Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

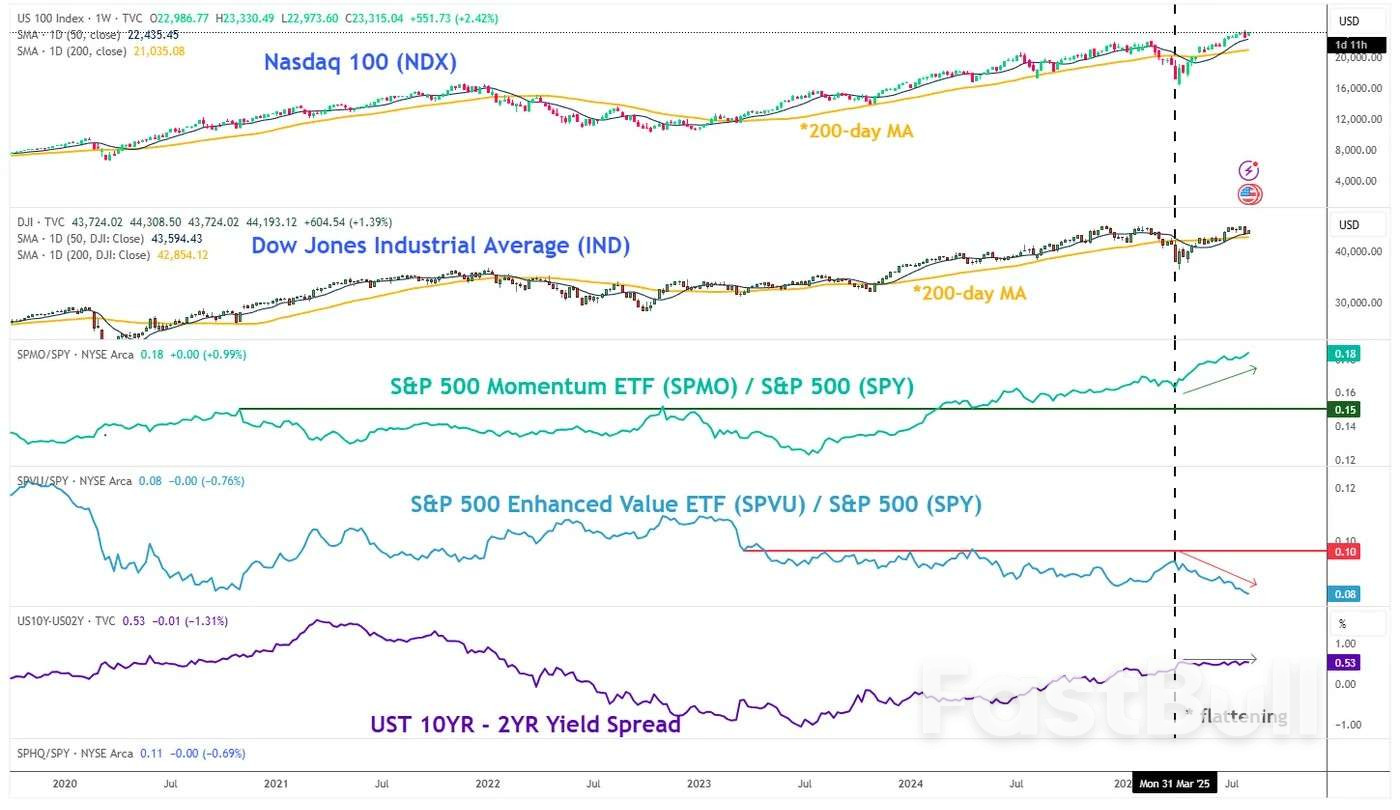

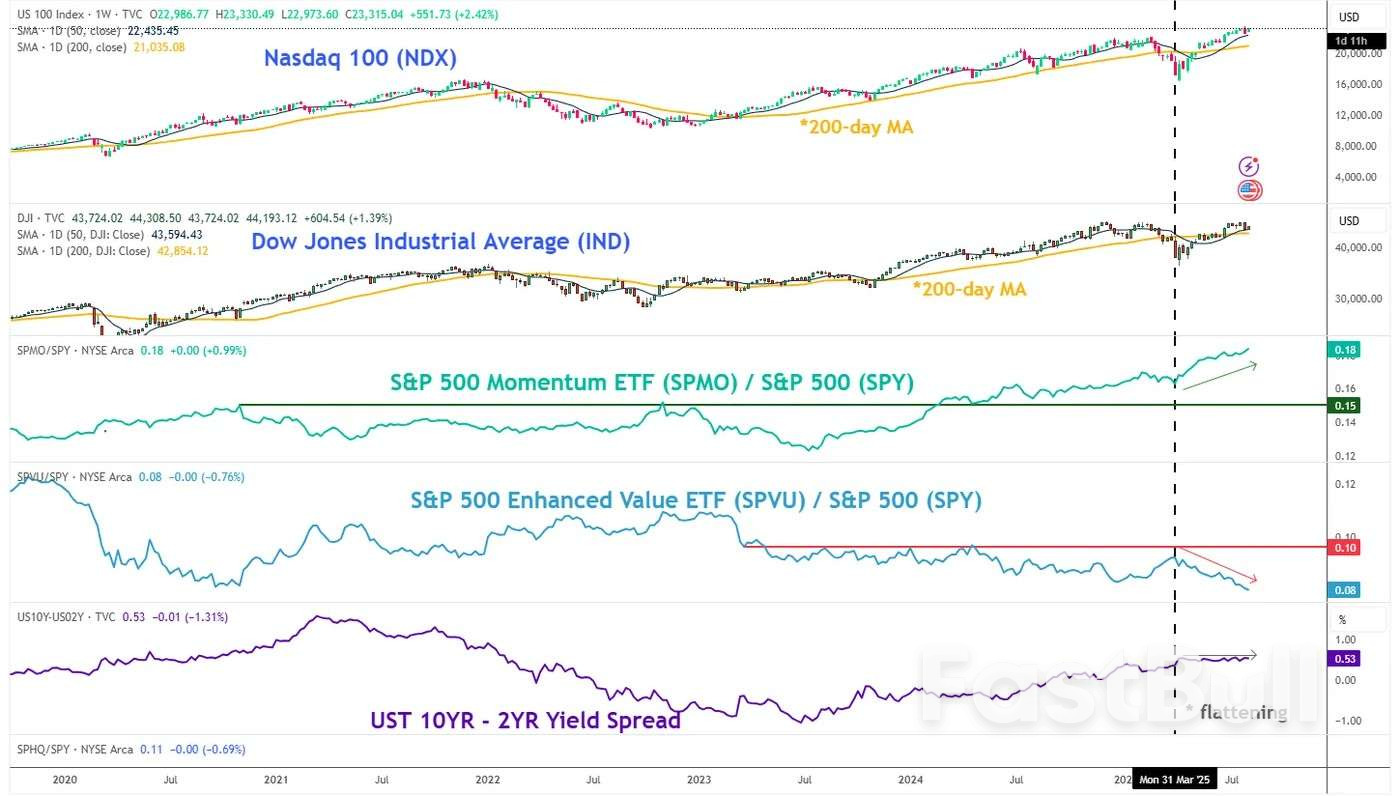

AI-driven optimism lifted Nasdaq 100, now targeting 23,820–24,220 amid bullish momentum and a flatter yield curve. Holding above 22,945 confirms the uptrend; a break below risks a drop to 22,410.

U.S. Commerce Secretary Howard Lutnick said on Thursday he expects the country to collect $50 billion a month in tariff revenues or more - up from $30 billion last month - as higher levies on imports from dozens of countries kick in.

"And then you're going to get the semiconductors, you're going to get pharmaceuticals, you're going to get all sorts of additional tariff money coming in," Lutnick said in an interview with Fox Business Network.

U.S. President Donald Trump's higher tariffs on imports from dozens of countries took effect on Thursday, raising the average U.S. import duty to its highest in a century, with countries facing tariffs of 10% to 50%.

Trump on Wednesday also announced plans to levy a tariff of about 100% on imported semiconductor chips unless manufacturers commit to produce in America, as well as a small tariff on pharmaceutical imports that would rise to 250% over time.

Details of those sectoral tariffs are expected in coming weeks after the Commerce Department completes investigations into the impact of those imports on U.S. national security.

Lutnick told Fox Business Network that companies could win exemptions from the expected semiconductor tariff if they filed plans to build plants in the United States, and those plans were overseen by an auditor.

"His objective is to get semiconductor manufacturing done here," he said, predicting that the initiative would result in some $1 trillion in investment to bolster domestic manufacturing.

Other exemptions have already been agreed, including with the European Union, which said its agreement to accept a 15% tariff on most EU exports includes chips, and with Japan, which has said the United States agreed not to give it a worse rate than other countries.

The push to boost domestic chip manufacturing is not new.

Congress created a $52.7 billion semiconductor manufacturing and research subsidy program in 2022 under former President Joe Biden, and all five leading-edge semiconductor firms agreed last year to locate chip factories in the U.S.

Last year the department said the U.S. produced about 12% of semiconductor chips globally, down from 40% in 1990.

Lutnick, asked about separate talks underway with China on extending a tariff truce that is due to end on August 12, said he felt an agreement was possible.

"I think we're going to leave that to the trade team and to the president to make those decisions, but it feels likely that they're going to come to an agreement and extend that for another 90 days, but I'll leave it to that team."

Federal Reserve Governor Christopher Waller is emerging as a top candidate to serve as the central bank's chair among President Donald Trump's team, Bloomberg News reported on Thursday, citing people familiar with the matter.

Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting interest rates, and while he has backed off threats to try to oust Powell before his term ends on May 15, has accelerated the search for a replacement.

Waller argued for an interest-rate cut at the Fed's July meeting, citing his worries about labor market deterioration, and dissented when the majority decided to leave short-term borrowing costs unchanged.

Waller, who was appointed to the Fed board by Trump in 2020, has said he would accept the job of Fed chair if offered.

Separately, the White House is interviewing candidates to fill the soon-to-be-open seat on the Fed board vacated by Governor Adriana Kugler.

Daily Gold (XAU/USD)

Daily Gold (XAU/USD) Daily Silver (XAG/USD)

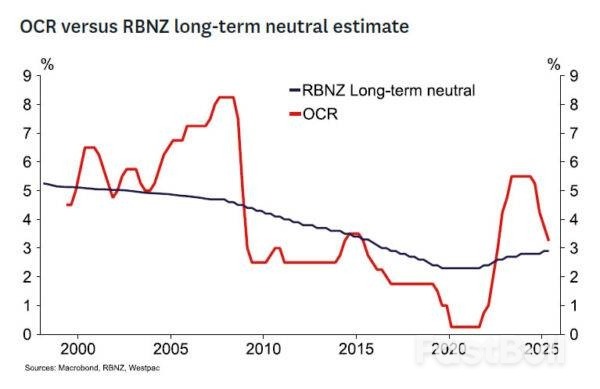

Daily Silver (XAG/USD)The winter of discontent has descended on the New Zealand economy since May. In some respects, business and consumer sentiment has soured, raising questions on exactly when the long-awaited pickup in the economy will become broader based and more sustainable. Parts of the economy are doing well and there is exuberance in the primary sector who are receiving the best returns seen for several years. The Government’s new “Investment Boost” policy might well bring forward some investment in some quarters.

Outside of New Zealand, the trade war has continued to progress – but the degree of heat in the battle has been much lower than feared a few months ago as countries have largely chosen to deal as opposed to fight. Global growth forecasts have picked up as some of the worstcase scenarios have been discounted. Nevertheless, there is still water to go under the bridge as the details of some deals done are unclear, and negotiations continue between the US and some trading partners.

Inflation remains too high, but the economy still has significant excess capacity. Hence there are divergent pressures on the Monetary Policy Committee as they chart the way forward.Against this backdrop, we expect the RBNZ will deliver another 25bp rate cut at this month’s policy review. It’s unlikely that the RBNZ will call time on the easing cycle just yet as the economy is yet to decisively and sustainably turn.With all that in mind, in this note we explore some of the hawkish and dovish arguments that might shape discussion regarding the outlook for policy over the coming months.

Inflation has increased to 2.7% and looks set to reach 3% in the next couple of quarters. Easing further in this context would be unwise.

The downside risks for global growth are receding and are less uncertain. Much of the case for additional easing in the April and May meetings rested on a weaker global economy.

The Government’s Investment Boost policy will partially offset downside risks to the growth outlook.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up