Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Samsung Electronics said on Friday it has named its mobile chief TM Roh as a new co-CEO and head of its device experience division, which oversees the company's mobile phone, TV and home appliance businesses.

Samsung Electronics said on Friday it has named its mobile chief TM Roh as a new co-CEO and head of its device experience division, which oversees the company's mobile phone, TV and home appliance businesses.

The appointment returns Samsung to its traditional co-CEO structure, which divides oversight of its chip and consumer divisions, after the company had been operating under a sole-CEO setup following the sudden death of co-CEO Han Jong-Hee in March.

Roh has been serving as acting head of the consumer business since April, following Han's death.

Ryu Young-ho, a senior analyst at NH Investment & Securities, said Samsung had made a "safe and predictable" choice, adding that the appointment appeared aimed at further strengthening competitiveness.

Ryu noted that Samsung's strongest-performing businesses so far this year have been memory chips and mobile, and by naming TM Roh as co-CEO, the company is signaling it wants to put more weight behind those divisions.

The memory business is benefiting from a favourable market, he said, but is also showing progress as Samsung works to narrow the gap with rivals in the AI chip race under co-CEO Jun Young-hyun's leadership of the division.

The reshuffle comes after Samsung's appointment earlier this month of a new head of its business support office, a key decision-making body at the technology giant that serves chairman Jay Y. Lee.

The body functions as a strategy unit that acts as a mini-control tower inside Samsung Group, South Korea's top conglomerate whose businesses range from chips to smartphones, ships and pharmaceuticals, and coordinates across business units and affiliates, analysts said.

Samsung Electronics shares were down 4.2% as of 0105 GMT, compared with a 3.2% fall in the benchmark KOSPI.

Analysts said the move was not related to the leadership changes, noting that Asian stocks broadly fell after U.S. tech shares slid on concerns over AI valuations and as U.S. jobs data failed to provide clarity on the interest rate outlook.

Greek Prime Minister Kyriakos Mitsotakis aid he's optimistic about the country's economic outlook over the next 18 months, adding that Greece's rebound reflects a broader trend of southern Europe outperforming traditional economic powerhouses.

"Greece has staged over the past years what I consider to be a pretty remarkable comeback," Mitsotakis said in an interview with Bloomberg News Editor-in-Chief John Micklethwait at the New Economy Forum in Singapore on Friday. "We have proven that the Greek crisis belongs to the past."

The Greek economy has been outperforming most of its European peers and is only one of a few countries in the region achieving budget surpluses. All major rating companies have placed Greece back in the investment grade zone and continue to upgrade the country's sovereign rating status, citing fiscal discipline as the main reason for doing so.

Southern Europe is now doing better than traditional leaders such as Germany and France, according to Mitsotakis. Politically, he said Greece also shows that the center can hold, even as far-right movements gain traction elsewhere in Europe.

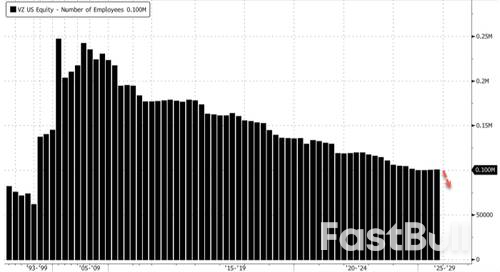

Verizon CEO Dan Schulman released a public letter to the company's 100,000-person workforce on Thursday morning, revealing that more than 13,000 job cuts will begin today. The timing is optically displeasing, coming just one week before the Thanksgiving holiday.

"Today, we will begin reducing our workforce by more than 13,000 employees across the organization, and significantly reduce our outsourced and other outside labor expenses," Schulman wrote in the letter.

Schulman said Verizon established a $20 million Reskilling and Career Transition Fund for departing workers, focused on training, digital skills, and job placement in the era of artificial intelligence.

"This fund will focus on skill development, digital training and job placement to help our people take their next steps. Verizon is the first company to set up a fund to specifically focus on the opportunities and necessary skill sets as we enter the age of AI," the CEO noted.

Schulman's letter comes one week after the Wall Street Journal reported that Verizon was planning about 15% in job cuts, or about 15,000 workers.

Bloomberg's latest data suggests that 13,000 job cuts equal about 13% of its roughly 100,000-person workforce. WSJ notes this would be the largest workforce reduction on record for the carrier.

Also, last week, Verizon chairman Mark Bertolini told CNBC's Becky Quick on "Squawk Box" that the company needs to "do something different" as it undergoes its leadership change.

Separate but notable...

So we guess that the "something different" is making 13,000 workers have a miserable holiday season.

Wall Street futures inched higher on Thursday evening, steadying after a whipsaw session that ended with deep losses as an earnings-driven rally in Nvidia reversed course, while investors further priced out bets on a December interest rate cut.

NVIDIA Corporation (NASDAQ:NVDA) fell slightly further in aftermarket trade, following a 3.1% loss during the main session as investors soured on its third quarter earnings. Losses in Nvidia spilled over into broader tech shares, amid growing concerns over an artificial intelligence-fueled bubble.

Sectors beyond tech also lost ground as strong September payrolls data spurred bets that resilience in the labor market will give the Federal Reserve even less impetus to cut interest rates.

S&P 500 Futures rose nearly 0.3% to 6,576.0 points, while Nasdaq 100 Futures rose 0.2% to 24,186.25 points by 19:40 ET (00:40 GMT). Dow Jones Futures rose 0.3% to 45,970.0 points.

Markets took some support from President Donald Trump signing an order to lower U.S. import tariffs on some Brazilian agrigoods, which could help lower food costs in the country.

Wall Street indexes tumbled on Thursday, logging wild swings as investors digested Nvidia's earnings.

While the top and bottom line figures were strong, some analysts raised concerns about Nvidia's rapidly growing inventories, while comments from management did little to quell broader concerns about an artificial intelligence bubble and circular investing.

Investor Michael Burry, famous for predicting the 2008 financial crisis, also criticized Nvidia's earnings, and warned that true end demand for AI was far less than what valuations were suggesting.

Nvidia slid 3% after initially rising 5%, logging a nearly $400 billion swing in valuation. The stock fell 0.2% in aftermarket trade.

Beyond Nvidia, positive earnings from top retailer Walmart Inc (NYSE:WMT) offered some support, with the stock rallying 6.5% during the main session.

The S&P 500 fell 1.6% to 6,538.97 points on Thursday. The NASDAQ Composite slid 2.2% to 22,078.05 points, while the Dow Jones Industrial Average fell 0.8% to 45,752.26 points. All three indexes have fallen for five of the past six sessions.

Wall Street was also pressured by investors further scaling back bets that the Federal Reserve will cut interest rates in December. This notion was furthered chiefly by stronger-than-expected nonfarm payrolls data for September.

Strength in the labor market and sticky inflation give the Fed less impetus to cut interest rates further. The minutes of the Fed's October meeting, released earlier this week, also showed policymakers largely split over a December cut.

Markets are pricing in a 31% chance for a 25 basis point cut in December, down from 45.8% last week, CME Fedwatch showed.

Morgan Stanley analysts said they no longer expected a December cut, after Thursday's payrolls reading.

The growth in Singapore's key exports is expected to moderate in 2026 to 0 per cent to 2 per cent as tariff impact materialises and frontloading eases, Enterprise Singapore said on Nov 21.

The trade agency also narrowed its 2025 forecast for growth in non-oil domestic exports (Nodx) to around 2.5 per cent, from its previous forecast range of 1 to 3 per cent.

In its quarterly review of trade performance, EnterpriseSG noted that the World Trade Organisation expects global trade growth to fall to 0.5 per cent in 2026 from 2.4 per cent in 2025.

"This slowdown primarily reflects the materialisation of tariff-related impact and the easing of frontloading effects," said the agency.

"Downside risks include potential re-escalation of tariff actions as well as sector-specific tariffs that could raise global economic uncertainty and dampen demand," it added.

In the third quarter, Singapore's key exports fell 3.3 per per cent from a year ago after a 7 per cent increase in the second quarter. Non-electronic shipments shrank while electronics grew at a slower pace.

Exports of electronic products grew 7.1 per cent year on year. Personal computers expanded 69.5 per cent, integrated circuits grew 9.2 per cent while disk drives were up 16.5 per cent.

Non-electronic shipments fell 6.5 per cent in the third quarter, dragged down by food preparations (-39.4 per cent), petrochemicals (-21.2 per cent) and pharmaceuticals (-9.3 per cent).

Key exports to the United States tumbled 30.7 per cent, while those to Indonesia dropped 29.3 per cent. Nodx to China fell 8.3 per cent.

The Ministry of Trade and Industry (MTI) announced on Nov 21 that Singapore's GDP growth forecast for 2025 has been upgraded from "1.5 to 2.5 per cent" to "around 4.0 per cent". It largely reflects the better-than-expected performance of the Singapore economy in the third quarter of 2025.

But growth is expected to slow to 1 per cent to 3 per cent in 2026.

The recent downward pressure on the cryptocurrency market could be the result of deep holes in the balance sheets of market makers, according to Tom Lee, chairman of Ether treasury company BitMine.

Speaking with CNBC on Thursday, Lee suggested that the Oct. 10 market crash, which saw a record $20 billion liquidated from the market, ultimately caught some market makers off-guard, causing severe liquidity issues.

With less capital to operate, combined with reduced capital from traders as their primary source of revenue, it's a tough time for market makers, Lee said. As a result, this has also led them to shrink their "balance sheet further" in a bid to free up more capital.

"And if they've got a hole in their balance sheet that they need to raise capital, they need to reflexively reduce their balance sheet, reduce trading. And if prices fall, they've got to then do more selling. So I think that this drip that's been taking place for the last few weeks in crypto reflects this market maker crippling," he said.

Tom Lee offers his current read on the market. Source: CNBC

Tom Lee offers his current read on the market. Source: CNBCLee, who is also the co-founder of Fundstrat, likened the importance of crypto market makers to "central banks" and suggested that the market may face more pain for a few more weeks until the market makers' liquidity issues are resolved.

"Today's stock market looks a lot like an echo of what happened on October 10th. But on October 10th, that liquidation was so big [...] it really crippled market makers," he said, adding:

Bitcoin (BTC) was priced at over $121,000 before the Oct. 10 crash, and has since declined back to $86,900, with most of the market following a similar pattern.

Lee said there may be another couple of weeks of market maker unwinding before the market starts to heal, as he pointed to a similar occurrence from 2022:

The US Justice Department has charged four people in a scheme to illegally export Nvidia artificial intelligence (AI) chips to China, prompting a key House Republican to call for urgent passage of a chip-tracking bill on Thursday.

"China recognises the superiority of American AI innovation and will do whatever it must to catch up," said John Moolenaar, the chair of the US House Select Committee on China. "That's why the bipartisan Chip Security Act is urgently needed."

The legislation, which Moolenaar introduced in May and has 30 cosponsors, would require location verification for chips, make it mandatory for chipmakers to report and share information about potential diversion, and look at additional ways to stop US chips from ending up in the wrong hands.

The case highlights the challenges Washington faces in enforcing its sweeping restrictions on high-tech exports to China, which are designed to hobble Beijing's military development and keep the US ahead on technology. China has criticised US export curbs as part of a campaign to weaponise economic and trade issues.

The indictment, which the US Department of Justice announced on Thursday, charges two US citizens and two Chinese nationals with conspiring to export Nvidia GPUs to China without required licences. The defendants allegedly created fake contracts and provided false documentation to ship the chips to third countries, knowing they were destined for China.

They then exported 400 Nvidia A100 GPUs to China through Malaysia between October 2024 and January 2025, according to the indictment. Law enforcement stopped attempts to export 10 Hewlett-Packard supercomputers with Nvidia H100 GPUs and 50 separate Nvidia H200 GPUs through Thailand, the US Department of Justice said.

In the Florida case, the conspiracy included the use of a Tampa company as a front to purchase and export chips, and nearly US$4 million (RM16.58 million) in wire transfers from China to fund the scheme, the Justice Department said.

A lawyer for one defendant declined to comment and a lawyer for a second defendant did not immediately respond to a request for comment. The other defendants could not immediately be reached.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up