Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street turned lower on Monday, dragged down by megacap stocks, while investors braced for a week packed with key economic data and earnings from some of the biggest U.S. companies.

The tech-heavy Nasdaq led declines, as megacap stocks lost ground. Tesla (TSLA.O), fell 3.2% and AI-darling Nvidia (NVDA.O), dipped 3.6%.

A report said China's Huawei Technologies was preparing to test its artificial-intelligence processor, which it hopes would replace some of Nvidia's products.

Other megacaps also fell, ahead of a busy week of corporate earnings.

Apple (AAPL.O), and Meta Platforms (META.O), are among the several "Magnificent Seven" heavyweight companies that will be reporting this week.

"We're going to have to live with higher volatility in the (tech) sector for a while, unless we get some really impressive de-escalation of the trade with China situation," said Bill Sterling, global strategist at GW&K Investment Management.

With 180 S&P 500 companies preparing to report results this week, investors will be watching for indications on how U.S. President Donald Trump's new tariffs could impact the outlook of the companies.

Though first-quarter earnings from S&P 500 companies are expected to climb 9.7% from a year ago, according to LSEG IBES, many firms have flagged the uncertainty caused by the U.S. trade policy, with some cutting or pulling annual forecasts.

Crucial economic data, including the monthly U.S. payrolls and the personal consumption expenditures price index, is also on the roster.

At 11:43 a.m. ET, the Dow Jones Industrial Average (.DJI), fell 2.29 points, or 0.01%, to 40,111.21, the S&P 500 (.SPX), lost 25.33 points, or 0.46%, to 5,499.87 and the Nasdaq Composite (.IXIC), lost 155.44 points, or 0.89%, to 17,227.50.

Gains in Boeing (BA.N), after Bernstein's rating upgrade limited losses for the Dow, while the technology sector (.SPLRCT), fell 1.3%, leading sector declines.

Trading was volatile, with the S&P 500 and the Nasdaq briefly touching their highest levels since April 2, prior to Trump's "Liberation Day" tariff announcement.

Signs that the U.S. and China could be willing to de-escalate trade tensions had injected some optimism in markets last week, with the three main indexes ending Friday with weekly gains.

Though markets have welcomed signs that the U.S. is softening its stance, it is too soon to tell what the outcome of any negotiations would be, Sterling said.

A lack of clarity on the negotiations between the two countries has kept the market on edge.

The S&P 500 (.SPX), remains over 10% off its February record high, as markets assess the potential impact of tariffs.

A majority of economists polled by Reuters said the risks of the global economy slipping into recession this year were high.

Spirit AeroSystems (SPR.N), rose 2.6% after Airbus (AIR.PA), reached a deal to take over some of the company's plants.

Advancing issues outnumbered decliners by a 1.13-to-1 ratio on the NYSE. Declining issues outnumbered advancers by a 1.27-to-1 ratio on the Nasdaq.

The S&P 500 posted three new 52-week highs and one new low, while the Nasdaq Composite recorded 33 new highs and 30 new lows.

Reporting by Lisa Mattackal and Purvi Agarwal in Bengaluru; Editing by Devika Syamnath and Shinjini Ganguli

DXY 280425 4h Chart

DXY 280425 4h Chart EUR/USD 280425 4h Chart

EUR/USD 280425 4h Chart GBP/USD 280425 4h Chart

GBP/USD 280425 4h Chart USD/CAD 280425 4h Chart

USD/CAD 280425 4h Chart USD/JPY 280425 4h Chart

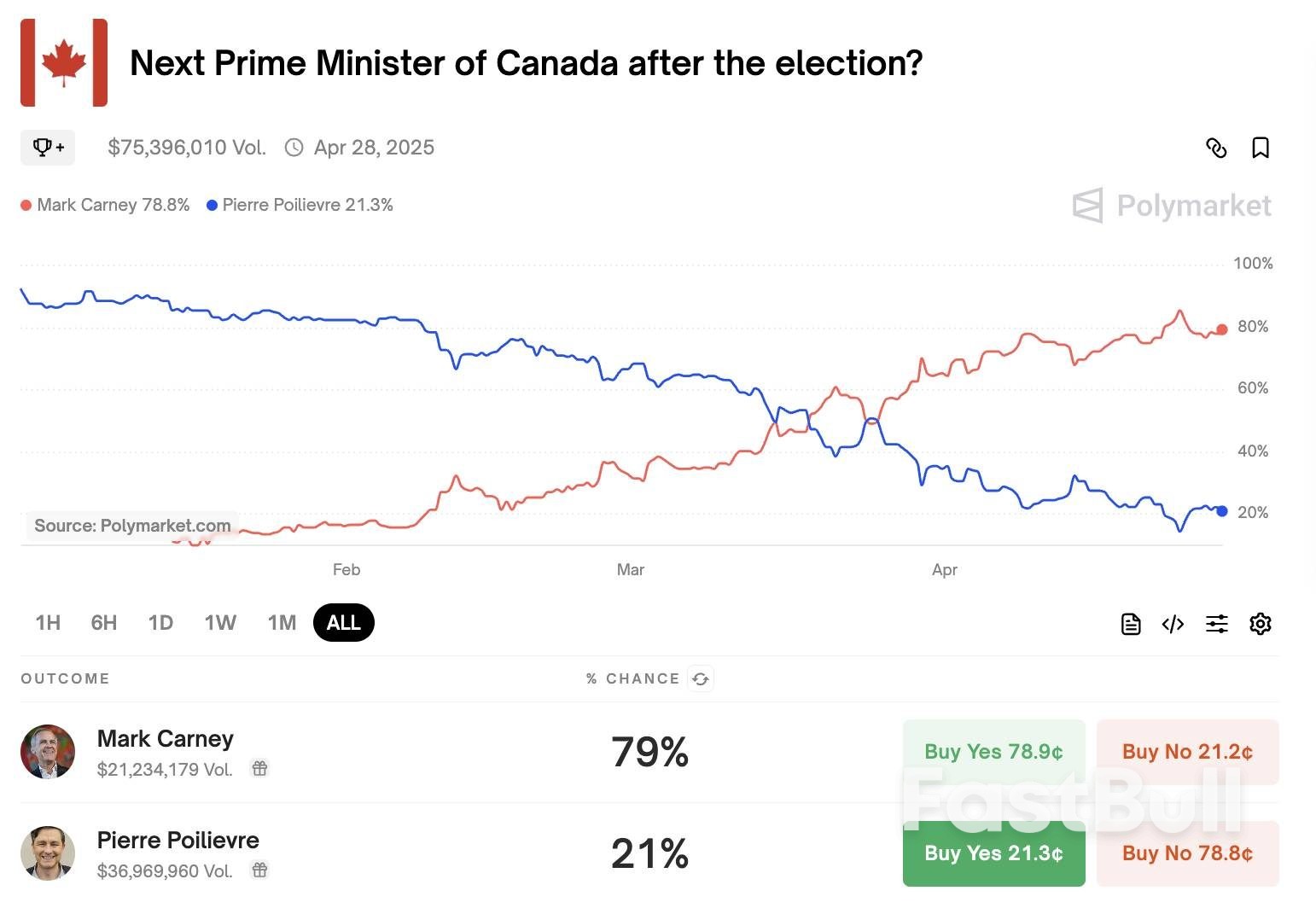

USD/JPY 280425 4h Chart Polymarket chances favor the Liberal Party's Mark Carney over the Conservative Party's Pierre Poilievre to be the next Canadian Prime Minister.

Polymarket chances favor the Liberal Party's Mark Carney over the Conservative Party's Pierre Poilievre to be the next Canadian Prime Minister.  Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesA gauge that tracks emerging stocks gained 0.55% and is trading near the highest level since the day after President Donald Trump presented his reciprocal tariffs. The MSCI Index leaped 3.4% last week.

The upward movement “seems to be driven by some optimism regarding a potential de-escalation of Trump’s tariffs,” said Gordian Kemen, head of emerging markets sovereign strategy at Standard Chartered.

Monday’s gains also put the EM stocks index above its 200-day moving average. If the gauge ends April with an advance, that would mark a gain in each of the first four months of a year — a feat last achieved in 2019. Earnings estimates for the gauge have risen 0.8% this month, the most since August.

For Michael Brown, a senior research strategist at Pepperstone Group Ltd, the recent EM rally has been largely driven by the broad “sell America” trade amid policy uncertainty from Trump. Those countries that reach trade deals with the US — which result in a permanent lowering of tariffs — are likely to outperform peers.

Meanwhile, in the foreign exchange market, currencies are trading mixed, with the MSCI currency index up just 0.1%. The South African rand and Argentina’s peso led the gains in the emerging basket, while the Chilean peso lagged its peers.

Earlier, assets in Colombia dropped after the International Monetary Fund paused access to an $8.1 billion flexible credit line. The country’s peso plunged as much as 0.8% while its dollar bonds fell across the curve, with notes maturing in 2035 down 1 cent to about 100 cents on the dollar

Hopes have grown that the worst of the US tariff threat may be passing after Treasury Secretary Scott Bessent said last week that the US and South Korea could reach an “agreement of understanding” on trade as soon as this week. Bessent said Sunday that negotiations with some trading partners “are moving along very well, especially with the Asian countries.”

Traders this week will also be watching for key US data including growth and a gauge of inflation to assess if Trump’s trade war has begun to affect the economy. Meanwhile, Chinese officials Monday reiterated a pledge to aid growth ahead of the release of factory activity data later this week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up