Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

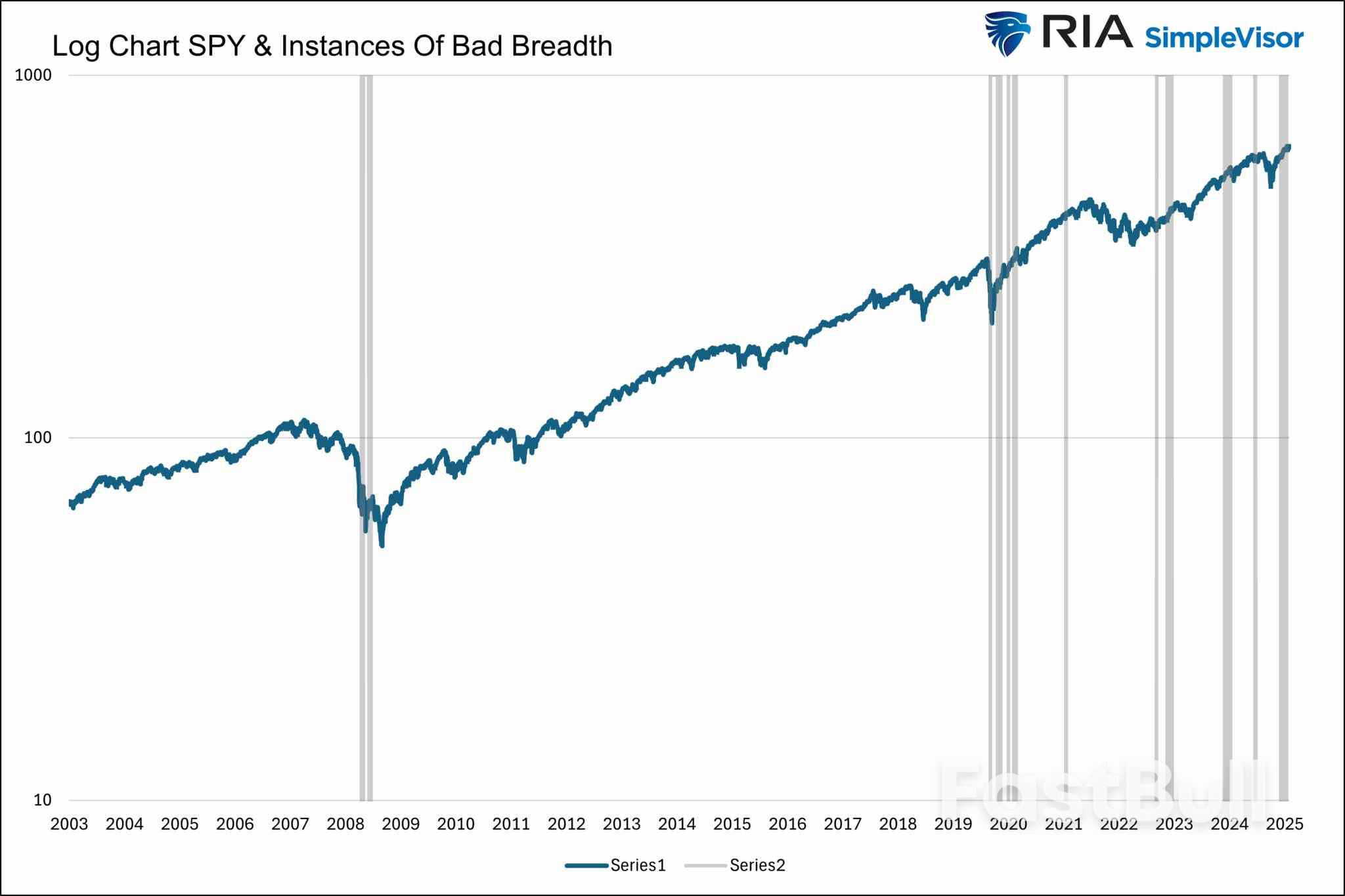

Since 2020, bad breadth in the S&P 500—rallies led by few mega-cap stocks—has appeared 95 times, nearly triple pre-pandemic levels. CPI met expectations at 2.7%, easing Fed concerns over lasting tariff-driven inflation.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesKey Points:

Vietnam will pilot a digital asset exchange in an international financial center, finalized by the Ministry of Finance, and awaiting government approval in August 2025.This move signals Vietnam's commitment to digital finance, potentially increasing regional liquidity and paving the way for modernized economic infrastructure.

Vietnam's move to pilot a digital asset exchange stems from legislative developments that include the National Assembly's resolution and the Ministry of Finance's comprehensive proposal. The planned pilot policy, awaiting August submission, will encompass trading, issuance, and management of digital assets, with a focus on blockchain and cybersecurity. The policy is designed to offer service providers the autonomy to select listed assets.The pilot exchange aims to boost liquidity and demand for leading digital assets, serving both Vietnamese and foreign markets. Vietnam's central bank's ongoing research into a national digital currency underlines the government's long-term strategy for a digital economy. Service providers will play a key role in asset selection, potentially elevating trading volumes.

Market observers note the announcement's potential to catalyze investment flows into Vietnam's digital asset market. Blockchain proponents herald this as an opportunity for expansion and innovation. The exchange pilot suggests broad support for blockchain technology, attracting notable attention within the regional and global financial community.

Did you know? Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region.

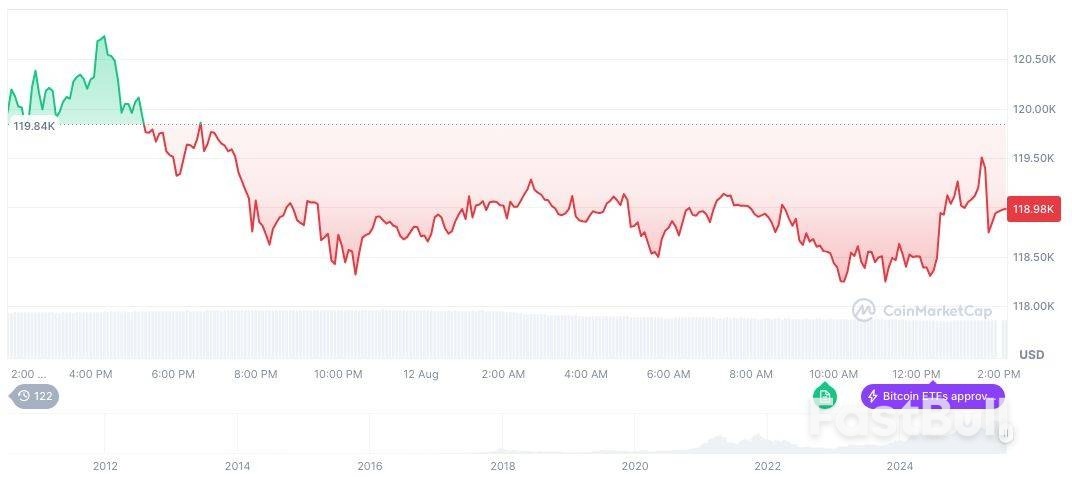

As of the latest data from CoinMarketCap, Bitcoin (BTC) holds a price of $119,220.74, with a market capitalization of $2.37 trillion and a dominance of 58.81%. However, its 24-hour trading volume decreased by 10.61% to $73.77 billion. Over 90 days, BTC's price increased by 15.74%.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.The Coincu research team highlights that Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region. "The pilot policy for digital asset trading finalized for government review by August," states the Vietnam Ministry of Finance. By integrating blockchain tech into the infrastructure, the exchange is positioned as a model of innovation in Southeast Asia's financial landscape. The pilot policy is anticipated to accelerate Vietnam's standing in an evolving financial climate.

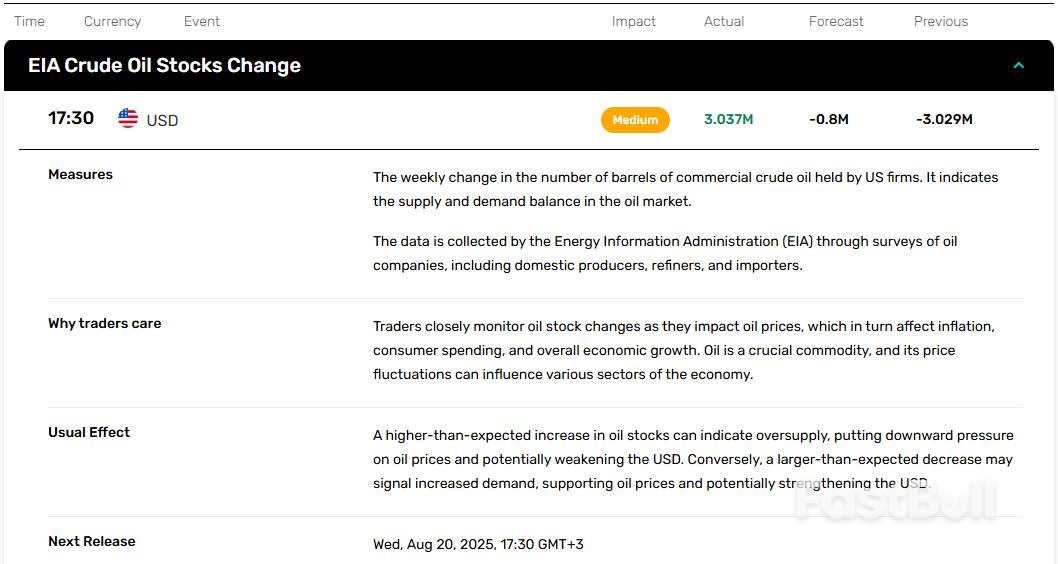

Strategic Petroleum Reserve increased from 403.0 million barrels to 403.2 million barrels.Domestic oil production grew from 13.284 million bpd to 13.327 million bpd.Oil prices moved lower as traders reacted to the EIA report.

On August 13, 2025, EIA released its Weekly Petroleum Status Report. The report indicated that crude inventories increased by +3 million barrels from the previous week, compared to analyst consensus of -0.8 million barrels. At current levels, inventories are about 6% below the five-year average for this time of the year.

Total motor gasoline inventories declined by -0.8 million barrels, compared to analyst forecast of -1 million barrels. Distillate fuel inventories increased by +0.7 million barrels from the previous week.

Crude oil imports increased by +958,000 bpd, averaging 6.9 million bpd. Over the past four weeks, crude oil imports averaged 6.2 million bpd. Rising crude oil imports were the key driver behind the increase in crude inventories.

Strategic Petroleum Reserve increased from 403.0 million barrels to 403.2 million barrels. From a big picture point of view, Strategic Petroleum Reserve has remained mostly unchanged in recent weeks.

Domestic oil production increased from 13.284 million bpd to 13.327 million bpd. A move above the 13.4 million bpd level will signal that domestic oil production is ready to increase at current oil price levels.

WTI oil remained under pressure as traders reacted to the EIA report. Currently, WTI oil is trying to settle below the $62.50 level.

Brent oil pulled back towards the $65.50 level after the release of the report.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up