Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

I gues Japan is now a bad guy too!

I gues Japan is now a bad guy too!

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

New Zealand's top central banker said on Thursday that the deterioration in the country's labour market was within the bank's expectations, after data this week showed the jobless rate in the third quarter rose to the highest level since 2016.

New Zealand's top central banker said on Thursday that the deterioration in the country's labour market was within the bank's expectations, after data this week showed the jobless rate in the third quarter rose to the highest level since 2016.

"It is hard out there, that is something that we had anticipated in terms of where we're in the economic cycle," Reserve Bank of New Zealand Governor Christian Hawkesby said at a parliamentary committee hearing.

Hawkesby was speaking following the release of the RBNZ'sFinancial Stability Report on Wednesday.

Hawkesby reiterated that the central bank's assessment ofthe financial system was that it was "well-placed, not only forwhat's going on at the moment, but some more severe scenarios aswell, if they were to play out."

Hawkesby also said that there was no shortage of things toworry about at the moment, that risks remain elevated relativeto recent years and that top of the list of concerns was globaltrade fragmentation and trade wars.

"We don't think we're out of the worst yet," Hawkesbysaid. * Hawkesby said New Zealand was currently experiencing amulti-speed economy with different regions and different sectorsresponding in different ways.

Nexperia said it suspended supplies to its China factory because the local unit refused to make payments, laying bare the internal discord at the embattled automotive chipmaker.

The Dutch company, owned by Chinese firm Wingtech Technology Co., supplies power control chips used by automakers from Volkswagen AG to BMW AG. It notified customers on Oct. 29 that it was halting the direct supply of wafers to its assembly plant in China.

Nexperia said its entities there had stopped operating within the established corporate governance framework and were ignoring global management's instructions, according to a statement late Wednesday.

"We cannot oversee if and when products from our facility in China will be delivered," the Nijmegen, Netherlands-based firm said. "Given the missing transparency and oversight over the manufacturing processes we cannot guarantee the intellectual property, technology, authenticity and quality standards for products delivered from the Nexperia facility in China as of Oct. 13."

The Dutch government assumed veto powers over Nexperia in September over concerns Wingtech was hobbling the chipmaker and threatening the supply of vital components. China retaliated by imposing restrictions on exports of Nexperia's products, a standoff that put the auto industry's supply chain at risk and forced carmakers to slow production.

Nexperia on Wednesday said the China unit's refusal to pay for the wafers shipped to its factory "is not an isolated incident." It alleged misappropriation of Nexperia China entities' corporate seals without legitimate cause or explanation, and said the unit sent unauthorized letters with false information to customers, subcontractors, third party suppliers and employees. Wingtech representatives didn't immediately respond to requests for comment.

Nexperia China also established "unauthorized bank accounts and was directing customers to remit payments to these accounts," it said in the statement.

China this week criticized the Dutch government for not taking enough steps to resolve the dispute after Beijing announced Nov. 1 that it would grant exemptions to Nexperia's exports from China.

The chipmaker, while welcoming China's commitment to the restoration of the supply chain, on Wednesday said it hoped to see further details on the conditions, criteria and procedures on lifting of the curbs.

President Donald Trump's administration has revoked around 80,000 non-immigrant visas since its inauguration on January 20 for offenses ranging from driving under the influence to assault and theft, a senior State Department official said on Wednesday.

The extent of the revocations, first reported by Washington Examiner, reflects a broad immigration crackdown initiated when Trump came into office, deporting an unprecedented number of migrants including some who held valid visas.

The administration has also adopted a stricter policy on granting visas, with tightened social media vetting and expanded screening.

Around 16,000 of the visa revocations were tied to cases of driving under the influence, while about 12,000 were for assault and another 8,000 for theft.

"These three crimes accounted for almost half of revocations this year," said the senior State Department official, speaking on the condition of anonymity.

In August, a State Department spokesperson said Washington had revoked more than 6,000 student visas for overstays and breaking the law, including a small number for "support for terrorism."

The department also said last month that it had revoked the visas of at least six people over social media comments about the assassination of conservative activist Charlie Kirk.

U.S. Secretary of State Marco Rubio in May said he has revoked the visas of hundreds, perhaps thousands, of people, including students, because of involvement in activities that he said went against U.S. foreign policy priorities.

Directives from the State Department this year have ordered U.S. diplomats abroad to be vigilant against any applicants whom Washington may see as hostile to the United States and with a history of political activism.

Trump administration officials have said that student visa and green card holders are subject to deportation over their support for Palestinians and criticism of Israel's conduct in the war in Gaza, calling their actions a threat to U.S. foreign policy and accusing them of being pro-Hamas.

Japan's real wages fell for the ninth consecutive month in September as resurgent inflation outgrew nominal pay, government data showed on Thursday, highlighting the wage-price gap that complicates the Bank of Japan's (BOJ) rate hike plans.

The BOJ kept interest rates unchanged at the October 29-30 policy meeting and Governor Kazuo Ueda signalled that the 2026 wage outlook would be the most crucial factor in determining the timing of the next hike.

Inflation-adjusted real wages, a key determinant of household purchasing power, decreased 1.4% in September from a year before, the labour ministry data showed.

That followed a revised 1.7% drop in August and extended the contraction streak that began in January.

Average nominal wage, or total cash earnings, rose 1.9% year-on-year to 297,145 yen ($1,971) in September, after posting revised 1.3% growth in the previous month.

The gain fell short of the 3.4% rise in consumer prices, which picked up pace for the first time since April. The inflation rate the ministry uses to calculate the headline real wage figure includes fresh food prices but not rent costs.

Regular pay, or base salary, increased 1.9% in September, matching the pace seen in August after a downward revision. Overtime pay, a barometer of business activity strength, rose 0.6% in September, picking up from revised 0.4% growth in August.

Special payments, mostly consisting of one-off bonus payments, rose 4.5% in September after a 7.8% fall in August. The indicator tends to be volatile outside of the common summer bonus months of June and July.

Japan's largest labour organisation, Rengo, last month set a "5% or more" target for the 2026 spring pay talks, which typically conclude in mid-March. This year, Rengo member unions secured an average wage hike of 5.25%, the biggest in 34 years.

New Japanese Prime Minister Sanae Takaichi on Tuesday said the country has yet to achieve sustainable inflation accompanied by wage gains, suggesting her preference for the central bank to go slow in raising interest rates.

A federal investigator said a UPS cargo plane's left wing caught fire and an engine fell off shortly before it crashed and exploded into a fireball in Louisville on Tuesday night, killing at least 11 people and injuring 15 with some people still unaccounted for.

At least 28 National Transportation Safety Board agents arrived at the site in Kentucky and began searching for clues about the possible cause of the disaster, which saw the UPS plane crash shortly after takeoff at the Louisville Muhammad Ali international airport, leaving behind a fiery trail of destruction on the ground and a huge plume of black smoke.

After the plane was cleared for takeoff, a large fire developed in the left wing, said agent Todd Inman of the NTSB, which is leading the investigation. The plane gained sufficient altitude to clear the fence at the end of the runway before crashing off airport property, Inman told reporters.

Airport security video "shows the left engine detaching from the wing during the takeoff roll", he said.

The cockpit voice recorder and data recorder were recovered, and the engine was discovered on the airfield, Inman said.

"There are a lot of different parts of this airplane in a lot of different places," he said, describing a debris field that stretched for half a mile.

The plane, a McDonnell Douglas MD-11, had three crew members onboard and crashed at about 5.15pm local time on Tuesday, according to the Federal Aviation Administration. It was bound for Honolulu.

So far, 11 deaths and at least 15 injuries have been reported, according to Andy Beshear, Kentucky's governor. He said in a social media post he expected the death toll to rise to 12 by end of day.

"The tough news continues today as the death toll in Louisville has now risen to at least 11, and I expect it to be 12 by end of the day," Beshear's post read. "Even harder news is that we believe one of those lost was a young child."

The UofL Health hospital system said it was treating 15 patients in relation to the crash, with two of them in critical condition at the hospital's burn center. Other injuries ranged from minor to severe burns, blast injuries, shrapnel injuries and smoke inhalation injuries.

"First responders have located nine total [dead] victims at the site of the UPS crash . We will continue to provide information as available," said Craig Greenberg, Louisville's mayor.

Beshear said officials did not expect to find any more victims and were moving from rescue to recovery mode. He said there were a handful of people investigators were still searching for that they hoped were not on site.

Four of those killed were not onboard the plane, said Brian O'Neill, the Louisville fire department chief.

Hundreds of firefighters have fanned out to deal with fires that erupted on the ground after the crash, although local leaders have asked the public to not move any debris and instead report it to help investigators piece together what happened.

"We have put together a form where residents can report debris in your yard," Greenberg posted on X. "We ask that residents do not touch or move any debris on your own."

Investigators will try to find out how a seemingly routine flight – the UPS hub at Louisville has 300 flights a day – went so badly wrong. Officials have said that there were no hazardous materials on the plane.

Videos taken by onlookers showed flames on the plane's left wing, with the aircraft then lifting off the ground before crashing and exploding into a huge fireball. Nearby residents reported hearing loud booms and witnessed flames in the sky and on the ground.

The amount of fuel on the plane would make a large explosion almost inevitable, Pablo Rojas, an aviation attorney, told the Associated Press. "There's very little to contain the flames and really the plane itself is almost acting like a bomb because of the amount of fuel," he said.

Mary Schiavo, a former Department of Transportation inspector general, analyzed video of the crash for CNN.

"[The parts] expel from that engine, and the centrifugal force from the engines, the blades spinning, and they can cut through the plane and cut fuel lines," Schiavo said of the parts. "That engine clearly came off of that plane before the final impact. The poor pilots could do nothing at that point."

The Louisville airport canceled all outbound flights following the crash. A shelter-in-place order surrounding the airport has now been reduced to a quarter-mile radius around the crash site.

Top Trump administration officials briefed members of the Senate and House of Representatives on Wednesday about strikes on alleged drug trafficking boats off Venezuela, after frustration in Congress about a lack of transparency about the operation.

Secretary of State Marco Rubio and Secretary of Defense Pete Hegseth met with Republican and Democratic congressional leaders and senior members of national security committees for about an hour, discussing U.S. strikes on vessels in the Caribbean and Pacific that have killed dozens of people since early September.

President Donald Trump's administration insists those targeted were transporting drugs, without providing evidence or publicly explaining the legal justification for the decision to attack the boats rather than stop them and arrest those on board.

Several senators and House members who attended the briefing said the administration officials said the boats were carrying cocaine, not fentanyl, and explained their legal justification.

Some legal experts say the strikes may violate international law as well as U.S. laws against murder and prohibitions on assassination.

Trump's fellow Republicans said they were pleased with the briefing.

House Speaker Mike Johnson described the intelligence about the vessels as "exquisite," although he said the U.S. knew who had been on board the boats "almost to a person."

Asked to clarify, Johnson said: "What I know from what I've learned so far, we have high reliability. These are the cartels. These are the people involved in it. They are doing this deliberately. These are not people who are haphazardly on a boat. They are intending to traffic into the country, and it does great harm to the American people."

The strikes have raised tensions between Washington and Caracas, more so as Trump ordered a major military buildup in the region and said his administration will carry out strikes against drug-related targets inside Venezuela.

President Gustavo Petro, leader of long-time U.S. ally Colombia, has been feuding with Trump over the strikes, whose victims have included Colombians. Trump has imposed sanctions on him.

Senator Mark Warner, the top Senate intelligence Democrat, said the administration's failure to publicly explain its actions, including the legal justification, had damaged the confidence of the U.S. public and partners in Latin America.

"Kinetic strikes without actually interdicting and demonstrating to the American public that these are carrying drugs and full of bad guys, I think, is a huge mistake that undermines confidence in the administration's actions," Warner said.

Warner last week blasted the administration for holding a briefing on the strikes that excluded Democrats.

Lawmakers from both parties had slammed the Pentagon as recently as Tuesday for not briefing them on national security issues and said at times top defense officials appeared to be undermining Trump's own policies, in a rare bipartisan show of frustration with the administration.

The Pentagon, which Trump has renamed the Department of War, on Wednesday denied accusations that its top policy official, Elbridge Colby, was not fully briefing Congress on important national security issues, suggesting a widening rift between the agency and senators from both parties.

Key Points:

World Economic Forum President Borge Brende, during a visit to São Paulo, Brazil, highlighted potential global financial bubbles in cryptocurrency, AI, and government debt on November 6, 2025.

These warnings underscore potential systemic risks, emphasizing the need for vigilance as countries navigate growing debt, rapid technological adoption, and volatile cryptocurrency markets, potentially impacting global economic stability.

Borge Brende cautioned on November 6th in São Paulo about three potential market bubbles: cryptocurrency, AI, and debt. He underscored the significant risk these pose to global financial stability. Brende stated, "We could possibly see bubbles moving forward. One is a crypto bubble, second an AI bubble, and the third would be a debt bubble."

Brende's warning is crucial due to the potential widespread impacts on economies and markets. The attention to AI highlights the employment threats as companies like Amazon and Nestlé announce layoffs.

Brende's remarks come amid growing investments in artificial intelligence and cryptocurrencies, drawing comparisons to past 'bubble' events. With AI's rapid adoption, stress on white-collar job security increases. Government debt concerns also highlight long-term financial vulnerability, potentially affecting fiscal policies.

Did you know? The "Dot-com bubble" from 1999–2000 saw tech overvaluation similarly to the current AI trends, making parallels between historical trends and current technological investment risks more apparent.

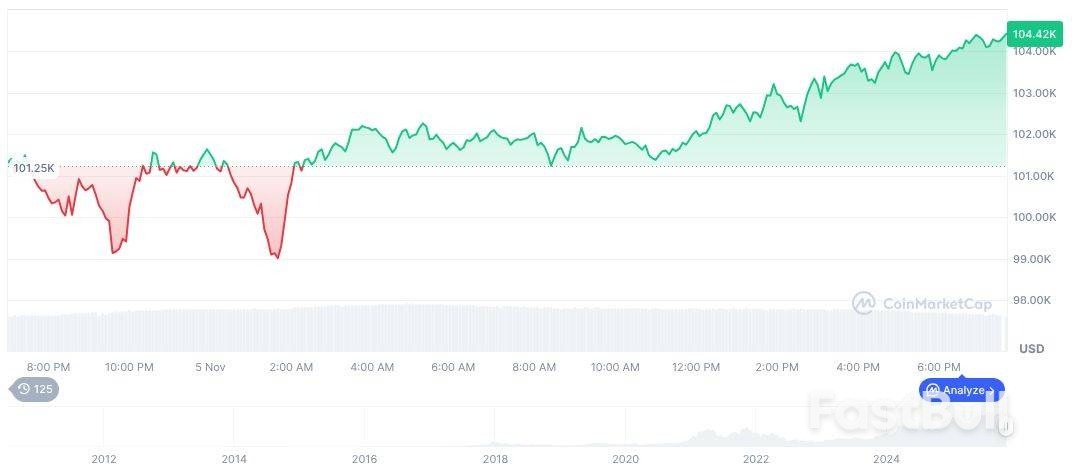

Bitcoin (BTC) recently traded at $103,899.85 with a market cap of $2.07 trillion, maintaining a 59.85% dominance, as per CoinMarketCap. Over 24 hours, BTC rose by 2.68%, but saw declines of 16.75% and 11.47% over 30 and 90 days, respectively. This data underlines the volatile nature of cryptocurrencies, amid Brende's warning of potential bubble dynamics.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 23:36 UTC on November 5, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 23:36 UTC on November 5, 2025. Source: CoinMarketCapWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up