Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)A:--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)A:--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)A:--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)A:--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)A:--

F: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)A:--

F: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)A:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)--

F: --

P: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)--

F: --

P: --

U.S. FHFA House Price Index (Oct)

U.S. FHFA House Price Index (Oct)--

F: --

P: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

SoftBank’s billionaire founder, Masayoshi Son, aims to capitalize on soaring demand for digital infrastructure, driven by the AI boom.

NEW YORK, Dec 29 (Reuters) - U.S. stocks dipped on Monday and gold pulled back from record highs at the top of a holiday-shortened week.

The three major U.S. stock indexes were weighed down by weakness in tech (.SPLRCT), opens new tab and materials stocks (.SPLRCM), opens new tab, while Treasury yields eased and the dollar hovered near its lowest in almost three months, reflecting expectations of further Federal Reserve interest rate cuts next year.

"It's a very light trading week ahead; volume is low, so therefore any kind of activity could push the index one way or the other," said Sam Stovall, chief investment strategist of CFRA Research in New York. "Possibly you have people who have decided to sell and they want to do some tax loss harvesting."

Market participants were closely monitoring negotiations between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy, with Trump saying they were getting "a lot closer" to a deal that could end Russia's war on Ukraine. Hopes for a deal dimmed after Russian authorities said Ukraine tried to attack President Vladimir Putin's residence, in a potential roadblock to further negotiations.

With just three sessions remaining, U.S. and global stocks were on course to end 2025 near record highs, having notched double-digit gains in a tumultuous year dominated by tariff wars, central bank policy and simmering geopolitical tensions.

"We started the year worried that we could be thrown into a recession because of the tariffs," Stovall added, but the tariffs' on-again, off-again activity helped allay those fears.

"We'll see what the final tally brings, but this will certainly be the (stock market's) third year of a double-digit gain," Stovall said.

The Dow Jones Industrial Average (.DJI), opens new tab fell 219.42 points, or 0.46%, to 48,489.11, the S&P 500 (.SPX), opens new tab fell 24.21 points, or 0.35%, to 6,905.73 and the Nasdaq Composite (.IXIC), opens new tab fell 117.42 points, or 0.50%, to 23,474.13.

European stocks steadied near all-time highs as gains in basic resources firms were counterbalanced by weakness in defense stocks.

MSCI's gauge of stocks across the globe (.MIWD00000PUS), opens new tab fell 2.06 points, or 0.21%, to 1,020.75.

The pan-European STOXX 600 (.STOXX), opens new tab index rose 0.07%, while Europe's broad FTSEurofirst 300 index (.FTEU3), opens new tab rose 1.69 points, or 0.07%.

Emerging market stocks (.MSCIEF), opens new tab rose 3.95 points, or 0.28%, to 1,401.35. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS), opens new tab closed higher by 0.3%, to 721.69, while Japan's Nikkei (.N225), opens new tab fell 223.47 points, or 0.44%, to 50,526.92.

World stocks YTD

World stocks YTDThe dollar steadied and the yen strengthened a bit following the release of the minutes from the Bank of Japan's policy meeting, but currency traders remained alert to the possibility of a BOJ intervention.

The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.03% to 98.00, with the euro up 0.09% at $1.1782.

Against the Japanese yen , the dollar weakened 0.22% to 156.19.

In cryptocurrencies, bitcoin gained 0.09% to $87,627.12. Ethereum rose 0.1% to $2,937.98.

U.S. Treasury yields edged lower as investors adjusted their bets for interest rate cuts from the U.S. Federal Reserve in the coming year.

The yield on benchmark U.S. 10-year notes fell 1 basis point to 4.124%, from 4.134% late on Friday.

The 30-year bond yield fell 1.1 basis points to 4.808% from 4.819% late on Friday.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 1.4 basis points to 3.469%, from 3.483% late on Friday.

Oil prices jumped as investors weighed hopes of progress from talks between U.S. and Ukrainian presidents on a possible deal to end the Russia-Ukraine war against potential oil supply disruptions in the Middle East.

U.S. crude rose 2.47% to $58.14 a barrel and Brent rose to $62.01 per barrel, up 2.26% on the day.

Gold and silver prices retreated from record highs amid profit taking. Spot gold fell 4.66% to $4,321.25 an ounce. U.S. gold futures fell 3.31% to $4,379.00 an ounce.

There is a rising market risk in 2026 that is largely overlooked as we wrap up this year. As discussed in the "Fed's Soft Landing Narrative," optimism about 2026 is running high.

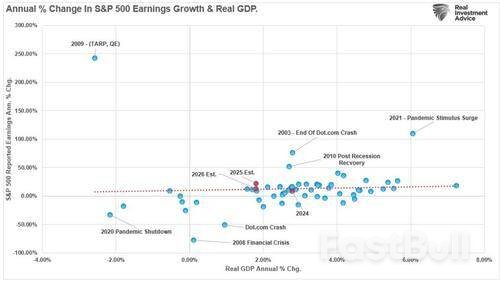

Currently, investors are pricing in strong economic growth, robust earnings, and a smooth path of disinflation. Notably, Wall Street estimates suggest a significant acceleration in corporate profits, particularly among cyclical stocks and small- to mid-cap sectors. To wit:

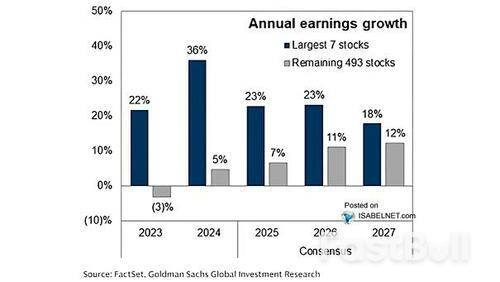

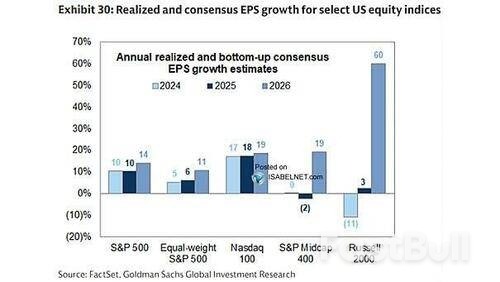

"Wall Street currently expects the bottom 493 stocks to contribute more to earnings in 2026 than they have in the past 3 years. This is notable in that, over the past three years, the average growth rate for the bottom 493 stocks was less than 3%. Yet over the next 2 years, that earnings growth is expected to average above 11%."

"Furthermore, the outlook is even more exuberant for the most economically sensitive stocks. Small and mid-cap companies struggled to produce earnings growth during the previous three years of robust economic growth, driven by monetary and fiscal stimulus. However, next year, even if the Fed's soft landing narrative is valid, they are expected to see a surge in earnings growth rates of nearly 60%."

There is nothing wrong with having an optimistic outlook when it comes to investing; however, "outlooks can change rapidly," which is a significant market risk, particularly when expectations and valuations are elevated.

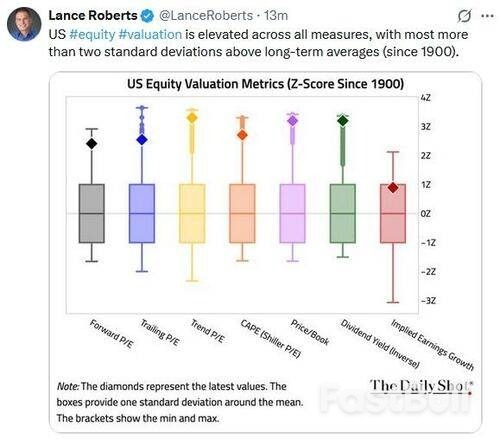

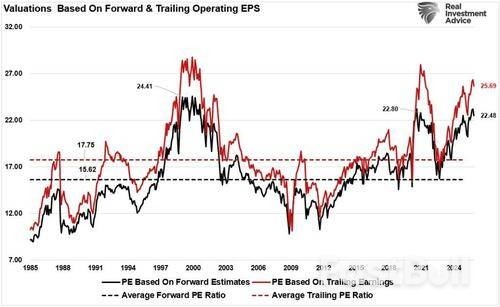

Notably, these forecasts rest on an assumption that the economy will not only avoid recession but reaccelerate in the face of waning inflation. As noted, equity markets have responded by pushing valuations higher across major indexes, with price-to-earnings ratios well above historical medians. Simultaneously, investors have rewarded narratives built on the idea of a soft landing and a return to pre-pandemic trends.

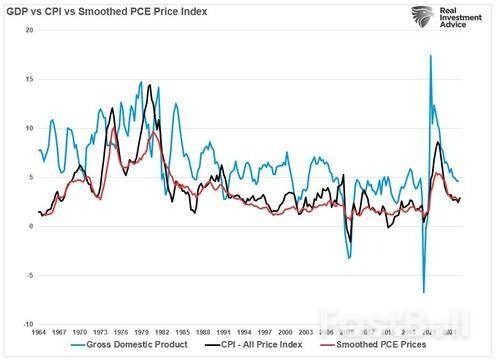

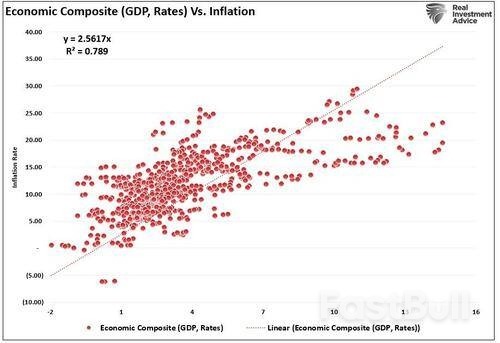

However, this narrative appears to overlook the trends in recent economic data. Inflation expectations have moderated, not because of increased demand, but due to weaker consumption and cooling labor dynamics. As recent economic data indicate, disinflation has accompanied slower GDP growth and a decline in personal consumption momentum. If the economy were indeed set to reaccelerate, these trends should be increasing rather than returning to historical averages.

The soft landing thesis posits a benign cycle in which inflation declines, growth remains stable, and earnings increase. Yet, that outcome would be historically rare. When inflation falls this quickly, it typically reflects a slowdown in demand rather than policy success. Additionally, the strong relationship between economic growth and earnings should not be dismissed. That disconnect exposes investors to market risk if growth does not materialize as expected and valuations are reconsidered.

With analysts expecting strong revenue growth and margin expansion despite rising input costs, global uncertainty, and declining employment, a market priced for perfection leaves little room for earnings misses or growth shocks. If those optimistic assumptions fail, market risk could rise abruptly.

Let's dig in.

As noted above, earnings growth is fundamentally tied to economic growth. When demand exceeds supply, companies expand output, raise prices, and increase profits. As discussed recently, this is why, without inflation, there can not be economic growth, increasing wages, and an improving standard of living. In other words, for there to be stronger economic growth and rising prosperity, prices must increase over time. Such is why the Fed targets a 2% inflation rate, thereby supporting 2% economic growth and stable employment levels.

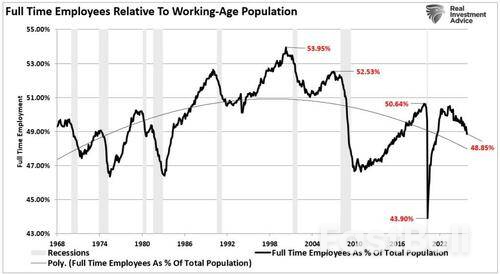

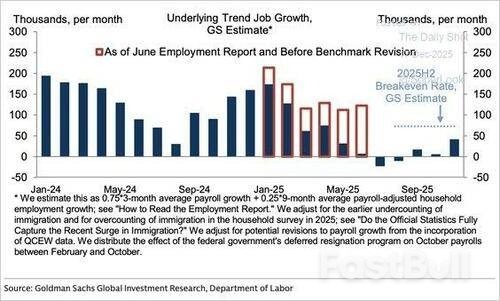

However, the employment data over the last year doesn't tell a story of substantial employment, rising wages, or a trend suggesting a more robust economic outlook. Instead, the latest data confirmed a deceleration in economic activity, as full-time employment (as a percentage of the population) declined.

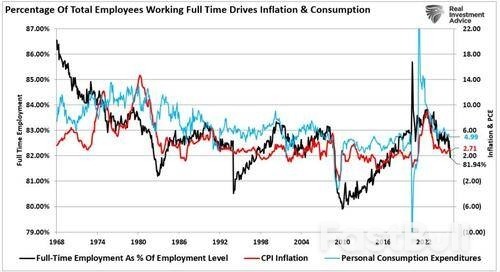

The importance of full-time employment should not be readily dismissed. Full-time employment pays higher wages, provides family benefits, and allows for an expansion of consumption. The decline in full-time employment currently is normally associated with recessions rather than expansions. Economic growth, inflation, and personal consumption are trending lower, given that employment, particularly full-time employment, supports economic supply and demand.

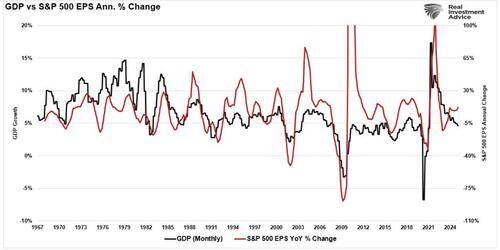

Furthermore, economic growth relies heavily on consumer spending, which accounts for nearly 70% of U.S. GDP. For that consumption to persist or grow, consumers must have rising incomes, which come from employment and wage growth. Without job creation or real wage increases, consumption growth stagnates, and the earnings narrative breaks down. As shown, when economic growth declines, so do earnings growth rates.

Recent employment data show cracks in this cycle. While headline job numbers suggest continued hiring, the quality and composition of those jobs are weakening. Today we see part-time workers filling full-time positions, often with lower pay and fewer benefits. Labor force participation remains below pre-pandemic levels, and many prime-age workers are not returning. Most notably, the negative revision of every monthly employment report in 2025 further undermines the "strong economy" narrative.

Even where wages are rising nominally, inflation-adjusted wages tell a different story. Real wage growth has been flat or negative in several key sectors. As housing, energy, and service prices remain high, the squeeze of disposable income increases. As such, consumers compensate by drawing down savings or using credit, both of which are unsustainable long-term strategies.

The market risk in 2026, is that for corporate earnings to accelerate and meet Wall Street's expecations, the consumer must be healthy. That means rising real wages and broad-based job creation. Without those pillars, top-line revenue growth slows, and margin pressures increase. Analysts projecting double-digit earnings growth into 2026 are assuming a demand-driven economy without the income growth needed to support it. That assumption is increasingly fragile. Without real economic growth, earnings become a product of financial engineering or cost-cutting, not organic expansion. Markets are pricing in a demand surge that the employment data do not confirm.

If this disconnect persists, Wall Street will revise earnings expectations lower.

That last sentence is the most crucial. With valuations near cycle highs, (the S&P 500 trades at over 22x times forward earnings, which is well above its long-term average), such assume strong earnings growth and low discount rates. Yet both assumptions are vulnerable. If economic growth undershoots, earnings revisions will follow. Historically, earnings have tended to lag behind the economic cycle. As consumption softens, revenue growth stalls. Margins then compress, especially for companies with high labor or financing costs, and with narrow market breadth and concentration in mega-cap names, the market risk is a sudden repricing of those expectations.

Credit risk premiums remain compressed across all asset classes, from high-yield to investment-grade, which reflects a belief in Fed control and continued monetary easing. If those beliefs are shaken, volatility will return. Market participants are not expecting a scenario where all risk assets decline simultaneously, including stocks, crypto, precious metals, and international markets.

The market risk for investors is not a 2008-style collapse. However, a far more likely scenario is a long period of underperformance. That underperformance will likely be a function of earnings disappointment, weak growth, and multiple compression. Market analysts are currently pricing the market for acceleration. But those views may struggle is stagnation, and the "path of least resistance," shifts from upward momentum to sideways drift or correction.

As such investors should continually monitor and assess the risk they are taking in portfolios.

Reassess exposure to high-multiple equities and overconcentrated sectors. While technologty drives index performance, valuations are high and if growth expectations are too high, tech earnings will likely fail to meet them. The same applies to consumer discretionary stocks tied to fragile spending.

Consider a more defensive position, focusing on free cash flow, balance sheet strength, dividends, and pricing power.

Add bonds to your portfolio to protect prinicpal and create income. Furthermore, in the event of a risk-off rotation, investors will seek the safety of bonds to reduce portfolio risk. Being there before the correction occurs can be beneficial to outcomes.

Liquidity should always be a priority. If risk aversion returns, liquidity conditions can tighten quickly. Investors consider a scenario where risk assets (stocks, commodities, metals, and cryptocurrencies) decline sharply as risk resets

A prudent approach is to reduce exposure to narrative-driven assets and increase allocations to quality. Investors should favor sectors with consistent earnings, low leverage, and stable dividends. Cash remains underappreciated as a strategic tool, and with real yields positive and volatility likely to rise, liquidity is a source of optionality.

The next two years will test the soft landing thesis. If growth falls short, earnings disappoint, or inflation returns, markets will face a reset. That reset may not be dramatic, but it will be painful for those overexposed to the current consensus.

The best defense is valuation discipline, risk awareness, and a willingness to question the prevailing narrative.

Russian President Vladimir Putin has made clear to both his citizens and to the world that the 'special military operation' in Ukraine will continue on until all goals are achieved, and that his forces are advancing 'confidently'.

He chaired a televised meeting with the country's top military officials, focused on a status update regarding Ukraine, and crucially coming the day after Presidents Trump and Zelensky met in Florida in a failed effort to reach breakthrough on the proposed peace deal. Moscow is pressing ahead with its goal of fully capturing and pacifying the four Ukrainian regions it declared part of the Russian Federation in fall of 2022 via a 'popular referendum'.

"The goal of liberating the Donbas, Zaporizhia and Kherson regions is being carried out in stages, in accordance with the plan of the special military operation," Putin described before underscoring, "The troops are confidently advancing."

Sputnik/Reuters

Sputnik/ReutersAt the meeting it was also announced that Russian troops have made more gains in the last 24 hours, especially the capture of Dibrova village in Donetsk region.

According to an update of the meeting via RT translation, battlefield gains of the past month are significant:

In December, Russian forces liberated over 700 square kilometers of territory, taking some 32 settlements under control, Gerasimov said at the meeting. This month, the military has shown the highest rate of progress in the entire outgoing year, he noted, adding that troops are advancing "along virtually the entire frontline."

"The adversary is not undertaking any active offensive actions. They have concentrated their main efforts on strengthening their defenses and are attempting to slow the pace of our advance by conducting counterattacks in isolated areas and using drones en masse," Gerasimov said.

The Kremlin has at the same time reiterated that it is not interested in a 'Plan B or Plan C' in terms of a peace deal, but that it only seeks lasting political settlement. This will of course include international recognition of its territories in the Donbass.

According to highlights the Russian president's speech after his meeting with top defense officials, via a TASS and Al Jazeera compilation:

Putin, surrounded by his generals, is making clear to the world that he remains in the driver's seat - with all the leverage on the field of battle - and that Zelensky has no cards to play.

Mining difficulty for Bitcoin has risen to 148.2 trillion in the latest 2025 difficulty reset, the highest level since miners' and adversarial network forces collided in earnest.

That is a significant jump in general, as the protocol is setting up for one more leg higher into early 2026. What is also increasing, and steadily rising through 2025, is the difficulty of inserting a new block into the Bitcoin ledger.

At the beginning of the year, it was substantially below 110 trillion and rose in tandem with the increasing demand for mining hash power. In competitive situations, some miners increased production to afford the necessary equipment for gains. The current level is roughly 35% above January's baseline, although still shy of the October peak, which was near 156 trillion.

The rising difficulty reflects the overall growth in the network's computational power. Analysts remain uncertain about what this major shift signals for Bitcoin, but it highlights both the resilience and the challenges faced by miners.

More complexity leads to a more secure network, albeit at the expense of smaller miners who run less powerful machines, in part because their profit margins are thin.

The Bitcoin network difficulty is directly proportional to the hashrate and adjusts itself every two weeks (or more precisely, every 2,016 blocks) to find new blocks approximately every 10 minutes.

Bitcoin's mining difficulty rises when blocks are mined too quickly and falls when they're mined too slowly. At the last adjustment, the average time between blocks was roughly 9.95 minutes—slightly slower than the current pace. This acceleration has effectively acted as a difficulty booster. With hash power continuing to climb, analysts project that difficulty could once again reach new highs, potentially surpassing 149 trillion, assuming current conditions persist until the next adjustment, expected around January 8, 2026.

The network's hash rate, which measures the total computational power available to secure the network, continued to increase throughout much of 2025. It reached over 1,150 EH/s at its highest point in October before gradually declining later in the year. Even with that slight dip, hash power is still significantly higher than it was in January.

Big companies and miners with industrial-scale operations have been driving this expansion, thanks to the use of expensive ASIC equipment and inexpensive power sources.

Difficulty serves as Bitcoin's only safety valve at the protocol level. Blocks cannot be added too quickly, which ensures predictable issuance and helps maintain network stability.

The mining challenge is recalibrated every 2,016 blocks, roughly every 10 minutes at the current hash rate. Bitcoin's decentralized consensus not only resists certain attacks but also provides resilience, making the network disaster-tolerant.

Greater difficulty also means that it takes more electricity and computer power to unlock each block. This can be margin-pressured, and with volatile price action on Bitcoin, it's becoming increasingly difficult to support the network as electricity costs rise – a challenge in maintaining network strength amid heightened activity. The network is stabilized with minor oscillations.

Ukraine attempted to attack Russian President Vladimir Putin's state residence in the Novgorod region using 91 drones, according to Russian Foreign Minister Sergei Lavrov.

All drones were destroyed during the attack, Lavrov said, as reported by Russian news agencies TASS and Interfax on Monday.

Following the incident, Lavrov stated that Russia will retaliate, with targets and timing for a counterstrike already determined. Despite the attack, Russia plans to continue negotiations with U.S. and others, but will change its negotiating position.

The Russian foreign minister did not provide specific details about the planned countermeasures.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up