Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices fell over 5% after Trump said China can continue buying Iranian oil, signaling a softer U.S. stance post-ceasefire. Markets now see reduced risk of Middle East supply disruption.

New York Fed President John Williams said Tuesday that maintaining a modestly restrictive monetary policy stance is "entirely appropriate" given current economic conditions.

Speaking at the NY CREATES Albany NanoTech Complex in Albany, New York, Williams emphasized that keeping the federal funds rate at its current level of 4.25% to 4.5% allows time for policymakers to analyze incoming data and evaluate risks.

Williams’ position contrasts with some other Fed governors who have suggested a potential rate cut in July might be appropriate. However, his comments align with Fed Chairman Jerome Powell, who on Tuesday signaled patience on rate cuts amid economic stability.

"Given the continued uncertainty, the solid labor market, and inflation still above our 2 percent goal, the FOMC decided at its meeting last week to leave the target range for the federal funds rate unchanged," Williams said in his speech.

He noted that the Fed continues to reduce its holdings of Treasury securities and agency debt and mortgage-backed securities, adding that "despite market volatility related to trade policy and other developments, that process continues to go very smoothly."

Williams pointed to mixed economic signals, with survey data showing pessimism and uncertainty about the economic outlook, while hard economic data indicates the U.S. economy "remains in a good place."

In his outlook, Williams expects real GDP growth to slow to just over 1% this year, with unemployment rising to around 4.5% by year-end. He projects inflation will increase to around 3% in 2025 due to tariffs, before gradually declining to 2% over the following two years.

The New York Fed president also highlighted findings from a recent survey showing that about three-quarters of manufacturers and service firms in New York and New Jersey have passed along at least some tariff-related cost increases to customers.

U.S. oil producers rapidly increased hedging activities to lock in higher prices following a surge triggered by Israel's strike on Iranian facilities.

Hedge trades hit record highs on platforms like Aegis Hedging as producers anticipated short-term price spikes, aiming to protect profits amid geopolitical risks.

With a ceasefire now easing geopolitical tensions, the window for securing higher oil prices has quickly closed, returning WTI to pre-conflict levels around $65 per barrel.

U.S. oil producers flocked to hedge higher prices for their output for the rest of the year and early into 2026 as international crude oil prices surged earlier this month.

Early on June 13 local time, Israel attacked Iranian nuclear facilities and military leadership in coordinated strikes that sent oil prices surging amid concerns that an escalating conflict could disrupt oil flows from the Middle East.

On the night of June 12 and the following morning, Texas-based Aegis Hedging Solutions – a company with a platform for oil producers’ hedging – registered its highest-ever number of hedge trades, Aegis Hedging’s president Matt Marshall told Bloomberg.

U.S. shale producers, who were under-hedged going into this spring, saw a major opportunity to lock in higher prices for the next few months as WTI crude prices surged out of the high $50s - low $60s per barrel price range and hit the $75 mark last week.

Oil prices had lingered into the low $60s for the three months between early April and early June, as the U.S. tariff blitz and the OPEC+ production hikes weighed on market sentiment with fears of oversupply.

As of March, a survey by Standard Chartered of 40 independent U.S. oil and gas companies revealed they had little protection, with a 2025 oil hedge ratio of just 21% for their combined 5.03 million barrels per day (bpd) of production and a 2026 hedge ratio of just 4%.

To compare, the U.S. shale industry entered 2020 with an oil hedge ratio of 51.7%, which provided significant support when oil prices collapsed during the pandemic.

As of the end of 2024, independent North American oil and gas producers had more than 80% of their first-half 2025 oil production unhedged, leaving them exposed as OPEC+ supply hikes and concerns about a global recession weighed on the market, data from Evaluate Energy showed in April.

Hedging activity, however, spiked on June 12-13 to a record high on the Aegis Hedging platform as producers rushed to lock in higher prices in the short term amid the geopolitics-driven jump in WTI prices.

Such war premium-related spikes in oil prices tend to lift the front of the futures curve more than contracts further out in time, unlike in price jumps related to fundamentals.

In the case with the Middle East conflict, the hedging strategy was geared more toward the short term, Aegis Hedging says.

“In this case it was probably a six-month effect,” Aegis Hedging’s Marshall told Reuters.

“Producers recognized that this could be a fleeting issue and so they saw a price that was above their budget for the first time in a few months, and instead of doing a structure that would give them a floor which is below market, they opted to be aggressive and lock in,” Marshall added.

U.S. oil and gas executives polled in the Dallas Fed Energy Survey in Q1 indicated that their companies need an average $65 per barrel to profitably drill a new well.

Oil companies that hedged production probably did so just in time. The tentative ceasefire between Iran and Israel, which was announced by U.S. President Donald Trump as "complete and total," has deflated the geopolitical risk premium and brought WTI oil back to $65 per barrel, roughly the level where it traded at before the Israeli strike on Iran.

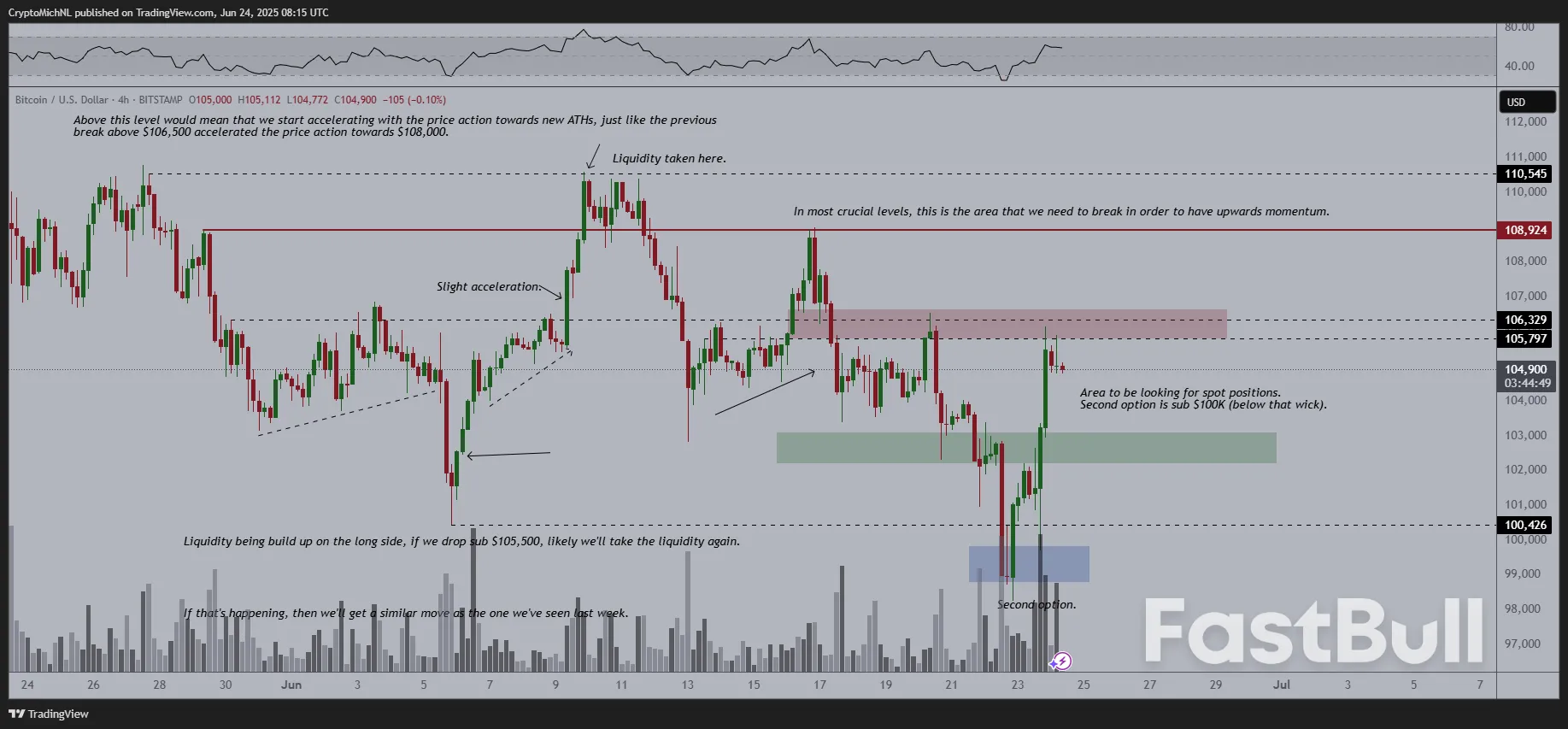

BTC/USD 4-hour chart. Source: Michaël van de Poppe/X

BTC/USD 4-hour chart. Source: Michaël van de Poppe/X

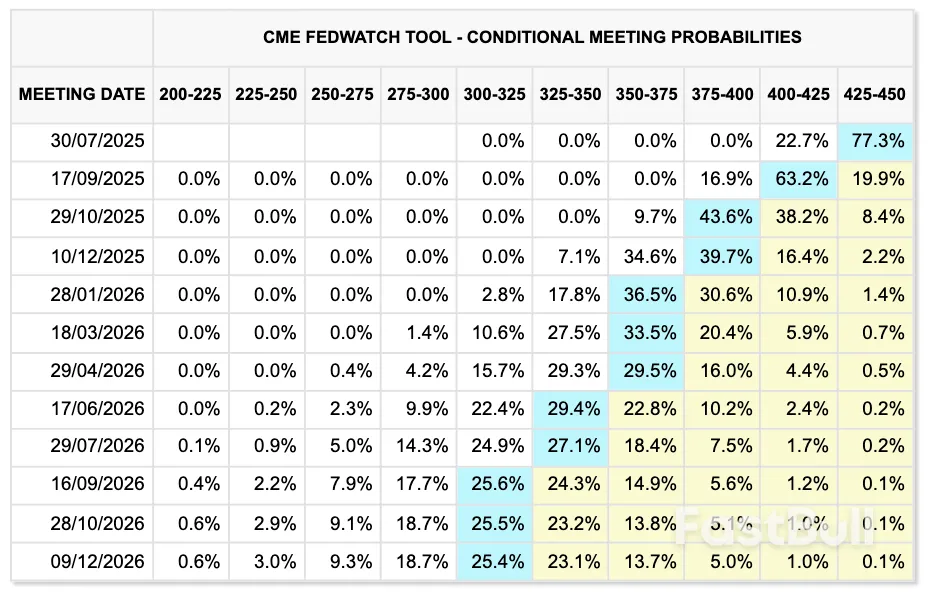

Fed target rate probabilities (screenshot). Source: CME Group

Fed target rate probabilities (screenshot). Source: CME GroupWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up