Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkish Foreign Minister: We Hope Solution Can Be Found To Avoid Conflict And Isolation Of Iran

Turkish Foreign Minister: Spoke With USA Envoy Witkoff On Thursday, Will Continue Speaking To USA Officials On Iran

Iran's Araqchi Says Tehran Welcomes Talks With Regional Countries That Aims At Bringing Stability And Peace

Istanbul - Iran's Foreign Minister Araqchi Says Tehran 'Is Prepared For Resumption Of Talks With The US'

Istanbul - Iran's Foreign Minister Araqchi: Talks With His Turkish Counterpart Fidan Was Very 'Good And Useful'

Turkish Foreign Minister: Turkey Closely Following Integration Agreement Between Damascus-Sdf In Syria

Turkish Foreign Minister: Turkey Calling On US, Iran To Come To Negotiating Table To Resolve Issues

Turkish Foreign Minister: Turkey Opposes Foreign Intervention On Iran, We Tell Our Counterparts This

Turkish Foreign Minister: Iran's Peace And Stability Important For US, Turkey Saddened By Deaths During Protests

Chevron: Continue To Engage With The USA And Venezuelan Governments To Advance Shared Energy Goals

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Middle powers court Beijing amid US unpredictability, securing modest deals yet confronting China's economic might and Washington's ire.

British Prime Minister Keir Starmer’s high-profile visit to China marks another victory for Beijing in its ongoing rivalry with Washington. But while he returns to London with new deals in hand, the trip also exposes the stark limitations facing middle powers trying to navigate a world fractured by US-China tensions.

Starmer is the latest Western leader to court Beijing, following Canadian counterpart Mark Carney, who secured a trade deal just weeks earlier. These visits are becoming a pattern as leaders from Europe, India, and beyond seek alternatives to an unpredictable United States under President Donald Trump, who has spent his second term disrupting long-standing alliances.

From London's perspective, engaging with China sends a clear message to Trump: if the U.S. continues to apply pressure over issues like Greenland or the USMCA trade pact, its traditional allies have other options. However, some analysts view these moves as "superficial gestures amid stalled global growth."

"Traditional U.S. allies feel hard done by and are now hedging their bets, but they are far from being able or willing to substitute China for the United States," said John Quelch, an expert in global strategy at Duke Kunshan University.

On his trip, Starmer secured a few tangible benefits for Britain:

• Visa-Free Travel: Britons gain 30-day visa-free access to China.

• Lower Whisky Tariffs: A key win for a signature British export.

• Major Investment: British pharmaceutical giant AstraZeneca unveiled a new $15 billion investment in China.

However, on more contentious topics, progress was limited to "frank dialogue." Key areas of tension—including China's stance on Taiwan, its close relationship with Russia, and the rights crackdown in Hong Kong—remain unresolved. The visit also drew criticism from politicians in both the UK and US over accusations of espionage and human rights abuses, which Beijing denies.

While the economic gains for Western nations are modest, the diplomatic visits are a significant boost for China's global standing. Beijing can present itself as a "reliable partner," contrasting its stability with Trump's chaotic tariff policies and frequent demands on allies.

"President Trump's efforts to decouple the United States from China are also decoupling the United States from the world," Quelch noted.

This narrative is reinforced with each visit, supporting the idea of a global "pivot to China" as a counterweight to American influence.

The deals Western powers are striking come at the cost of deeper integration with an economy running on overdrive. China’s trade surplus hit a record $1.2 trillion last year—roughly the size of the Dutch economy. This surplus is fueled by a manufacturing sector so powerful that it overwhelms foreign markets, even as domestic consumption remains too weak to support its own producers.

The trade data tells a clear story of imbalance:

• European Union: China's exports grew 8.4%, while imports fell 0.4%.

• United Kingdom: China sold 7.8% more goods while buying 4.7% less.

• Canada: Chinese sales increased 3.2%, while purchases dropped 10.4%.

"These visits highlight the severe limits of any 'pivot' to China," said Alicia Garcia-Herrero, chief Asia-Pacific economist at Natixis. "They expose middle powers' vulnerability, chasing scraps while China's export flood overwhelms their industries."

The flood of Chinese exports poses a direct threat to Western manufacturing. At its current pace, China's trade surplus is on track to match the size of France's $3 trillion economy by 2030 and Germany's $5 trillion economy by 2033.

"This makes it an especially risky proposition for countries trying to protect or grow their own manufacturing industries to substantially increase trade integration with China," warned Eswar Prasad, former China director at the IMF. "China hardly provides a safe harbour."

Furthermore, cozying up to Beijing invites backlash from Washington. Before Starmer even left China, Trump warned that it was "very dangerous" for the UK to get into business with Beijing. Similarly, Canada’s deal on canola and lobsters was met with threats of 100% U.S. tariffs and a warning against allowing Chinese EVs into North America.

Despite the risks, some analysts argue that these diplomatic missions are less about securing major trade wins and more about managing complex relationships. For countries like Britain and Canada, simply "reducing tension with Beijing" may be the most realistic goal.

Noah Barkin of the German Marshall Fund called the visits a "propaganda coup for Beijing" but clarified, "This is not a pivot to China. It is about reducing tension."

After all, previous deteriorations in relations with China exposed critical supply chain vulnerabilities and only widened trade imbalances. In a world dominated by two superpowers, the ultimate goal for middle powers is survival. As Barkin puts it, "No country wants to be in open conflict with the two superpowers at the same time."

China's imports of liquefied natural gas (LNG) are on track for a third straight month of year-over-year growth, signaling a sustained recovery in demand. According to analytics firm Kpler, the country is expected to import 6.94 million tons of LNG in January.

This projection represents a 15% increase compared to January 2025. The rising import volumes may indicate that more cargoes are now being delivered to China under long-term contracts.

The recent growth marks a significant turnaround. For most of the past year, China's LNG imports saw annual declines, influenced by tariffs and a surge in domestic gas production.

Domestic output hit an all-time high earlier in the year, causing LNG imports to fall to a six-year low. In the first seven months of 2025, imports dropped by 19% year-over-year. This slowdown was also partly a consequence of a record-setting import year in 2024, when China focused on filling its gas inventories ahead of winter.

From November 2024 to October 2025, China recorded 12 consecutive months of falling LNG import volumes.

The downward trend finally reversed in November 2025 as seasonal demand for electricity and heating began to climb.

• November 2025: Imports rose to 6.94 million tons, a 13.6% increase from the previous year.

• December 2025: Volumes grew further, reaching an estimated 7.17 million tons, according to Kpler data.

Imports from Russia, in particular, reached an all-time high at the end of last year. In November, China imported 1.6 million tons of Russian LNG, a figure that doubled from October. This strong import trend was expected to continue into December and possibly into January.

British lenders approved 61,013 mortgages in December, the lowest since June 2024 and down from a revised 64,072 in November, Bank of England data showed on Friday.

Economists polled by Reuters had a median forecast of 64,800 for December, up marginally from November's original reading of 64,530.

Britain's housing market slowed in 2025 after the end of a temporary tax break on some house purchases, and there were was some further loss of momentum in the months running up to finance minister Rachel Reeves' annual budget on November 26 due to fears of higher taxes on more expensive homes.

Mortgage lender Halifax reported that house prices rose just 0.3% in the 12 months to December - well below the rate of consumer price inflation - and rival Nationwide recorded a 0.6% annual increase.

However, the Royal Institution of Chartered Surveyors said there was the beginning of signs of a turnaround in sentiment in December as sales expectations rose to their highest since October 2024.

Hong Kong’s economy posted a robust 3.8% year-on-year expansion in the fourth quarter of 2025, according to official advance estimates. This marks the city's 12th consecutive quarter of growth, driven by strong regional trade, a recovery in tourism, and vigorous activity in the financial services sector.

The fourth-quarter performance represents an acceleration from previous periods. The economy grew by a revised 3.7% in the third quarter, 3.1% in the second, and 3.0% in the first quarter of 2025. On a seasonally adjusted quarterly basis, GDP expanded by 1.0% in the final three months of the year, up from 0.7% in the third quarter.

For the entirety of 2025, Hong Kong's real GDP grew by 3.5%. This figure not only surpassed the government's own forecast of 3.2% but also marked a significant increase from the 2.5% growth recorded in 2024.

The momentum was underpinned by strong performance across several key economic pillars:

• Private Consumption: Expenditure rose by 2.5% in the fourth quarter, slightly ahead of the 2.4% increase in Q3. For the full year, private consumption grew by 1.6%.

• Goods Exports: Total exports surged by 15.5% in Q4, a notable jump from the 12% rise in the previous quarter. This brought full-year export growth to 12%.

• Goods Imports: Imports expanded by 18.4% in Q4, up from 11.7% in Q3, resulting in 12.6% growth for the full year.

Looking ahead, the government anticipates that the Hong Kong economy will maintain its positive trajectory into 2026. A government spokesperson stated that the city is "expected to maintain good momentum."

Several factors are expected to support this continued growth. A moderate but sustained expansion of the global economy, combined with strong international demand for electronics enabled by artificial intelligence, is projected to bolster Hong Kong's export performance.

Furthermore, improving sentiment among consumers and businesses, alongside the possibility of interest rate cuts in the United States, is expected to stimulate local consumption and investment.

Despite the optimistic forecast, officials cautioned that external uncertainties persist, particularly amid escalating geopolitical tensions that could pose risks to the outlook.

On Wednesday, after the close of the regular trading session, Microsoft (MSFT) released its quarterly earnings report, which exceeded analysts' expectations:

→ Earnings per share: actual $4.14, forecast $3.90;

→ Gross revenue: actual $81.2bn, forecast $80.3bn;

→ Operating profit: up 21%.

Despite the strong results, MSFT shares suffered a dramatic sell-off of around 10% by the close of yesterday's trading. According to media reports, this was the largest one-day drop in Microsoft's share price on record, with the company losing roughly $360bn in market capitalisation.

Market participants were most likely disappointed by the following factors:

→ A sharp rise in capital expenditure: capex surged by 66% to $37.5bn as Microsoft continued to invest heavily in data centres and AI infrastructure, while the timing of meaningful returns on these investments remains uncertain.

→ Slowing growth in the cloud computing segment.

When analysing the MSFT chart on 15 January, we identified a key ascending channel reflecting the stock's long-term price structure. At that time, we suggested that the market might find a temporary balance ahead of the earnings release.

Since then, although volatility persisted, the price showed an ability to recover from 22 January onwards, indicating that buyers were attempting to wrest control from sellers.

Yesterday's record decline significantly altered the picture, but two factors are worth noting:

1 → The price fell below the 1 May low, entering the area of a broad bullish gap located above the psychological $400 level.

2 → In 2026, the market has been forming a descending channel (shown in red), with the price now reaching its lower boundary.

It is reasonable to assume that these two factors could act as support. The structure of yesterday's candle supports this view: the session closed well above the low, and trading volumes were the highest in several years. This suggests active buying interest, with the price rebounding from around $422 to $433.

As a result, it is possible that the initial emotional reaction may fade and MSFT shares will avoid a further acceleration of the downtrend. However, a meaningful shift back to a bullish market structure would require strong fundamental catalysts.

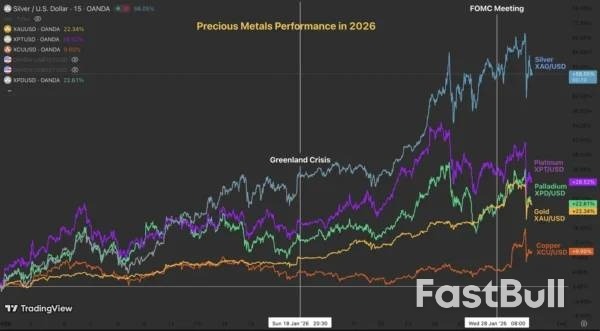

If 2025 was volatile for metals, 2026 is starting with even greater intensity.

The global order is fracturing as historic allies clash and new conflicts appear imminent.

For metal maximalists, this confirms a long-held thesis. Decades of high deficits create predictable capital flows and supply shortages, which are now driving prices to daily records.

As geopolitical tensions rise, investors are rushing to commodities to hedge against supply shortages and inflation, a classic play.

But today's flows feel different.

It is almost impossible to predict tops in such extreme, unidirectional trends. Some periods can be more favorable for squeezes. Some others are more favorable for rangebound conditions and selloffs.

And such periods tend to change at the beginning of the New Year, at the start of Quarters, Months, or even after FOMC meetings.

As the US President announced he will officially announce his decision on the Fed Chair next week, Markets are looking back at yesterday's Federal Reserve decision.

Higher rates for longer will be the way to go for the Fed until anything cracks, as the US Labor Market bounced back and the US economy is shining – Can't justify many cuts with that.

Today marked a brutal stalling in rallies throughout the Metals asset class.

Gold was trading 6% higher than the day before the FOMC, only to give up those gains in a 10% flash crash.

Similar flows occurred in Copper, Silver, Palladium, and Platinum, all dropping by 9% to 11%.

By the way, Copper spiked to new record highs in yesterday's evening session, reaching $6.52 per lb, but still lacking a more fundamental foundation to persistently elevated prices.

In the meantime, let's dive right into intraday timeframe analysis for Gold (XAU/USD), Silver (XAG/USD) and Copper (XCU/USD) to spot where the session dynamic takes the price action. Is the trend challenged?

This morning's action could pose a significant test to the 30% yearly run in the Bullion.

The current fundamentals are heavily backing the recent rise, particularly as it is far less extreme than the one seen in Silver for example.

Still, when profit-taking occurs so suddenly, traders can look around, question the current state of the Market and reassess if the trend can still hold.

Since the flash, prices have rebounded – Hence look at these two levels:

Resistance Levels:

Support Levels:

Evolving in a steep upward channel, Silver is testing its upper bound in high volatility consolidation.

Prices have maintained within a $107 to $120 range since Monday, hence trades will look for breakouts either to the upside or downside for future action.

Similarly as in Gold, look for a candle close above or below with high volumes to get confirmation.

A break lower could go test the Upward channel lower bounds, currently around $92.

Resistance Levels:

Support Levels:

The recent moves are not particularly indicative of a trend-end but recent up and down action may precede doubts to the sustainability of the recent moves.

Copper spiked by 10% during overnight trading, corrects by a similar amount and is now holding tight at its January 14 record range ($6.00 to $6.10 Major Pivot).

Higher Timeframe Levels to watch for Copper (XCU/USD):

Resistance Levels:

Support Levels:

Watch out for positioning and fast-paced moves!

January is already coming to an end and it has historically been the best month for Gold, Silver and Platinum. Keep a close eye to see if the rally holds the colder February ahead.

Safe Trades!

China is set to cut its import tariff on whisky in half, a significant move that provides a major boost to the British whisky industry. The tariff will be lowered from 10% to 5%, with the new rate taking effect on February 2.

This decision comes directly after high-level talks between British Prime Minister Keir Starmer and Chinese President Xi Jinping, aimed at repairing diplomatic ties and strengthening economic cooperation.

The reduction is expected to deliver substantial financial benefits for UK-based exporters. According to the British Prime Minister's office, the deal is valued at approximately £250 million ($344.13 million) over the next five years.

The UK is the dominant player in China's whisky market. Customs data from 2025 shows that China imported $445.5 million worth of whisky, with a staggering 84% of that total originating from the United Kingdom. This market share underscores why the tariff adjustment is a critical win for the Scotch whisky sector.

The tariff change marks a reversal of a recent effective rate hike. While Beijing had previously set a provisional tariff of 5% on whisky in 2017, this provision was removed for 2025, causing the rate to revert to 10%. The new policy reinstates the lower 5% tariff.

The agreement was a key outcome of discussions between Starmer and Xi in Beijing. Beyond whisky tariffs, the two leaders also committed to pursuing greater cooperation in the broader fields of trade, investment, and technology.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up