Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The India rupee is poised to open weaker on Friday, with the imbalance between robust importer hedging and hesitant exporter flows making it vulnerable to a lifetime low and dependent on central bank support.

The India rupee is poised to open weaker on Friday, with the imbalance between robust importer hedging and hesitant exporter flows making it vulnerable to a lifetime low and dependent on central bank support.

The 1-month non-deliverable forward indicated the rupeewill open in the 89.40-89.42 range versus the U.S. dollar, having settled at 89.3050 on Thursday, and within striking distance of last week's all-time low of 89.49.

The Reserve Bank of India stepped in heavily at the beginning of the week in a bid to break the cycle of weakness that threatened to deepen after last week's breakdown.

Its intervention briefly lifted the rupee back through the 89 handle, offering a short-lived reprieve. The relief, however, faded with persistent dollar demand from importers, hesitant exporter hedging and lacklustre portfolio flows eroding much of the RBI-spurred recovery.

The fact that the rupee is back under pressure despite the RBI's support is noteworthy considering the softness in the dollar.

The dollar indexis headed for its worst week in four months on mounting confidence that the Federal Reserve will deliver a third straight rate cut next month, a tailwind that would normally offer rupee some respite.

Fed funds futures now imply an 86% chance of a 25-basis point rate cut on December 10, up from about 40% just a week ago, according to the CME's FedWatch tool.

"You don't get this kind of this slow relentless push higher (on dollar/rupee) unless corporate flows are skewed and there is nothing to offset it," a currency trader at a private sector bank said.

For speculators, there's no macro trigger to chase USD/INR higher, he added.

Mexico's Attorney General Alejandro Gertz Manero resigned under pressure from President Claudia Sheinbaum, who had grown increasingly frustrated over his handling of high-profile investigations.

The Senate approved his resignation Thursday afternoon and announced that the next attorney general will be selected through an open contest allowing up to 10 candidates to compete for the job. People familiar with the matter said Ernestina Godoy, who served as Mexico City's prosecutor when Sheinbaum was mayor, has the president's support.

The president's office didn't immediately reply to a request for comment.

Sheinbaum's dissatisfaction with Gertz Manero deepened as her team considered his office responsible for leaking sensitive information related to a widening fuel-smuggling scandal known in Mexico as "huachicol fiscal," the people familiar added, requesting anonymity because they're not authorized to speak publicly.

The last straw was how the Attorney General's Office handled a probe into one of the owners of Mexico's Miss Universe franchise, Raul Rocha Cantu, who is facing allegations of smuggling fuels and weapons into the country as part of the "huachico fiscal" scheme.

Details of the investigation leaked to the press revealed Rocha Cantu's ties with state oil company Pemex and the father of the current Miss Universe winner, raising questions about the fairness of the competition.

Sheinbaum was displeased by media reports that the attorney general had offered criminal immunity to Rocha Cantu during the investigation, the people familiar said. She was particularly upset about the probe's impact on Miss Universe, a cherished event in Mexico, according to one of the people.

Speaking to reporters on Wednesday morning, the president said the investigation into Rocha Cantu's dealings should not overshadow the beauty queen's win.

"That's separate from the young woman who won the contest," Sheinbaum said. "They want to lump it together, but it's different. They want to take away her merit."

In his letter to the Senate, Gertz Manero justified his resignation by saying Sheinbaum offered him the position of ambassador to a "friendly country," without specifying which one.

The 86-year-old lawyer became Mexico's attorney general in 2019 after the position was revamped the previous year. He had three years left in his mandate. A former Mexico City prosecutor, federal security minister and congressman, he was appointed by former President Andres Manuel Lopez Obrador — a move questioned by some within the ruling party given his roles in previous administrations and his age.

Gertz Manero's replacement marks the second major change in Sheinbaum's one-year-old administration after she appointed Edgar Amador as finance minister in March.

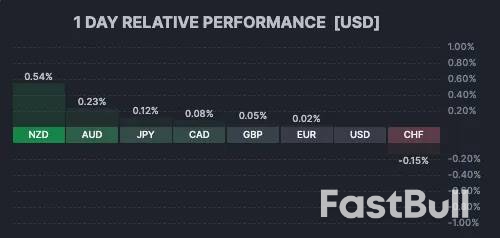

While US Markets are away for the Thanksgiving holiday, leaving the broader session fairly calm, the FX markets remain open and active, with all eyes turning to the Kiwi Dollar (NZD), posting yet another strong session.

The Antipodean currency has faced its share of struggles this year, weighed down by a slowing New Zealand economy that proved more sensitive than its neighbor Australia to the slowdown in global trade post-tariffs—a weakness that was starkly evident in a terrible Q2 GDP growth rate of -0.9%.

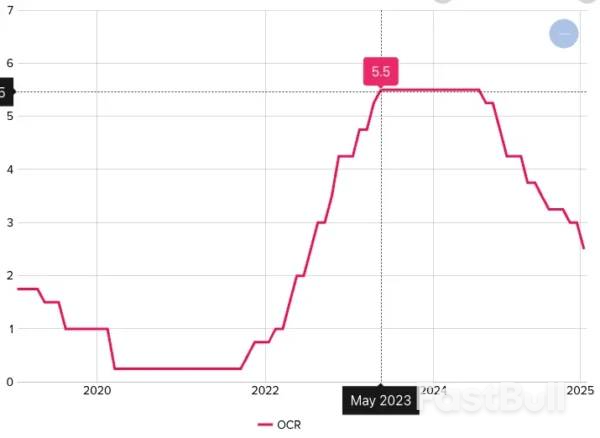

However, after 325 basis points of cuts, the data has started to come back in a flash. New Zealand Retail Sales just posted a strong beat of 1.9% versus the 0.5% expected, a sign of strong recovery that follows stronger inflation prints and improving Manufacturing PMIs.

Adding to the shift in sentiment, RBNZ Governor Christian Hawkesby mentioned that a future rate cut faces "significant hurdles."

This wording sufficed the market to assume that the 2.25% rate is the lower bound for the Kiwi rate, with markets now pricing rates to stay put throughout 2026.

This fundamental pivot is a clear sign of renewed strength for the NZD, which is up 2.65% against the US Dollar since last Friday.

Let's look at the major Kiwi pair, NZD/USD, to spot where that takes the action looking forward.

Daily Chart

Since July 1st and the comeback of the US Dollar, the NZD/USD has been in a one-way descent, exacerbated by diverging policies between the Fed and the RBNZ.

Taking the pair all the way down to a retest of the Liberation Day troughs in a Monthly Downward Channel, the action is now marking a first clear rebound in months.

Propulsed by changing fundamentals and bullish daily divergences, the ongoing action is strong and will face hurdles at the 50-Day Moving Average (0.57268) and Channel highs.

Still, when looking at how strong the current candles are, these hurdles could be breached soon. For confirmation, look at a session close above the 50-MA.

The ongoing rally is also facing a few hurdles on the intraday timeframe:

Overbought RSI levels within the Pivot Zone (0.5720 to 0.5750) could trigger some small mean-reversion.

A retest of the 4H-MA 200 (0.5690) could see higher probability for the action to continue its path higher.

NZD/USD Technical Levels to keep on your charts:

Resistance levels (NZDUSD)

Support levels

Looking even closer, the action is strongly following the 20-Hour MA at 0.57140;

Hong Kong fire authorities said they expected to wrap up search and rescue operations after the city's worst fire in nearly 80 years tore through a massive apartment complex on Friday, killing at least 94 people and leaving scores more missing.

Soon after dawn on Friday, firefighters had mostly contained the blaze that destroyed the Wang Fuk Court housing complex in the northern district of Tai Po. The eight-tower estate housing more than 4,600 people had been undergoing renovations and was wrapped in bamboo scaffolding and green mesh.

Police said they had arrested three construction company officials on suspicion of manslaughter for using unsafe materials, including flammable foam boards blocking windows.

Firefighters said they expect a search and rescue operation at the still-smoldering complex to be completed by 9 a.m. (0100 GMT).

"We'll endeavor to effect forcible entry to all the units of the seven buildings, so as to ensure there are no other possible casualties," Deputy Fire Services Director Derek Chan told reporters early on Friday.

As many as 279 people were listed as missing in the early hours of Thursday morning, but that figure has not been updated for more than 24 hours. Chan said 25 calls for help to the Fire Department remain unresolved, including three in recent hours which would be prioritised.

Rescuers battled intense heat, thick smoke and collapsing scaffolding and debris as they fought to reach residents feared trapped on the upper floors of the complex.

A distraught woman carrying her daughter's graduation photograph searched for her child outside a shelter, one of eight that authorities said are housing 900 residents.

"She and her father are still not out yet," said the 52-year-old, who gave only her surname, Ng, as she sobbed. "They didn't have water to save our building."

Most of the victims were found in two towers in the complex, while firefighters found survivors in several buildings, Chan said, but gave no further details.

The confirmed death toll rose to 94 early on Friday, the Hospital Authority said. It is Hong Kong's deadliest fire since 1948, when 176 people died in a warehouse blaze.

Police arrested two directors and an engineering consultant of Prestige Construction, a firm that had been doing maintenance on the buildings for more than a year.

"We have reason to believe that the company's responsible parties were grossly negligent, which led to this accident and caused the fire to spread uncontrollably, resulting in major casualties," Police Superintendent Eileen Chung said on Thursday. Prestige did not answer repeated calls for comment.

Police seized bidding documents, a list of employees, 14 computers and three mobile phones in a raid of the company's office, the government added.

The city's development bureau has discussed gradually replacing bamboo scaffolding, opens new tab with metal scaffolding as a safety measure.

Hong Kong's leader, John Lee, said the government would set up a HK$300 million ($39 million) fund to help residents while some of China's biggest listed companies announced donations.

On the second night after the blaze, dozens of evacuees set up mattresses in a nearby mall, many saying official evacuation centres should be saved for those in greater need.

People - from elderly residents to schoolchildren - wrapped themselves in duvets and huddled in tents outside a McDonald's restaurant and convenience shops as volunteers handed out snacks and toiletries.

Hong Kong, one of the world's most densely populated cities, is scattered with high-rise housing complexes. Its sky-high property prices have long been a trigger for discontent and the tragedy could stoke resentment towards authorities despite efforts to tighten political and national security control.

The leadership of both the Hong Kong government and China's Communist Party moved quickly to show they attached utmost importance to a tragedy seen as a potential test of Beijing's grip on the semi-autonomous region.

The fire has prompted comparisons to London's Grenfell Tower inferno, which killed 72 people in 2017. That fire was blamed on firms fitting the exterior with flammable cladding, as well as failings by the government and the construction industry.

Nexperia warned that customers across industries are facing impending production halts, while calling on its Chinese unit to take concrete steps to re-establish dialog.

The Dutch chipmaker, which has lost the cooperation of its Chinese subsidiary since the Netherlands government took action to gain influence over decision making, said it welcomed efforts by Chinese authorities to facilitate the resumption of exports but its customers were "still reporting imminent production stoppages."

"This situation cannot persist," Nexperia wrote in an open letter to Nexperia's entities in China on Thursday. The company designs and makes essential semiconductors for the automotive and consumer electronics sectors. Carmakers from Asia to Europe have raised alarm about disruption of its output.

The Dutch government last week suspended an order that gave it powers to block or revise decisions at Nijmegen-based Nexperia. Dutch Economic Affairs Minister Vincent Karremans had called it a "show of goodwill," noting that discussions with Chinese authorities were continuing.

Nexperia said in its letter that it had made repeated attempts to directly communicate with its subsidiary through calls, emails, proposed meetings and even "formal correspondence to demand performance of rights," but did not receive "any meaningful response."

The Dutch company also pushed its Chinese unit to engage in talks either through email or a "neutral, professional third-party mediator" to restore predictable supply flows.

Wingtech Technology Co., the chipmaker's Chinese owner, did not immediately respond to an email requesting comment. It has asked for the restoration of its full control and shareholder rights over Nexperia in the Netherlands.

Earlier on Thursday, the Chinese government urged the Netherlands to take concrete actions to resolve concerns around Nexperia and to bring back stability to the global supply chain.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up