Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

USA Natural Gas Inventories Seen Down 232 Billion Cubic Feet Last Week In Thursday's EIA Report, Reuters Poll Shows

Torsten Slok, Chief Economist At Apollo: The Fed Is Expected To Say They Are Staying On The Sidelines

[Market Update] Spot Gold Fell More Than $20 In The Short Term, Currently Trading At $5280.94 Per Ounce

U.S. Senate Majority Leader John Thune: Democrats Must Work With President Trump’s White House To Address The Budget Issues (related To The Department Of Homeland Security/Dhs)

[Market Update] Ahead Of The Fed's Decision, Spot Gold Rose Above $5,320 Per Ounce, Hitting A New High, Up 2.71% On The Day

New York Fed Accepts $1.103 Billion Of $1.103 Billion Submitted To Reverse Repo Facility On Jan 28

Petrobras Says Sales Potential Up To 60 Million Barrels, With A Total Value That May Exceed $ 3.1 Billion

Canada, South Korea Sign Memorandum Of Understanding Intending To Bring South Korean Auto Manufacturing And Investment To Canada -The Globe And Mail, Citing Document

European Central Bank Executive Board Member Schnabel: European Central Bank Rates In A Good Place And Expected To Remain At Current Levels For Extended Period

USTR: Talks On Stronger Rules Of Origin For Key Industrial Goods, Enhanced Collaboration On Critical Minerals, And Increased External Trade Policy Alignment

LME Copper Rose $80 To $13,086 Per Tonne. LME Aluminum Rose $50 To $3,257 Per Tonne. LME Zinc Rose $13 To $3,364 Per Tonne. LME Lead Fell $3 To $2,017 Per Tonne. LME Nickel Rose $101 To $18,270 Per Tonne. LME Tin Rose $1,075 To $55,953 Per Tonne. LME Cobalt Was Unchanged At $56,290 Per Tonne

Iran's Araqchi: Tehran Has Always Welcomed A Fair Nuclear Deal Which Ensures Iran's Rights And Guarantees No Nuclear Weapons

Rubio: There Might Be A USA Presence In The Ukraine Talks In Abu Dhabi This Weekend But It Won't Be Witkoff And Kushner

French Presidential Residence Elysee: France Supports The Inclusion Of The Islamic Revolutionary Guard Corps On The European List Of Terrorist Organisation

Brazil Treasury: Bonds Linked To Selic Rate To Account For Between 46% And 50% Of Outstanding Public Debt In 2026

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Secretary Rubio defended the Venezuela intervention to a skeptical Senate, facing intense debate over war powers and trust.

Secretary of State Marco Rubio faced intense questioning from the Senate on Wednesday, making his first public appearance before lawmakers since the dramatic U.S. raid that captured Venezuelan President Nicolas Maduro earlier this month.

Addressing a packed hearing room, Rubio argued that Venezuela's new leadership is already pivoting toward a closer relationship with the United States. The Trump administration is currently working with Delcy Rodriguez, a former Maduro ally who assumed the role of interim president following his arrest. However, the White House has made it clear that further military action remains an option if her government fails to meet U.S. demands.

Rubio, himself a former Florida senator, described communications with the new Venezuelan leaders as "very respectful and productive." He expressed confidence that the U.S. could quickly re-establish a diplomatic presence in the country, framing the new dynamic as a historic opportunity.

"For the first time in 20 years, we are having serious conversations about eroding and eliminating the Iranian presence, the Chinese influence, the Russian presence as well," Rubio stated. "In fact, I will tell you that there are many elements there in Venezuela that welcome a return to establishing relations with the United States on multiple fronts."

Later on Wednesday, Rubio was scheduled to meet with Venezuelan opposition leader Maria Corina Machado, sparking questions about whether the Trump administration might seek to install her as Maduro's permanent replacement.

Rubio laid out the administration's case for removing Maduro, arguing that Venezuela had become a strategic threat to the United States. He presented a stark picture of the situation prior to the raid, citing several key factors:

• Hostile Foreign Influence: The country had become a base of operations for U.S. adversaries, including China, Russia, and Iran.

• Regional Instability: Maduro's alleged cooperation with drug traffickers was destabilizing the region and directly impacting the U.S.

"It was an untenable situation and it had to be addressed," Rubio declared. He added that the U.S. has established a short-term mechanism to sell Venezuelan oil, with the ultimate goal of fostering a "friendly, stable, prosperous Venezuela" that holds free and fair elections.

Despite Rubio's assurances, the administration's actions have triggered significant pushback on Capitol Hill. Lawmakers from both parties have voiced frustration over a pattern of poor communication regarding major foreign policy decisions, including the Maduro raid and cuts to foreign aid programs.

Committee Chairman Jim Risch, a Republican, noted the "confusion over how it will be done" but praised Rubio for explaining the administration's plans. However, the underlying tension was palpable, especially following a recent, high-stakes legislative battle.

The War Powers Showdown

Just two weeks ago, Senate Republicans narrowly defeated a resolution that would have required President Trump to seek congressional authorization before taking further military action in Venezuela. The vote was so close that Vice President JD Vance had to be called in to break a tie.

The resolution initially seemed poised to pass after five Republicans sided with Democrats to advance it—a rare rebuke of President Trump. In response, Trump publicly attacked the five defectors, while he and Rubio launched an intense lobbying effort to flip their votes.

They successfully persuaded two senators, Josh Hawley of Missouri and Todd Young of Indiana, to change their positions by promising that Rubio would testify before the committee and insisting no U.S. troops were in Venezuela.

A Breach of Trust

The close vote reflects a growing anxiety in Congress over presidential war powers and a desire to reclaim constitutional authority over military deployments.

Members of Congress, including some of Trump's fellow Republicans, accused Rubio of misleading them. They claimed he had insisted the administration was not planning a leadership change in Venezuela just days before the raid. Adding to the frustration were reports that oil company executives were briefed on the operation before lawmakers were.

Democratic Senator Chris Coons of Delaware voiced a common fear, warning of the risk of being drawn into another protracted conflict. "You and I both know a long and painful history of wars that began and seemed to be resolved and then opened up into excruciating, expensive years-long conflict," he said.

These concerns are amplified by other recent statements from President Trump, who said this month that the U.S. will run Venezuela for years, told Iranian protestors that "help is on the way," and threatened military action to take Greenland.

Mexico's state-owned oil firm, Pemex, has canceled a planned oil shipment to Cuba in a move widely seen as a response to pressure from the United States. The decision follows President Donald Trump's declaration that "zero" oil should reach the island and recent reports that Washington is pursuing regime change in Havana.

During a press conference on Tuesday, Mexican President Claudia Sheinbaum addressed reports about the canceled Pemex shipment, which was scheduled for January. Without explicitly denying the cancellation, she framed the action as a "sovereign decision" made by the state oil company at a time it "deemed necessary."

The policy shift comes after Reuters reported last week that the Mexican government was reviewing its oil sales to Cuba, fearing potential U.S. reprisals. Washington has maintained a full trade embargo against Cuba for decades and intensified its stance by blockading Venezuelan oil shipments to the island late last year. That blockade was imposed shortly after U.S. forces captured Venezuelan President Nicolas Maduro on drug charges.

The disruption of Venezuelan supply elevated Mexico to the position of Cuba's main petroleum provider, accounting for around 44% of its crude imports. However, President Trump’s recent insistence that "zero" money or oil should be sent to the island forced Mexico to reevaluate its trade policy.

When asked about a potential mediating role between the U.S. and Cuba, Sheinbaum stated that Mexico would only act if requested by both nations, though she affirmed her country's commitment to promoting dialogue.

Mexico’s diplomatic efforts may face significant headwinds. According to The Wall Street Journal, Washington is actively planning for regime change in Cuba before the end of the year.

The report suggests that U.S. officials are seeking "Cuban government insiders who can help cut a deal to push out the Communist regime." The strategy allegedly uses the capture of Venezuela's Maduro as a "blueprint" for toppling the Cuban state.

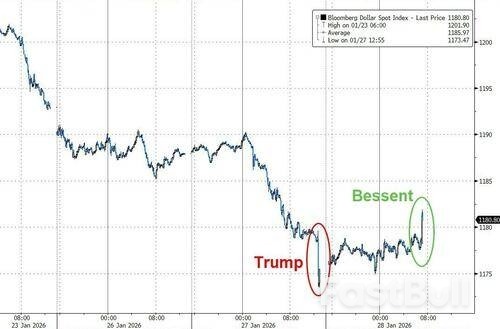

US Treasury Secretary Scott Bessent told CNBC Sara Eisen this morning that "the US always has a strong dollar policy".

This statement comes after President Trump's apparent 'comfort' last night with the dollar declining...

When asked if he was worried about losses in the dollar, Trump told reporters in Iowa on Tuesday: "No, I think it's great."

Bessent then dropped two more tapebombs...

While stating that "WE DON'T COMMENT ON INTERVENTION SPECULATION"...

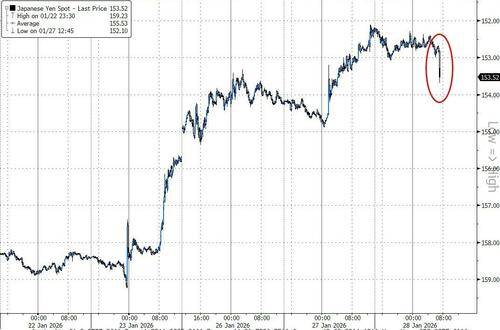

Bessent then confirmed that "US IS 'ABSOLUTELY NOT' INTERVENING IN DOLLAR-YEN NOW"

This prompted yen weakness, retracing some of the post 'rate check' rally...

...and dollar strength...

This move comes minutes after Goldman Sachs Delta-One desk head warned: Near-term, feels dangerous to press dollar downside given how extreme the moves have been.

Germany has downgraded its economic growth forecasts for 2026 and 2027, citing ongoing global trade uncertainty and a slower-than-expected rollout of domestic economic and fiscal policies.

The government now anticipates GDP growth of 1.0% in 2026, a reduction from the previous forecast of 1.3%. The projection for 2027 has also been trimmed from 1.4% to 1.3%.

German Economy Minister Katherina Reiche explained the revision on Wednesday, stating that "the larger economic and fiscal-policy measures that had been expected have not materialized quite as quickly and not to the extent that we had assumed."

Despite the downgrade, these figures represent an improvement over the 0.2% expansion recorded in 2025, which itself followed two consecutive years of economic contraction. The economy ministry's annual report noted that a "cyclical recovery is being supported by stronger domestic momentum, while external headwinds are easing somewhat."

A key pillar of Germany's growth strategy, a landmark €500 billion ($600 billion) special fund for infrastructure, is facing implementation delays. Although the national parliament approved the fund in March, only €24 billion had been invested by the end of the year, reflecting the slow pace of decision-making within Germany's federal system.

Despite the slow start, the government projects that fiscal policy measures will contribute significantly to the economy, accounting for approximately two-thirds of a percentage point of GDP growth in 2026.

However, economists and business groups have warned that this fiscal package alone is insufficient to secure long-term growth. They are calling for more comprehensive structural reforms to bolster the economy's foundation.

While government spending is expected to drive growth, other areas of the economy show signs of weakness.

Private consumption is forecast to grow by only 0.8% in 2026, a notable slowdown from the 1.4% growth seen in 2025. This projection assumes the household savings rate will remain unchanged at around 10.5%.

On the trade front, Germany continues to face challenges. The economic report highlights that U.S. tariff increases from last year are still weighing on the global economy. Combined with weaker demand from key export markets outside of Europe, this will likely cause Germany to lose further global market share.

After declining for three consecutive years, exports are expected to see a modest recovery with 0.8% growth.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up