Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

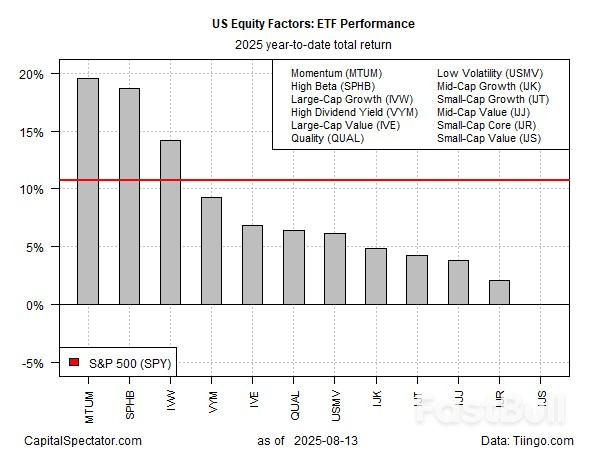

Momentum stocks lead 2025 with MTUM up 19.6%, followed by high-beta SPHB at 18.7%, far ahead of the S&P 500’s 10.7%. Small-cap value lags, while high-dividend VYM hits record highs.

U.S. President Donald Trump said on Thursday he thought Vladimir Putin was ready to make a deal on ending the war in Ukraine after the Russian president floated the prospect of a nuclear arms agreement on the eve of their summit in Alaska.

Ukrainian President Volodymyr Zelenskiy and his European allies have intensified their efforts this week to prevent any deal between the U.S. and Russia emerging from Friday's summit that leaves Ukraine vulnerable to future attack.

"I think he's going to make a deal," Trump said in a Fox News radio interview, adding that if the meeting went well he would call Zelenskiy and European leaders afterwards and that if it went badly he would not.

The aim of Friday's talks with Putin is to set up a second meeting including Ukraine, Trump said, adding: "I don't know that we're going to get an immediate ceasefire."

Putin earlier spoke to his most senior ministers and security officials as he prepared for the meeting with Trump in Anchorage, Alaska on Friday that could shape the endgame to the largest war in Europe since World War Two.

In televised comments, Putin said that the U.S. was "making, in my opinion, quite energetic and sincere efforts to stop the hostilities, stop the crisis and reach agreements that are of interest to all parties involved in this conflict".

This was happening, Putin said, "in order to create long-term conditions for peace between our countries, and in Europe, and in the world as a whole - if, by the next stages, we reach agreements in the area of control over strategic offensive weapons."

His comments signalled that Russia will raise the issue of nuclear arms control as part of a wide-ranging discussion on security when he sits down with Trump. A Kremlin aide said Putin and Trump would also discuss the "huge untapped potential" for Russia-U.S. economic ties.

A senior eastern European official, who requested anonymity to discuss sensitive matters, said Putin would try to distract Trump from Ukraine at the talks by offering him possible progress on nuclear arms control or something business-related.

"We hope Trump won't be fooled by the Russians, he understands all (these) dangerous things," the official said, adding that Russia's only goal was to avoid any new sanctions and have existing sanctions lifted.

Trump said there would be a press conference after the talks but that he did not know whether it would be joint. He also said that there would be a give and take on boundaries and lands.

Russia controls around a fifth of Ukraine and Zelenskiy and the Europeans worry that a deal could cement those gains, rewarding Putin for 11 years of efforts to seize Ukrainian land and emboldening him to expand further into Europe.

Item 1 of 8 U.S. President Donald Trump looks on as he speaks to the press about deploying federal law enforcement agents in Washington to bolster the local police presence, in the Press Briefing Room at the White House, in Washington D.C., U.S., August 11, 2025. REUTERS/Annabelle Gordon

[1/8]U.S. President Donald Trump looks on as he speaks to the press about deploying federal law enforcement agents in Washington to bolster the local police presence, in the Press Briefing Room at the White House, in Washington D.C., U.S., August 11, 2025.

An EU diplomat said it would be "scary to see how it all unfolds in the coming hours. Trump had very good calls yesterday with Europe but that was yesterday".

Trump had shown willingness to join the security guarantees for Ukraine at a last-ditch virtual meeting with European leaders and Zelenskiy on Wednesday, European leaders said, though he made no public mention of them afterwards.

Zelenskiy said the security guarantees had been discussed in "considerable detail" in comments after a meeting in London on Thursday with British Prime Minister Keir Starmer.

Friday's summit, the first Russia-U.S. summit since June 2021, comes at one of the toughest moments for Ukraine in a war that has killed tens of thousands and displaced millions since Russia's full-scale invasion in February 2022.

Speaking after Wednesday's meeting, French President Emmanuel Macron said Trump insisted that the transatlantic NATO alliance should not be part of security guarantees that would be designed to protect Ukraine from future attacks in a post-war settlement.

Macron said, however, that Trump had also said the United States and all willing allies should be part of the security guarantees.

Expanding on that, a European official told Reuters that Trump said on the call he was willing to provide some security guarantees for Europe, without spelling out what they would be.

It "felt like a big step forward", said the official, who did not want to be named.

It was not immediately clear what such guarantees could mean in practice.

On Wednesday, Trump threatened "severe consequences" if Putin does not agree to peace in Ukraine and has warned of economic sanctions if his meeting on Friday proves fruitless.

Russia is likely to resist Ukraine and Europe's demands and has previously said its stance had not changed since it was first detailed by Putin in June 2024.

U.S. President Donald Trump has once again made clear his position on interest rates, advocating for a significant reduction. His remarks have intensified discussions around the Federal Reserve’s (Fed) potential moves, specifically regarding upcoming meetings. Trump has also hinted at potential plans to appoint someone new in place of Fed Chair Jerome Powell, emphasizing his desire for a change in leadership.

Expectations are mounting in financial markets that the Fed might lower its interest rate at the forthcoming meeting. Amid these rising expectations, Trump has reiterated his call for a rate cut, as he has consistently done in the past. Economists predict that these statements might catalyze new dynamics in financial markets.

In recent months, Trump has persistently argued that policy rates should be lower. His insistence has been driven mainly by an aim to stimulate economic growth, urging the Fed to “strongly” consider rate reductions. He has explicitly stated his desire for rates to be lowered to around 1%.Trump elaborated on this topic, declaring, “Interest rates should be at 1%. Our economy needs this level for sustainable growth.”

Trump also mentioned the possibility of announcing a new candidate to replace Fed Chairman Jerome Powell in the near future. This declaration aligns with earlier reports from sources close to the administration indicating discussions with 11 potential candidates. The anticipated shift in Fed leadership is under close scrutiny by financial circles.Following Kugler’s early resignation, Trump suggested Powell might soon follow suit. After receiving no positive response, Trump implied the possibility of litigation by referencing an inflated renovation cost, which hinted at underlying pressure. Powell has yet to comment on this indirect threat.

Many still anticipate a rate cut by the Fed in September. Abnormalities in employment figures suggest a “latent downturn” in the economy. Even members previously unsupportive of cuts are considering them if poor employment figures persist, resulting in a 90% probability of a September cut. Currently, five members favor a cut, though support must grow to at least seven members.Despite Trump’s public statements, the Fed’s independent decision-making process remains intact. However, discussions on potentially eroded independence have emerged due to Powell’s distancing from prior optimism amid political pressure, alongside continuous unfavorable statistics being revised by the Bureau of Labor Statistics (BLS).

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up