Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Deutsche Bank: We Are Cooperating Fully With Prosecutor's Office. We Cannot Comment Further On This Matter

US President Trump: The Next Attack On Iran Will Be Worse Than The Attack On Its Nuclear Facilities

Bank Of America Will Match The USA Government's $1000 Pilot Contribution For All Eligible USA Teammates To Trump Accounts

The US MBA Mortgage Application Activity Index Fell 8.5% Week-over-week For The Week Ending January 23, Compared To 14.1% Previously

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Luxury consumption in China is increasingly concentrated in second-tier cities, where rising middle-class wealth, lower living costs, and Gen Z spending power are reshaping how and where global luxury brands grow....

The main event will be tonight's FOMC meeting. We expect no monetary policy changes, in line with broad consensus and market pricing. As the Fed will not be releasing updated economic projections, attention will centre on Powell's assessment of recent economic data, and the likelihood of further rate cuts this spring. We expect Powell to avoid any specific speculation regarding future Fed nominations and recent challenges to the central bank's independence.

The Bank of Canada also meet today, and we expect the central bank to maintain its policy rate at 2.25%.

What happened yesterday

In the US, the consumer confidence index for January unexpectedly fell to 84.5 (cons: 90.9, prior: 94.2), diverging sharply from the University of Michigan's survey, which had painted a more optimistic picture. The decline was most pronounced in the 'present situation' assessment, with labour market indicators showing weakness. The widely followed 'jobs plentiful' index dropped to its lowest level since February 2021, a time when the unemployment rate stood at 6.2%. This appears more tied to real economic conditions than tariff concerns, as inflation expectations eased. These sentiment indicators have sent somewhat conflicting signals lately, but all else equal, this could fuel some further USD weakness.

The EU and India have concluded a landmark trade agreement that will remove tariffs on over 90% of goods traded between the two economies. Under the deal, India will lower tariffs on European automobiles and agricultural products, while the EU will reciprocate by easing duties on India's labour-intensive exports, which have suffered significantly due to the 50% tariffs imposed by the US. Currently ranked as the EU's ninth-largest trading partner, India accounted for 2.4% of the bloc's total goods trade in 2024. The EU anticipates that the agreement will double its exports to India by 2032, fostering stronger economic ties.

In Hungary, the central bank kept policy rate unchanged at 6.50%, in line with market expectations.

Equities: Equities generally higher, with the same dynamics observed over the last three trading sessions: US tech and related utilities orchestrated a comeback, while small caps underperformed for a third session. Semis were particularly strong, likely speculation of hiked AI capex plans from the hyperscalers. Microsoft is important, reporting today after US closing.

European and Nordic equities also somewhat higher, but below the highs taken prior to the tariff threats. The rapid dollar decline probably plays a role behind the sluggish rebound, as the FX headwind hits earnings. Be aware that earnings revisions will be negative for most Nordic companies after post results, solemnly due to FX, although demand assumption is held constant, or even lifted. Another reason is that there were no contrarian dip to buy in the first place. Despite last week's selloff we did not observe any genuine market stress and positioning were far from oversold. Investors are buying equities, but anchored in fundamental economic strength, which is a slower process higher than a dip buying opportunity.

FI and FX: Broad USD remains under heavy pressure as the prospect of joint FX intervention between the US and Japan added further momentum to the recent USD sell-off. EUR/USD finds itself flirting with the 1.20 mark, whereas EUR/CHF broke below the 0.92 mark, as the CHF has benefitted from the increased uncertainty and as an alternative to the USD. Scandies continue to do well, just as anything with a reverse correlation to USD, and EUR/SEK and EUR/NOK both saw Monday's bounce completely reversed yesterday, with the latter once again breaking below 10.60.

There were plenty of major stories and market moves yesterday, but the most significant — and most impactful — was undoubtedly the sharp sell-off in the US dollar. It pushed the US Dollar Index to a four-year low and continues to drive gold and silver to fresh record highs this morning.

Trade and geopolitical uncertainty, tied to an increasingly unreliable American friend and ally, as well as growing concerns about what will happen to the Federal Reserve's (Fed) credibility once Jerome Powell leaves office (it will fly out of the window), continue to weigh on the US dollar. Add to that the latest US consumer survey, which showed a sharp drop in consumer confidence, a marked deterioration in how households view the current situation, a decline in the share of consumers expecting income growth, and a steady rise in those saying jobs are hard to get. You get a pretty murky picture for the greenback and the two-speed US economy.

Still, this will hardly convince the Fed to cut rates today or in the coming months. Jerome Powell is likely to avoid political commentary at his post-decision speech today and keep the focus firmly on economic data to justify policy decisions.

That said, we all know the US President is waiting just outside the room — and anything he might say about the Fed's decision, or about how much he dislikes Powell, would only risk making matters worse for the US dollar, much to the delight of gold and silver longs. But with or without buzzy headlines, the US dollar looks condemned to weaken.

The only real comfort is that US inflation has not surged as a result of tariffs. That is partly because importers built up stockpiles to buy time, but also because only around 20% of announced tariff threats have actually been implemented since November 2024, according to Bloomberg. In other words, only a fifth of tariff threats have materialised so far — giving the so-called TACO trade ("Trump Always Chickens Out") some concrete data backing today.

This may help explain why Korean equities barely reacted when President Trump threatened to impose 25% tariffs on Korea, citing the lack of formal codification of last year's trade deal. That agreement includes up to $350bn of Korean investment commitments in the US — a massive sum, especially with the won under pressure. South Korea has already signalled it may delay up to $20bn of planned US investment this year. Fury.

Political tensions aside, the Kospi hit fresh highs today, with SK Hynix continuing its "Free Solo" climb after reports it has become the exclusive supplier of memory chips for Microsoft's new AI chip!

Elsewhere, after a year of trade tensions, former US allies appear increasingly keen to diversify. Last week, Canada signed a trade arrangement with China, easing rules on several sensitive areas, including Chinese EV exports. This week, Europe finalised a trade deal with Mercosur and another with India after two+ decades of negotiations. Funny how a common adversary can accelerate diplomacy!

Ursula von der Leyen dubbed the India agreement "the mother of all deals". It eliminates more than 95% of tariffs on both sides and covers cars, industrial goods, wine, pasta, chocolate and other European exports for India's 1.5bn consumers to enjoy without tariffs.

The mood among European investors would have been even better had LVMH not reported weaker sales on the same day. Still, the Stoxx 600 closed close to record highs, led once again by defence stocks, as Europe continues to ramp up spending on security and technology amid an increasingly strained relationship with the US.

Europe has strong players in defence. In tech, the challenge is far greater and will take years to address. That said, there are signs of progress: this week, the EU switched on parts of its home-grown secure satellite communications network, designed to reduce reliance on Starlink for sensitive uses. These efforts are likely to intensify as geopolitical risks grow, justifying investment in European defence and tech.

Speaking of tech, ASML — Europe's largest technology company and the world's sole supplier of the most advanced chip-making machines — reported earnings this morning. Results showed a modest beat on revenue and profit, and a significant upside surprise on bookings. Order intake reached around €13.2bn, roughly double expectations, underlining strong forward demand, particularly for EUV systems.

European futures are higher, while Nasdaq futures are leading gains among major indices, with ASML's results boosting sentiment ahead of a busy US earnings calendar. Meta, Microsoft and Tesla report after the bell. For Microsoft, focus will be on Azure growth, AI-related product revenues and data-centre spending plans. For Meta, attention will centre on costs and monetisation of AI initiatives. I personally remain little convinced with Meta's shift from social media to AI media, but hey… For Tesla, the spotlight is happily less on plunging car sales and more on dream… The pace of robotaxi expansion and the timeline for Optimus will matter more than actual numbers— though Elon Musk has already warned that production will be slow. Market reaction may once again hinge more on a single man's persuasion than on reality.

Ahead of the Fed's interest rate decision, the EURUSD pair made a sharp move higher and is trading near 1.1995.

The EURUSD forecast takes into account that today the euro is forming a correction after a sharp rally and is trading near the 1.1985 level.

Amid uncertainty in the global economy and elevated global risks, the market is currently focused on the US Federal Reserve's interest rate meeting.

Today, the Fed is expected to keep the interest rate unchanged at 3.75%, as part of its strategy to fight inflation. While markets generally expect further tight monetary policy, analysts do not rule out an unlikely but possible 0.25% rate hike if US economic data continues to show growth. Such a decision would become a trigger for EURUSD movement, as even small rate changes can affect USD dynamics.

At the same time, today's EURUSD forecast also considers an alternative scenario surrounding the interest rate decision, taking into account Donald Trump's desire to weaken the USD to boost competitiveness. The US president has recently been frequently interfering in the Fed's work and attempting to exert political influence on economic decision-making. In this case, the Fed may leave the interest rate unchanged or lower it.

A rate cut would further weaken the USD and push the EURUSD rate towards the 2021 highs.

On the H4 chart, the EURUSD pair formed a Harami reversal pattern near the upper Bollinger Band. At this stage, it may develop a corrective wave following this signal. Since quotes have moved outside the ascending channel, they may head towards the 1.1935 level. A rebound from this area would open the way for continued upward momentum.

At the same time, today's EURUSD forecast also suggests an alternative scenario, in which the pair continues to rise towards 1.2120 without testing the support level.

Main scenario (Buy Limit)

A pullback towards the 1.1935 level will allow buyers to build new positions, and amid pressure on the US dollar and expectations surrounding the Fed meeting outcome, the market may continue to move towards the upper targets of the range.

The risk-to-reward ratio exceeds 1:3. The upside potential is around 185 pips, with the risk limited to 50 pips.

Alternative scenario (Sell Stop)

A decline and consolidation below 1.1800 will signal profit-taking and waning bullish momentum after January's sharp rally. In this case, a corrective pullback towards lower support levels is likely.

Any unexpected hawkish signals from the Fed, strong US macroeconomic data, or easing political tensions could temporarily support the US dollar and trigger a correction in the EURUSD pair.

With the market awaiting the Fed's interest rate decision, the EURUSD pair is forming a correction. Technical analysis of EURUSD suggests a pullback towards the 1.1935 support area before further growth.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold's recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

India's gold and silver imports soared to record levels in 2025, raising serious concerns among policymakers. Despite sky-high prices, the nation's demand for precious metals has proven resilient, leaving the government with few effective tools to manage the inflows.

In 2025, the country's gold imports climbed 1.6% year-over-year to $58.9 billion. Silver imports saw an even more dramatic increase, jumping 44% to $9.2 billion, even as both metals traded at record highs.

India ranks as the world's second-largest gold consumer and the biggest market for silver. The nation relies almost entirely on imports to meet its gold demand and sources over 80% of its silver from overseas.

This heavy reliance has significant economic consequences. Last year, gold and silver imports consumed nearly a tenth of the country's total foreign exchange reserves. With prices projected to rise further in 2026, this import bill is expected to grow, widening the trade deficit and putting sustained pressure on the rupee, which fell to a record low this month.

While silver has industrial applications in sectors like solar power and electronics, gold is primarily used for jewelry and investment. The government considers this demand non-essential and has historically tried to curb it by raising import duties to make purchases more expensive.

The combination of record prices and strong import volumes is fueling speculation about another government intervention. A rising import bill threatens to further expand the trade deficit and weaken the rupee, which has already lost ground against the dollar.

Trade and industry officials believe these pressures could prompt the government to raise import duties on both gold and silver in the coming weeks. This would be a reversal of the 2024 policy, which cut duties on both metals from 15% to 6% in an effort to curb smuggling. The government previously hiked gold duties sharply in 2012 and 2013 to stabilize a rapidly depreciating rupee, setting a precedent for the current situation.

Anticipating a potential tax increase, both gold and silver are already trading at a premium to global benchmarks in the domestic market.

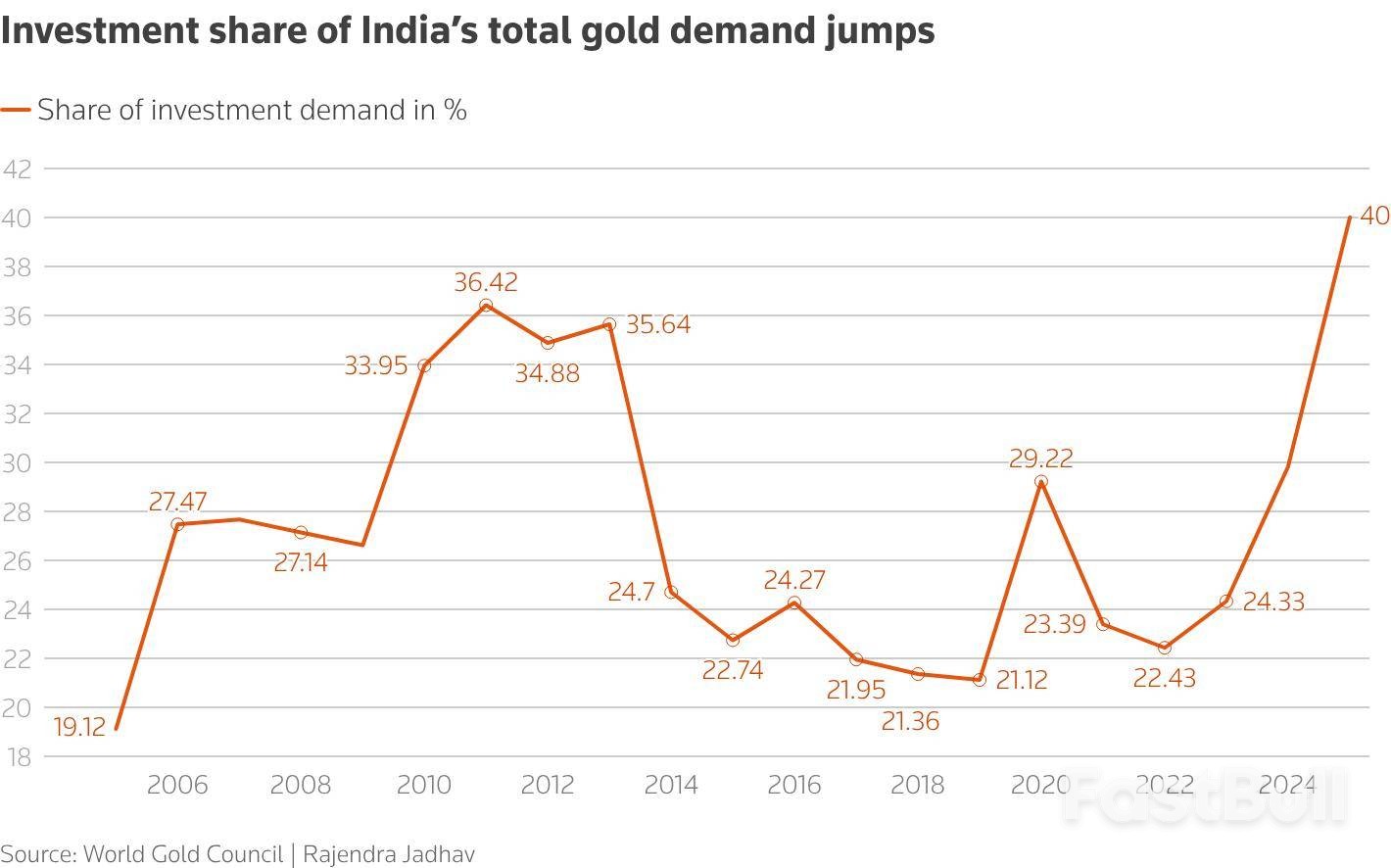

Historically, jewelry sales accounted for over three-quarters of India's gold consumption. However, international gold prices have surged 98% since the beginning of 2025, which has cooled demand for jewelry.

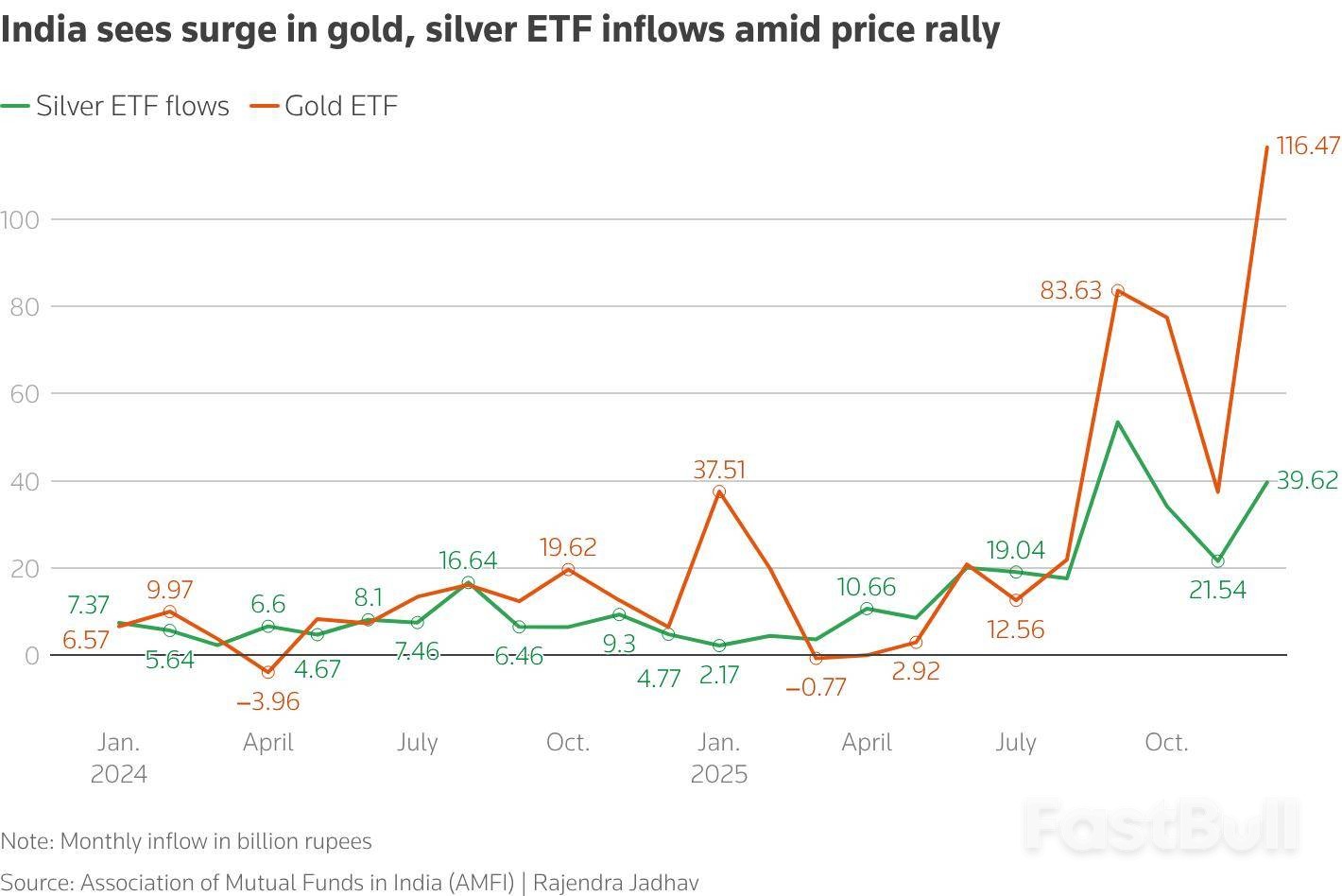

Despite this, overall demand has not fallen. Instead, there has been a significant shift toward investment. Indians are increasingly purchasing physical gold in the form of coins and bars. At the same time, exchange-traded funds (ETFs) backed by physical gold and silver have gained massive popularity.

In 2025, inflows into gold ETFs jumped 283% from the previous year to a record 429.6 billion rupees ($4.69 billion). This structural shift pushed the investment share of total gold consumption above 40% in 2025, a trend expected to continue in 2026.

India has a long history of attempting to curb gold imports with higher duties, but these measures have had limited success. For example, when the government raised the import tax from 2% to 10% in August 2013, demand remained steady.

Domestic gold prices have skyrocketed from around 8,000 rupees per 10 grams in early 2006 to approximately 162,000 rupees today. Even a 76.5% price jump in 2025 failed to deter buyers. Consequently, another duty hike of 4 to 6 percentage points is unlikely to significantly reduce demand.

Instead, higher duties could inadvertently boost investor returns and encourage smuggling. With weak returns in the equity market, bullion remains an attractive asset, and inflows into gold ETFs are expected to stay strong. Furthermore, any sharp drop in gold prices could weaken investment demand but would likely trigger a rebound in jewelry sales from buyers awaiting a market correction.

Silver imports are also becoming a major concern. Silver prices have risen even faster than gold, inflating India's import bill. While industrial consumption was the primary driver of silver demand until last year, investment demand has recently become a major supporting factor.

In 2025, silver ETFs attracted inflows of 234.7 billion rupees, a substantial increase from 85.69 billion rupees the previous year. The growing popularity of these investment vehicles suggests that silver imports for investment purposes will continue to rise if the current price rally persists.

The European Union is making major strategic moves, securing two massive trade deals in quick succession. Just weeks after finalizing an agreement with Mercosur after 25 years of talks, the EU has concluded a landmark free trade agreement with India, a negotiation that has spanned nearly two decades.

European Commission President Ursula von der Leyen dubbed it the "mother of all deals," and the scale is immense. The agreement links the EU, the world's third-largest internal market, with India's economy of over 1.4 billion people and a GDP of approximately €3.4 trillion. Currently, India ranks as the EU's ninth-largest trading partner.

A key objective for the EU is to rebalance its trade relationship with India. The bloc currently imports significantly more from India than it exports, with over 17% of India's total exports destined for the EU.

According to the European Commission, this new agreement is designed to dramatically shift that dynamic. The deal is projected to double the value of EU goods exported to India by 2032. This growth will be driven by the elimination or reduction of tariffs on 96.6% of exports, saving European companies an estimated €4 billion in duties each year. While EU exports to India saw growth until 2023, momentum had recently stalled, a trend this agreement aims to reverse.

The EU has secured far more favorable terms than India has offered other trading partners, with deep tariff cuts across key sectors.

Unprecedented Tariff Reductions

The agreement outlines a schedule for significant tariff reductions:

• Automobiles: Tariffs on cars will be gradually cut from 110% to just 10% over the next five years.

• Auto Parts: Levies on car components will be completely eliminated within five to ten years.

• Industrial Goods: Tariffs on machinery, chemicals, and pharmaceuticals, which can be as high as 44%, will be mostly eliminated.

• EU Reciprocity: The EU will eliminate or reduce its tariffs on 99.5% of goods imported from India within seven years.

Beyond Goods: Services, Security, and Climate

The pact extends beyond physical goods. It includes provisions for a new security partnership and gives EU companies privileged access to India's vast services market. Additionally, a memorandum will establish an EU-India platform to cooperate on climate action and support India's efforts to reduce its greenhouse gas emissions.

The automotive sector highlights both the opportunity and the difficulty of the Indian market. New Delhi has agreed to allow up to 250,000 European-made vehicles to enter the country annually at preferential duty rates. This quota is more than six times larger than the 37,000-unit limit in India's recent deal with the United Kingdom.

Despite this access, breaking into the market will be a formidable challenge. Japanese brands like Suzuki and Hyundai dominate, holding a combined market share of over 50%. In contrast, European carmakers currently account for less than 3% of the market. Any significant gains for European brands will likely take considerable time to materialize.

While the agreement is a major breakthrough, the deal is not yet final. As the Mercosur negotiations showed, ratification can be a long and complex process.

The pact must first undergo legal vetting, which could take several months. Following that, it must be adopted by the Council, signed by both the EU and India, and finally receive consent from the European Parliament before it can be applied. A swift ratification would send a powerful signal that the EU can effectively close and implement major trade deals.

If ratified, the EU-India agreement will become one of the most significant economic partnerships in the EU's history. After two decades of stalled talks, the sudden progress demonstrates that Europe can act decisively under pressure.

Paired with the Mercosur deal, this agreement provides more than just near-term economic relief; it opens the door for substantial future growth and proves Europe can execute a strategic vision. However, it also represents a high-stakes bet on the EU's export-driven growth model, especially with intense industrial competition from China already present in the Indian market.

The year 2026 is shaping up to be a critical test of how much resilience and strategic autonomy the EU is willing and able to build. While ratification challenges remain, these agreements mark a promising start to the EU's ambitious drive to strengthen its global standing.

EUR/USD started a fresh surge above 1.1900 and 1.2000. USD/CHF declined further and is now struggling below 0.7750.

· The Euro started a major increase from 1.1700 against the US Dollar.

· There is a key bullish trend line forming with support near 1.1915 on the hourly chart of EUR/USD at FXOpen.

· USD/CHF declined below the 0.7800 and 0.7750 support levels.

· There is a key bearish trend line forming with resistance near 0.7675 on the hourly chart at FXOpen.

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.1700 zone. The Euro cleared the 1.1850 barrier to move into a bullish zone against the US Dollar.

The bulls pushed the pair above the 50-hour simple moving average and 1.1950. Finally, the pair cleared 1.2000 and 1.2050. A high was formed near 1.2080 and the pair is now consolidating gains. There was a minor pullback to the 23.6% Fib retracement level of the upward wave from the 1.1669 swing low to the 1.2080 high.

An Immediate bid zone on the downside is near a connecting bullish trend line at 1.1915 and the 50-hour simple moving average. The next area of interest could be near the 50% Fib retracement at 1.1875.

A downside break below 1.1875 might send the pair toward 1.1765. Any more losses might send the pair into a bearish zone toward 1.1670.

If there is a fresh increase, an immediate hurdle on the EUR/USD chart is 1.2050. The first major pivot level for the bulls could be 1.2080. An upside break above 1.2080 might send the pair to 1.2120. The next selling zone could be 1.2150. Any more gains might open the doors for a move toward 1.2200.

On the hourly chart of USD/CHF at FXOpen, the pair started a fresh decline from well above 0.7880. The US Dollar dropped below 0.7800 to move into a negative zone against the Swiss Franc.

The bears pushed the pair below the 50-hour simple moving average and 0.7750. Finally, the bulls appeared near 0.7600. A low was formed near 0.7600, and the pair is now consolidating losses. There was a minor recovery toward the 23.6% Fib retracement level of the downward move from the 0.7914 swing high to the 0.7600 low.

On the upside, the pair could face bears near 0.7675 and a key bearish trend line. The first major resistance sits near the 50-hour simple moving average at 0.7740. The main barrier for an upside break could be near the 61.8% Fib retracement at 0.7795.

A daily close above 0.7795 could start a fresh increase. In the stated case, the pair could rise toward 0.7885. The next stop for the bulls might be 0.7915.

On the downside, immediate support on the USD/CHF chart is 0.7600. The first major breakdown zone could be 0.7565. A close below 0.7565 might send the pair to 0.7730. Any more losses may possibly open the doors for a move toward 0.7700 in the coming days.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up