Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

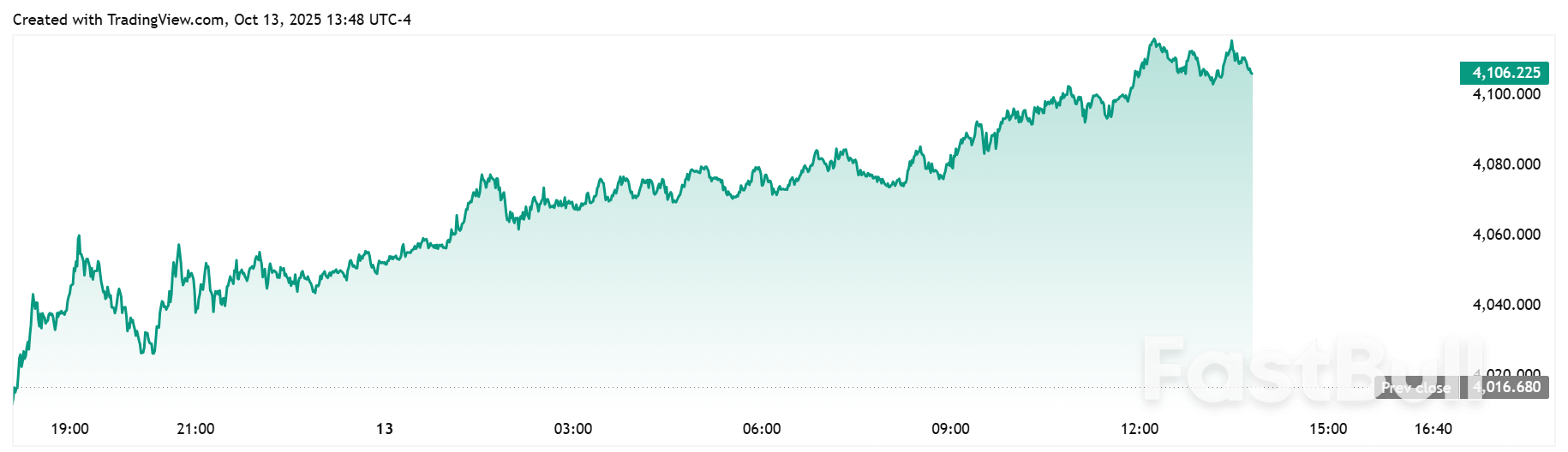

Trump’s tariff threats reignited U.S.-China tensions, sending the S&P 500 down 2.7% and Nasdaq 3.5%. Beijing responded with rare-earth export controls and ship levies as both sides harden positions before the late-October summit.

Global markets are getting too comfortable with risks like trade wars, geopolitical tensions and yawning government deficits, which, combined with already overpriced assets, increase the chance of a "disorderly" market correction, the International Monetary Fund said on Tuesday.

Underscoring the IMF’s warning, President Donald Trump’s revived threats on Friday to hike tariffs on China stoked investor fears of a major asset price correction. The comments sparked a sell-off in U.S. stocks and sent bitcoin tumbling.

Despite this recent volatility, markets have mostly been resilient since April, when Trump unleashed his trade war, underpinned by expectations of monetary easing in most major advanced economies. However, this market optimism masks the potential damage from tariffs and high government debt. The IMF warned that the close ties between banks and less-regulated financial firms could amplify these risks.

"Beneath the calm surface, the ground is shifting in several parts of the financial system, giving rise to vulnerabilities," the body wrote in its semiannual Global Financial Stability Report.

"Valuation models indicate that risk asset prices are well above fundamentals, increasing the probability of disorderly corrections when adverse shocks occur," it wrote.

Despite some negative economic data, equity and corporate credit valuations are "fairly stretched" as enthusiasm over AI mega-cap stocks drives historic stock market concentration. That creates the risk of a "sudden, sharp correction" if expected returns fail to justify lofty valuations, the IMF said.

Analysis of sovereign bond markets also highlights growing pressure from widening fiscal deficits on market functioning. While bond markets have been mostly stable so far, abrupt jumps in yields could strain bank balance sheets and pressure open-ended funds like mutual funds, the IMF said.

U.S. bond markets sold off last month as concerns about global fiscal health escalated, although the pain was quickly reversed and bonds rallied on weak economic data.

The IMF added that central banks should remain alert to tariff-driven inflation risks and take a cautious stance on monetary easing to minimize further valuation spikes in riskier assets. Central bank independence is "critical" for anchoring market expectations and allowing those institutions to fulfill their mandates, it added, without referring to a specific institution.

Trump’s attacks on Federal Reserve policymakers are emerging as the biggest threat to central bank independence in decades, sparking worries among central bankers worldwide, Reuters reported in August.

The IMF also called for "urgent fiscal adjustments" to curb deficits and ensure resilient bond markets.

Heightened interconnectedness between banks and the more lightly regulated nonbank sector would amplify any shocks stemming from sectors such as private credit or cryptocurrencies, the IMF said.

The group for years warned about patchy nonbank oversight but cautioned on Tuesday that the sector - which includes insurers, pension funds and hedge funds - continues to grow and now holds roughly half of the world’s financial assets. In the United States and Europe, many banks have nonbank exposures that exceed their high-quality loss-absorbing capital, the IMF said.

Roughly 10% of U.S. banks and 30% of European banks would experience a substantial hit to their capital if nonbanks drew down all their credit lines, according to an IMF analysis.

"Vulnerabilities in the nonbank sector are interconnected," the IMF wrote. "They can quickly transmit to the core banking system, amplifying shocks and complicating crisis management."

The body urged policymakers to adopt a more comprehensive approach to assessing these less visible risks, particularly around interactions between banks and nonbanks.

Echoing European policymakers, the IMF also called on governments to adopt a comprehensive policy response to crypto assets, including stablecoins, the adoption of which could weaken a government’s control over its own currency and disrupt the traditional banking system.

Israeli Defense Minister Israel Katz said on Sunday that the Israeli military would destroy tunnels in Gaza after the remaining Israeli captives are released by Hamas, which has happened on Monday."Israel’s great challenge after the phase of returning the hostages will be the destruction of all of Hamas’s terror tunnels in Gaza, directly by the IDF and through the international mechanism to be established under the leadership and supervision of the United States," Katz wrote on X.

“This is the primary significance of implementing the agreed-upon principle of demilitarizing Gaza and neutralizing Hamas of its weapons. I have instructed the IDF to prepare for carrying out the mission,” he added.

According to the outline of the Gaza ceasefire proposal released by the White House, all “military, terror, and offensive infrastructure, including tunnels and weapon production facilities, will be destroyed and not rebuilt,” and there will be a “process of demilitarization of Gaza under the supervision of independent monitors.” But the details of how those steps will be taken, including who will be doing it, are unclear. A senior Hamas official has also said that Hamas won’t disarm unless it can hand its weapons to a Palestinian state.

So far, Israel and Hamas have just entered the first phase of the ceasefire deal, which involves the release of the Israeli hostages in exchange for thousands of Palestinians held in Israeli jails, the IDF pulling back to an agreed-upon line, and Israel allowing more aid to enter Gaza. Details on implementing the rest of the agreement still need to be worked out in negotiations between Israel and Hamas.Katz’s comments come as many are concerned Israel will restart its brutal war once Hamas releases the Israeli captives. Also on Sunday, Israeli Prime Minister Benjamin Netanyahu said the military “campaign is not over,” though he could be referring to other areas where Israel is at war or potential escalations elsewhere in the region.

“And I want to say: Everywhere we fought – we won. But in the same breath, I must tell you: The campaign is not over. There are still very great security challenges ahead of us,” Netanyahu said, according to a statement from his office. “Some of our enemies are trying to rebuild themselves to attack us again. And as we say – ‘We’re on it.'”According to a report from Israel Hayom, the US has given Israel a guarantee that it would back Israeli military action if it determined Hamas violated the deal in a way that “poses a security threat.” The report said the understanding “constitutes a side agreement” between the US and Israel.The US gave Israel a similar side deal for the November 2024 Lebanon ceasefire agreement, which Israel continues to violate on a near-daily basis.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up