Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The November CPI report creates more questions than answers about the recent pace of price growth. Consumer prices rose 2.7% in the 12 months ending in November, materially below our expectations for a 3.0% gain.

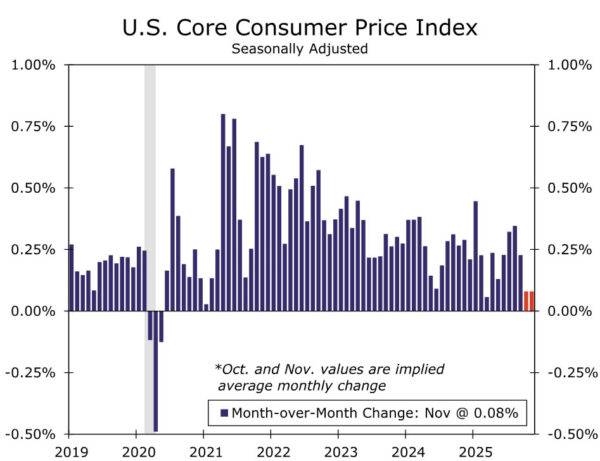

The November CPI report creates more questions than answers about the recent pace of price growth. Consumer prices rose 2.7% in the 12 months ending in November, materially below our expectations for a 3.0% gain. The core index similarly fell short of expectations, advancing 2.6% over the past 12 months versus our forecast for a 2.9% increase. The stark miss comes on the heels of the longest-ever government shutdown that led the BLS to skip October data collection and not begin the November collection process until the middle of the month.

As such, we caution against reading too much into today's report. The November data suggest core prices rose 0.16% over the past two months, or an average of 0.08% per month. For comparison, the core index has increased at an average monthly pace of 0.25% this year. CPI data are not revised, and as a result we believe the data will be noisy for at least another month or two. A bounce back in prices in the December CPI report to be released on January 13 is probably coming. Through the noise, we believe inflation is slowing on trend, even if today's reading overstates the magnitude of the slowdown. We remain comfortable with our current projection of rate cuts from the FOMC in March and June of next year.

The government shutdown appears to have caused issues in the consumer price inflation data collection process. The two-month percent change in headline and core CPI were 0.20% and 0.16%, respectively, meaningfully below our forecasts of 0.45% and 0.48%. For context, the two-month change in headline and core CPI from July to September was 0.69% and 0.57%, respectively. This pushed the year-ago pace of headline and core CPI inflation down to 2.7% and 2.6%, a steep decline from 3.0% and 3.1% in September. The slowdown was broad-based across nearly all categories, adding to our suspicions that the shutdown's disruptions caused issues in the data. Data collection didn't begin until the second half of November, which may have skewed the sample more than we anticipated.

Food prices rose 0.06% over the past two months, a significantly slower pace than the 0.25% average monthly rise this year. Taking a step back from this report's noise, forward-looking measures of food-related commodities have slipped into deflation territory, which, when coupled with recent rollbacks on select food tariffs, point to a disinflationary trend in food inflation even if not to the extent implied in today's report. Energy was the lone category that came in reasonably near expectations, rising 1.08% over the past two months and up 4.1% year-over-year in November. This is likely due to gasoline prices being collected from a non survey source and thus being one of the few sub-categories the BLS was able to publish price data for in October. New and used autos prices were also produced under their usual methodology and came in a touch stronger than we expected.

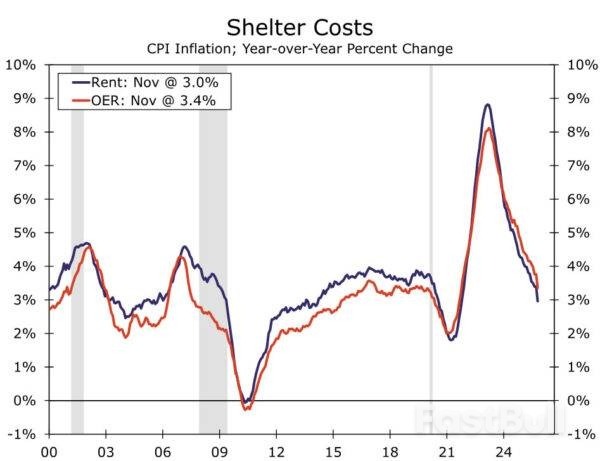

Core goods prices rose only 0.06% between September and November, compared to a 0.15% average monthly rise headed into this report. Similarly, core services rose only 0.16% over the past two months. Shelter inflation was a prime example of the puzzlingly weak inflation data in core. Owners' equivalent rent rose 0.27% over two months, while rents rose just 0.13%. The weak outturn lead these categories down to 3.4% and 3.0%, respectively, on a year-over-year basis, breaking away from their recent trends (chart). In short, we are not putting much weight on the details of this report, and we anticipate a bounce back in the December reading to be released on January 13.

While materially softer than expected, we think the collection issues around this particular report means it will do little to change Fed officials' current views on inflation. Inflation pressures are softening, but not to this degree. With the Fed waiting for (reliable) inflation data before cutting rates again, today's data add to our conviction that the FOMC will be on hold at the January meeting. That said, data issues aside, our belief is that inflation is slowing on trend, even if today's print overstates the slowdown. When paired with the softening in the labor market, we remain comfortable with rate cuts in March and June of next year. At that point, we believe cleaner data will give the Committee more confidence that inflation is leveling off and will soon be moving back toward 2%.

A U.S. appeals court said on Thursday it will consider whether millions of Apple customers can band together in a lawsuit accusing the iPhone maker of monopolizing the market for apps and inflating prices, after a trial judge stripped the case of class action status earlier this year.

In a brieforder, the San Francisco-based 9th U.S. Circuit Court of Appeals said it will review a ruling that decertified a class of nearly 200 million consumers who claim Apple's App Store rules led to $20 billion in overcharges.

U.S. District Judge Yvonne Gonzalez Rogers in Oakland, California, ruled in October that the customers failed to provide a model "capable of reliably showing classwide injury and damages in one stroke" by matching Apple accounts to consumers, while limiting the number of "unharmed" consumers in the class.

The three plaintiffs asked the appeals court to overturn the decision and revive the class action before their individual claims are decided. Class actions can expose companies to far greater damages than individual lawsuits.

Apple did not immediately respond to a request for comment.

Mark Rifkin, a lawyer for the plaintiffs, said they "look forward to briefing and arguing the merits of the appeal in the Ninth Circuit."

The lawsuit, filed in 2011, accuses Apple of violating U.S. antitrust law by too tightly restraining how customers download apps and pay for transactions, causing overcharges for apps and in-app content on their iPhones and iPads. Apple has denied any wrongdoing.

In their appeal, the consumers called the decertification ruling "manifestly erroneous," saying they showed Apple's conduct harmed virtually all class members.

They warned the ruling creates a "death knell" for claims worth only $268 collectively for the three named plaintiffs.

Apple told the appeals court that the plaintiffs still can pursue individual claims and that review was unwarranted because the decertification order turned on fact-specific rulings, not unsettled law.

The case is In re Apple iPhone Antitrust Litigation, 9th U.S. Circuit Court of Appeals, No. 25-7122.

Japan's core consumer prices rose 3.0% in November from a year earlier, data showed on Friday, staying above the central bank's 2% target for the 44th straight month.

The outcome reinforces market expectations the Bank of Japan will raise interest rates to 0.75% from 0.5% at a two-day policy meeting concluding on Friday.

The increase in the core consumer price index (CPI), which excludes volatile fresh food prices, matched a median market forecast and was steady from the year-on-year pace of rise in October.

An index stripping away volatile fresh food and fuel costs, which is closely watched by the BOJ as a better gauge of underlying price trends, rose 3.0% in November from a year earlier, compared with a 3.1% increase in October.

The BOJ exited a decade-long, radical stimulus programme last year and raised short-term interest rates to 0.5% in January on the view Japan was on the cusp of sustainably hitting its 2% inflation target.

With stubbornly high food prices keeping inflation above its 2% target, a growing number of BOJ board members have signaled their readiness to vote for a rate hike to avoid being behind the curve in addressing the risk of too-high inflation.

Ireland's central bank on Friday raised its forecasts for domestic economic growth, saying the impact of U.S. economic policies had so far been relatively benign and consumer spending steadier than expected.

Ireland is one of the countries most exposed to President Donald Trump's efforts to force firms to boost their operations inside the United States, with a significant proportion of Irish employment, tax receipts and exports dependent on a cluster of mainly tech and pharmaceutical U.S. multinationals.

But so far the Irish economy has proven "really, really resistive" to the expected economic headwinds, said Robert Kelly, Director of Economics and Statistics.

Modified domestic demand (MDD) - a gauge of economic performance that strips out the distorting effects of multinational firms - is expected to grow by 3.9% this year, the central bank said in its quarterly report, up from a forecast of 2.9% three months ago.

Domestic economic growth will slow to 3.0% in 2026 and 2.8% in 2027, it forecast, both upgrades from September.

The upward revision was in part due to a stronger outlook for multinational investment, construction activity and government expenditure, the report said.

Adjustments by foreign multinationals in Ireland in response to the new environment have so far been relatively benign, Kelly said.

The report also said inflation is expected to increase from 2.1% this year to 2.3% next year with risks tilted to the upside.

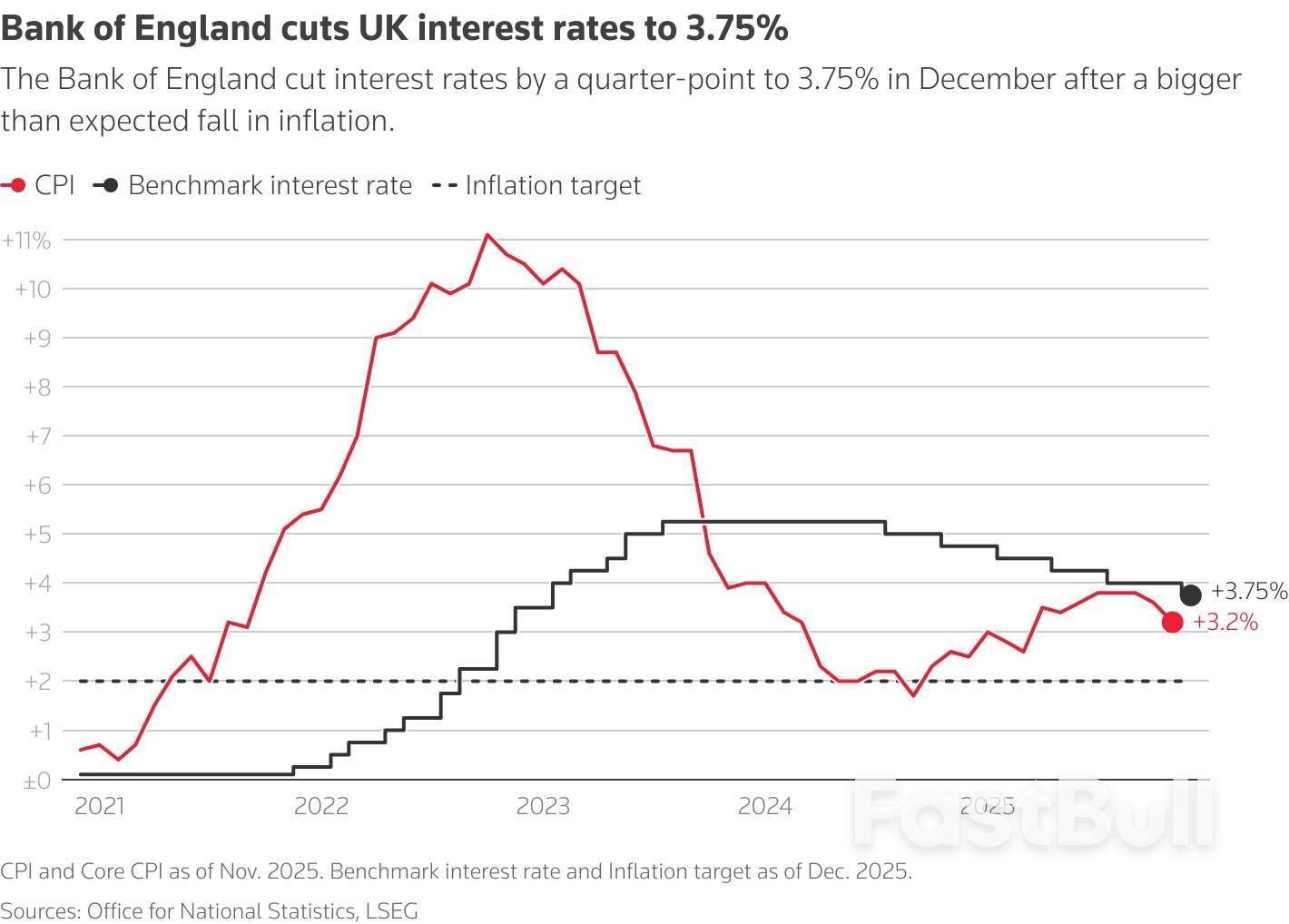

The Bank of England cut interest rates on Thursday after a narrow vote by policymakers but it signalled that the already gradual pace of lowering borrowing costs might slow further.

After a big drop in inflation and a new forecast from BoE staff that the economy is stagnating, five Monetary Policy Committee members voted to lower the BoE's benchmark rate for the sixth time since August 2024 to 3.75% from 4%.

The four other members supported no change as they worried about the potential for inflation - still the highest among the Group of Seven economies - to remain too high.

Analysts polled by Reuters last week had mostly expected a 5-4 vote for a rate reduction as Britain's economy struggles to grow and inflation falls.

Governor Andrew Bailey changed his view and voted for a cut as he sees inflation returning close to the BoE's 2% target as soon as April or May next year, about a year earlier than forecast by the central bank just last month.

But he cautioned that inflation still posed some risks.

"The calls will become closer, and I would expect the pace of cuts, therefore, to ease off at some point," he told broadcasters. "But I'm not going to judge exactly when that is, because it's too uncertain at the moment."

Sterling strengthened by as much as a cent against the U.S. dollar after the decision, before paring gains.

Interest-rate-sensitive two-year gilt yields - which were at their lowest since August 2024 before the decision was announced - rose as much as 6 basis points as investors saw slightly less chance of more than one rate cut next year.

A line chart with the title 'Britain's inflation and interest rates'

A line chart with the title 'Britain's inflation and interest rates'Sanjay Raja, chief UK economist at Deutsche Bank, said he was sticking to his forecast of two more quarter-point cuts in 2026 - in March and in June - but said there was a chance the BoE could move more slowly and ultimately have to cut rates more.

James Smith and Chris Turner, economists at ING, said the lines between the two MPC camps had become more blurred. Some of the policymakers who voted for a rate cut showed signs of concern about high wage growth while others among those who called for a hold hinted at diminishing inflation risks.

"That said, we don't view today's decision as a game-changer," they wrote in a note to clients. "Fundamentally, the Bank - or most officials at least - still think further cuts are likely. It has not changed our mind that the Bank will cut rates twice more next year."

Among the senior policymakers who voted against the rate cut, Deputy Governor Clare Lombardelli said she remained more concerned about the risk of inflation proving stronger than expected and the recent data had only softened "at the margin".

Chief Economist Huw Pill said he saw a bigger risk of inflation getting stuck too high than too low.

But Catherine Mann said her decision not to vote for a rate reduction was "quite finely balanced".

The cut took Bank Rate to its lowest level in nearly three years although it is still almost double the European Central Bank's equivalent rate which it kept on hold on Thursday.

British inflation remains higher than among peer economies - in part because of finance minister Rachel Reeves' decision last year to raise taxes on employers - even after it fell unexpectedly sharply to 3.2% in data released on Wednesday.

Data on Tuesday showed a weakening jobs market including the highest unemployment rate since 2021.

The BoE said it now expected the economy to stagnate in the last three months of 2025, down from a forecast of 0.3% growth made last month, although it thought underlying growth was stronger at about 0.2% a quarter.

Britain's economy shrank by 0.1% in the three months to October amid reports that businesses put investment projects on ice in the run-up to Reeves' budget on November 26.

The BoE said the budget would bring down inflation in 2026 by about half a percentage point due to one-off measures which would then push it up a bit in the following two years.

The budget measures would add at most 0.2% to the size of the economy in 2026 and 2027.

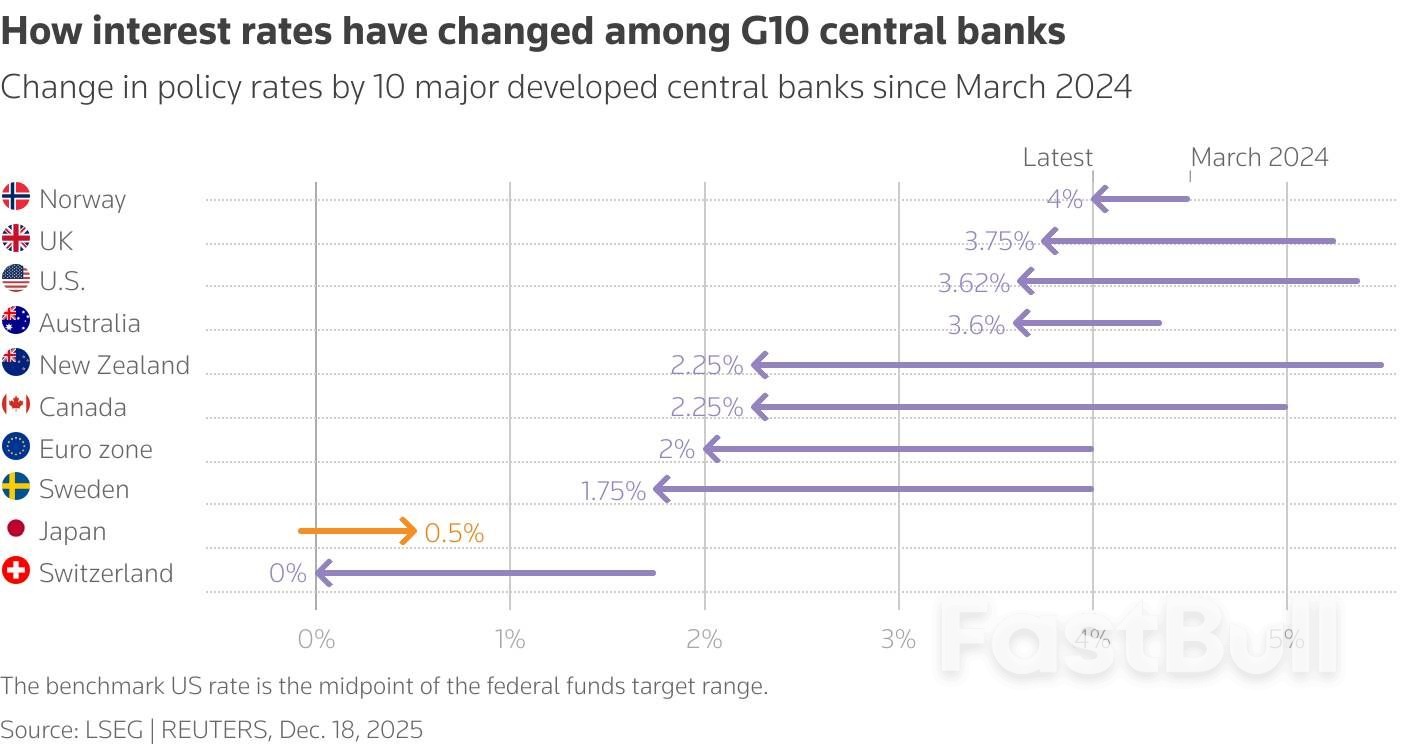

Other major central banks are believed to be close to halting their rate cuts. The U.S. Federal Reserve last week signalled one more move in 2026, while the ECB has probably already come to the end of its monetary loosening cycle.

An arrow chart with the title 'How interest rates have changed among G10 central banks'

An arrow chart with the title 'How interest rates have changed among G10 central banks'U.S. President Donald Trump's move to relax marijuana regulations could ease some burden for cannabis companies, but will likely keep doors to access capital from big banks closed, experts said.

Cannabis companies, once in the spotlight during their boom, have limitations to access capital, often relying on smaller banks or alternative lenders, credit unions that come with higher borrowing costs. The executive order seeks a speedy reclassification of marijuana that would ease federal restrictions on research that could lead to new medical marijuana products.

While Trump's order that reclassifies cannabis as a controlled substance is good news for cannabis companies and removes red tape, including compliance costs, large lenders will remain on the sidelines unless it is federally legal, as lending could spark risks.

"Rescheduling is great progress, but I do not expect it to open the lending floodgates for cannabis operators, or for it to be materially behavior-altering for larger banks," said Samantha Gleit, a partner at Feuerstein Kulick leading the firm's debt finance and corporate restructuring practices.

"Until there is full federal legalization, lending and providing treasury services to cannabis companies will continue to be a banking hurdle, particularly for the larger institutions that need to maintain their FDIC ensured status."

Even under a reclassification, marijuana would still be treated as a controlled substance on a federal level and its use subject to tight restrictions and criminal penalties.

"For big banks, this isn't the moment they ... start handing out term sheets. You might see some regional or tech-savvy banks start edging closer to the pot of gold, but not (the big banks)," said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.

Most major American and Canadian banks declined comment. Some others referred questions to the American Bankers Association.

The American Bankers Association, which represents major banks, said it would continue to call on Congress and the administration to pass the bipartisan SAFER Banking Act, which would give financial institutions the legal certainty they need to offer banking services to cannabis and cannabis-related businesses in the states where it has been legalized.

"Because cannabis remains illegal under federal law, proceeds from its sale are still considered illicit, which carries significant risks for banks that want to serve the industry," a spokesperson said.

For Ari Raptis, CEO of cannabis distributor Talaria Transportation, the news brings optimism but core challenges on accessing capital remain.

"From a financial standpoint, this improves a lot of optics, but not access. Capital follows clarity and clarity still hasn't arrived yet," Raptis said.

The table below presents a summary of the latest financial aggregates statistics.

| Monthly | Year-ended | ||||

|---|---|---|---|---|---|

| Oct 25 | Nov 25 | Nov 24 | Nov 25 | ||

| Total credit | 0.7 | 0.6 | 6.3 | 7.4 | |

| – Housing | 0.6 | 0.6 | 5.4 | 6.6 | |

| – Personal | 0.1 | −0.5 | 2.0 | 3.9 | |

| – Business(a) | 0.8 | 0.7 | 8.6 | 9.2 | |

| Broad money | 0.7 | 0.3 | 5.6 | 7.1 | |

(a) Lending to non-financial businesses. Sources: ABS; APRA; RBA | |||||

All growth rates for the financial aggregates are seasonally adjusted, and adjusted for theeffects of breaks in the series. Data for the levels of financial aggregates are notadjusted for series breaks, and growth rates should not be calculated from data on thelevels of credit.

Historical levels and growth rates for the financial aggregates have been revised owing tothe resubmission of data by some financial intermediaries, the re-estimation of seasonalfactors and the incorporation of securitisation data. The RBA credit aggregates measurecredit provided by financial institutions operating domestically. They do not capturecross-border or non-intermediated lending.

Since the July 2019 release, the financial aggregates have incorporated an improvedconceptual framework and a new data collection. This is referred to as the Economic andFinancial Statistics (EFS) collection. For more information, seeUpdates to Australia's FinancialAggregates and the July 2019 Financial Aggregates.

Since the March 2023 release, series that exclude lending to warehouse trusts in business credit were added tothe financial aggregates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up