Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Switzerland is continuing discussions with the United States about reducing potentially crippling import duties, its government said on Friday, as the country's gold industry warned exports of gold bars to the U.S. could be severely impacted by a 39% tariff.

Switzerland is continuing discussions with the United States about reducing potentially crippling import duties, its government said on Friday, as the country's gold industry warned exports of gold bars to the U.S. could be severely impacted by a 39% tariff.

The tariff talks in Washington are being led by Helene Budliger Artieda, head of the State Secretariat for Economic Affairs (SECO), and come after the import levy - among the highest of any applied under President Donald Trump's global trade reset - took effect on Thursday.

A last-ditch Swiss trip led by President Karin Keller-Sutter failed to produce a better deal.

"Discussions with the United States are ongoing," SECO said in a statement to Reuters on Friday. "The discussions have consistently focused on reducing the additional U.S. tariffs."

SECO said it would give no further details on the talks, which could include further concessions Switzerland may offer the U.S. in return for lower tariffs.

No discussions were scheduled for Friday, although they are due to continue next week on a technical level, a Swiss source said, without giving further details.

The Swiss precious metals association on Friday said it was concerned about an increase in tariffs on gold exports to the United States to 39%.

Gold bars of 1 kg and 100 oz were previously exempt from U.S. tariffs, but country-specific tariffs may now apply.

Switzerland is the world's largest gold refining centre, with up to 70% of gold produced annually worldwide melted down and processed at the five refineries in the country.

The country imports gold bars and resizes them for the U.S. market. Switzerland exported gold bars worth 7.86 billion Swiss francs ($9.7 billion) to the U.S. last year, according to customs data.

"We are particularly concerned about the implications of the tariffs for the gold industry and the physical exchange of gold with the U.S., a long-standing and historical partner for Switzerland," said Christoph Wild, president of the Swiss Association of Manufacturers and Traders in Precious Metals.

"With a tariff of 39%, exports of gold bars will definitely be stopped to the U.S.," Wild told Reuters.

Economist Hans Gersbach, from the KOF Economic Institute at ETH, a university in Zurich, estimated that 7,500 to 15,000 jobs could be lost in Switzerland as a result of the U.S. tariffs.

"The effect will be severe in some industries like watches, machinery and precision instruments," Gersbach said.

"If pharma was also targeted, the figure would be higher," he added, although no figure has yet been calculated.

Washington and Moscow are aiming to reach a deal to halt the war in Ukraine that would lock in Russia’s occupation of territory seized during its military invasion, according to people familiar with the matter.

US and Russian officials are working toward an agreement on territories for a planned summit meeting between Presidents Donald Trump and Vladimir Putin as early as next week, the people said, speaking on condition of anonymity to discuss private deliberations. The US is working to get buy-in from Ukraine and its European allies on the deal, which is far from certain, the people said.

Putin is demanding that Ukraine cede its entire eastern Donbas area to Russia as well as Crimea, which his forces illegally annexed in 2014. That would require Ukrainian President Volodymyr Zelenskiy to order a withdrawal of troops from parts of the Luhansk and Donetsk regions still held by Kyiv, handing Russia a victory that its army couldn’t achieve militarily since the start of the full-scale invasion in February 2022.

Such an outcome would represent a major win for Putin, who has long sought direct negotiations with the US on terms for ending the war that he started, sidelining Ukraine and its European allies. Zelenskiy risks being presented with a take-it-or-leave-it deal to accept the loss of Ukrainian territory, while Europe fears it would be left to monitor a ceasefire as Putin rebuilds his forces.

Russia would halt its offensive in the Kherson and Zaporizhzhia regions of Ukraine along the current battlelines as part of the deal, the people said. They cautioned that the terms and plans of the accord were still in flux and could still change.

It’s unclear if Moscow is prepared to give up any land that it currently occupies, which includes the Zaporizhzhia nuclear power plant, the largest in Europe.

The White House didn’t reply to a request to comment. Kremlin spokesman Dmitry Peskov didn’t immediately respond to a request to comment.

Ukraine declined to comment on the proposals.

The agreement aims essentially to freeze the war and pave the way for a ceasefire and technical talks on a definitive peace settlement, the people said. The US had earlier been pushing for Russia to agree first to an unconditional ceasefire to create space for negotiations on ending the war that’s now in its fourth year.

Having returned to the White House in January on a pledge to rapidly resolve Europe’s worst conflict since World War II, Trump has expressed increasing frustration with Putin’s refusal to agree to a ceasefire. The two leaders held six phone calls since February and Trump’s envoy Steve Witkoff met with Putin five times in Russia to try to broker an agreement.

SEVENOAKS, England, Aug 8 (Reuters) - Britain and the United States may disagree about how to address the crisis in Gaza but they share common goals in the region, U.S. Vice President JD Vance said at the start of a meeting with British Foreign Secretary David Lammy in southern England.

Vance, who has previously criticised Britain and its governing Labour Party, landed with his wife Usha and their three children in London before heading to Chevening, the large, red-brick country residence used by the British foreign minister.

Appearing before reporters and TV cameras, the two leaders exuded plenty of bonhomie, with Lammy recommending Vance enjoy a coastal walk in Kent and the vice president professing his "love" for Britain.

Asked about Britain's plan to recognise Palestine, Vance said the U.S. and Britain had a common goal to resolve the crisis in the Middle East, adding: "We may have some disagreements about how exactly to accomplish that goal, and we'll talk about that today."

Vance also reiterated that the U.S. had no plans to recognise a Palestinian state, saying he didn't know what recognition actually meant, "given the lack of a functional government there."

Britain, by contrast, has taken a harder stance against Israel, declaring its intention to recognise Palestine along with France and Canada to put pressure on Israeli leader Benjamin Netanyahu over the continuing conflict and humanitarian crisis in Gaza.

Earlier on Friday, Vance and Lammy also went fishing in the lake behind Chevening House, appearing relaxed in blue button-down shirts and sharing a laugh.

Vance joked to reporters that the "one strain on the special relationship" between Britain and the U.S. was that all his children had caught fish but that the British foreign minister had not.

"Before beginning our bilateral, the Vice President gave me fishing tips, Kentucky style," Lammy said in a post on X.

After spending two nights in Chevening's bucolic surroundings with Lammy, the Vances will travel to the Cotswolds, a picturesque area of English countryside and a popular retreat for wealthy and influential figures, from footballers and film stars to media and political figures.

The visit comes amid heightened transatlantic tensions, domestic political shifts in both countries and increased attention on Vance's foreign policy views as he emerges as a key figure in President Donald Trump’s administration.

A source familiar with the planning described the trip as a working visit that will include several official engagements, meetings and visits to cultural sites. Vance is also expected to meet with U.S. troops.

Vance and Lammy will also discuss the war in Ukraine, the pair told reporters.

Close to Chevening House, a small group of protesters had gathered, some waving Palestinian flags and one holding up a sign showing a meme of a bald Vance.

US President Donald Trump signed an executive order on Thursday, aimed at eliminating practices by banks and their regulators that result in certain customers being denied access to financial services for ideological reasons.The order directs federal banking regulators to remove reputational risk standards from their guidance and training materials, and identify financial institutions that engaged in unlawful “debanking” in the past, the White House said in a fact sheet published after the signing.

Federal authorities are also directed to impose fines or take other remedial measures they deem appropriate on institutions that are found to have had such policies.And regulators will also be required to review complaint data, and refer instances of unlawful debanking based on religion, to the US Justice Department. Financial institutions under the jurisdiction of the Small Business Administration, will also be required to make reasonable efforts to reinstate clients who were unlawfully denied services.

“President Trump believes that no American should be denied access to financial services because of their political or religious beliefs, and that banking decisions must solely be made on the basis of individualised, objective, and risk-based analyses,” the White House said.Some of the nation’s biggest banks have been accused by the Trump administration of shutting customer accounts for political or religious reasons. And many conservatives have complained that major Wall Street firms have debanked gunmakers, fossil-fuel companies, religious groups, and cryptocurrency firms.

Trump signed the order alongside an action designed to increase access to alternative assets such as private equity, real estate and cryptocurrency in retirement accounts Thursday afternoon, at the White House. Details of the debanking executive order were reported earlier by Fox Business.Trump earlier this week said banks had discriminated against him in the past. JPMorgan Chase & Co had asked him to close accounts he held for decades within 20 days, and Bank of America Corp declined his attempt to deposit more than US$1 billion (RM4.23 billion), he said in a CNBC interview. Regulators in the Biden administration had been ordered to “destroy Trump,” the president said.

Both JPMorgan and Bank of America have denied rejecting business on ideological grounds.The executive order requires the lenders to examine their processes for deciding whether to close accounts, and asks regulators to remove references to so-called “reputational risk” posed by customers — a practice banks have said led to decisions not to deal with certain customers or industries.

Bank of America, the second-largest US bank, had restricted lending to companies that make assault-style guns used for non-military purposes, following shootings at a high school in Florida in 2018. Citigroup Inc also announced its own set of restrictions for clients selling guns that year.Bank of America went on to loosen its gun restrictions and made similar changes to its energy-lending policies, including dropping a blanket ban on financing for Arctic drilling. Then in June, Citigroup ended a seven-year policy that placed restrictions on firearms sales by its retail sector clients, citing recent legislative developments, and concerns over access to banking services.

Bills have been reintroduced in Congress this year, that would prohibit banks from accessing certain lending programmes if they deny “fair access” to their services. The “Fair Access to Banking Act” has gained support from groups in the firearms industry.

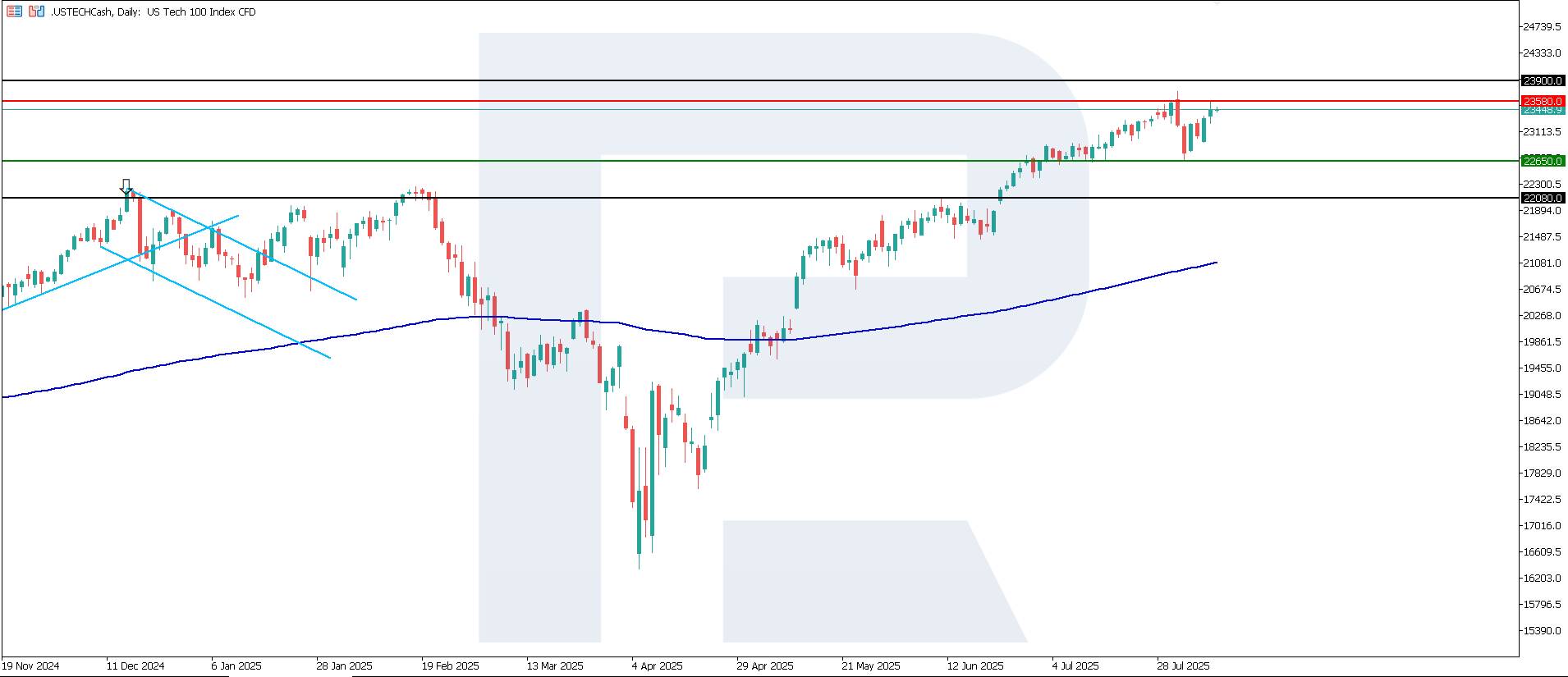

The US Tech stock index remains in a strong uptrend and is set to reach new all-time highs. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

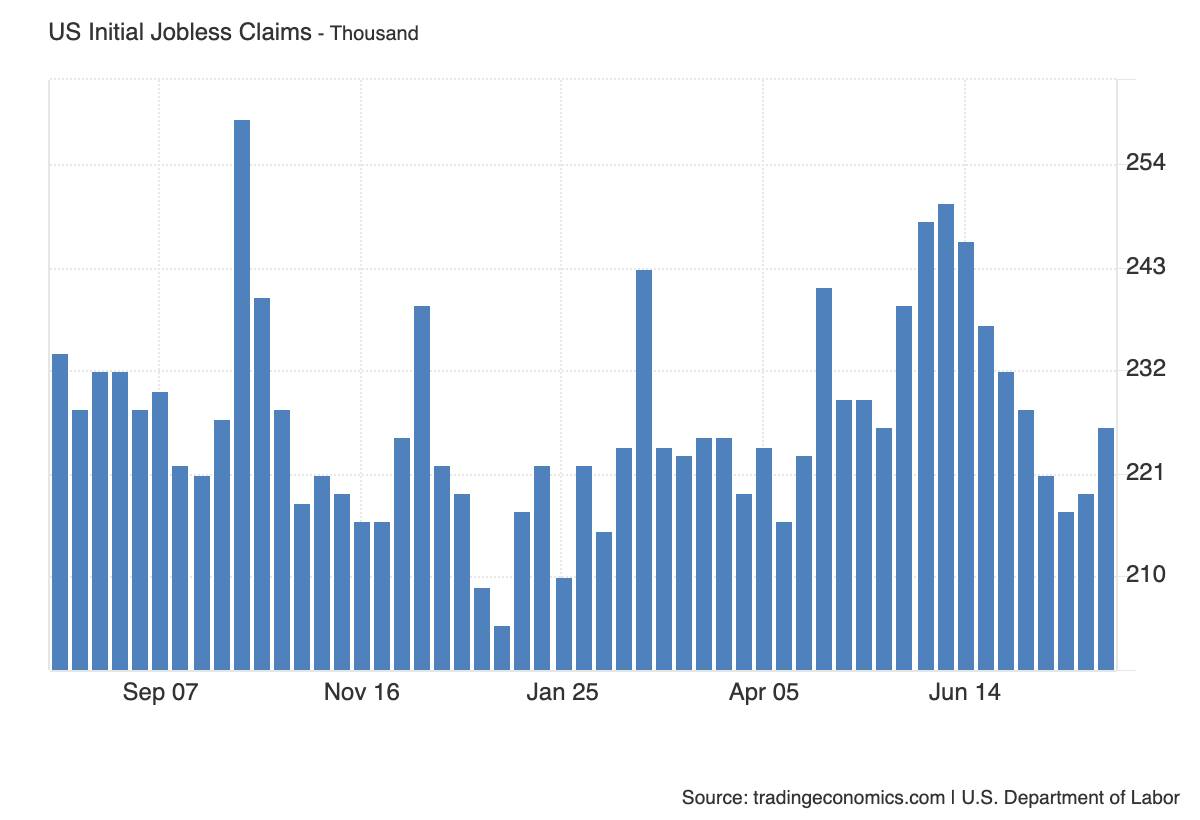

As of 7 August 2025, US initial jobless claims totalled 226 thousand, above the forecast of 221 thousand and the previous reading of 219 thousand. The stock market may react negatively, as rising claims are often seen as a sign of an economic slowdown and potential risks to corporate earnings. The financial and industrial sectors are likely to be hit the hardest.

However, the technology sector (US Tech) could see a moderately positive boost. A rise in unemployment may heighten expectations of Federal Reserve policy easing, which benefits growth stocks, particularly tech companies with high debt levels and interest rate sensitivity. Nevertheless, if unemployment continues to rise, it could lead to weaker consumer demand and investment activity, negatively affecting IT companies.

The increase in jobless claims could support the US technology sector in the short term due to falling bond yields and expectations of a softer Fed policy. However, prolonged deterioration in the labour market could weigh on corporate revenues, especially in consumer and advertising segments. The market’s reaction will depend on whether this data is seen as a one-off deviation or the start of a new phase of economic weakness.

The US Tech fell below the previous support level of 23,260.0, forming new resistance at 23,580.0 and nearest support around 22,650.0. The index is moving within a corrective downward channel, which will likely remain short-term, with the nearest downside target at 22,905.0.

The following scenarios are considered for the US Tech price forecast:

The rise in US initial jobless claims to 226 thousand (above forecast and previous reading) has a mixed but potentially positive impact on the US Tech index, particularly in the short term. However, if the labour market continues to weaken and the Federal Reserve does not cut rates, technology stocks could come under pressure. The US Tech index has entered a downtrend, with the next downside target possibly at 22,080.0.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up