Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Standard Chartered analyst Geoffrey Kendrick revised his Bitcoin forecast, saying the $120,000 target may be too low, citing strong institutional inflows and shifting investor sentiment as Bitcoin tops $100,000.

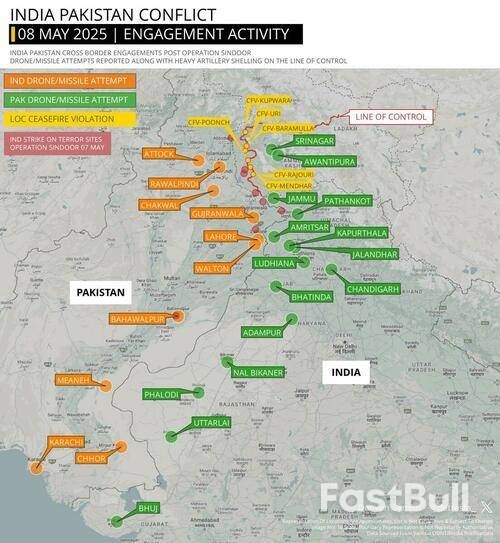

While there's been no official confirmation, a Pakistani official has described major aerial engagements above Jamu and Kashmir Thursday.

Some 125 Indian and Pakistani fighter jets battled for over an hour in one of the biggest dogfights in recent history, according to a Pakistani security source quoted by CNN.

If the numbers of aircraft were confirmed, it would make it one of the largest air battles since World War Two.

According to more of the unverified claims:

The "dog fight" between Pakistani and Indian fighter jets, which Pakistani officials say downed five Indian planes, was one of the "largest and longest in recent aviation history," a senior Pakistani security source told CNN. The Pakistani claim has not been corroborated and could not be immediately verified by Newsweek.

What is certain is that the last 24 hours have seen intense artillery fire exchanges, as well as drone strikes and intercepts, amid a ratcheting situation between the nuclear-armed rivals.

Purported video footage of Kashmir amid blackout and anti-air fire overhead...

China, the US and Russia are watching closely, also given the weapons being pitted against each other:

A top Chinese-made Pakistani fighter shot down at least two Indian military aircraft on Wednesday, two US officials have told the Reuters news agency, marking a major milestone for Beijing’s advanced fighter jet.

One US official, speaking on condition of anonymity, said there was high confidence that Pakistan had used the Chinese-made J-10 aircraft to launch air-to-air missiles against Indian fighter jets, bringing down at least two.

In the latest developments along the war-ready Indian-Pakistan border, the Pakistani military says it has downed 25 Indian drones over its territory, while India in in turn is announcing it thwarted a Pakistani drone and missile attack on its military.

The official Pakistani death toll after the Wednesday missile 'retaliatory' attacks on Punjab province and Pakistan-administered Kashmir yesterday is at least 31 killed and dozens more wounded. Heavy artillery fire across the Line of Control (LOC) has remained steady, but the kind of feared wider and out of control all-out war has yet to be sparked. Islamabad is now claiming to have killed scores of Indian troops.

On the other side, the last 48 hours of hostilities has resulted in at least 13 people killed in Indian-administered Kashmir, with others wounded due to Pakistani fire.

India's 'Operation Sindor' to avenge the 26 tourists killed last month's terror attack has been called an 'act of war' by Pakistani leaders. Islamabad has denied any involvement in supporting or harboring the gunmen, amid repeat Indian accusations.

As for the newest major Indian drone attack, it mainly targeted the second-largest city of Lahore, and India's government hailed that the operation successfully took out air defense radars at several locations. However, Pakistani Defense Minister Khawaja Asif rejected this, saying there was no damage, amid an ongoing fog of war where it's hard for international observers to confirm much.

But as for a much bigger claim which has yet to be confirmed or substantiated, Al Jazeera reports that "Attaullah Tarar, the Pakistani information minister, has said the country’s armed forces have killed 40 to 50 Indian soldiers in the exchanges along the Line of Control dividing Indian- and Pakistan-administered Kashmir." The assertions were made before legislators in the National Assembly.

Indian Foreign Secretary Vikram Misri's latest words suggest New Delhi is still seeking to prevent escalation, claiming that all our air strikes were against "carefully selected terror targets" and that Indian drones and shelling have only hit sites connected to "incidents of cross-border terror in India and terrorist infrastructure."

And provocatively, he alleged that Pakistan has been "using religious sites as a cover to train terrorists" - which strongly suggests India's assaults on Pakistan-administered Kashmir will continue, given the presence of armed Islamist factions. Much of this was directed at rejecting Pakistan's claim that Indian air strikes have damaged the vital Neelam-Jhelum dam.

But the question of disinformation, and the motive for India's 'counterterror' strikes, have been called "domestic theater" by one regional analyst:

Yet as tensions between the nuclear-armed neighbors escalate hour by hour, with Pakistan accusing India of launching a wave of drones into its territory on Thursday, military and geopolitical analysts question whether India’s approach serves as a deterrent against armed groups eager to target it. They argue that New Delhi’s actions are more symbolic and aimed at addressing its domestic audience rather than tactical advancement in the so-called “fight against terror”.

"This is all a domestic theatre," said Ajai Sahni, executive director of South Asia Terrorism Portal (SATP), a platform that tracks and analyses armed attacks in South Asia. "The Indian strikes [in Pakistan] have no deterrent value."

A steady spread of the border conflict...

Markets in India and Pakistan have again closed in the red, with India's benchmark stock market indices - the Sensex and Nifty - having fallen around half a percent in trade.

Pakistan's Karachi Stock Exchange was halted Thursday, with the benchmark KSE100 index losing more than 6% in trade. Amid the deep uncertainty the Indian rupee has slipped more than a percent against the US dollar.

XAU/USD quotes continue to move within the development of the correction and the bullish channel. At the time of publication of the forecast, the price of Gold for today is 3340 Dollars per Troy Ounce. Moving averages indicate the presence of a short-term upward trend. Prices have broken through the area between the signal lines upwards, which indicates pressure from asset buyers and potential continuation of growth from the current levels. At the moment, we should expect an attempt to develop a bearish correction of gold and a test of the support level near the 3320 area. From where we should expect an upward rebound and continued growth in the price of Gold with a potential target above the level of 3525.

An additional signal in favor of the growth of XAU/USD quotes will be a test of the support line on the relative strength indicator (RSI indicator). The second signal will be a rebound from the lower border of the bullish channel. The cancellation of the Gold price increase option on May 9, 2025 will be a fall in prices and a breakout of the 3295 level. This will indicate a breakout of the support area and a continuation of the fall in asset quotes to the area below the 3245 level. It is worth expecting an acceleration of the growth of XAU/USD quotes with a breakout of the resistance area and a price close above the 3425 level.

GOLD Forecast and Analysis for May 9, 2025 suggests an attempt to develop a price decline and test the support area near the 3320 level. Further, the continuation of the growth of non-ferrous metal quotes with a target above the 3525 level. The cancellation of the Gold price increase option will be a fall in the asset value on the markets and a breakout of the 3295 level. This will indicate a continuation of the decline in Gold prices with a potential target below the 3245 mark.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up