Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Russia unleashed a major missile and drone barrage on Ukraine overnight into Saturday, after U.S. and Ukrainian officials said they'll meet on Saturday for a third day of talks aimed at ending the nearly 4-year-old war.

Russia unleashed a major missile and drone barrage on Ukraine overnight into Saturday, after U.S. and Ukrainian officials said they'll meet on Saturday for a third day of talks aimed at ending the nearly 4-year-old war.

Following talks that made progress on a security framework for postwar Ukraine, the two sides also offered the sober assessment that any "real progress toward any agreement" ultimately will depend "on Russia's readiness to show serious commitment to long-term peace."

The statement from U.S. special envoy Steve Witkoff, Trump's son-in-law Jared Kushner as well as Ukrainian negotiators Rustem Umerov and Andriy Hnatov came after they met for a second day in Florida on Friday. They offered only broad brushstrokes about the progress they say has been made as Trump pushes Kyiv and Moscow to agree to a U.S.-mediated proposal to end the war.

Russia used 653 drones and 51 missiles in the wide-reaching overnight attack on Ukraine, which triggered air raid alerts across the country and came as Ukraine marked Armed Forces Day, the country's air force said Saturday morning.

Ukrainian forces shot down and neutralized 585 drones and 30 missiles, the air force said, adding that 29 locations were struck.

At least eight people were wounded in the attacks, Ukrainian Minister of Internal Affairs Ihor Klymenko said.

Among these, at least three people were wounded in the Kyiv region, according to local officials. Drone sightings were reported as far west as Ukraine's Lviv region.

Russia carried out a "massive missile-drone attack" on power stations and other energy infrastructure in several Ukrainian regions, Ukraine's national energy operator, Ukrenergo, wrote on Telegram.

Ukraine's Zaporizhzhia nuclear power plant temporarily lost all off-site power overnight, the International Atomic Energy Agency said Saturday, citing its Director General Rafael Mariano Grossi.

The plant is in an area that has been under Russian control since early in Moscow's invasion of Ukraine and is not in service, but it needs reliable power to cool its six shut-down reactors and spent fuel, to avoid any catastrophic nuclear incidents.

Ukrainian President Volodymyr Zelenskyy said that energy facilities were the main targets of the attacks, also noting that a drone strike had "burned down" the train station in the city of Fastiv, located in the Kyiv region.

Russia's Ministry of Defense said its air defenses had shot down 116 Ukrainian drones over Russian territory overnight into Saturday.

Russian Telegram news channel Astra said Ukraine struck Russia's Ryazan Oil Refinery, sharing footage appearing to show a fire breaking out and plumes of smoke rising above the refinery. The Associated Press could not independently verify the video.

The General Staff of the Ukrainian Armed Forces later said Ukrainian forces had struck the refinery. Ryazan regional Gov. Pavel Malkov said a residential building had been damaged in a drone attack and that drone debris had fallen on the grounds of an "industrial facility," but did not mention the refinery.

Months of Ukrainian long-range drone strikes on Russian refineries have aimed to deprive Moscow of the oil export revenue it needs to pursue the war. Meanwhile, Kyiv and its western allies say Russia is trying to cripple the Ukrainian power grid and deny civilians access to heat, light and running water for a fourth consecutive winter, in what Ukrainian officials call "weaponizing" the cold.

The latest round of attacks came as U.S. President Donald Trump's advisers and Ukrainian officials said they'll meet for a third day of talks on Saturday, after making progress on finding agreement on a security framework for postwar Ukraine.

Following Friday's talks, the two sides also offered the sober assessment that any "real progress toward any agreement" ultimately will depend "on Russia's readiness to show serious commitment to long-term peace."

Authorities in Nigeria said Sunday that they have secured the release of 100 schoolchildren who were kidnapped from a Catholic school last month.

The Christian Association of Nigeria (CAN) said 315 pupils and staff were abducted by gunmen on November 21 from St. Mary's co-educational boarding school in the north-central Niger state.

Fifty students were able to escape in the following hours.

The fate of another 165 students and school staff, who are believed to still be in captivity, remains unclear.

Twelve teachers and 303 children were kidnapped from St: Mary's in Papiri, Niger state [FILE: November 23, 2025]Image: Ifeanyi Immanuel Bakwenye/AFP

Twelve teachers and 303 children were kidnapped from St: Mary's in Papiri, Niger state [FILE: November 23, 2025]Image: Ifeanyi Immanuel Bakwenye/AFPThe 100 schoolchildren who were released have arrived in the capital Abuja, a UN source told the AFP news agency. They will be handed over to local officials in Niger state on Monday, the source added.

Presidential spokesman Sunday Dare confirmed to AFP that the schoolchildren have been released.

Local media, including broadcaster Channels Television, also reported that 100 children had been released.

It was unclear whether the release was the result of military force or negotiations. It is also not known which group is responsible.

Niger state authorities as well as the CAN have said they have not been formally notified of the children's release. Nigeria's government has also not officially commented.

For years, Nigeria has been fighting an Islamist insurgency in the northeast of the country, while gangs of so-called "bandits" carry out abductions and ransack villages in the northwest.

The country is still scarred by the 2014 kidnapping of nearly 300 schoolgirls by Boko Haram militants. Some of the former students, most of whom were between the ages of 16 and 18 at the time, are still missing.

But a recent surge in abductions since last month has again highlighted the West African nation's poor security situation. Last week, Mohammed Badaru Abubakar resigned as defense minister as authorities look to respond.

In November, 25 Muslim schoolgirls were kidnapped in the state of northwestern Kebi, as were 38 Christian worshipers and their pastor in Kogi state, in the North Central region.

In a separate incident in Sokoto state in the northeast, a bride and 10 of her bridesmaids were abducted from a village.

The kidnappings have coincided with US President Donald Trump ramping up the pressure on Nigeria over the alleged mass killings of Christians.

Trump has said a Christian "genocide" is unfolding in Nigeria and has threatened military action unless the government addresses the situation.

Nigeria's government has rejected Trump's claims.

Salaries are picking up in the UK after months of near-stagnation, according to a survey that's closely watched by the Bank of England policymakers.

The Recruitment & Employment Confederation and KPMG said starting pay for permanent staff rose at the fastest pace in five months in November, as firms stepped up efforts to attract talent in areas facing skill shortages.

The numbers could fuel worries about sticky price pressures ahead of an interest-rate decision from the BOE later this month.

At the same time, the survey also contained some signs of labor market easing. Hiring continued to fall, albeit at a softer rate, and the number of candidates looking for work surged.

The report echoes the BOE's Decision Maker Panel, painting a picture of stubborn wage inflation despite a rapid deterioration in employment. Policymakers often cite the REC survey as an early warning signal of labor-market pressures before they surface in official data.

A pick-up in pay growth could provide ammunition to the monetary policy committee's most hawkish members — such as Catherine Mann or Megan Greene — who fear that a loosening labor market won't bring down wage pressures, forcing companies to keep raising prices instead.

The BOE's DMP showed companies expect to increase wages by 3.8% over the next year, the highest since April and above the Bank's 3-3.5% comfort levels. Expectations possibly reflect a 4.1% increase in the minimum wage due to take effect in April, a figure that was widely expected before Reeves confirmed it ahead of her Nov. 26 fiscal statement.

While the UK central bank is expected, on balance, to reduce interest rates at its next meeting on Dec. 18, the path forward is even less clear. BOE policymakers are increasingly divided over how to balance weak growth and rising unemployment with the risk that inflation will settle above their 2% target.

The labor market has deteriorated this year as firms cut jobs to cope with Labour's increase in payroll taxes. Speculation of more fiscal pain ahead of Reeves' budget on Nov. 26 added to the hiring slowdown, the REC report showed.

With no new employment taxes unveiled in the fiscal plan, however, conditions may begin to steady.

"Pre-budget nerves knocked temporary recruitment back just a little in November after a growing October, but the overall picture was still relatively benign by comparison to the last year," Neil Carberry, chief executive at REC, said. "We can see signs of the market stabilizing."

The U.S. dollar steadied on Monday after two weeks of selling, ahead of a week crammed with central bank meetings and headlined by the U.S. Federal Reserve, where an interest rate cut is all but priced in but a divided committee makes for a wild card.

Besides Wednesday's Fed decision, central bank policy meetings are also due in Australia, Brazil, Canada and Switzerland, though no moves are expected outside of the Fed.

The euro , which has been trading in a reasonably tight range since June, hovered at $1.1644. The yen , which has found a footing after sliding through November, traded at 155.28 a dollar.

Analysts expect a "hawkish cut", where the language of the statement, median forecasts and Chair Jerome Powell's press conference point to a higher bar on further rate reduction.

That could support the dollar if it pushes investors to dial back expectations for two or three rate cuts next year.

"We expect to see some dissents, potentially from both hawkish and dovish members," said BNY's head of markets macro strategy Bob Savage in a note to clients.

The Australian dollar traded just below last week's two-and-a-half-month high at $0.6640, taking a breather after having rallied through 200-day and 50-day moving averages in recent weeks as markets swung away from expecting rate cuts.

The Reserve Bank of Australia meets on Tuesday after a run of hot data on inflation, economic growth and household spending. Futures implying the next move will be up and possibly as soon as May, leaving the focus on the post-meeting statement and media conference.

"We expect the RBA to be on an extended hold, with the cash rate to remain at its current level of 3.60%," said analysts at ANZ in a note last week, where they revised previous expectations for a cut.

A similar dynamic in Canada had the loonie surging to a 10-week high on Friday following strong labour data. The Bank of Canada is widely expected to leave its interest rate on hold on Wednesday and a hike is fully priced by December 2026.

The currency was marginally weaker at C$1.3829 early on Monday.

The New Zealand dollar idled at $0.5779, while the Swiss franc edged 0.1% lower to 0.8045 per U.S. dollar.

Subdued inflation is seen keeping Switzerland's policy interest rate at 0% for a while.

Sterling was pinned near its 200-day moving average at $1.3324, while China's yuan was taking a breather at 7.068 a dollar in offshore trade.

A hold is widely expected in Brazil, where the policy rate is at 15%, with a possible nod towards a cut next quarter.

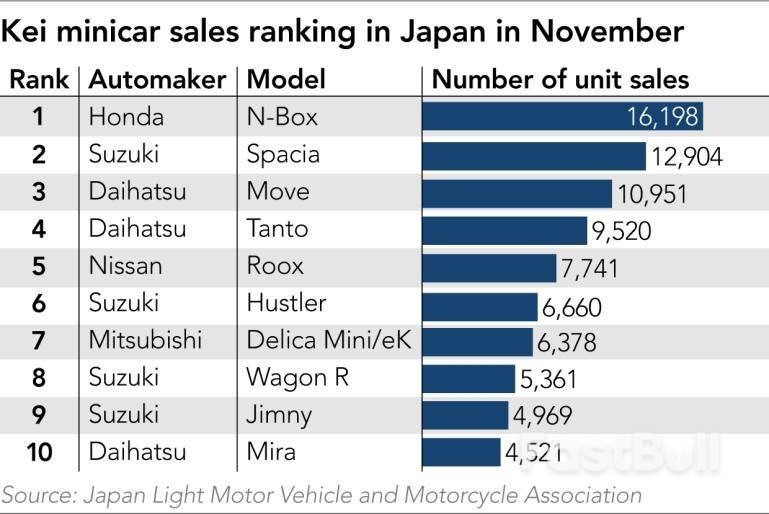

Nissan Motor is hoping its smallest vehicle can help spark a big recovery, with its latest minicar selling well and giving it a headstart against Chinese competition at home, while President Donald Trump is encouraging the introduction of such cars in the vital U.S. market.

The struggling Japanese carmaker announced on Monday it had received more than 20,000 orders for the latest generation of its Roox kei minicar, the first model it launched after unveiling a radical restructuring plan in May. The vehicle will serve to counter a move by China's BYD into the popular category in Japan and strengthens Nissan's ability to expand in the US.

"The number of orders is very strong and positive," Nissan Chief Marketing Manager Keiko Kondo said, as the company reported orders that opened in mid-September had reached 22,000 by Dec. 1. According to data from the Japan Light Motor Vehicle and Motorcycle Association, Roox sales numbered 7,741 in November, up 43% from October and 41% from the same month last year.

Kei minicars are a Japanese category of vehicle that meets certain size and engine standards. It accounts for more than 30% of domestic sales, as the cars cope well with Japan's narrow roads and incur lower taxes, making them more affordable than larger ones. Prices for the new Roox start from around 1.6 million yen ($10,300).

The cars have appealing safety features, with the fourth-generation Roox boasting a wide-angle camera that eliminates blind spots.

Yuki Tanaka, chief product specialist at Nissan, said, "You've probably had a moment of panic when you come out of an alley onto the street and can't see clearly to the left or right. The camera helps with that."

Nissan is also aiming to attract female drivers with small kids, offering plenty of storage for a smartphone, tissue box and other items around the front seats of the Roox, and easy access and space created to the rear to care for a child in the back seat.

As part of the Re:Nissan restructuring efforts to improve development efficiency and reduce production costs, the latest Roox was developed with alliance partner Mitsubishi Motors. Shinichiro Irie, program design director at Nissan, explained that around 70% of its parts were the same as Mitsubishi's Delica Mini, its sister model. The companies have given them different exteriors, interior designs and functions.

Both are preparing to take on BYD's kei minicar, due to launch in the Japanese market around next summer. The Racco, unveiled at the Japan Mobility Show in October, is BYD's first model designated exclusively for an overseas market, but the Chinese automaker has yet to disclose prices, battery capacity or range.

Nissan's Tanaka said that while BYD's entry would increase competition, "the growing awareness of EVs in Japan has a positive side which helps expand the [EV] market." Nissan also has the Sakura kei electric car in its lineup and is launching a new Leaf EV, the world's first mass-produced electric vehicle.

Trump created an unexpected opportunity for Japan's kei cars last week. Speaking at the White House, he said he had seen them on his recent trip to Japan, South Korea and Malaysia.

"They have a very small car ... They're very small and they're really cute, and I said 'How would that do in this country?'"

The president added, "But you're not allowed to build them and I've authorized the (transportation) secretary to immediately approve the production of those cars." He stated the names of "Honda, [and] some of the Japanese companies" as major players.

While U.S. demand remains uncertain, introducing kei cars could expand the market and give added momentum to production cooperation between Japanese automakers there.

Nissan President and CEO Ivan Espinosa said in an interview with Nikkei Asia last month, "We are talking about how we can collaborate in the U.S. Is there any opportunity for joint product development or for powertrain development?" Mitsubishi President and CEO Takao Kato also stated he was considering manufacturing vehicles in the U.S. with Nissan and Honda Motor. They are all major kei minicar makers in Japan.

Sometime in the evening of Dec 2, three days before India's largest airline would lose control of its operations in one of the country's worst aviation disruptions, IndiGo executives noticed that a technology glitch in its check-in system was delaying late-night flights.

This in turn was affecting a pilot duty roster recently fine-tuned to incorporate new government rules mandating longer rest hours and fewer night landings.

Compounded by winter flight schedule changes, air congestion and adverse weather, the math was suddenly not adding up for the low-cost airline whose relentless optimisation had allowed it to turn a profit within three years of inception and over time capture nearly 66 per cent of India's aviation market.

The resource-efficient instincts baked into IndiGo's DNA had led to a severe under-estimation of redundancies needed to accommodate the new pilot rest rules, despite carriers having had nearly two years to prepare since the guidance was first announced in January 2024.

Scheduling changes began to snowball: IndiGo cancelled at least 70 flights on Dec 3, then 300 on Dec 4 and finally, over 1,000 on Dec 5 – about half of the flights it normally operates daily.

As thousands of furious passengers became stranded in major city airports over the weekend, Prime Minister Narendra Modi's government was forced to suspend the new pilot rest rules, cap fares to avoid price gouging and order more trains into operation.

On Dec 7, the country's aviation regulator also demanded that chief executive officer Pieter Elbers explain within 24 hours this severe disruption and why action shouldn't be taken against him for the "significant lapses in planning, oversight, and resource management."

The debacle now threatens IndiGo's position in the industry, and its ambitious expansion plans.

After cementing its dominant position in domestic skies, IndiGo was boosting its overseas footprint, had ordered more Airbus jets, and added business class seats. Earlier in 2025, it signed a codeshare pact with Delta Air Lines, Air France-KLM and Virgin Atlantic Airways.

The flight cancellations pushed parent InterGlobe Aviation down 9 per cent last week, making it the company's worst week since Mr Elbers' appointment in 2022. Even with the drop, the shares have almost tripled since the Dutch executive took over as CEO, far outperforming the Sensex's 49 per cent gain and an 8.4 per cent increase in an index tracking Asian carriers.

The events of the past week, occurring just six months after an Air India crash that killed over 260 people in Ahmedabad, cap one of the worst years for India's aviation industry.

The sight of one carrier bringing national air traffic to a near-halt underscores the danger of India's reliance on too-big-to-falter industrial giants.

"This airline is supposed to be a market leader with outstanding management," said Mark D. Martin, founder of India-based aviation advisory Martin Consulting. "This is going to be so extremely damaging to the airline. They have lost credibility."

It's a stark fall from grace for a company that became a business school case study for its profitable, lean operations in a sector notorious for cash-burn and bankruptcies.

IndiGo's tightly-run operations are built on a rapid turnaround of flights and a strategy of sweating every asset - man or machine - to the limit. It flies only one aircraft type, Airbus A320s family jets – a standardisation that cuts costs on pilot and crew training, maintenance and parts inventory.

The focus is equally sharp on reducing time on the ground, with the carrier terming its punctual reputation "IndiGo Standard Time". Flights have a four-zone system for quick boarding, and crews open all exit doors for speedier disembarking.

No efficiency is too small: flight staff have even switched to a faster method of weighing sandwiches – their top-selling onboard item– instead of counting them, said people familiar with the matter.

This modus operandi shaved down an IndiGo jet's turnaround time to 20 or 25 minutes versus an industry average of 45 minutes. This meant it could squeeze in more and more flights over the years.

"IndiGo's operations are so tightly knit that one flight cancellation would impact at least six flights," said Shakti Lumba, who was IndiGo's head of operations when it first began operating in 2006.

The lack of slack in the system became all too apparent over the last week, as the scheduling breakdown cascaded through its operations. A flight took off with three cabin crew staff meant for another flight that then got stranded, people familiar with the matter said. One IndiGo pilot was stuck for days at his hotel in the Middle East, waiting for his return flying schedule.

Ground staff cowered from furious throngs of passengers, and could not even retrieve check-in bags that were stuck in grounded aircraft.

Indian officials are furious with the carrier, people familiar with the matter said, and have now sprung into action to quell public anger by tightening scrutiny around the carrier. It also casts a poor light on the country's aviation infrastructure that the government wants to rapidly develop.

The situation is stabilising: there were fewer cancellations on Dec 6 at about 850 and the airline said on Dec 7 that it was "confident" operations will stabilize by Dec 10. But observers expect the crisis to trigger some fundamental changes in the industry.

It's dangerous for one airline to have such a high market share, said Ajay Bodke, a Mumbai-based independent markets analyst.

In the United States and China, the only other aviation markets bigger than India's domestic market, no carrier has a market share of more than a quarter.

"Defying government regulations announced months in advance, and now seeking a last-minute two-month reprieve to comply," Mr Bodke said. "This is not inefficiency. It's willful disregard." BLOOMBERG

The Japanese stock market is trading slightly lower on Monday, extending the losses in the previous session, despite the broadly positive cues from Wall Street on Friday, with the Nikkei 225 falling below the 50,450 level, with weakness is index heavyweights, financial and technology stocks partially offset by gains in automakers and exporter stocks.

The benchmark Nikkei 225 Index is down 54.83 points or 0.11 percent at 50,437.04, after hitting a low of 50,224.65 earlier. Japanese shares ended significantly lower on Friday.

Market heavyweight SoftBank Group is losing more than 2 percent and Uniqlo operator Fast Retailing is edging down 0.2 percent. Among automakers, Honda is edging up 0.1 percent and Toyota is gaining almost 1 percent.

In the tech space, Advantest is declining more than 1 percent, Screen Holdings is edging down 0.4 percent and Tokyo Electron is down almost 1 percent.

In the banking sector, Sumitomo Mitsui Financial is losing almost 1 percent, Mitsubishi UFJ Financial is declining more than 1 percent and Mizuho Financial is edging down 0.5 percent.

The major exporters are mostly higher. Mitsubishi Electric is gaining more than 2 percent, while Panasonic and Canon are adding almost 1 percent each. Sony losing almost 1 percent.

Among the other major losers, Aeon is declining almost 5 percent, Lasertec is losing more than 3 percent and Resonac Holdings is down almost 3 percent.

Conversely, Secom, Fuji Electric and Toppan Holdings are advancing more than 4 percent each, while Japan Steel Works and Mitsubishi Estate are gaining almost 4 percent each. BayCurrent is adding almost 3 percent.

In economic news, Japan's gross domestic product contracted a seasonally adjusted 0.6 percent on quarter in the third quarter of 2025, the Cabinet Office said in Monday's preliminary reading. That missed forecasts for a decline of 0.4 percent following the 0.5 percent increase in the three months prior. On an annualized basis, GDP declined 2.3 percent - again missing expectations for a fall of 2.0 percent following the 2.2 percent gain in the second quarter.

Capital expenditure was down 0.2 percent on quarter, missing forecasts for an increase of 1.0 percent following the 0.6 percent gain in the previous three months. External demand was down 0.2 percent on quarter and private consumption was up 0.2 percent on quarter, while the GDP price index jumped 3.4 percent on year.

Meanwhile, Overall bank lending in Japan was up 4.2 percent on year in November, the Bank of Japan said on Monday - coming in at 652.547 trillion yen. That exceeded expectations for an increase of 4.0 percent and was up from 4.1 percent in October. Excluding trusts, lending was up 4.5 percent at 573.647 trillion yen - accelerating from 4.4 percent in the previous month.

In the currency market, the U.S. dollar is trading in the lower 155 yen-range on Monday.

On Wall Street, stocks saw modest strength during trading on Friday after ending Thursday's choppy trading session little changed. With the upward move, the Nasdaq and the S&P 500 reached their best closing levels in a month.

The major averages gave back ground after an early advance but remained in positive territory. The Dow rose 104.05 points or 0.2 percent to 47,954.99, the Nasdaq climbed 72.99 point or 0.3 percent to 23,578.13 and the S&P 500 increased 13.28 points or 0.2 percent to 6,870.40.

Meanwhile, the major European markets also turned mixed on the day. While the German DAX Index climbed by 0.6 percent, the French CAC 40 Index edged down by 0.1 percent and the U.K.'s FTSE 100 Index fell by 0.5 percent.

Crude oil prices edged higher on Friday on persistent geopolitical tension due to the Russia-Ukraine war and the U.S.-Venezuela standoff. West Texas Intermediate crude for January delivery was up $0.35 or 0.59 percent at $60.02 per barrel.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up