Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The figures are reported on a so-called net basis, the agency said, meaning they factor in “repayments made to importers as part of existing relief programs or remission orders.”

“Financial assets are America’s greatest export” is something you’ve probably heard me say repeatedly on the podcast and in previous writings. It’s obviously a simplistic framework — there’s a difference between exporting tennis rackets to Germany or whatever, versus selling them your debt, but it does say something important about what everyone is getting out of the relationship. America in effect produces debt, which other countries buy. In return, those countries get yield (returns) and dollars. America, meanwhile, gets a source of cheap and abundant funding plus the greenback’s special position in the financial system.

Now, you can argue whether that dollar dynamic has been a net negative or a net benefit for America over time. That’s not the focus of this piece (if it was, this newsletter would be a lot longer). What’s important now is that the Trump administration looks to be increasingly on the side of “net negative” and is more and more willing to treat US securities as tariffable goods. What’s weird is, in this case, the US is basically tariffing its own exports to make them less attractive to international buyers.

Yesterday, Wall Street woke up to Section 899 in the “One Big Beautiful” tax bill currently working its way through the Senate. The new tax code would introduce retaliatory taxes on foreign investors from countries who impose “unfair” taxes on US businesses. The definition of unfair is clearly open to interpretation, but awareness of Section 899 was enough to spook markets after George Saravelos at Deutsche Bank (and Odd Lots guest) pointed out that there was something else to worry about aside from the usual trade wranglings.

Here’s George in the note that set off alarm bells:

What does Section 899 imply for foreign buyers of Treasuries specifically? It potentially suspends the foreign government (i.e. central bank) exception put in place by Ronald Reagan, of all people. Put simply, as George does in his note, the result of this change could be that “the de facto yield on US Treasuries would drop by nearly 100 basis points.” Buyers of US government bonds would ostensibly be less incentivized to buy American debt, since they’ll get lower returns, at a time when the US government arguably really needs them to keep doing so.

Fast forward to this Friday, and some analysts are playing down the whole Section 899 saga. In the case of Treasuries specifically, they point to carve-outs under the existing Portfolio Interest Exemption (PIE), which, under certain circumstances, exempts bonds where the foreign investor owns less than 10% of the voting power of the issuer. That would probably mean trillions of dollars in both US Treasuries and corporate debt held by foreign investors could escape the tax, and may be why the Joint Committee on Tax has estimated that Section 899 will only increase revenue by about $116 billion over a decade.

All of which raises the question of why bother with Section 899 in the first place if you’re only going to simultaneously exempt a majority of US bond holdings? As Michael McNair put it yesterday: “Congress wouldn’t draft a ‘retaliatory surtax’ that raises only a few billion unless they expected the portfolio interest base to re-enter the tax net.” Section 899 only really makes sense, he argues, if PIE is simultaneously repealed.

So now, investors around the world are once again left to decide for themselves how serious the administration is about all of this, and whether it will reverse course in the event that investors push back. For all the inconsistencies in some of the administration’s policies, you could argue that Trump’s love of tariffs, his hatred of imports, and his ambivalence towards exports, are proving to be some of his most consistent positions. And for all the back and forth on a potential Mar-a-Lago Accord aimed at depreciating the dollar, Section 899 sounds a lot like Stephen Miran’s suggestion in his 2024 paper of imposing “user fees” on Treasuries. (Miran recently downplayed the paper, describing it as “a zombie that I just haven’t been able to kill”).

And so, you have analysts like Matt King at Satori Insights arguing that investors shouldn’t get too bogged down in the details of Section 899. The key, he argues, is to figure out just how serious Trump is when it comes to clamping down on foreign capital, and how much pain or criticism he’s willing to stomach in order to do it.

Trump came out swinging early (as we detailed below) and has now followed up with an upper cut as Bloomberg reports, the Trump administration plans to broaden restrictions on China’s tech sector with new regulations to capture subsidiaries of companies under US curbs.

Officials are drafting a rule that would impose US government licensing requirements on transactions with companies that are majority-owned by already-sanctioned firms, according to people familiar with the matter.

The subsidiary rule — which applies a 50% ownership threshold in relation to companies on the Entity List, Military End-User list and Specially Designated Nationals list — could be unveiled as soon as June, said the people, who asked not to be named to discuss private deliberations.

The people emphasized that the contents and timing of the rule and related sanctions are not yet finalized and could still change.

After the rule is published, the US is likely to move forward with new sanctions on major Chinese companies, the people said.

So trade policy uncertainty is about to skyrocket again

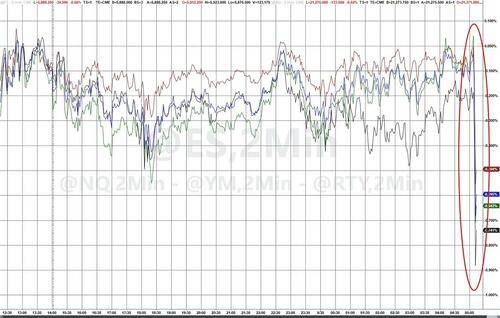

The reaction in stocks was immediate... and lower...

NVDA has erased all of its post-earnings gains

Following earlier comments by TsySec Bessent that trade talks with China had "stalled", President Trump took to social media to explain his position:

Two weeks ago China was in grave economic danger!

The very high Tariffs I set made it virtually impossible for China to TRADE into the United States marketplace which is, by far, number one in the World.

We went, in effect, COLD TURKEY with China, and it was devastating for them.

Many factories closed and there was, to put it mildly, "civil unrest."

I saw what was happening and didn’t like it, for them, not for us. I made a FAST DEAL with China in order to save them from what I thought was going to be a very bad situation, and I didn’t want to see that happen.

Because of this deal, everything quickly stabilized and China got back to business as usual.

Everybody was happy! That is the good news!!!

The bad news is that China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!

The reaction was swift - US equity futures dumped...

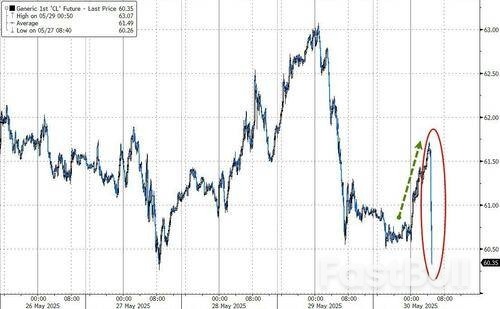

And crude crashed...

Source: Roman/X

Source: Roman/X

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: Glassnode

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: GlassnodeHOUSTON, May 30 (Reuters) - Oil prices fell on Friday and headed for a second consecutive weekly loss, as investors weigh a potentially larger OPEC+ output hike for July, and uncertainty spreads around U.S. tariff policy after the latest courtroom twist.

Brent crude futures fell by 21 cents, or 0.33%, to $63.94 a barrel by 1451 GMT. U.S. West Texas Intermediate crude fell by 34 cents, or 0.56%, to $60.60 a barrel.

The Brent July futures contract is due to expire on Friday. The more liquid August contract was trading 43 cents lower, or 0.71%, at $59.77 a barrel.

At these levels, the front-month benchmark contracts were headed for weekly losses over 1%.

Price moves dipped into negative territory after Reuters reported that OPEC+ may discuss an increase in July output larger than the 411,000 barrels per day (bpd) that the group had made for May and June.

"The oil price would probably only come under greater pressure if the oil-producing countries were to increase their production even more than in previous months or give indications that there will be similarly high production increases in the following months," Commerzbank analysts said earlier on Friday in a note, published before the news.

Senior Analyst Phil Flynn with Price Futures Group said an online post on Truth Social by U.S. President Donald Trump that seemed to threaten more changes in tariff levels for Chinese imports also put pressure on crude prices.

"Trump's Truth Social message on China failing to observe a truce on tariffs also combined with the Reuters headline to push prices down," Flynn said.

The potential OPEC+ output hike comes as the global surplus has widened to 2.2 million bpd, likely necessitating a price adjustment to prompt a supply-side response and restore balance, said JPMorgan analysts in a note, adding that they expect prices to remain within the current range before easing into the high $50s by year-end.

Trump's tariffs were expected to remain in effect after a federal appeals court temporarily reinstated them on Thursday, reversing a trade court's decision a day earlier to put an immediate block on the sweeping duties.

Oil prices were down more than 1% on Thursday.

Oil prices have lost more than 10% since Trump announced his "Liberation Day" tariffs on April 2.

Also pressuring prices, U.S. consumer spending slowed in April, according to data published on Friday.

Federal Reserve policymakers wary of cutting interest rates in the face of President Donald Trump's aggressive tariffs will likely stick to their wait-and-see stance amid fresh data Friday showing muted inflation last month and evidence of increased consumer caution.

April's 2.1% year-over year increase in the Personal Consumption Expenditure price index, down from 2.3% in March, puts inflation within a stone's throw of the Fed's 2% target.But analysts don't see that trend continuing, with businesses expected to pass on to consumers at least some of their rising costs from higher import levies. Already goods prices are firming, the report showed.

"The Fed will welcome the favorable inflation reading in this report, but they are likely to interpret it as the calm before the storm," said Olu Sonola, who heads U.S. economic research at Fitch Ratings. The central bank will continue to wait for the storm, unless consumer spending buckles and the unemployment rate rises rapidly, Sonula added.

Consumer spending growth slowed to 0.2% last month, the Commerce Department also said on Friday, and the personal saving rate jumped to 4.9% from 4.3%. Analysts saw both as signs of renewed consumer caution amid uncertainty over tariff policy that continues to change on a near-daily basis.

For the Fed, wrote III Capital Management's Karim Basta, there's "nothing to do but wait."

The Fed has kept short-term borrowing costs in the 4.25%-4.50% range since last December. Since their last meeting, in May, policymakers have repeatedly voiced concerns that tariffs could reverse progress on inflation.

"As long as inflation is printing above target and there's some uncertainty about how quickly it can come back down to 2%, well, then inflation is going to be my focus because the labor market's in solid shape," San Francisco Fed President Mary Daly told Reuters late Thursday, adding that rates need to stay moderately restrictive to keep that pressure on prices.

Dallas Fed President Lorie Logan late Thursday similarly said it could be "quite some time" before it's clear if Trump's policies pose bigger risks to employment or to inflation; for now, she said, the risks are in rough balance, leaving the Fed on hold.

Traders after the data continued to bet that by September the Fed will begin cutting rates gradually, bringing the policy rate down to 3.75%-4.0% by year's end.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up