Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

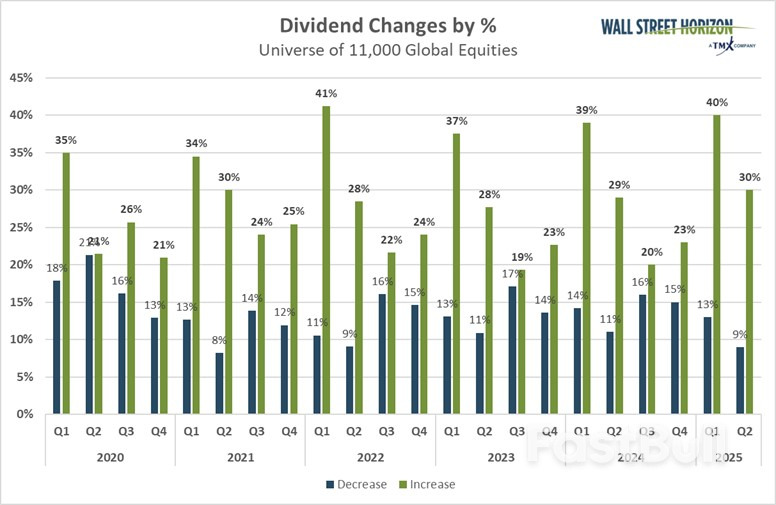

Despite macro uncertainty, 30% of global companies raised dividends in Q2, while only 9% cut them. Firms like Caterpillar and UnitedHealth signaled confidence with payout hikes despite ongoing challenges.

Daily Light Crude Oil Futures

Daily Light Crude Oil Futures

Daily Broadcom Inc

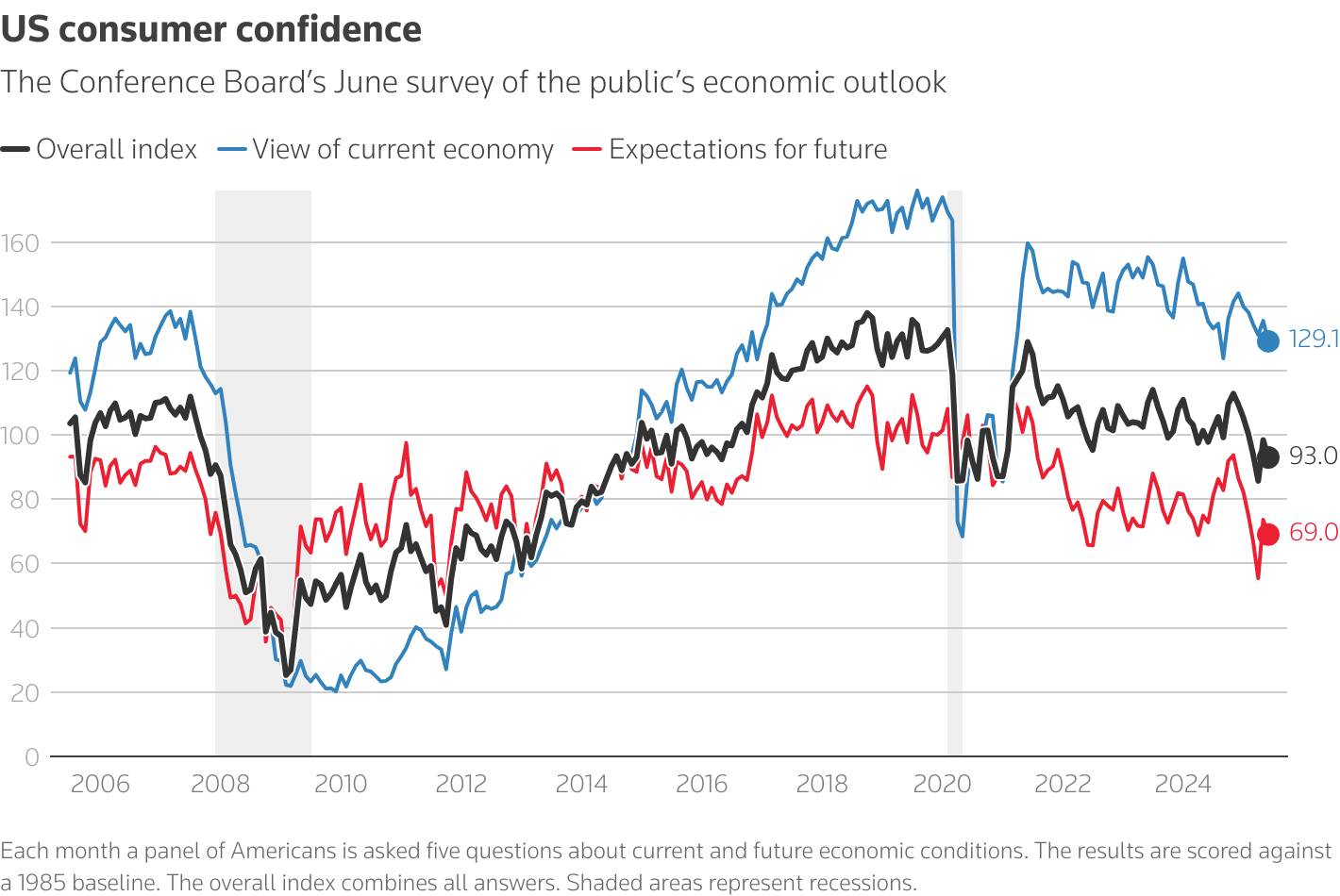

Daily Broadcom IncU.S. consumer confidence unexpectedly deteriorated in June as households increasingly worried about job availability, another indication that labor market conditions were softening against the backdrop of rising economic uncertainty because of the Trump administration's tariffs.

The ebb in confidence reported by the Conference Board on Tuesday was across all age cohorts and nearly all income groups. It was also across the political spectrum, with the largest decline among Republicans.

Consumers remained pre-occupied with the import duties and were mostly undecided on big-ticket purchases. There was a decline in the share expecting their incomes to increase, though perceptions of the current financial situation remained solid.

The share of consumers viewing jobs as plentiful was the smallest since March 2021, aligning with the continued elevation in the number of people collecting unemployment checks as well as a moderation in job growth.

"Worry over prices in tandem with a diminished share of consumers who expect their household incomes to increase over the next six months points to still-elevated household financial anxieties," said Tim Quinlan, a senior economist at Wells Fargo.

"Our forecast still calls for a stall in spending in the second half of this year. We have been making the case that what looks like resilience in retail spending in recent months may in fact be an indication of pulled-forward demand ahead of the full price impact of tariffs and that those outlays are apt to be curtailed in coming months."

The Conference Board's consumer confidence index dropped 5.4 points to 93.0 this month, erasing nearly half of the sharp gain in May. Economists polled by Reuters had forecast the index increasing to 100.0.

The cutoff date for the survey was June 18, before the U.S. joined in the fray between Israel and Iran, by bombing Tehran's nuclear facilities. Trump on Monday announced a ceasefire. The survey noted that "references to geopolitics and social unrest increased slightly from previous months but remained much lower on the list of topics affecting consumers' views."

The share of consumers who viewed jobs as being "plentiful" dropped to 29.2%, the lowest since March 2021, from 31.1% in May. Some 18.1% of consumers said jobs were "hard to get," down from 18.4% last month.

The survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, narrowed to a four-year low of 11.1 from 12.7 last month. This measure correlates to the unemployment rate in the Labor Department's monthly employment report.

Economists said that, combined with high numbers of people on unemployment benefits, raised the risk that the jobless rate could rise to 4.3% in June from 4.2% in May.

"Given the concurrent rise in continuing jobless claims, it looks increasingly likely that the unemployment rate will rise to 4.3% in next week's employment report," said Abiel Reinhart, an economist at JPMorgan.

This is a line chart that shows a consumer confidence index over the past 20 years. In the month of June, the overall index was 93.0, the view of the current economy was 129.1 and expectations for the future were 69.0.

Though consumers' one-year inflation expectations decreased to 6.0% from 6.4% in May, the share expecting interest rates to rise was the highest since October 2023.

Federal Reserve Chair Jerome Powell told lawmakers on Tuesday the U.S. central bank needed more time to gauge if tariffs pushed up inflation before considering lowering rates. The Fed last week left its benchmark overnight interest rate in the 4.25%-4.50% range where it has been since December.

Stocks on Wall Street traded higher. The dollar fell against a basket of currencies. U.S. Treasury yields were lower.

While consumers were unsure about big-ticket purchases over the next six months, they were less inclined to spend more on services, though spending intentions for dining out, motor vehicle services, visits to museums and historic sites as well as fitness activities rose.

Vacation plans were unchanged, though more consumers planned to travel abroad. Plans to travel within the United States fell. Fewer consumers intended to buy a home, likely because of higher mortgage rates, which have combined with still-high house prices to reduce affordability.

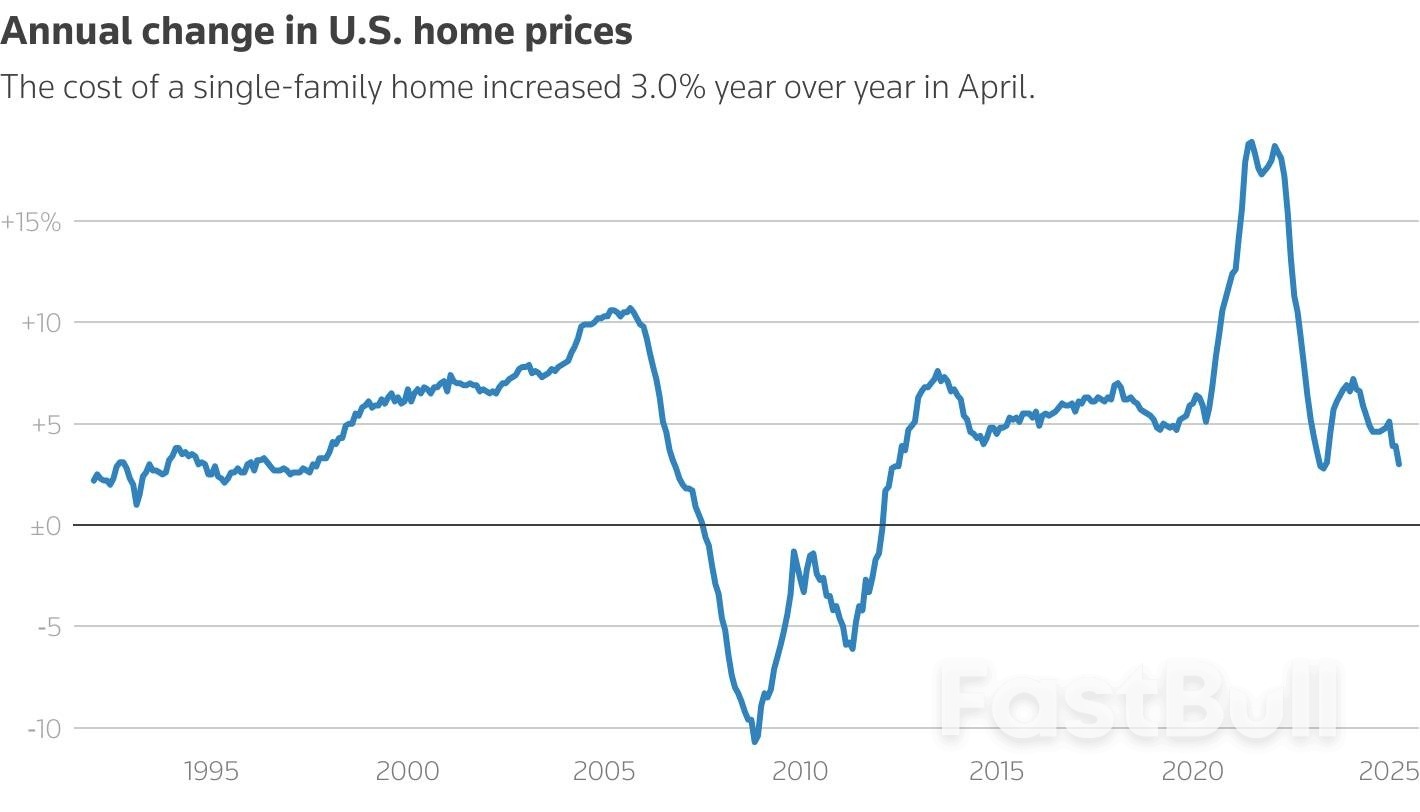

But house price inflation is slowing as weak demand boosts the supply of unsold homes on the market.

A separate report from the Federal Housing Finance Agency showed single-family house prices fell 0.4% in April, the first decline since August 2022, after being unchanged in March.

That lowered the annual increase to 3.0% in April, the smallest rise since May 2023, from 3.9% in March. Economists do not expect an outright decline in house prices at a national level, though some individual markets could see sharp decreases.

"While the supply of homes for sale has increased, the housing market continues to suffer from a shortage of supply," said Bernard Yaros, lead U.S. economist at Oxford Economics.

"However, some regions, mainly those that saw the biggest run-up in prices around the pandemic, may be at risk of a period of negative price growth, something already occurring in parts of Florida."

New York Fed President John Williams said Tuesday that maintaining a modestly restrictive monetary policy stance is "entirely appropriate" given current economic conditions.

Speaking at the NY CREATES Albany NanoTech Complex in Albany, New York, Williams emphasized that keeping the federal funds rate at its current level of 4.25% to 4.5% allows time for policymakers to analyze incoming data and evaluate risks.

Williams’ position contrasts with some other Fed governors who have suggested a potential rate cut in July might be appropriate. However, his comments align with Fed Chairman Jerome Powell, who on Tuesday signaled patience on rate cuts amid economic stability.

"Given the continued uncertainty, the solid labor market, and inflation still above our 2 percent goal, the FOMC decided at its meeting last week to leave the target range for the federal funds rate unchanged," Williams said in his speech.

He noted that the Fed continues to reduce its holdings of Treasury securities and agency debt and mortgage-backed securities, adding that "despite market volatility related to trade policy and other developments, that process continues to go very smoothly."

Williams pointed to mixed economic signals, with survey data showing pessimism and uncertainty about the economic outlook, while hard economic data indicates the U.S. economy "remains in a good place."

In his outlook, Williams expects real GDP growth to slow to just over 1% this year, with unemployment rising to around 4.5% by year-end. He projects inflation will increase to around 3% in 2025 due to tariffs, before gradually declining to 2% over the following two years.

The New York Fed president also highlighted findings from a recent survey showing that about three-quarters of manufacturers and service firms in New York and New Jersey have passed along at least some tariff-related cost increases to customers.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up