a cut should Powell deliver?” said Ian Lyngen at BMO Capital Markets.A report on producer prices due Thursday will offer insights on additional categories that feed directly into the Fed’s preferred price gauge — which is scheduled for later this month.“Tariff-related costs are still being absorbed by corporate profit margins rather than passed on to consumers, giving the Fed room to pivot without sparking inflationary risk,” said Fawad Razaqzada at City Index.

Some companies have been holding off on price increases for fear that consumers will pull back on spending, which will heighten interest for Friday reports on retail sales and consumer sentiment.In other corporate news, Trump’s controversial plan to take a cut of revenue from chip sales to China has US companies reconsidering their plans for business with the country, offering a model for circumventing years of trade tensions.Meanwhile, geopolitical tensions remained on edge after the US president warned he would impose “very severe consequences” if Vladimir Putin didn’t agree to a ceasefire agreement later this week, following a call with European leaders ahead of his meeting with the Russian president.

Key Points:

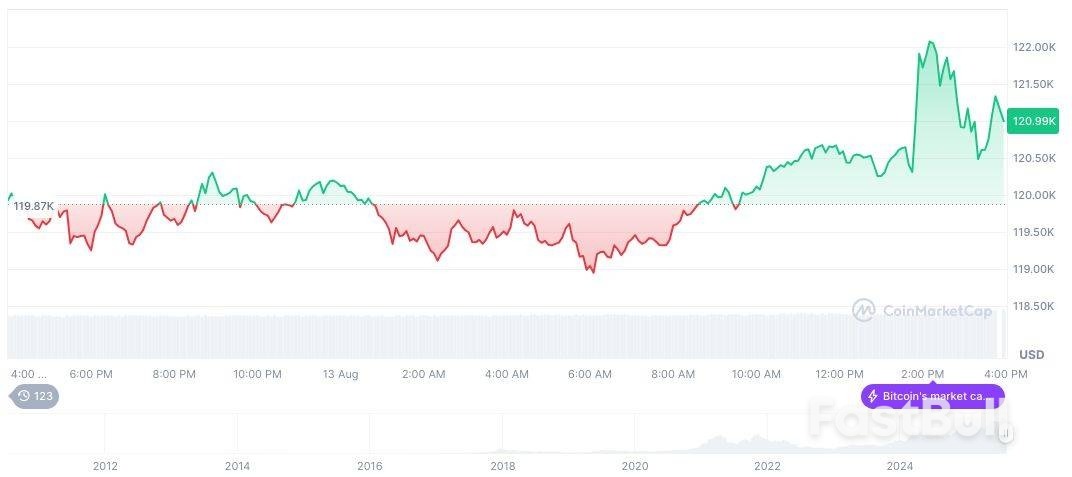

Bitcoin's market capitalization has surpassed Alphabet's, reaching $2.46 trillion and securing the fifth spot among global mainstream assets, as noted by 8marketcap data reported on August 14, 2025.This milestone underscores Bitcoin's growing influence in mainstream finance, potentially increasing institutional attention and prompting future market reactions despite the absence of immediate official commentary.

Bitcoin's market capitalization achieving $2.456 trillion surpasses Alphabet's, ascending to fifth in global rankings. This is a significant event for Bitcoin as no official reactions from major development teams or key opinion leaders have surfaced as of the report date. Major exchanges and key institutional figures have yet to release statements.The achievement highlights Bitcoin's increasing institutional interest and mainstream acceptance. While no immediate on-chain data shifts have occurred, financial analysts suggest potential for increased capital inflow as this milestone could attract further scrutiny from investors.As of August 14, 2025, there are no direct quotes from key opinion leaders (KOLs), institutional advocates, or core developers regarding Bitcoin's recent milestone of surpassing Alphabet in market capitalization.

Did you know? In 2021, Bitcoin's market cap broke $1 trillion for the first time, often surpassing corporations such as Tesla and Meta.Bitcoin (BTC) currently trades at $123,824.70, with a market cap of approximately $2.46 trillion, dominating 58.90% of the market. Recent price changes include a 3.20% increase over 24 hours and a 19.22% spike in the past 90 days, reflecting robust market momentum with data from CoinMarketCap.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:26 UTC on August 14, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:26 UTC on August 14, 2025. Analysts from Coincu note that this milestone could spur further institutional interest and investments in Bitcoin, potentially leading to future regulatory considerations. Historical trends suggest that such achievements often coincide with increased market volatility and investor attention.

Shipments of refined petroleum products out of Russia declined by 6.6% in July from the previous month, Reuters estimates showed on Wednesday, as domestic demand rose and capacity under planned maintenance increased.

Port of Murmansk

Port of MurmanskRussian seaborne fuel exports fell to 8.67 million metric tons last month, with shipments from the Baltic ports, the Black Sea and Sea of Azov ports, and the Arctic Murmansk and Arkhangelsk ports all down in July compared to June.

Only the fuel shipments from the Far Eastern ports rose in July from a month earlier as most maintenance works at refineries in the area were completed, according to the data provided by industry sources and calculated by Reuters.

Going forward, Russia’s refined product shipments could fall further in August, while crude oil exports could rise, as several refineries sustained damages during Ukrainian drone strikes earlier this month.

A Sunday drone attack on the Saratov refinery, owned by Russia’s oil giant Rosneft, prompted the facility to halt the intake of crude oil, a source with knowledge of the matter told Bloomberg on Monday.

The Saratov Refinery in the Volga region has the capacity to process 140,000 barrels per day (bpd) of crude, but it has now been forced offline due to Ukrainian drone strikes.

The refinery has become the third Russian crude processing facility to have been damaged by Ukrainian drone strikes so far in August.

The halt to three major refineries would mean that Russia will see lower domestic gasoline and diesel supply while it will have more crude available for export as it doesn’t have too much storage for the unprocessed crude.

Last week, reports emerged that Russia is preparing to sharply increase crude oil exports this month after Ukrainian drone strikes disabled major refineries, prompting a shift toward western port shipments.

Crude shipments from Russia’s western ports could increase to 2 million bpd in August, about 200,000 bpd more than previously planned, sources told Reuters last week.

The cryptocurrency world is buzzing with news of a significant legal battle. The Justin Sun lawsuit has just been filed, seeing the prominent Tron founder take on a major media powerhouse, Bloomberg. This legal action centers on the alleged planned release of highly sensitive financial information, sparking widespread discussion about privacy in the digital asset space. What exactly is happening, and what does this mean for the crypto community?

Tron founder Justin Sun, a well-known figure in the blockchain industry, has initiated a legal challenge against Bloomberg. The core of this Justin Sun lawsuit stems from Bloomberg’s alleged intention to publish personal financial details belonging to Sun. According to a court filing, as cited by the X account “zoomer” (which boasts over 61,000 followers), this information is considered highly sensitive.This development immediately raises questions about the boundaries of financial reporting and individual privacy. It highlights the increasing tension between public interest in transparency and the right to keep personal financial dealings confidential, especially for high-profile individuals in the often-scrutinized crypto sector.

The concept of crypto privacy is a cornerstone for many in the digital asset space. While blockchain transactions are often public, the identities behind them are typically pseudonymous. However, when a major news outlet plans to reveal personal sensitive financial information, it touches upon fundamental concerns.

This case serves as a critical test for these principles within the evolving landscape of digital finance and media.

The Bloomberg lawsuit brings a significant media entity into the legal spotlight. Bloomberg is renowned globally for its financial news and data services. Their alleged intention to publish this information suggests they believe it falls within the realm of public interest or newsworthiness.Conversely, Justin Sun’s legal team is arguing that such a publication constitutes an unwarranted invasion of privacy. The legal battle will likely hinge on the definition of “sensitive financial information” and whether its public disclosure serves a legitimate public interest that outweighs an individual’s right to privacy. This clash of interests is a common theme in high-profile media disputes.

For the Tron founder, Justin Sun, this lawsuit is more than just a personal matter; it carries broader implications for his public image and the projects he leads, including Tron and BitTorrent. Such legal disputes can divert attention and resources, though they also underscore a commitment to protecting personal data.

Beyond Sun, this case could set precedents for how media outlets report on the financial dealings of prominent figures in the cryptocurrency space. It may also influence how individuals, particularly those with significant crypto holdings, manage their public and private financial profiles. The outcome of the Justin Sun lawsuit will be closely watched by many.

The debate surrounding sensitive financial information is particularly complex in the crypto world. While many advocate for decentralization and pseudonymity, there’s also a growing push for transparency, especially concerning large holders or projects. This lawsuit highlights the delicate balance that needs to be struck for crypto privacy.Users and project founders in the crypto space often face unique challenges in maintaining privacy while operating in a largely open ledger environment. This legal action serves as a stark reminder of the potential for personal financial data to become a point of contention, necessitating robust legal and personal strategies for protection.

As the Justin Sun lawsuit unfolds, legal proceedings will determine the fate of this sensitive financial information. The outcome will have significant ramifications, not just for Justin Sun and Bloomberg, but for the broader discussion around media freedom, individual privacy, and the evolving nature of financial reporting in the digital age.

We will continue to monitor this developing situation closely. The resolution of this Bloomberg lawsuit could shape future interactions between public figures in crypto and the media, impacting how personal financial data is handled and reported across the industry.

In summary, the legal action taken by Tron founder Justin Sun against Bloomberg over the publication of his sensitive financial information marks a pivotal moment. It underscores the ongoing tension between media transparency and individual privacy rights, especially within the cryptocurrency sector. The outcome of this case will undoubtedly influence future discussions and practices regarding financial data and public figures in crypto.

Frequently Asked Questions (FAQs)

Q1: Who is Justin Sun?A: Justin Sun is the founder of Tron, a prominent blockchain platform, and a well-known figure in the cryptocurrency industry.

Q2: What is Bloomberg accused of in the lawsuit?A: Bloomberg is accused by Justin Sun of planning to release his “sensitive financial information” without authorization.

Q3: Why is this Justin Sun lawsuit important for crypto privacy?A: This lawsuit highlights the ongoing debate about individual financial privacy versus media transparency in the cryptocurrency space, potentially setting precedents for how personal financial data of crypto figures is handled.

Q4: What is considered “sensitive financial information” in this context?A: While the exact details are part of the legal proceedings, it generally refers to personal financial data that, if disclosed, could lead to privacy breaches, security risks, or undue public scrutiny.

Q5: What could be the potential outcomes of the Bloomberg lawsuit?A: The lawsuit could result in an injunction preventing the publication of the information, a settlement, or a court ruling that defines the boundaries of media reporting on private financial data, impacting future cases involving public figures in crypto.

Donald Trump, from inside the White House, said Wednesday that he’s already trimmed his Fed chair shortlist down to “three or four” people. At the same time, the US Treasury confirmed 11 candidates will still go through formal interviews.

According to the Financial Times, those interviews will be led by Scott Bessent, who currently serves as Treasury Secretary. Trump also said he might announce a preferred successor before Jay Powell’s term ends in May 2026.

Trump didn’t name names during his statement, but three contenders keep coming up: Kevin Hassett, who runs the National Economic Council; Kevin Warsh, a former Fed governor; and Christopher Waller, who is currently sitting on the Fed board. Trump described them only as “great” candidates. Meanwhile, Scott is preparing to interview eight more names that few see as serious contenders.

Trump also went off on Powell again, calling him a “moron” and a “numbskull” during his Wednesday comments. He repeated that Powell’s refusal to cut interest rates has hurt the economy.

Trump said he plans to make a decision on Powell’s replacement “a little bit early” and wants interest rates slashed all the way down to 1%. The current rate stands between 4.25% and 4.5%.

The president blames Powell for stalling cuts that began in 2024, saying the trade war made things worse. Powell had argued back then that more cuts could lead to rising prices, especially with tariffs still hitting imports.

But July’s lower inflation reading and weak job numbers have brought new pressure. Trump’s administration, including Scott, now wants a 0.5 percentage point cut at the next Fed meeting in September.

Other names on the interview list include David Zervos, chief market strategist at Jefferies; Larry Lindsey, former Fed governor and ex-NEC chair; and Rick Rieder, BlackRock’s bond chief. Scott confirmed all three will be interviewed, but most believe they’re just there to fill the schedule.

Also on the list but not likely to get picked: Michelle Bowman, Philip Jefferson, Lorie Logan, James Bullard, and Marc Sumerlin. Michelle and Christopher wanted a 0.25% cut during last month’s vote, but their proposal didn’t pass.

Michelle’s experience is in banking supervision, not rate-setting. Philip has more of an economics background, but was nominated by Joe Biden, which hurts his chances under Trump.

Christopher and Michelle are now part of the president’s short-term focus, especially after the Fed held rates steady in July. Michelle supported a cut based on early labor signals. Christopher backed her, saying the weakness needed attention. But the rest of the committee voted to hold.

Then came the Labor Department’s revisions. Job growth in May and June was slashed, and July’s report came in worse than expected. Trump immediately accused the department of manipulating data and fired the commissioner responsible. Despite that, Scott and other officials used the data to argue the Fed now has a green light to cut faster.

James Bullard, former St. Louis Fed chief, told CNBC the Fed needs to act now. He pushed for a full 1% cut by mid-next year. Marc Sumerlin, a Bush-era adviser who had also been considered in 2017 before Powell got the job, is on the list again but has not made any public comments.

Austan Goolsbee, who runs the Chicago Fed, told a room in Springfield, Illinois, that the Fed is still trying to figure out what kind of impact tariffs are having. “These are going to be some live meetings as we go into the fall,” he told the Greater Springfield Chamber of Commerce. He added that “the hardest thing a central bank ever has to do is to get the timing right when there are moments of transition.”

Austan said he doesn’t trust the idea that tariffs will only raise prices temporarily. He’s waiting on new wholesale price data this week and broader inflation numbers next month before deciding whether to support a cut.

He also pushed back on panic over the weak July job print. Austan said the slowdown might have more to do with a sharp drop in immigration than actual labor market cracks. “I think the state of the labor market is pretty strong, pretty solid,” he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up