Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

More details are emerging about President Trump's latest show of force in Latin America aimed at narco-terrorist cartels fueling America's drug crisis, which claims 100,000 lives a year.

More details are emerging about President Trump's latest show of force in Latin America aimed at narco-terrorist cartels fueling America's drug crisis, which claims 100,000 lives a year. According to Reuters, three Aegis destroyers, surveillance aircraft, and an attack submarine are being deployed to international waters off Venezuela.

Sources close to the media outlet say 4,000 sailors and Marines will support the large force projection mission that includes three U.S. Aegis guided-missile destroyers (USS Gravely, USS Jason Dunham, and USS Sampson), along with P-8 surveillance planes, other warships, and at least one attack submarine.

The operation will run for several months and focus on enhancing hemispheric defense to dismantle narco-terrorist cartels' command and control nodes that funnel drugs into the U.S. Also, this force projection is a signal to Beijing to limit Chinese activity in the region, particularly around critical infrastructure and trade chokepoints. The Trump administration has put Mexico's Sinaloa Cartel and Venezuela's Tren de Aragua on notice, classifying them as foreign terrorist organizations. The broader understanding is that this is all a part of hemispheric defense.

Source: Heritage Foundation

Source: Heritage FoundationThe deployment also signals to Venezuelan President Nicolas Maduro's government that Washington is not playing around. Maduro told the nation on Monday that his country will "defend our seas, our skies and our lands." He hinted at what he called "the outlandish, bizarre threat of a declining empire."

On Tuesday, Mao Ning, a spokeswoman for the Chinese Foreign Ministry, said combating drugs is a shared responsibility around the world: "But we hope that major countries should play the role responsibly, maintain regional peace and stability, and properly handle the issue together with relevant countries."

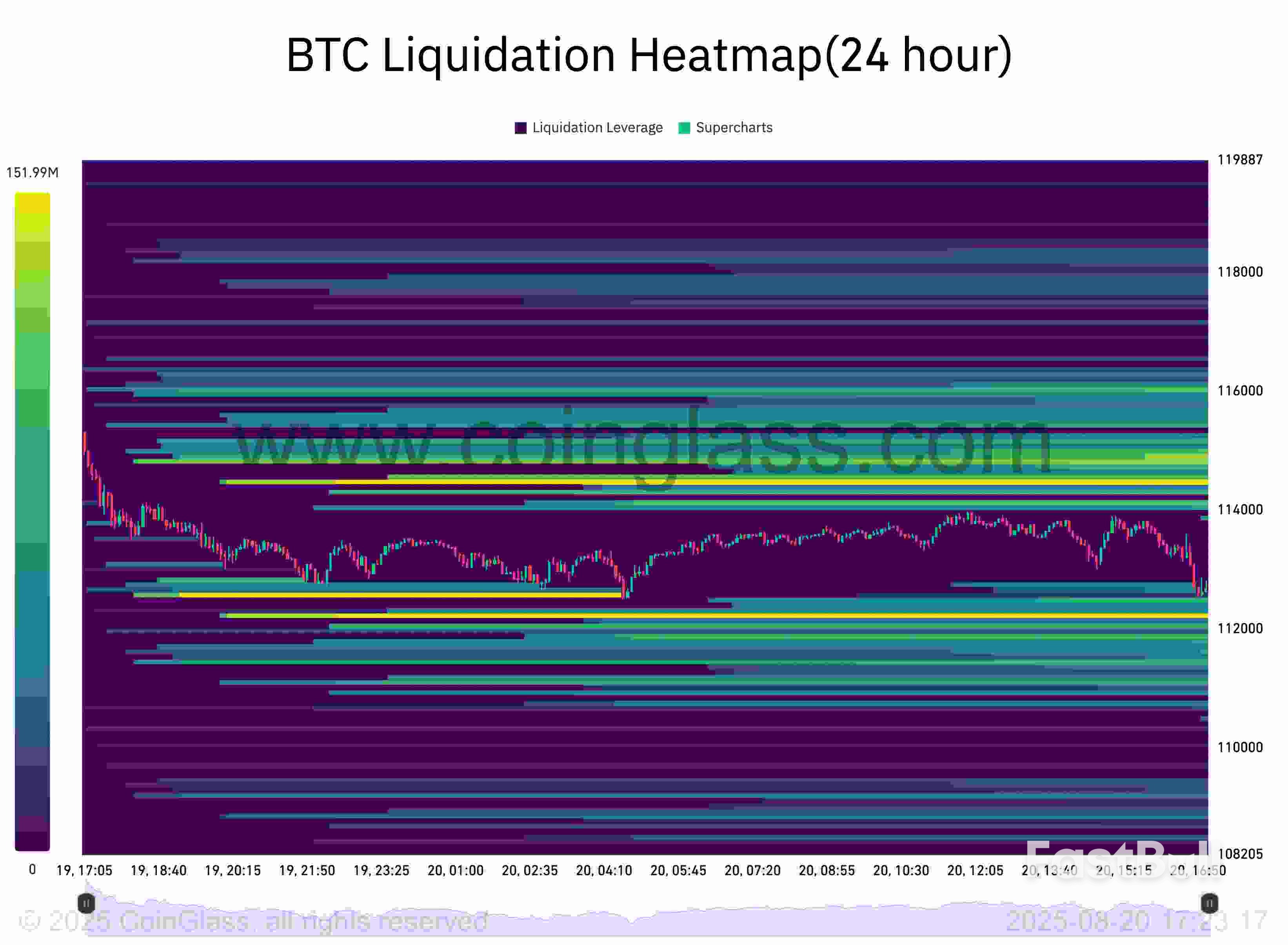

BTC liquidation heatmap. Source: CoinGlass

BTC liquidation heatmap. Source: CoinGlass BTC/USDT order book liquidity with whale volume data. Source: Keith Alan/X

BTC/USDT order book liquidity with whale volume data. Source: Keith Alan/X Total altcoin market cap one-day chart. Source: Cointelegraph/TradingView

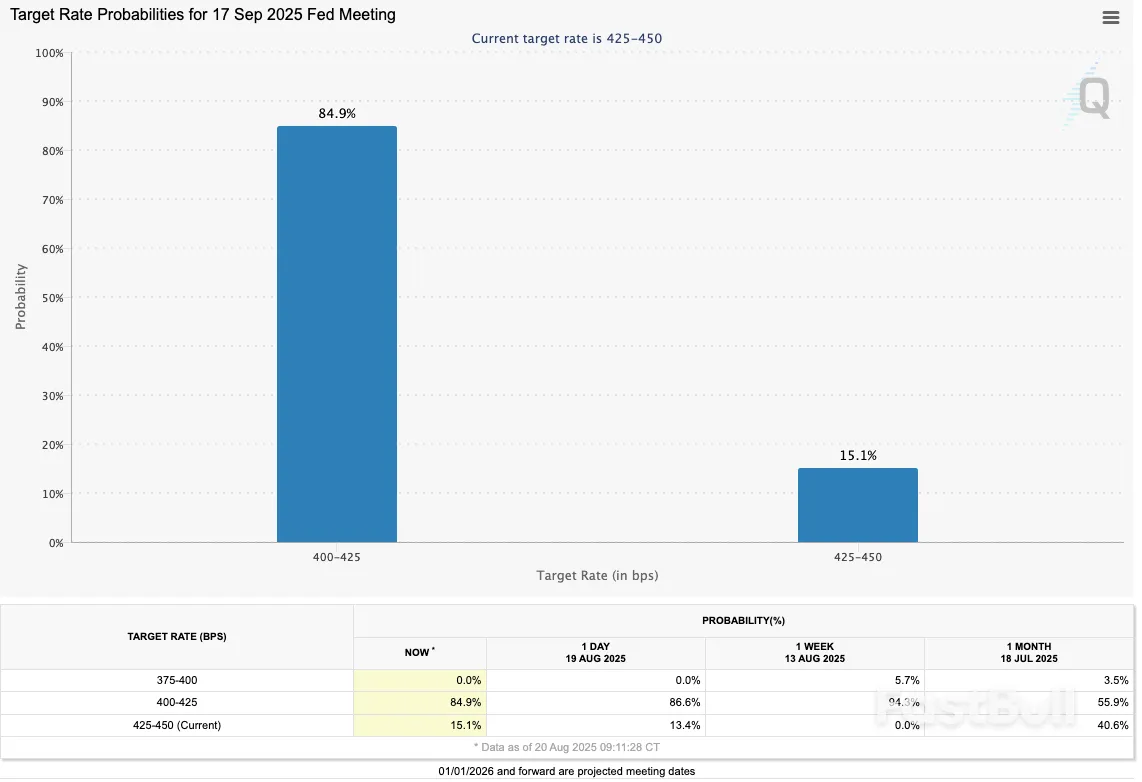

Total altcoin market cap one-day chart. Source: Cointelegraph/TradingView Fed target rate probabilities for September FOMC meeting (screenshot). Source: CME Group FedWatch Tool

Fed target rate probabilities for September FOMC meeting (screenshot). Source: CME Group FedWatch Tool Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price ChartKey Points:

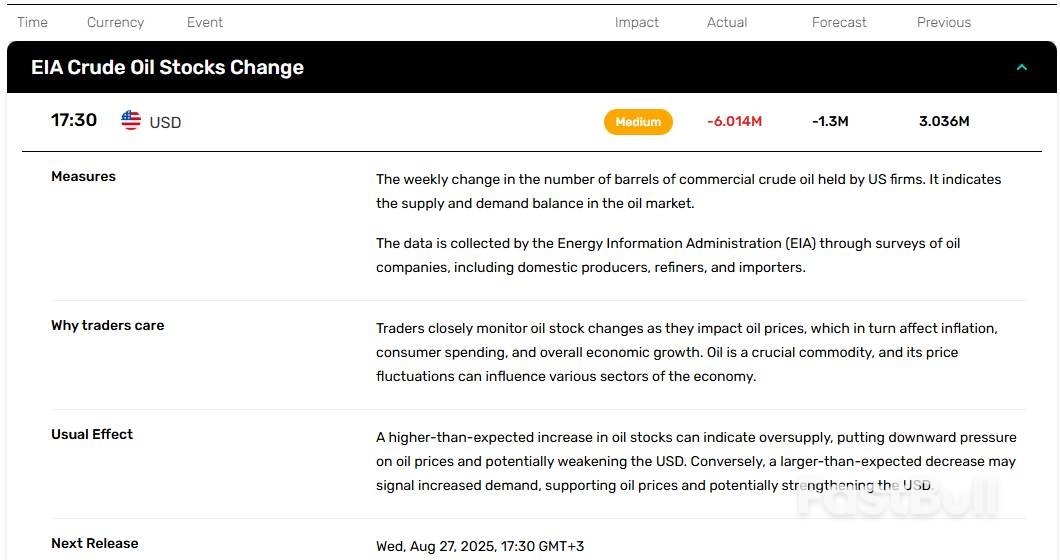

On August 20, 2025, EIA released its Weekly Petroleum Status Report. The report indicated that crude inventories decreased by -6 million barrels from the previous week, compared to analyst consensus of -1.3 million barrels. At current levels, crude inventories are about 6% below the five-year average for this time of the year.

Gasoline inventories declined by -2.7 million barrels, compared to analyst forecast of -0.8 million barrels. Distillate fuel inventories increased by +2.3 million barrels from the previous week.

Crude oil imports declined by 423,000 bpd, averaging 6.5 million bpd. Over the past four weeks, crude oil imports averaged 6.4 million bpd.

Strategic Petroleum Reserve increased from 403.2 million barrels to 403.4 million barrels. The SPR continues to grow at a slow pace.

Domestic oil production increased from 13.327 million bpd to 13.382 million bpd. From a big picture point of view, domestic oil production stabilized after recent pullback.

WTI oil was mostly flat after the release of the EIA report. Currently, WTI oil is trying to settle above the $62.50 level.

Brent oil made an attempt to settle above the $66.50 level as traders reacted to the report. Falling crude inventories may provide some support to oil markets, although traders remain worried about oversupply due to rising production from OPEC+ countries.

President Donald Trump on Wednesday demanded that Federal Reserve Governor Lisa Cook resign after a U.S. housing agency chief called on the Department of Justice to launch a criminal mortgage fraud investigation into the central bank official.

"Cook must resign, now!!!" Trump wrote in a Truth Social post that linked to a Bloomberg report on the allegations that Bill Pulte, director of the Federal Housing Finance Agency, has lodged against Cook.

The Fed declined CNBC's request for comment on Pulte's claims and Trump's reaction.

It's the latest example of the Trump administration airing allegations of mortgage-related wrongdoing against the president's opponents. The Justice Department is investigating Sen. Adam Schiff, D-Calif., and New York Attorney General Letitia James on similar grounds.

The remarks also show Trump expanding his attacks on the Fed beyond its chairman, Jerome Powell, as he pressures the central bank to slash interest rates.

Cook, who was nominated by former President Joe Biden in 2022, voted with the majority on the Federal Open Market Committee to keep rates unchanged after the group's latest meeting last month.

Pulte, an aggressive critic of Powell, wrote in the letter dated Aug. 15 that mortgage documents obtained by FHFA appear to show Cook "falsified bank documents and property records to acquire more favorable loan terms, potentially committing mortgage fraud."

He accused Cook of "falsifying residence statuses" for a residence in Ann Arbor, Michigan, and a property in Atlanta, Georgia "in order to potentially secure lower interest rates and more favorable loan terms."

For both properties, Cook "appears to have acquired mortgages that do not meet certain lending requirements and could have received favorable loan terms under fraudulent circumstances," Pulte alleged.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up