Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

On Tuesday, the S&P 500 and Nasdaq each logged their best third quarter since 2020 and strongest September since 2010, as tech stocks continued to dominate.

Bank of England Deputy Governor Sarah Breeden cautioned on Tuesday that maintaining high interest rates for an extended period could harm the economy and push inflation below target.

"Holding policy too tight for too long comes with costs to output and employment, which could then pull inflation below target," Breeden said in a speech at Cardiff Business School.

Breeden, who was part of the majority that voted to keep rates at 4% during the September Monetary Policy Committee meeting, noted that the recent rise in headline inflation was likely temporary. The central bank expects inflation to reach 4% in September.

She described the recent inflation increase as a "hump" that was unlikely to generate additional inflationary pressure in the economy. Breeden added that the underlying disinflationary process appears to be on track, though policymakers face a balancing act.

The deputy governor expressed some concern about the significant rise in household inflation expectations since the lows of 2024. She warned that if expectations continue to increase alongside further food price rises, this "could be a cause for concern."

The Bank of England is currently weighing inflation concerns against signs of slowing economic growth as it determines its future interest rate policy. The central bank had previously cut rates by 25 basis points in August before holding steady in September.

Owing to uncertainties on higher inflation and muted growth in the United States (US), coupled with concerns around America’s rising debt and tariffs imposed by President Donald Trump, the world’s largest economy has become the epicentre of an unabated record rally in prices of precious metals.

While prices of gold and silver have been going up in the past two years, the first six months (H1) this financial year (FY26) have seen strong gains.

In H1FY26, international gold has returned 22.1 per cent, the highest in any first half in at least 30 years.

Likewise, silver has returned 35.8 per cent, the best in three decades after the 66.3 per cent gain in the first half of 2020-21, when the pandemic came.

The returns are based on prices as on September 30, 5.40 pm.

In rupee terms, gold is up 29.5 per cent in H1FY26, again the highest first-half return in the past three decades, while silver gave 43.1 per cent, the best after the first half of the lockdown year’s 53 per cent gain.

On Tuesday, however, the gold and silver rally paused, with prices marginally correcting.

After reaching an all-time high of $3,871 an ounce in morning trade, gold prices corrected and the yellow metal was trading around $3,815. Silver corrected from $47.1 an ounce and was trading around $46.3, a little away from its all-time high of $49 per ounce.

In Mumbai’s spot market, the 995-purity 24-carat gold closed at nearly ₹1.15 lakh per 10 gm (down from the opening price of about ₹1.16 lakh) while silver closed at more than ₹1.42 lakh per kg (down from ₹1.45 lakh in morning trade), in line with international prices.

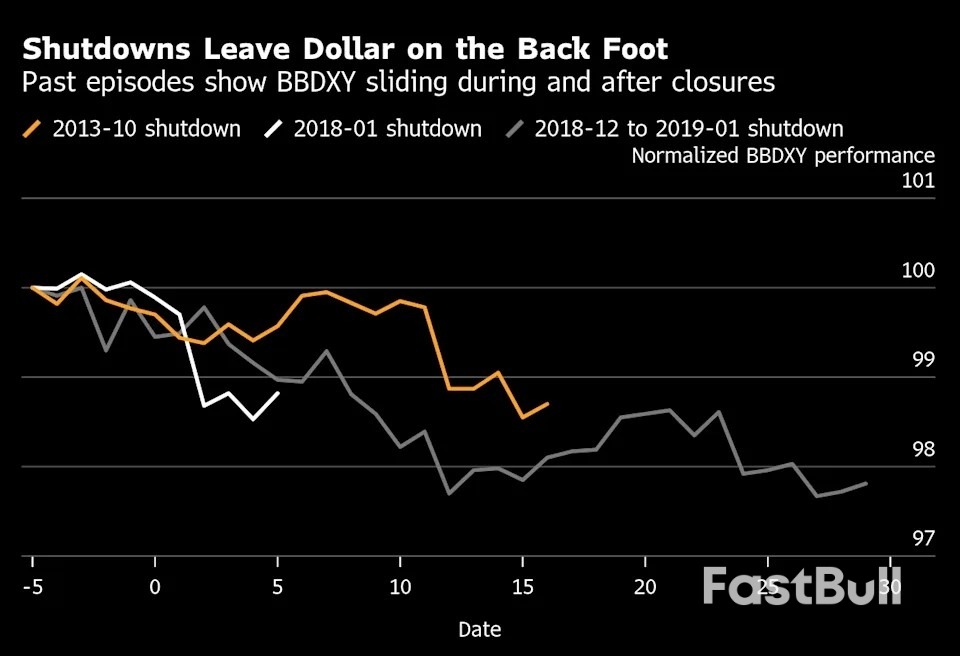

The major reason for the recent rally in precious metals, especially gold, is the looming US government shutdown. Its record debt of $37.5 trillion is difficult to finance, and the recent meeting between representatives of the Trump administration and the US Congress did not produce any result.

Shutdown fears in 1971 had led the Richard Nixon administration to suspend the dollar’s convertibility into gold. For the past few months, the US Federal Reserve’s rate hike, looming inflation, the government’s comments against US Fed officials and geopolitical uncertainties in West Asia have boosted the rally in precious metals.

Globally, central banks have also been big buyers of gold.

Chirag Thakkar, director, Amrapali Gujarat, who has been recommending silver for a few months, said: “Silver now looks overbought and a correction is expected before the rally takes it to another new high.”

Thakkar, however, said high demand for silver from industry and investors had resulted in the market turning into a premium of 50 cents in India, while adding that ready delivery was difficult to get.

A leading trader said globally too electric-vehicle manufacturers were big buyers of silver, which is required for battery manufacturing, supported by demand from solar panel makers and investors.

While silver is in big demand, local demand for gold at present is weak. Customers are buying coins and exchanging old jewellery for new. Jewellers are worrying about Diwali demand.

But there is optimism. Rajesh Rokde, chairman, All India Gem and Jewellery Domestic Council, said: “As we approach Diwali, I expect demand to rise significantly, particularly for lightweight and investment-grade pieces or coins. We are projecting a 12–15 per cent growth in gold sales this year, which reflects both traditional buying and evolving consumer preferences.”

Jewellers are looking for non-traditional ways to market gold, Rokade said.

“This year we’re engaging Gen Z buyers through digital campaigns, influencer collaboration, and showcasing contemporary, eco-friendly designs. The response has been phenomenal, and we’re confident this edition will surpass expectations.”

T Gnansekar, cofounder, Commtrendz Research, a commodities risk advisory firm, said: “Gold prices may see resistance between $4,000 and $4,100 because it is difficult to avoid government shutdown in the US.” He said “silver prices may test all-time high levels of $49 per ounce multiple times before it goes further high. Silver is projected to see a level of $60 per ounce.”

The first nine months' returns on gold and silver in international markets are the highest in 45 years.

The return in the first nine months of calendar year (CY) 2025 for gold is 45 per cent, while for silver it is 59 per cent.

In the first nine months of CY1979, in the international market, gold had returned 75.8 per cent while silver almost 170 per cent.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up