Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Tech-led losses pushed Nasdaq 100 down 1.4% as investors took profits ahead of Fed minutes and Powell’s Jackson Hole speech. USD strengthened, NZD fell after RBNZ cut, GBP rose on hot UK inflation.

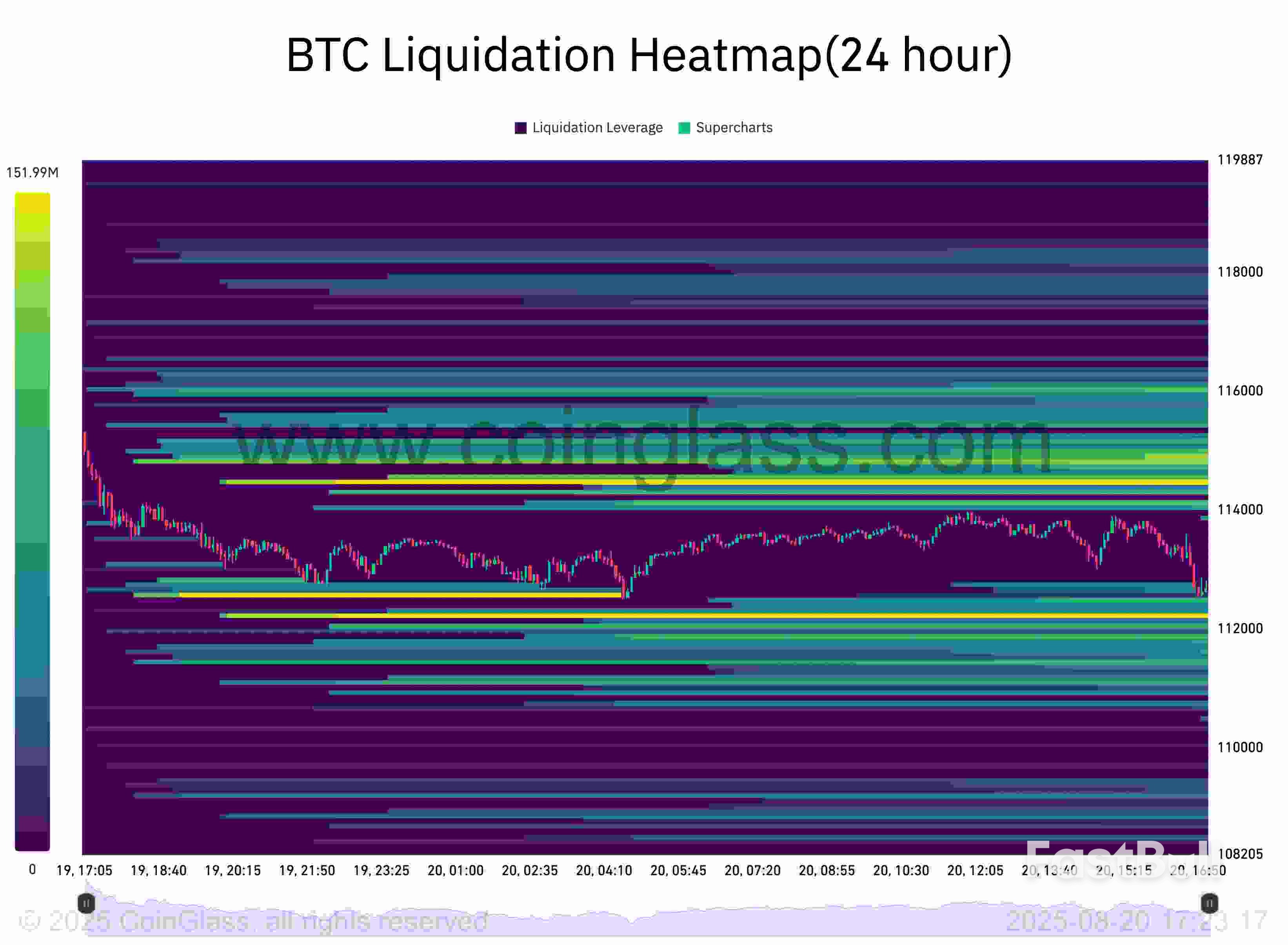

BTC liquidation heatmap. Source: CoinGlass

BTC liquidation heatmap. Source: CoinGlass BTC/USDT order book liquidity with whale volume data. Source: Keith Alan/X

BTC/USDT order book liquidity with whale volume data. Source: Keith Alan/X Total altcoin market cap one-day chart. Source: Cointelegraph/TradingView

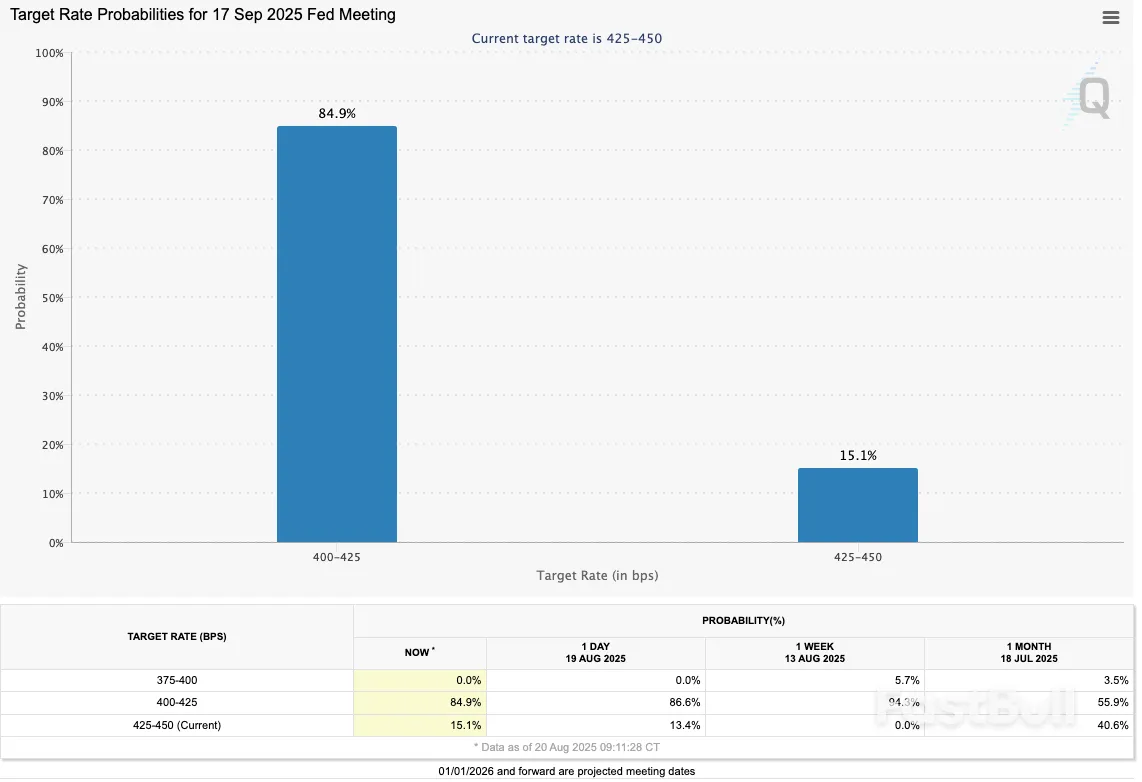

Total altcoin market cap one-day chart. Source: Cointelegraph/TradingView Fed target rate probabilities for September FOMC meeting (screenshot). Source: CME Group FedWatch Tool

Fed target rate probabilities for September FOMC meeting (screenshot). Source: CME Group FedWatch Tool Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price ChartKey Points:

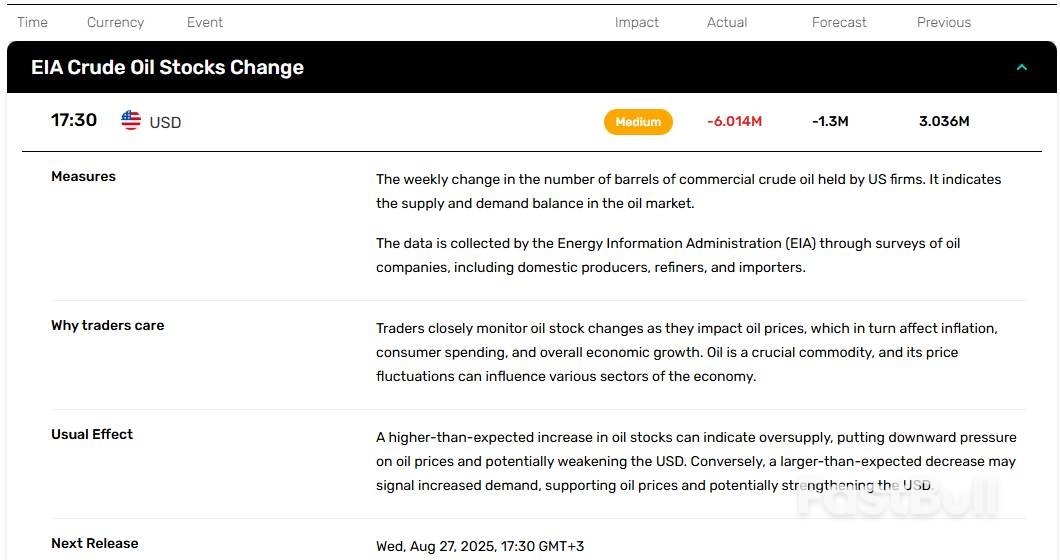

On August 20, 2025, EIA released its Weekly Petroleum Status Report. The report indicated that crude inventories decreased by -6 million barrels from the previous week, compared to analyst consensus of -1.3 million barrels. At current levels, crude inventories are about 6% below the five-year average for this time of the year.

Gasoline inventories declined by -2.7 million barrels, compared to analyst forecast of -0.8 million barrels. Distillate fuel inventories increased by +2.3 million barrels from the previous week.

Crude oil imports declined by 423,000 bpd, averaging 6.5 million bpd. Over the past four weeks, crude oil imports averaged 6.4 million bpd.

Strategic Petroleum Reserve increased from 403.2 million barrels to 403.4 million barrels. The SPR continues to grow at a slow pace.

Domestic oil production increased from 13.327 million bpd to 13.382 million bpd. From a big picture point of view, domestic oil production stabilized after recent pullback.

WTI oil was mostly flat after the release of the EIA report. Currently, WTI oil is trying to settle above the $62.50 level.

Brent oil made an attempt to settle above the $66.50 level as traders reacted to the report. Falling crude inventories may provide some support to oil markets, although traders remain worried about oversupply due to rising production from OPEC+ countries.

President Donald Trump on Wednesday demanded that Federal Reserve Governor Lisa Cook resign after a U.S. housing agency chief called on the Department of Justice to launch a criminal mortgage fraud investigation into the central bank official.

"Cook must resign, now!!!" Trump wrote in a Truth Social post that linked to a Bloomberg report on the allegations that Bill Pulte, director of the Federal Housing Finance Agency, has lodged against Cook.

The Fed declined CNBC's request for comment on Pulte's claims and Trump's reaction.

It's the latest example of the Trump administration airing allegations of mortgage-related wrongdoing against the president's opponents. The Justice Department is investigating Sen. Adam Schiff, D-Calif., and New York Attorney General Letitia James on similar grounds.

The remarks also show Trump expanding his attacks on the Fed beyond its chairman, Jerome Powell, as he pressures the central bank to slash interest rates.

Cook, who was nominated by former President Joe Biden in 2022, voted with the majority on the Federal Open Market Committee to keep rates unchanged after the group's latest meeting last month.

Pulte, an aggressive critic of Powell, wrote in the letter dated Aug. 15 that mortgage documents obtained by FHFA appear to show Cook "falsified bank documents and property records to acquire more favorable loan terms, potentially committing mortgage fraud."

He accused Cook of "falsifying residence statuses" for a residence in Ann Arbor, Michigan, and a property in Atlanta, Georgia "in order to potentially secure lower interest rates and more favorable loan terms."

For both properties, Cook "appears to have acquired mortgages that do not meet certain lending requirements and could have received favorable loan terms under fraudulent circumstances," Pulte alleged.

The selloff in Chinese bonds that sent them to near the bottom of Asia’s performance rankings is likely to cool for now as yields rise to near levels which some investors may perceive as attractive, analysts say.The benchmark 10-year bond yield has climbed to the highest in four months and is within whisker of 1.8%, a level that brokerages including Huachuang Securities see as appealing. Investors may start to rethink their strategy of shunning stocks for bonds, with rising yields also enhancing returns on trades that involve borrowing from the money market to buy debt.

Chinese government bonds, which some saw as a surest bet for returns earlier this year, stumbled in July as bets on a trade truce with the US and Beijing’s efforts to quell deflation improved China’s growth prospects. Signs that the People’s Bank of China may refrain from aggressive policy easing and the reintroduction of a tax on bond interest further weighed on debt this month, making them the worst performers in Asia after India.“Long-term bonds are beginning to look attractive now,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group. “I expect the 10-year yield to hover between 1.75% to 1.8% by the end of September.”

Investors who rushed for stocks may start having second thoughts, considering their relative value versus bonds. Government bonds haven’t been this cheap compared with equities since 2021, as per Bloomberg calculations based on the 10-year sovereign yield and the earnings yield on the Shanghai Composite Index.

Bonds are also more appealing for leveraged traders. The once popular strategy of using overnight cash borrowed from the money market to buy bonds — which drove some of the most spectacular bull runs in China’s debt market — is at its most profitable since December.“The worst pressure facing Chinese bonds may be over in the near term,” China Securities analysts led by Zeng Yu wrote in a note. “Some financial institutions will start trying finding opportunities to add positions.”

That’s because a further selloff in bonds risks triggering redemptions from wealth management products. Huachuang Securities and China Securities say this can create a negative feedback loop that amplifies the rout.The PBOC added to its support for the bond market on Wednesday by injecting most amount of short-term cash into the financial system since late July. Keeping borrowing costs low not only helps the nation’s companies to finance operations but also facilitates the government’s debt issuance program.

While there’s a pause in declines, Chinese bonds are nowhere close to embarking on a bull run. Continued reallocation into stocks and a lack of monetary easing by the PBOC can still weigh on the debt market, said Winson Phoon, head of fixed income research at Malayan Banking Bhd in Singapore.Yields on 30-year bonds slipped one basis point on Wednesday. Earlier this week, a technical indicator suggested that 30-year bond futures are around the most oversold since they were made available in 2023, which some see as a sign for a turnaround.“The long-end may start to see some consolidation here,” said Clair Gao, a rates strategist at Nomura Holdings Inc.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up