Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)

U.S. Real Personal Consumption Expenditures Final QoQ (Q3)A:--

F: --

P: --

Canada New Housing Price Index MoM (Dec)

Canada New Housing Price Index MoM (Dec)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Real GDP Annualized QoQ Final (Q3)

U.S. Real GDP Annualized QoQ Final (Q3)A:--

F: --

P: --

U.S. PCE Price Index Final QoQ (AR) (Q3)

U.S. PCE Price Index Final QoQ (AR) (Q3)A:--

F: --

P: --

U.S. PCE Price Index MoM (Nov)

U.S. PCE Price Index MoM (Nov)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Nov)

U.S. PCE Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Nov)

U.S. Real Personal Consumption Expenditures MoM (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Nov)

U.S. Personal Income MoM (Nov)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Nov)

U.S. Core PCE Price Index MoM (Nov)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Nov)

U.S. Personal Outlays MoM (SA) (Nov)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Nov)

U.S. Core PCE Price Index YoY (Nov)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Jan)

Euro Zone Consumer Confidence Index Prelim (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Jan)

U.S. Kansas Fed Manufacturing Composite Index (Jan)A:--

F: --

U.S. Kansas Fed Manufacturing Production Index (Jan)

U.S. Kansas Fed Manufacturing Production Index (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. 10-Year TIPS Auction Avg. Yield

U.S. 10-Year TIPS Auction Avg. YieldA:--

F: --

P: --

Argentina Retail Sales YoY (Nov)

Argentina Retail Sales YoY (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Australia Manufacturing PMI Prelim (Jan)

Australia Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

Australia Services PMI Prelim (Jan)

Australia Services PMI Prelim (Jan)A:--

F: --

P: --

Australia Composite PMI Prelim (Jan)

Australia Composite PMI Prelim (Jan)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Dec)

Japan CPI YoY (Excl. Fresh Food & Energy) (Dec)--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Dec)

Japan National CPI YoY (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Dec)

Japan National CPI MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan National CPI MoM (Not SA) (Dec)

Japan National CPI MoM (Not SA) (Dec)--

F: --

P: --

Japan National Core CPI YoY (Dec)

Japan National Core CPI YoY (Dec)--

F: --

P: --

Japan National CPI MoM (Dec)

Japan National CPI MoM (Dec)--

F: --

P: --

Japan National CPI YoY (Dec)

Japan National CPI YoY (Dec)--

F: --

P: --

Japan CPI MoM (Dec)

Japan CPI MoM (Dec)--

F: --

P: --

U.K. GfK Consumer Confidence Index (Jan)

U.K. GfK Consumer Confidence Index (Jan)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Jan)

Japan Manufacturing PMI Prelim (SA) (Jan)--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest Rate--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement BOJ Press Conference

BOJ Press Conference U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Dec)

U.K. Core Retail Sales YoY (SA) (Dec)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Dec)

U.K. Retail Sales YoY (SA) (Dec)--

F: --

P: --

Turkey Consumer Confidence Index (Jan)

Turkey Consumer Confidence Index (Jan)--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Supplies are also returning to the global market from Venezuela, while Indian refiner Reliance Industries Ltd. has once again purchased Russian crude, with deliveries scheduled to February and March.

Bank of America and Citigroup are reportedly exploring options to launch new credit cards with a 10% interest rate. According to a Bloomberg News report citing sources familiar with the discussions, the move is a potential response to President Donald Trump's call for a broad cap on credit card rates.

Both banks are independently evaluating the new card offerings as a possible solution to avoid a government-mandated rate ceiling. When asked for a statement, neither Citigroup nor Bank of America provided an immediate comment.

Following the news, Bank of America's shares saw a nearly 2% increase in afternoon trading, while Citigroup's stock climbed 2.4%.

The consideration by the two major banks follows President Trump's announcement that he would ask Congress to approve a 10% interest rate cap on all credit cards for a one-year period.

U.S. banks had previously faced a Tuesday deadline to implement this cap, which Trump first proposed in a Truth Social post. However, the White House had not released any details on how such a limit would be enforced.

Financial industry executives have voiced concerns that a wide-ranging cap on all credit card interest rates would force a pullback in lending and negatively impact economic growth.

Bank of America CEO Brian Moynihan has stated that the proposal would ultimately restrict consumer access to credit. Similarly, Citigroup CEO Jane Fraser warned that a rate cap would have a direct impact on consumer spending and the broader economy.

While executives warn of negative consequences, some experts argue that the credit card industry is highly profitable and has enough margin to accommodate lower interest rates.

Market analysts believe that implementing such a rate cap would require new legislation, which is considered unlikely to pass in Congress.

Some observers have suggested that the industry might seek a compromise. Under this scenario, lenders could voluntarily launch no-frills credit cards at the proposed 10% rate. These cards would likely come with fewer benefits and rewards compared to standard offerings.

Canada is fundamentally reshaping its trade strategy, forging a major energy and economic partnership with China in a clear move to reduce its long-standing reliance on the United States. This pivot signals a significant adjustment in global trade flows, driven by new infrastructure and shifting political alliances.

The new alliance was solidified during Prime Minister Mark Carney’s visit to China, the first by a Canadian leader in nearly a decade. Following meetings with President Xi Jinping, the two nations outlined a strategic partnership focused on collaboration in energy, clean technology, and climate change.

A key objective of this agreement is for Canada to increase its exports to China by 50% by the year 2030, marking an ambitious new chapter in the country's foreign trade policy.

This strategic shift is widely seen as a direct response to a strained trade relationship with the United States. In 2025, the Trump administration imposed steep tariffs on Canadian goods, including:

• A 50% tariff on copper imports

• A 25% tariff on steel and aluminum imports

• A 10% tariff on energy imports like oil

These measures highlighted Canada's economic vulnerability. In 2024, a staggering 95% of the nation's energy exports were sent to the United States, underscoring the high stakes of its dependence on a single trading partner. While Canada has traditionally been one of America's top two trading partners, this dynamic is now rapidly changing.

The groundwork for this pivot was laid long before the recent tensions. The crucial piece of infrastructure enabling this diversification is the Trans Mountain Expansion (TMX) project, which was completed in the summer of 2024.

Announced in 2013 with construction starting in 2019, the TMX pipeline provides a vital corridor for Canada's landlocked oil reserves. It allows crude oil from Alberta to be transported directly to the Pacific coast in British Columbia, opening up direct access to Asian and Pacific markets for the first time.

The impact has been immediate and dramatic. In 2025, as Chinese imports of U.S. crude oil fell by over 60%, its imports of Canadian oil skyrocketed by more than 300%, demonstrating the pipeline's game-changing role.

The new agreement extends far beyond energy, creating a broader economic alliance between Canada and China. Other key components of the deal include:

• Electric Vehicles: China will export 49,000 EVs to Canada in 2026, with plans for further expansion.

• Agriculture: China will slash tariffs on Canadian canola seeds from 84% to just 15% and is expected to lower duties on Canadian lobsters, peas, and crabs.

• Metals: Canada will open its markets to Chinese steel and aluminum products, further reducing its reliance on U.S. supply chains.

This comprehensive trade pact represents an evolution in Canadian foreign policy, prioritizing economic strength and diversification. It signals that Canada is serious about creating a new economic future for itself, independent of the political and trade pressures from its southern neighbor.

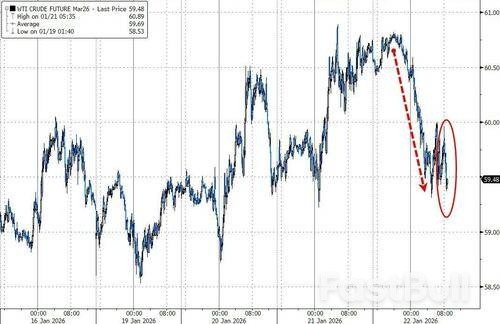

Oil prices are lower this morning after Ukrainian President Zelenskiy said that the US, Russia and Ukraine will meet in coming days for trilateral team meetings.

WTI dropped below $60 as Zelenskiy urged Russia to be "ready for compromises."

Any breakthrough to end Moscow's war in Ukraine could iron out supply disruptions and end sanctions on Russian crude in an already oversupplied global market, sapping a longstanding geopolitical risk premium.

Adding to pressure on prices, Kazakhstan is getting closer to ending a weeks-long export constraint as repairs at a key Black Sea oil-loading facility near completion. A backlog of cargoes at the Caspian Pipeline Consortium terminal is easing.

And supplies are also returning to the global market from Venezuela.

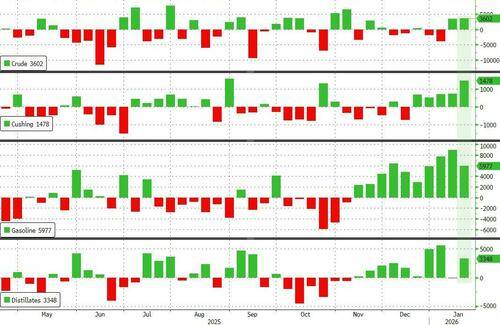

Easing tensions returned the focus to market fundamentals, as traders look to rising global inventories as supply runs well ahead of demand (seemingly confirmed by a large build in crude and product stocks reported overnight by API).

Crude +3.04mm

Cushing +1.2mm

Gasoline +6.2mm

Distillates -33k

Crude +3.6mm

Cushing +1.478mm - biggest build since Aug 2025

Gasoline +5.977mm

Distillates +3.348mm

The official data showed inventory builds across the board with Cushing stocks jumping by the most since August and gasoline inventories up for the 10th week in a row

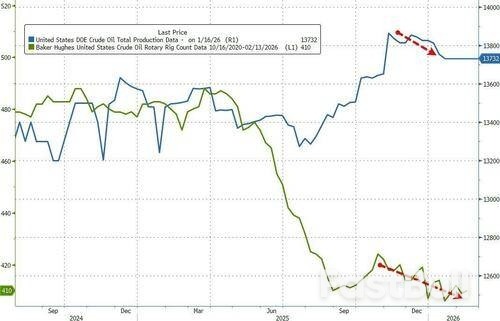

US Crude production dipped a little from record highs as rig counts continue to trend lower...

WTI extended losses after the across the board builds...

"The geopolitical temperature has eased a few degrees," said Ole Sloth Hansen, a strategist at Saxo Bank A/S in Copenhagen.

But with a range of supply threats unresolved, and colder weather set to bolster US demand, prices will likely "hold firm."

U.S. President Donald Trump declared on Thursday that he had secured "total and permanent" American access to Greenland through a new agreement with NATO. Speaking from the World Economic Forum in Davos, Trump’s announcement followed a period of high tension after he backed away from threats of tariffs and force to acquire the territory.

However, the declaration was immediately met with confusion and pushback from Denmark and Greenland, who insisted that sovereignty over the Arctic island was not up for negotiation. The move has sent ripples through the transatlantic alliance, calming markets but leaving deep questions about the stability of Western partnerships.

While Trump projected confidence, key stakeholders claimed to be in the dark. In an interview with Fox Business Network, Trump described the agreement as providing "total access" with "no end, there's no time limit," adding that the details were currently being negotiated.

This was news to Greenland's Prime Minister Jens-Frederik Nielsen. "I don't know what there is in the agreement, or the deal, about my country," he told reporters in Nuuk. While expressing readiness to discuss a better partnership, he drew a firm line on autonomy. "Sovereignty is a red line," Nielsen stated. "We have to respect our territorial integrity."

His Danish counterpart, Prime Minister Mette Frederiksen, confirmed that no negotiations regarding Greenland's sovereignty had occurred with NATO. "It is still a difficult and serious situation," she said, acknowledging that discussions could now focus on promoting "common security in the Arctic region."

The deal, as framed by Trump, centers on NATO's role in the Arctic. NATO Secretary General Mark Rutte, speaking in Davos, said it was now up to the alliance's senior commanders to define the extra security requirements. "I have no doubt we can do this quite fast," Rutte told Reuters. "Certainly I would hope for 2026, I hope even early in 2026."

Frederiksen later echoed the need for enhanced security, calling for a "permanent presence of NATO in the Arctic region, including around Greenland" ahead of an EU summit in Brussels.

Similarly, Finnish President Alexander Stubb expressed hope that allies could formulate a concrete plan to boost Arctic security by the NATO summit in Ankara in July.

The U.S. interest in Greenland is driven by clear strategic goals. After meeting with Rutte, Trump said a potential deal could satisfy his desire for a "Golden Dome" missile-defense system and secure access to critical minerals. He also emphasized the need to block the ambitions of Russia and China in the Arctic. Rutte clarified that mineral exploitation was not discussed in their meeting.

Any new arrangement would build on an existing foundation. A 1951 agreement between Washington and Copenhagen already grants the U.S. the right to build military bases and move freely in Greenland. Washington currently operates a base at Pittufik in northern Greenland.

"It is important to clarify that the U.S. had 17 bases during the Cold War and much greater activity. So that is already possible now under the current agreement," explained Marc Jacobsen, an associate professor at the Royal Danish Defence College. He anticipates concrete discussions about the missile defense system and measures to exclude Russia and China from Greenland.

While Trump's U-turn from his earlier aggressive posture triggered a rebound in European markets, the episode has severely damaged business confidence and transatlantic trust.

Diplomats told Reuters that leaders in the European Union are now poised to rethink relations with the U.S. Many EU governments reportedly view Trump as an unpredictable actor that Europe must learn to stand up to.

This sense of uncertainty is also felt by residents in Greenland's capital, Nuuk. "I think it's all very confusing," said pensioner Jesper Muller. "One hour we are, well, almost at war. Next hour everything is fine and beautiful, and I think it's very hard to imagine that you can build anything on it."

A potential overhaul of Venezuela's oil industry could trigger a rapid recovery in its exports, threatening Mexico's market share and potentially slowing its economic growth by 2026, according to the Mexican Institute of Finance Executives (IMEF).

Mexican GDP growth is forecast at 1.3% for 2026, but this outlook faces several risks. A key concern is a potential shift in global crude oil flows if Venezuela successfully attracts new investment to revitalize its battered energy sector.

According to IMEF president Gabriela Gutierrez, Venezuela could once again become an attractive destination for upstream capital if the country achieves political stability and provides operators with secure property rights.

"Venezuela could become more attractive for oil investment than Mexico, which has already seen crude producers reduce their interest," Gutierrez noted.

Currently, Mexico is the larger producer. In 2025, state-owned Pemex and several smaller private firms produced approximately 1.6 million barrels per day (b/d). Pemex, the only Mexican company authorized to export crude, shipped about 600,000 b/d from January to November 2025.

In contrast, Venezuela's crude output was just 934,000 b/d in November, based on an average of OPEC secondary sources. This is a dramatic fall from its production levels of over 3 million b/d in the early 2000s, a decline largely driven by underinvestment and U.S. sanctions.

However, recent shifts in U.S. policy have allowed more Venezuelan crude back onto the market. Chevron, the second-largest U.S. oil producer, now operates in Venezuela with state firm PdV under a special sanctions waiver. In December, Chevron imported around 120,000 b/d of Venezuelan crude into the United States.

Boosting output significantly will not be easy for either nation. Gutierrez estimates that both countries would need to invest tens of billions of dollars, with a payoff period of five to ten years.

Mexico faces major hurdles in financing new upstream projects, as its government has limited capacity to support the heavily indebted Pemex.

Venezuela presents its own set of challenges for investors. The country's unstable political environment remains a primary risk. A meaningful turnaround would require costly repairs to essential energy infrastructure, from pipelines to power grids. It would also demand access to modern equipment and a skilled workforce. Furthermore, U.S. producers will need clear legal frameworks for contracts and significantly higher oil prices to justify the massive investments required.

The critical difference between the two nations lies in their crude reserves. Mexico holds proven reserves of around 7.5 billion barrels. Venezuela, on the other hand, reports over 300 billion barrels.

"Even conservative specialist estimates place Venezuelan reserves at over 10 times larger than Mexico's estimated reserves," Gutierrez said, highlighting the country's immense long-term potential.

Mexico's strategic decision to cut crude exports in favor of domestic refining has already cost the country valuable market share, according to Victor Herrera, IMEF's economic studies chair.

"We export less every year, while Venezuela is doing everything possible to export more," Herrera explained. He added that diverting crude to national refineries has generated financial losses, further weakening Pemex's already strained financial position.

Finnish President Alexander Stubb is calling for NATO to develop a comprehensive Arctic security plan by its July summit, a move prompted by a new U.S. framework deal designed to resolve tensions over Greenland.

Speaking on Thursday at the World Economic Forum in Davos, Switzerland, Stubb said he wants a package of measures to bolster security in the region. This initiative follows an announcement by U.S. President Donald Trump that he had secured "total and permanent U.S. access to Greenland" in an accord with NATO.

Stubb envisions a security package for the Arctic that is "not dissimilar" to the agreement reached in The Hague last June, where NATO leaders committed to a significant increase in defense spending at Trump's request.

"In an ideal world, we would have something ready by the NATO summit in Ankara," Stubb told Reuters.

This renewed focus on Arctic security comes as NATO’s head acknowledged that allies must step up their commitments to counter threats from Russia and China in the resource-rich region.

The proposed Arctic security architecture would rely on close cooperation between several key nations. According to Stubb, this would include:

• NATO's five Scandinavian members: Sweden, Finland, Norway, Denmark, and Iceland.

• The United States.

• Canada.

Stubb emphasized Finland's own capabilities, noting that its armed forces are highly trained for regional operations. "We have one million women and men who've done their military service in Arctic conditions," he stated.

The call for a new strategy follows a period of strain within the alliance. President Trump had previously threatened to impose tariffs on eight European allies over their position on Greenland, an autonomous region of Denmark. He also ruled out acquiring the island by force.

The new U.S.-NATO agreement de-escalated the conflict, with Trump arguing that only the United States can guarantee Greenland's security against Chinese and Russian ambitions. His approach, however, had threatened to fracture the alliance and trigger a trade war with Europe.

As Stubb spoke in Davos, EU leaders were preparing to meet in Brussels to discuss the Greenland issue. The Finnish president said he was confident that European leaders would maintain a united front and stressed the importance of hearing from Danish Prime Minister Mette Frederiksen.

Stubb, considered by many to be skilled at building bridges with the Trump administration, also voiced support for the U.S. president's demands on European defense. He praised NATO Secretary General Mark Rutte for his role in finding common ground on the Greenland matter.

"I think it's completely justified for President Trump to ask Europeans to do more about their defence, and also to pay more for the alliance and have more capability," Stubb said. "The stronger NATO is, the better off we are."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up