Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

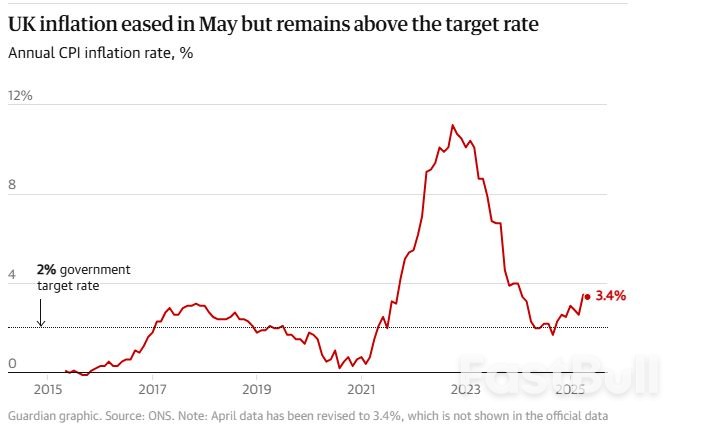

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Pro-Israel hackers attacked Iran’s largest crypto exchange, Nobitex, destroying over $90 million in a politically motivated breach. Tied to the IRGC, the act symbolized protest, not profit.

Iranian Supreme Leader Ayatollah Ali Khamenei rejected Donald Trump's demand for unconditional surrender on Wednesday, and the U.S. president said his patience had run out, though he gave no clue as to what his next step would be.

Speaking to reporters outside the White House, Trump declined to say whether he had made any decision on whether to join Israel's bombing campaign against Iran.

"I may do it. I may not do it. I mean, nobody knows what I'm going to do," he said.

Trump said Iranian officials had reached out about negotiations including a possible meeting at the White House but "it's very late to be talking," he said.

"Unconditional surrender, that means I've had it."

Asked for his response to Khamenei rejecting his demand to surrender, Trump said: "I say, good luck."

Iranians jammed the highways out of the capital Tehran, fleeing from intensified Israeli airstrikes.

In its latest bombing run, Israel said its air force had destroyed Iran's police headquarters.

"As we promised – we will continue to strike at symbols of governance and hit the ayatollah regime wherever it may be," Defence Minister Israel Katz said.

Khamenei, 86, rebuked Trump in a recorded speech played on television, his first appearance since Friday.

The Americans "should know that any U.S. military intervention will undoubtedly be accompanied by irreparable damage," he said.

"Intelligent people who know Iran, the Iranian nation and its history will never speak to this nation in threatening language because the Iranian nation will not surrender."

Trump has veered from proposing a swift diplomatic end to the five-day-old war to suggesting the United States might join it. In social media posts on Tuesday, he mused about killing Khamenei, then demanded Iran's "UNCONDITIONAL SURRENDER!"

A source familiar with internal discussions said Trump and his team were considering options that included joining Israel in strikes against Iranian nuclear installations. Defense Secretary Pete Hegseth told a Senate committee that the Pentagon was prepared to execute any order given by Trump

Iran's mission to the United Nations mocked Trump in posts on X: "Iran does NOT negotiate under duress, shall NOT accept peace under duress, and certainly NOT with a has-been warmonger clinging to relevance," it wrote.

"No Iranian official has ever asked to grovel at the gates of the White House," it said. "The only thing more despicable than his lies is his cowardly threat to 'take out' Iran’s Supreme Leader."

Israel's military said 50 Israeli jets struck around 20 targets in Tehran overnight, including sites producing raw materials, components and manufacturing systems for missiles. The military told Iranians to leave parts of the capital for their own safety while it struck targets.

Traffic was backed up on highways leading out of the capital Tehran, a city of 10 million people, as residents sought sanctuary elsewhere.

Arezou, a 31-year-old Tehran resident, told Reuters by phone that she had made it out to the nearby resort town of Lavasan.

"We will stay here as long as this war continues. My friend’s house in Tehran was attacked and her brother was injured. They are civilians," she said. "Why are we paying the price for the regime’s decision to pursue a nuclear programme?”

In Israel, sirens rang out warning people of retaliatory Iranian missile strikes. At Ramat Gan city train station east of Tel Aviv, people were lying on city-supplied mattresses lined along the floor or sitting in the odd camping chair, with plastic water bottles strewn about.

"I feel scared, overwhelmed. Especially because I live in a densely populated area that Iran seems to be targeting, and our city has very old buildings, without shelters and safe spaces," said Tamar Weiss, clutching her four-month-old daughter.

Iran has been exploring options for leverage, including veiled threats to hit the global oil market by restricting access to the Gulf through the Strait of Hormuz, the world's most important shipping artery for oil.

Oil prices leapt 9% on Friday and have marched further higher this week. The CEO of Italian energy company Eni (ENI.MI), opens new tab said the rises so far were still limited, signaling an expectation that serious disruption would be averted.

A former Iranian economy minister, Ehsan Khandouzi, said on X that Iran should start demanding tankers obtain permission to transit the strait. Iran's Oil Ministry and Foreign Ministry did not immediately respond to requests for comment.

Inside Iran, authorities are intent on preventing panic and shortages. Fewer images of destruction have been allowed to circulate than in the early days of the bombing, when state media showed pictures of explosions, fires and flattened apartments. A ban on filming by the public has been imposed.

The state has placed limits on how much fuel can be purchased. Oil Minister Mohsen Paknejad told state TV that restrictions were in place to prevent shortages, but there would be no problem supplying fuel to the public.

Iranian officials have reported at least 224 deaths in Israeli attacks, mostly civilians, though that toll has not been updated for days.

In Israel, Iran's missile volleys mark the first time in decades of shadow war and proxy conflict that a significant number of projectiles fired from Iran have penetrated defences, killing Israelis in their homes.

Since Friday, Iran has fired around 400 missiles at Israel, some 40 of which have pierced through air defences, killing 24 people, all of them civilians, according to Israeli authorities.

With Khamenei's main military and security advisers killed, the leader's inner circle has been narrowed, raising the risk that he could make strategic errors, according to five people familiar with his decision-making process.

During the Gaza war, Israel has dealt heavy blows to Iran's regional allies Hamas and Hezbollah, limiting Tehran's ability to retaliate through strikes by its proxy fighters close to Israeli borders. Syrian leader Bashar al-Assad, propped up by Iran through 13 years of war, was toppled last year.

Wall Street indexes posted modest gains and oil prices dipped on Wednesday as investors weighed the impacts of a Middle East conflict and a U.S. rate decision on a global economy already grappling with uncertainty stemming from U.S. economic policy.

Brent crude oil prices initially extended their recent rise as the Israel-Iran air war entered its sixth day, feeding concerns over global oil supply, before falling 1.52% to $75.31 per barrel after U.S. President Donald Trump said Iran wanted to negotiate.

Stock buyers made cautious inroads in early trading on Wall Street, giving a 0.50% push to both the Dow Jones Industrial Average and the S&P 500 (.SPX), and a 0.56% boost to the Nasdaq Composite (.IXIC).

While geopolitics were the biggest immediate concern, other lingering doubts included a squabble over President Trump's tax bill, said Chris Maxey, Managing Director and Chief Market Strategist at New York-based Wealthspire.

"Uncertainty began at the start of the year, and it felt like it just kept growing ... It's uncertain about what's coming next with respect to the (U.S.) tax package, what's going to happen with the Federal Reserve, what's going to happen in the Middle East," he said.

"People are trying to digest all of this information without a huge amount of clarity," Maxey added.

Trump declined to answer questions on whether the U.S. was planning to strike Iran or its nuclear facilities, saying: "Nobody knows what I am going to do."

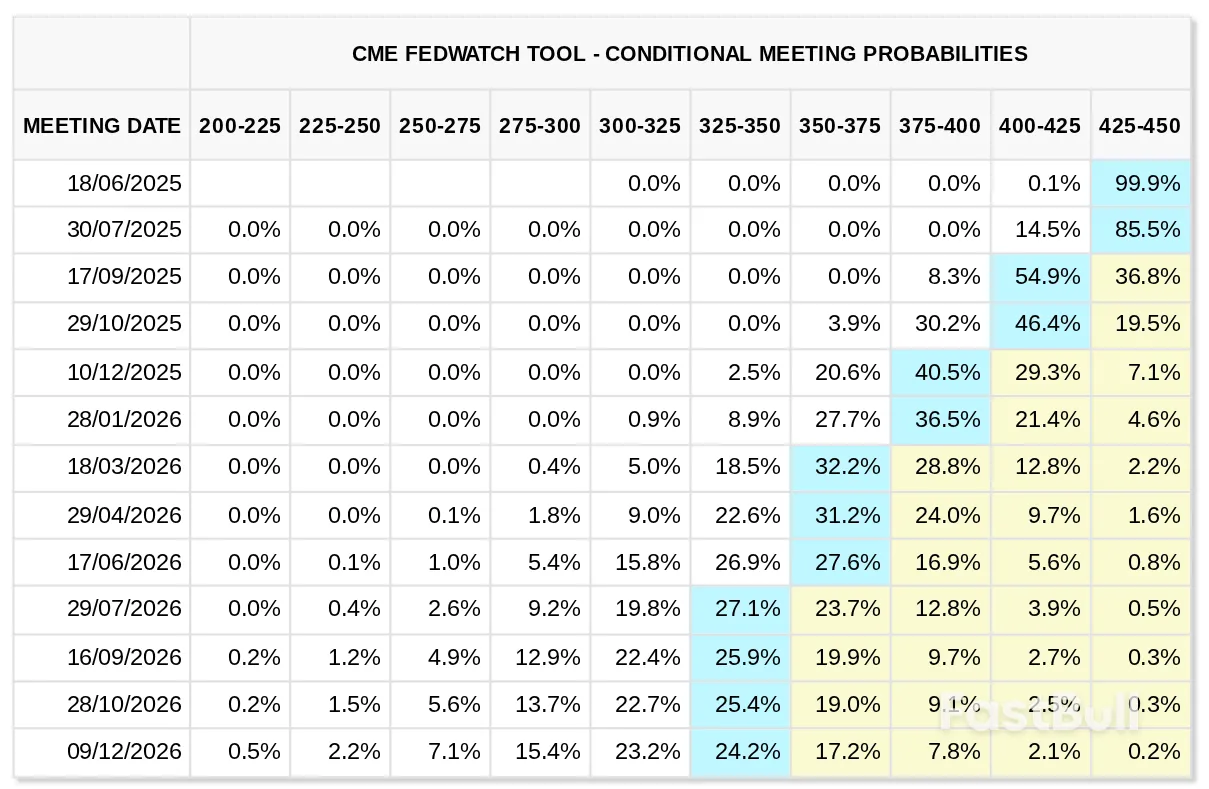

The Fed is expected to keep its main funds rate steady on Wednesday in the 4.25%-4.50% range it has held since December. It is expected to issue projections, known as a dot plot, that signal it will not move decisively for months to come.

Signs of fragility in the U.S. economy make for a challenging backdrop.

U.S. retail sales fell by a larger-than-expected 0.9% in May, data showed on Tuesday, the biggest drop in four months, while labour market indicators are showing weakness.

"Markets are going to be closely watching the Fed's quarterly dot plot for clues on how and when the central bank will resume its cutting cycle," Insight Investment co-head of global rates Harvey Bradley said.

"As tensions in the Middle East have the potential to threaten the inflation picture further, it cannot be ruled out that projections adjust to reflect just one rate cut this year,” he added.

U.S. Treasury yields fell again on Wednesday, continuing a slide on Tuesday prompted by investors calculating that geopolitical risks abroad were greater than the chances the U.S. debt pile becomes unmanageable.

The benchmark 10-year note was last yielding 2.6 basis points less, at 4.365%, from 4.391% late on Tuesday.

The two-year yield, which is more sensitive to changes in expectations for Fed interest rates, fell 1.1 basis points to 3.939%, from 3.95% late on Tuesday.

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

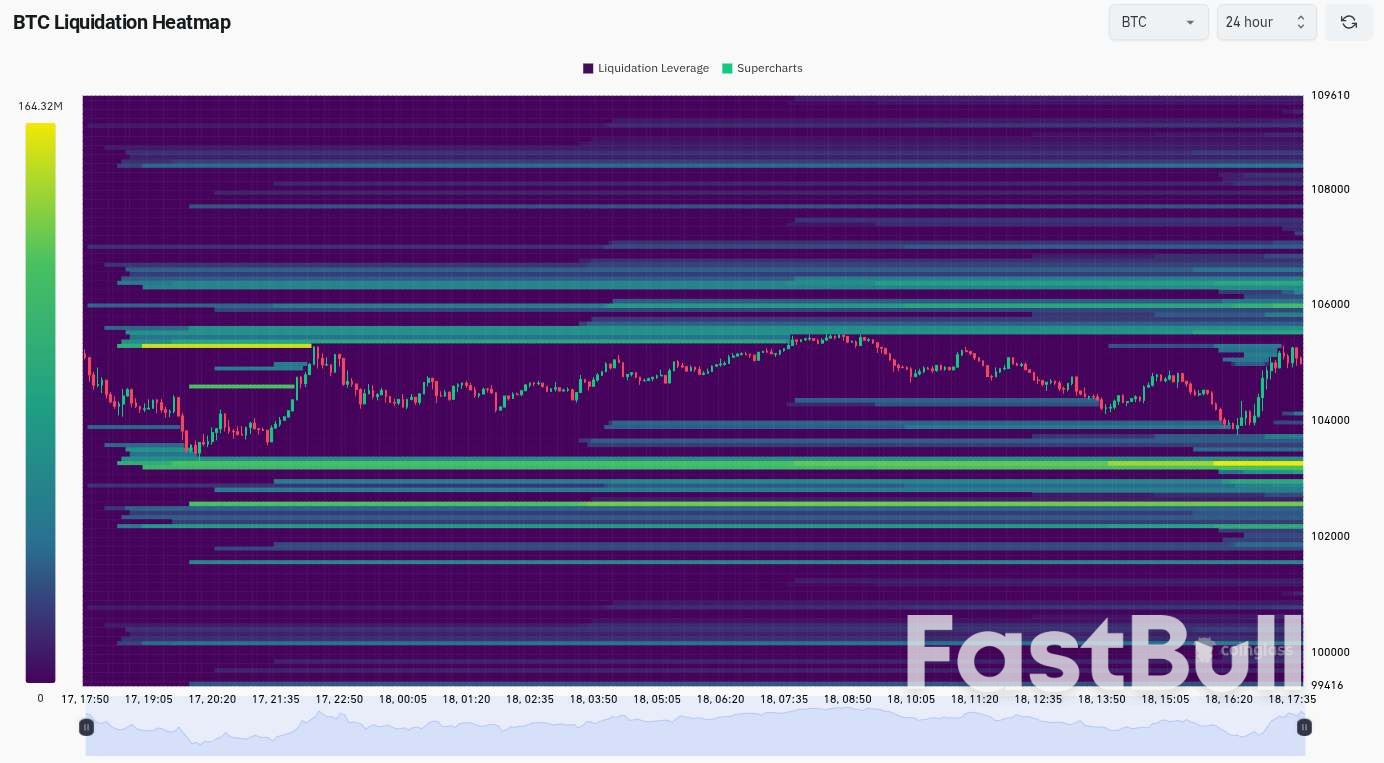

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool BTC liquidation heatmap (screenshot). Source: CoinGlass

BTC liquidation heatmap (screenshot). Source: CoinGlass

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up