Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Nov)

France Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Nov)

Italy Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Euro Zone Retail Sales MoM (Nov)

Euro Zone Retail Sales MoM (Nov)A:--

F: --

Euro Zone Retail Sales YoY (Nov)

Euro Zone Retail Sales YoY (Nov)A:--

F: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Dec)

Brazil IPCA Inflation Index YoY (Dec)A:--

F: --

P: --

Mexico Industrial Output YoY (Nov)

Mexico Industrial Output YoY (Nov)A:--

F: --

P: --

Brazil CPI YoY (Dec)

Brazil CPI YoY (Dec)A:--

F: --

P: --

U.S. Building Permits Revised YoY (SA) (Oct)

U.S. Building Permits Revised YoY (SA) (Oct)--

F: --

P: --

U.S. Building Permits Revised MoM (SA) (Oct)

U.S. Building Permits Revised MoM (SA) (Oct)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

P: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

States urge delay of new SNAP cost-sharing rules, citing fiscal strain and fragility exposed by a federal shutdown.

State and local governments across the United States are formally asking Congress to delay new rules that would shift a significant portion of food stamp costs onto their budgets, citing major operational and financial concerns.

The changes stem from President Donald Trump's "One Big Beautiful Bill," which was signed into law last July. The new legislation overhauls the funding structure for the Supplemental Nutrition Assistance Program (SNAP), which provides benefits to over 42 million Americans.

Under the new law, the federal government, which previously covered the full cost of SNAP benefits, will require states to share the financial burden. The changes are set to be phased in over the next decade.

• Benefit Costs: Beginning in fiscal year 2028, states will be required to pay up to 15% of all SNAP benefits issued. The exact percentage will depend on a state's payment accuracy in fiscal years 2025 or 2026.

• Administrative Costs: Starting in fiscal year 2027, the states' share of administrative costs will increase from the current 50-50 split to as much as 75%.

A coalition of government associations, including the National Governors Association and the National Conference of State Legislatures, argued in a letter that states are not prepared for these changes. They pointed to the severe difficulties they faced during the 43-day federal government shutdown in 2025 as evidence of the system's fragility.

During the shutdown, federal SNAP funding lapsed for the first time. This forced states to scramble, using their own funds to issue partial benefits while navigating rapidly changing guidance from the federal government. At the same time, they were also working to implement other new provisions of the law, such as expanded work requirements for SNAP recipients.

The letter stated that "these overlapping events exposed states and counties to significant, unintended fiscal risks that undermine program stability and integrity."

To avoid destabilizing the food aid program, the organizations are asking Congress to delay the new cost-sharing provisions until 2030. They argue this would give states enough time to lower their payment error rates and properly prepare their SNAP systems for the new financial responsibilities.

The financial impact of the law is projected to be substantial. On average, each state faces $218 million in new annual spending. The burden is even greater for larger states, with Florida expecting to pay an additional $991 million and California facing a $1.8 billion increase.

The letter warns that without some form of relief, the combined effects of these challenges could put the entire SNAP program "in jeopardy across the country."

President Trump has made his choice for the next leader of the Federal Reserve, a nomination that could fundamentally reshape U.S. monetary policy amid intense political scrutiny of the central bank.

In a Wednesday night interview with The New York Times, the President confirmed his decision was made but did not reveal the name, leaving markets and policymakers waiting for a formal announcement.

"I have in my mind a decision," Trump stated, adding, "I haven't talked about it with anybody."

While President Trump kept his final choice under wraps, his comments provided a strong hint regarding his top economic adviser, Kevin A. Hassett.

When asked if Hassett was the nominee, the President was reportedly evasive but offered praise. "I don't want to say," Trump commented, noting that Hassett is "certainly one of the people that I like."

A nomination for Hassett, a proponent of supply-side economics, would signal a significant philosophical shift at the Fed, aligning it more closely with the administration's agenda. The new chair is set to succeed Jerome H. Powell, whose term ends in May.

Besides Hassett, several other candidates have been reported as front-runners for the influential position. The leading contenders to replace Powell also include:

• Kevin Warsh: A former Federal Reserve Governor.

• Christopher Waller: A current Governor at the central bank.

The next Fed chair will step into a role at the center of a historic conflict between the central bank's institutional independence and pressure from the executive branch.

Throughout the past year, current Chair Jerome Powell has been a frequent target of the President's public criticism, particularly over the pace of interest rate cuts.

Financial markets remain on high alert as they await the official nomination. The Fed chair's ability to manage inflation while fending off political interference is widely seen as critical for global financial stability.

A nominee perceived as more political could introduce significant volatility into the bond markets and alter the long-term outlook for the U.S. Dollar.

A new report from the New York Federal Reserve reveals a growing disconnect in the American economy: while households feel better about their personal finances, anxiety over the U.S. job market has climbed to a record high. The December survey also showed a notable increase in near-term inflation expectations.

According to the New York Fed’s Survey of Consumer Expectations, Americans' confidence in finding a new job if they become unemployed has fallen to its lowest level since the survey began in 2013. This concern was most pronounced among households earning less than $100,000 per year.

The December data painted a complex picture of the labor market. While fewer people expected the overall unemployment rate to rise compared to November, the perceived probability of personally losing a job actually increased. At the same time, the likelihood of voluntarily leaving a job declined, suggesting workers are becoming more cautious.

Households are bracing for rising prices in the near future. The survey showed that one-year inflation expectations rose to 3.4% in December, up from 3.2% in November. This uptick coincides with price pressures linked to the Trump administration's tariffs.

However, longer-term inflation outlooks remained stable, with both three-year and five-year expectations holding steady at 3%. Federal Reserve officials typically place more emphasis on these long-term projections, as they are considered a more reliable indicator of public confidence in the central bank's ability to control inflation.

New York Fed President John Williams commented in late December that future inflation projections "remain well-anchored," adding that he watches this data closely because it is "critical to ensuring low and stable inflation."

The survey’s findings highlight the challenge facing the Federal Reserve. Last month, the central bank cut its benchmark interest rate to a range of 3.50%-3.75% in an effort to shield the job market from risks while inflation remains significantly above its 2% target.

Fed officials anticipate that the unemployment rate, which stood at 4.6% in November, will decline slightly this year. They also forecast that inflation will moderate but stay above the target level. Many officials believe the price impact from tariffs will fade over the year, but they are monitoring inflation expectations for any signs that the public is losing faith.

The U.S. Labor Department is set to release its official December employment report on Friday, which will provide a clearer picture of the job market's health.

Despite widespread job market fears, the survey found that households were generally more optimistic about their current and future financial situations in December.

However, this optimism was tempered by other concerns:

• Tighter Credit: Respondents reported that it is becoming more difficult to access credit.

• Debt Worries: The expected probability of missing a debt payment rose to its highest level since the early days of the pandemic in April 2020.

• Income vs. Spending: While expectations for income growth saw a slight increase, forecasts for spending and earnings growth both declined.

Looking ahead, the path for Fed policy in 2026 remains uncertain. Philadelphia Fed President Anna Paulson recently stated that if the economy performs as she expects, "some modest further adjustments to the (federal) funds rate would likely be appropriate later in the year."

A long-simmering rivalry between Saudi Arabia and the United Arab Emirates has finally boiled over, with a recent military clash in Yemen signaling a dramatic break between the two powerful Gulf allies. The confrontation threatens to redraw the geopolitical map of the Middle East, forcing regional players to choose sides and escalating conflicts from North Africa to the Horn of Africa.

The immediate crisis ignited last month when UAE-backed forces advanced from their stronghold in Aden, Yemen, seizing several oil-rich areas previously controlled by Saudi Arabia. The move was met with little initial resistance.

However, in mid-December, Saudi Arabia launched a decisive counteroffensive. The attack not only expelled Emirati-backed troops from the newly captured territories but also threatened their entire presence in Yemen.

This military escalation was matched by a fierce propaganda war. Emirati media figures accused Saudi Arabia of supporting the Muslim Brotherhood and bullying a smaller neighbor. In response, Saudi commentators attacked the UAE as anti-Islamic, pro-Israel, and a reckless backer of secessionist movements across the region. The hostile rhetoric echoed the 2017-2021 blockade of Qatar, a campaign the two nations once waged together.

This conflict is far more than a local dispute. It represents a fundamental realignment of power in the Middle East. Saudi Arabia’s actions are not just aimed at curbing the UAE's regional ambitions but also at creating a counterbalance to an increasingly aggressive Israel.

The shifting allegiances became clear following a sudden trip by the Saudi foreign minister to Cairo. Egyptian officials publicly affirmed their complete support for Riyadh's positions on Libya and Sudan—a significant pivot after a decade of closer ties and economic reliance on the UAE. This signals a major disruption to the regional order at a time when Iran is facing internal protests and the United States' role remains ambiguous.

For years, the UAE and Saudi Arabia were close partners. They collaborated to push back against democratic movements during the 2011 Arab uprisings, jointly intervened in Libya in 2011 and Yemen in 2015, and worked together to orchestrate Crown Prince Mohammed bin Salman's rise to power in Riyadh. In 2017, they led the blockade against Qatar.

However, cracks in the alliance began to emerge over differing strategies in several key conflicts:

• Sudan: Saudi Arabia and Egypt backed the Sudanese military under Abdel Fattah al-Burhan, while the UAE supported the rival Rapid Support Forces (RSF) led by Mohammed Hamdan Dagalo.

• Libya: The UAE and Egypt backed General Khalifa Haftar's campaign, which devolved into a protracted civil war.

• Yemen: While Saudi Arabia was focused on fighting the Houthis, the UAE quietly established control over key ports like Aden and the island of Socotra as part of a broader Red Sea maritime strategy.

The Abraham Accords and the Gaza War

The UAE’s 2020 signing of the Abraham Accords with Israel marked a turning point. The agreement separated diplomatic normalization from the Palestinian issue, allowing the UAE to build deep security, intelligence, and political ties with Israel. For a time, Saudi Arabia seemed poised to follow, with the Biden administration heavily promoting a similar deal.

That all changed after the Hamas attack on October 7, 2023, and Israel's subsequent war in Gaza. The devastation galvanized Arab public opinion and forced a change in Saudi calculations.

Riyadh reverted to its traditional stance, making normalization with Israel conditional on a credible path to a Palestinian state. The UAE, however, maintained its Israeli ties, positioning itself as a key Arab player in a post-Hamas Gaza. It became clear that Saudi Arabia had no intention of following an initiative led by Abu Dhabi, especially one so closely aligned with Israel.

Saudi Arabia grew alarmed by Israel's escalating military actions across the region. While a weakened Hezbollah and Iran were welcome, Riyadh feared an unrestrained Israel conducting strikes at will, continuing its war in Gaza, and openly seeking regional hegemony. From this perspective, the UAE appeared to be a critical component of a threatening Israeli-led project.

The split between Saudi Arabia and the Emirati-Israeli alliance is now forcing other nations to take sides. Egypt and most other Gulf states appear to be aligning with Riyadh. This competition is inflaming civil wars, much as it did a decade ago. The UAE-backed RSF is escalating its campaign in Sudan, while Haftar's forces in Libya could shatter the country's fragile truce. The UAE has also reportedly backed secessionist movements in southern Yemen and among the Druze in Syria, undermining Saudi and Qatari efforts to stabilize a post-Assad Syria.

The conflict's reach extends into the Horn of Africa and the Red Sea. Israel's recent recognition of Somaliland, combined with the UAE’s control of Aden, could establish dominance over the critical Bab el-Mandeb strait. The war in Sudan is no longer a localized conflict but one with major implications for Egypt, Ethiopia, and the broader East African security landscape. Potential allies are also being drawn in, with India sympathetic to Israel and Pakistan recently signing a strategic partnership with Riyadh.

Washington's Ambiguous Position

Amid this turmoil, Washington's stance remains alarmingly unclear. The recent U.S. attack on Venezuela and the abduction of President Nicolás Maduro have been interpreted in the region as a setback for Iran and a potential template for regime change there—a move Israel strongly supports.

Some U.S. hawks see the UAE's strategy as a way to pressure not only Iran but also China by controlling Red Sea shipping lanes. Yet, the White House also maintains close relations with Saudi Arabia. A distracted Trump administration might simply observe the transformation from the sidelines, but it could just as easily make an impulsive gamble that accelerates regional conflicts and pushes the new order in unforeseen directions.

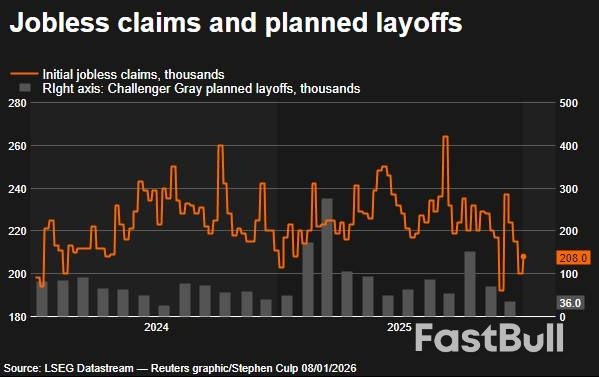

WASHINGTON, Jan 8 (Reuters) - The number of Americans filing new applications for unemployment benefits increased moderately last week amid relatively low layoffs, though demand for labor remained sluggish, with businesses squeezing more output from their existing workforce.

Worker productivity grew at its fastest pace in two years in the third quarter, other data from the Labor Department showed on Thursday, suggesting a boost from increased artificial intelligence investment was underway. The surge in productivity, which depressed unit labor costs, underscored what economists have termed a jobless economic expansion. It followed on the heels of robust economic growth in the third quarter.

"Firms are successfully doing more with less labor, giving more credence to a jobless expansion," said Matthew Martin, senior U.S. economist at Oxford Economics. "Productivity will be key to determining the economy's speed limit and inflationary dynamics. If productivity growth continues to accelerate ... economic growth can pick up without causing unwanted inflation."

Initial claims for state unemployment benefits rose 8,000 to a seasonally adjusted 208,000 for the week ended January 3. Economists polled by Reuters had forecast 210,000 claims for the latest week. Claims have been choppy in recent weeks amid challenges adjusting the data for seasonal fluctuations around the year-end holiday season. Through the volatility, layoffs have remained low by historical standards.

Employers have been reluctant to boost headcount amid tariff-related uncertainty and integration of AI in some job roles, but they have not engaged in mass firings of workers, keeping the labor market in a state of paralysis.

Initial jobless claims and Challenger Gray layoffs

Initial jobless claims and Challenger Gray layoffsWhile a separate report from global outplacement firm Challenger, Gray & Christmas showed layoffs announced by U.S.-based employers jumped 58% to a five-year high of 1.206 million in 2025, cost cutting by the federal government and technology companies accounted for the bulk of the planned reductions.

Job cuts in the technology sector were attributed to AI and overhiring in prior years.

Planned hiring by businesses fell 34% to 507,647 last year, the lowest level since 2010. Lackluster hiring means more unemployed people are experiencing long bouts of joblessness.

The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, increased 56,000 to a seasonally adjusted 1.914 million during the week ended December 27, the claims report showed.

The government reported on Wednesday that job openings dropped to a 14-month low in November. There were 0.91 job openings for every unemployed person in November, the lowest level seen since March 2021, and down from 0.97 in October.

The claims data have no bearing on December's employment report due to be released on Friday.

Nonfarm payrolls probably increased by 60,000 jobs last month after rising 64,000 in November, a Reuters survey of economists predicted. But the focus is likely to be on the unemployment rate, estimated to have slipped to 4.5% after accelerating to more than a four-year high of 4.6% in November.

The November unemployment rate was partially distorted by the 43-day federal government shutdown, which also prevented the collection of household data for October. The unemployment rate for October was not published for the first time since the government started tracking the series in 1948.

U.S. stocks opened lower. The dollar advanced against a basket of currencies. U.S. Treasury yields rose.

In a separate report, the Labor Department's Bureau of Labor Statistics said nonfarm productivity, which measures hourly output per worker, accelerated at a 4.9% annualized rate in the third quarter. That was the quickest pace since the third quarter of 2023 and followed an upwardly revised 4.1% growth rate in the second quarter.

Economists had forecast productivity would grow at a 3.0% rate after a previously reported 3.3% pace of expansion in the April-June quarter. The report was delayed by the government shutdown. Productivity grew at a 1.9% rate from a year ago.

Though the Federal Reserve was not expected to cut interest rates again this month, economists said Thursday's reports gave the U.S. central bank room for monetary policy easing this year.

The jump in productivity helps to explain the gap between strong gross domestic product growth and a lackluster labor market. The economy grew at a robust 4.3% rate in the third quarter. In contrast, private job gains averaged 55,000 per month in the three months through October.

Unit labor costs - the price of labor per single unit of output - decreased at a 1.9% rate in the third quarter. That followed a 2.9% pace of decline in the April-June quarter. Labor costs increased at a 1.2% rate from a year ago.

"Given that labor is the key input for super core services inflation this is good news for the inflation outlook, even if some of the survey-based prices paid indicators remain a little elevated," said Paul Ashworth, chief North America economist at Capital Economics.

A new United Nations report projects the global economy will continue to experience sluggish growth, failing to recapture its pre-pandemic momentum. The forecast sees global economic growth declining to 2.7% in 2026 before ticking up to 2.9% in 2027.

This outlook, detailed in the UN's "World Economic Situation and Prospects" report, remains significantly below the 3.2% average growth rate the world enjoyed between 2010 and 2019.

The report identifies new trade tensions, sparked by a sharp increase in U.S. tariffs in 2025, as a key factor shaping the forecast. However, the absence of a wider trade war has so far limited major disruptions to international commerce.

According to the UN Department of Economic and Social Affairs, global economic activity has proven resilient despite the tariff shock. This stability was supported by several factors:

• Front-loaded shipments and inventory accumulation

• Solid consumer spending

• Monetary easing measures

• Broadly stable labor markets

While continued macroeconomic policy support is expected to soften the blow from higher tariffs, the report cautions that growth in both trade and overall economic activity will likely moderate in the near term.

The global forecast masks divergent paths for the world's largest economic blocs, from a slowdown in the United States and China to more modest growth in Europe and robust expansion in India.

United States: Slowdown Followed by Modest Rebound

Economic growth in the United States is projected to slow from 2.8% in 2024 to 1.9% in 2025. The UN forecasts a slight recovery to 2.0% in 2026 and 2.2% in 2027, aided by expansionary fiscal and monetary policies. Inflation is expected to remain above the 2% target in 2026 but should gradually cool as tariff effects fade and housing costs stabilize.

China: Growth Decelerates Despite Policy Support

China’s economy is projected to grow by 4.6% in 2026 and 4.5% in 2027, marking a slowdown from the estimated 4.9% expansion in 2025. A temporary easing of trade tensions with the U.S., including targeted tariff cuts and a one-year trade truce, has helped stabilize business confidence. Meanwhile, policy support is expected to sustain domestic demand.

European Union: Consumers Face Export Headwinds

Growth in the European Union is forecast at 1.3% in 2026 and 1.6% in 2027, a slight adjustment from 1.5% in 2025. This growth is primarily driven by resilient consumer spending. However, the report warns that higher U.S. tariffs and ongoing geopolitical uncertainty are likely to weigh on the bloc's export performance.

South Asia: India Remains a Bright Spot

Growth across South Asia is expected to moderate to 5.6% in 2026 from 5.9% in 2025, before returning to 5.9% in 2027.

India stands out with a strong forecast. After an estimated 7.4% growth in 2025, the economy is projected to expand by 6.6% in 2026 and 6.7% in 2027. The report credits this performance to resilient consumption and strong public investment, which are expected to largely offset the adverse impact of higher U.S. tariffs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up