Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The Philadelphia Gold And Silver Index Closed Down 0.40% At 380.81 Points. The NYSE Arca Gold Miners Index Fell 1.62% To 2699.52 Points, After A Sharp Rise Followed By A Fall In Early Trading. The Materials Index Closed Up 0.58%, And The Metals & Mining Index Closed Up 1.44%

On Monday (February 2nd) In Late New York Trading, Spot Silver Fell 6.73% To $79.4438 Per Ounce. Comex Silver Futures Rose 1.56% To $79.760 Per Ounce. Comex Copper Futures Fell 1.49% To $5.8345 Per Pound, Having Fallen As Low As $5.5640 At 14:40 Beijing Time. Spot Platinum Fell 2.93%, While Spot Palladium Rose 0.74%

On Monday (February 2nd) In Late New York Trading, Spot Gold Fell 4.54% To $4671.58 Per Ounce, Remaining In A Downward Trend Throughout The Day. At 14:38 Beijing Time, It Had Fallen To $4402.95. On The Daily Chart, Gold Prices Have Fallen For Three Consecutive Trading Days, Approaching The December 31st Low Of $4319.37, And Briefly Breaking Below The 50-day Moving Average And Approaching The 100-day Moving Average (currently At $4483.43 And $4228.16 Respectively). Comex Gold Futures Fell 0.90% To $4702.60 Per Ounce, Also Briefly Falling To $4423.20 At 14:38

US President Trump, Speaking About The Justice Department's Investigation Into The Federal Reserve, Declared: "We'll See How It Goes."

U.S. Treasury Secretary Bessant: Federal Reserve Chairman Nominee Warsh Will Have A Great Start

[Airline ETFs Rise 3.5%, Leading US Sector ETFs; S&P Energy Sector Falls About 2%] On Monday (February 2), The Global Airline ETF Rose 3.51%, Regional Bank ETFs And Banking ETFs Rose Up To 1.79%, Semiconductor ETFs Rose 1.12%, Technology ETFs Rose 0.96%, And Energy ETFs Fell 1.96%. Among The 11 Sectors Of The S&P 500, Consumer Staples Rose 1.58%, Industrials Rose 1.26%, Financials Rose 1.02%, Information Technology/technology Rose 0.46%, And Energy Fell 1.98%

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

EU sanctions loom for Kyrgyzstan over alleged Russian sanctions evasion, imperiling a US-backed trade forum.

The timing could hardly be more difficult for Bishkek. Just as Kyrgyzstan prepares to host a major trade forum with the United States and other Central Asian nations, reports have emerged that the European Union is considering sanctions against the country.

According to a report first published by Bloomberg, Brussels may be readying trade restrictions on Kyrgyzstan for its alleged role in helping Russia evade sanctions imposed after its attack on Ukraine. The proposed measures would specifically target machine tools and radio equipment.

If implemented, these sanctions would mark a significant escalation, making Kyrgyzstan the first Central Asian nation to face such penalties from the EU. Previously, the US and EU have only sanctioned specific individuals and companies within the region.

For some time, Kyrgyzstan has been suspected of acting as a key channel for Russia to acquire not only goods with potential military uses but also purely civilian products, including automobiles.

Western experts also point to the introduction of a Russian ruble-denominated stablecoin, A7A5, in 2025 as a tool designed to help facilitate transactions that bypass international sanctions.

In response to earlier sanctions targeting Kyrgyz banks, Deputy Prime Minister Emil Baisalov attributed the penalties to a "misunderstanding." He affirmed that Kyrgyz officials "are committed to working with" the EU.

However, Baisalov also emphasized that Bishkek would continue to pursue its "own pragmatic interests of national development and we are focused on our own internal affairs."

The potential action against Kyrgyzstan comes as the EU considers additional sanctions on Russia itself, covering sectors like banking and crypto services. A ban on all ocean-going tanker traffic carrying Russian oil is also reportedly under consideration.

This news from Brussels casts a shadow over the upcoming B5+1 forum, a US-backed event scheduled for February 4-5 in Bishkek. The forum is designed to bring together government and business leaders from the United States and across Central Asia.

Its primary goals are to build stronger business-to-business connections and accelerate trade flows within Central Asia and between the region and the West—objectives now complicated by the threat of EU sanctions.

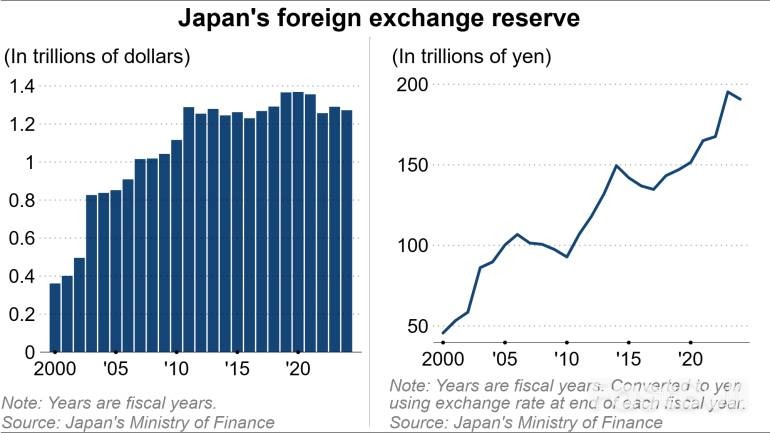

A hot-button topic has emerged in Japan's lower house election campaign: using the nation's massive foreign currency reserves to pay for new policies. Prime Minister Sanae Takaichi brought the issue to the forefront, but analysts warn that tapping into this fund is more complicated than it seems.

During a campaign speech, Takaichi, who leads the ruling Liberal Democratic Party, pointed to a potential source of cash. "There's something called the Foreign Exchange Fund Special Account (FEFSA), and its coffers are brimming now," she said.

Both ruling and opposition parties are now eyeing this account as a way to finance their agendas.

The FEFSA is the government's tool for managing foreign currency reserves and intervening in currency markets. Its operation is straightforward:

• To weaken the yen: The government issues bills to raise yen, sells that yen to buy dollars, and then invests those dollars in assets like U.S. Treasurys.

• To strengthen the yen: It sells its dollar-denominated assets to buy back yen.

The account generates profit primarily because Japan's interest rates have been lower than those of other countries. It earns higher interest on its foreign assets than it pays on the bills it issues. A weaker yen also boosts profits by increasing the yen-denominated value of interest income earned overseas.

Japan's foreign exchange reserves stood at $1.37 trillion at the end of 2025, according to the Finance Ministry. This figure has been hovering around the $1.3 trillion mark since 2012, swelled by past interventions to buy up dollars.

The FEFSA logged a record gain of 5.36 trillion yen ($34.5 billion) in fiscal 2024, the highest since financial disclosures began in fiscal 2008.

These profits already contribute to the government's general budget. Current rules permit 70% of the gains to be transferred. For fiscal 2025, 3.2 trillion yen was moved to the general account, with about 1 trillion yen allocated to defense spending. Under the existing framework, it would be difficult to extract more funds.

While politicians talk about using unrealized gains from foreign assets, significant obstacles stand in the way.

"By the special forex account's very nature, converting its foreign currency assets to yen would be currency intervention, which imposes some limits on its use as a funding source," said Takahiro Hattori, a project associate professor at the University of Tokyo.

International norms permit currency market intervention only on a limited basis, typically to counter speculative swings. If Japan were to sell its dollar assets for domestic funding when no such crisis exists, it would likely face opposition from the U.S. and could reduce its capacity for necessary interventions in the future.

The idea of using the FEFSA is not limited to the ruling party. Opposition parties also see it as a potential funding source.

The Democratic Party for the People has proposed using investment profits and asset sales from the account, along with pension reserves and Bank of Japan-held ETFs, to fund proactive fiscal policy. Similarly, in last summer's upper house election, the Constitutional Democratic Party suggested using forex account gains to help finance a temporary suspension of the consumption tax on food.

Prime Minister Takaichi later elaborated on her comments in a post on X, stating her goal was not to praise a weak or strong yen but to "build a strong economy that is resilient to exchange rate fluctuations." She pushed back on the interpretation that she "stress[ed] the benefits of yen depreciation" but did not address her remarks about the special account.

As Takaichi noted, a weak yen has both pros and cons. It boosts the profits of Japanese exporters and can lift stock prices. However, it also drives up the cost of imported energy, food, and raw materials, fueling inflation. In recent years, Japan's export volume has stagnated even as the yen has weakened.

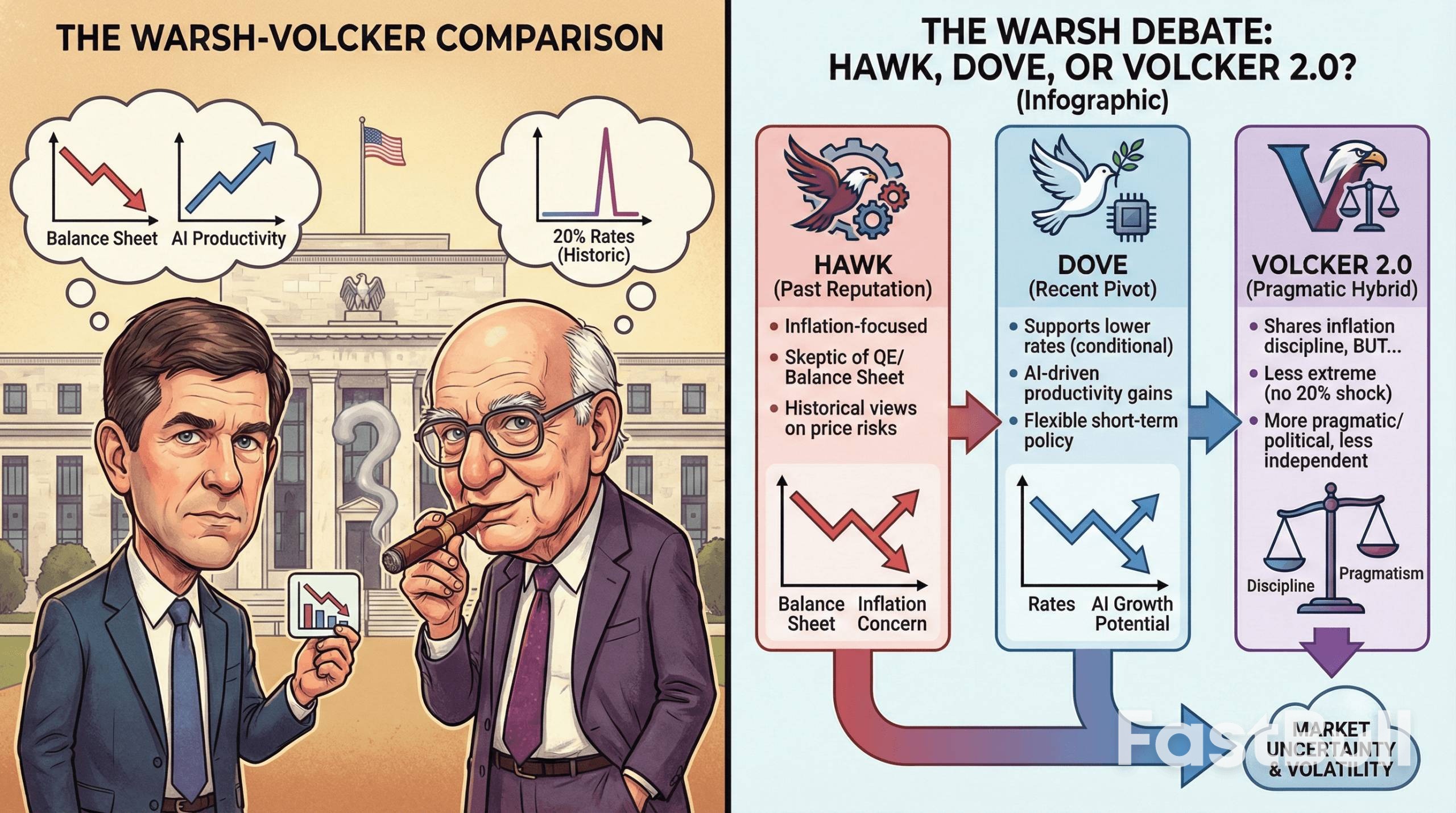

Investors are trading the nomination of Kevin Warsh for Federal Reserve Chair as if Paul Volcker himself just walked back into the Eccles Building. But is Warsh truly the inflation hawk his reputation suggests? The answer is far more complicated.

President Trump announced the nomination on January 30, 2026, positioning Warsh as a figure who can restore discipline at the central bank as Jerome Powell's term ends in May. The move comes after Trump's repeated criticism of the Fed's rate policy and independence, placing Warsh’s monetary philosophy squarely in the spotlight.

Warsh’s record provides ample fuel for the hard-money narrative. As a Fed governor from 2006 to 2011, he built a reputation as one of the board's most consistent voices on inflation. Even as the 2008 financial crisis unfolded, pushing unemployment up and sparking fears of deflation, Warsh persistently warned that inflation expectations could become unanchored.

"Inflation risks, in my view, continue to predominate as the greater risk to the economy," he stated at the time.

After leaving the Fed, this view solidified. Warsh became a prominent critic of quantitative easing (QE), arguing that the central bank's expanding balance sheet distorted capital allocation and dangerously blurred the lines between monetary and fiscal policy. He has maintained that inflation isn't a random event but the direct result of excessive spending and money creation.

"My overriding concern about continued QE, then and now, involves the misallocations of capital in the economy and the misallocation of responsibility in our government," Warsh said in 2018.

This history triggered a classic hawkish reaction in markets upon his nomination. Gold and silver sold off, the dollar strengthened, and traders immediately began making comparisons to Volcker.

However, the full picture is more complex. In recent years, Warsh has also criticized Powell’s policy for being too restrictive and hindering economic growth. He has argued for both lower interest rates and a smaller Fed balance sheet, signaling a willingness to cut rates if accompanied by structural reforms.

This dual position has divided analysts.

• One camp sees intellectual consistency: They believe Warsh's goal is to shrink the Fed's overall footprint, which in turn creates the flexibility to ease short-term rates.

• Another camp sees political pragmatism: They suggest Warsh is adapting his views to align with Trump's well-known preference for lower interest rates.

The tension in Warsh's platform fuels comparisons to Paul Volcker, but the analogy has clear limits. Volcker, the Fed's 12th chairman, inherited runaway inflation in the late 1970s and broke its back by raising the federal funds rate above 20%, knowingly inducing a recession to restore the Fed's credibility. Warsh has neither faced such an extreme scenario nor indicated he would deploy similar economic shock therapy.

Furthermore, Volcker was defined by his staunch independence from political pressure. Warsh is widely seen as more pragmatic and attuned to political realities, making it less likely he would wage a public war against the administration that appointed him.

This doesn't make him a dove; it makes him conditional. While Warsh views inflation control as non-negotiable, he also believes productivity gains, particularly from artificial intelligence, could enable lower rates without stoking price pressures. If the economy delivers on that productivity promise, he may appear accommodative. If inflation surges, the hawk would likely reemerge.

Markets are still trying to solve the puzzle. Fed funds futures are pricing in more rate cuts for 2026, even as traders prepare for a potentially faster reduction of the Fed's balance sheet. This suggests the market is bracing for a hybrid Fed—one that is structurally tighter but potentially looser in its rate signaling.

If confirmed, Warsh could also bring back an old-school communication style. This would mean less forward guidance and more emphasis on actions over promises. Such a shift away from verbal interventions could increase market volatility as traders adjust to a central bank that speaks less but acts more decisively.

Ultimately, Warsh is not a simple Volcker successor. He shares a skepticism of easy money but not an appetite for inflicting economic pain. For investors, the message is clear: ignore the simple labels. Warsh is neither a committed hawk nor a predictable dove. He is a pragmatist who believes in credibility and will likely respond to data, not dogma, making his tenure anything but certain.

Key Points on a Warsh-Led Fed

• Hawkish Credentials: Warsh has a long-standing record of prioritizing inflation control and opposing prolonged quantitative easing.

• Dovish Flexibility: He has recently supported lower interest rates, provided they are paired with balance-sheet reduction and productivity gains.

• The Volcker Parallel: He shares Volcker's focus on monetary discipline but likely lacks his predecessor's tolerance for extreme rate hikes and political confrontation.

• Potential Policy Mix: A Warsh-led Fed might combine faster balance-sheet runoff with targeted rate cuts and a less predictable communication strategy.

Czech Prime Minister Andrej Babis is calling for a significant overhaul of the European Union's carbon emissions trading system, arguing that reforms are necessary to curb rising energy prices. In a letter sent to the European Commission, the European Council, and leaders of all 26 member states, Babis outlined proposals aimed at protecting European industry.

The prime minister is actively seeking support for his position ahead of an informal EU summit on February 12, with plans to lobby leaders from countries including France and Italy.

The core of the proposal involves two key changes to the EU's Emissions Trading System (ETS). Babis insists it is necessary to cap the cost of carbon allowances "to prevent excessive price increases and the relocation of industry from Europe." He highlighted that current allowance prices have far exceeded earlier forecasts, placing a heavy burden on the region's industrial sector.

Additionally, the letter calls for delaying the next phase of the carbon market, known as ETS2. This expansion would apply the emissions trading scheme to buildings and transport. Babis has requested that its rollout be postponed until at least 2030. This comes after the EU had already moved the launch date from 2027 to 2028.

The EU's Emissions Trading System is the bloc's primary policy tool for reducing CO2 emissions. Launched in 2005, the system operates on a "cap and trade" principle:

• It sets a cap on the total amount of greenhouse gases that can be emitted by covered sectors.

• Companies receive or buy emission allowances, which they can trade.

• For every ton of carbon they produce, industries and power plants must surrender an allowance.

This mechanism is designed to create a financial incentive for companies to invest in low-carbon technologies and shift toward cleaner production methods. On Monday, EU carbon prices were trading around 81 euros per metric ton of CO2, having briefly touched 90 euros in mid-January.

The proposal highlights a growing rift within the EU over its climate policy. While many factors contribute to Europe's high energy costs—including fuel prices, underinvestment in grids, and national taxes—the ETS has become a major point of contention.

Countries like Poland have long argued that EU carbon prices are excessively high and have called on Brussels to intervene. They contend that the market is being driven by financial speculation rather than genuine demand from industries.

However, other EU nations maintain that a strong carbon price is essential for meeting climate targets. From their perspective, the higher cost of emissions provides a critical incentive for the private sector to invest in the green transition and move away from fossil fuels.

Here we go again.

The government shutdown, which should be lifted in 24-48 hours once the House votes (we reported yesterday that Mike Johnson allegedly has the votes to pass the vote), is again jamming the machinery of government data reporting.

The BLS has pushed back the January 2026 jobs report, originally set for Feb 6, along with December's Job Openings and Labor Turnover Survey and Metropolitan Area Employment data.

"The release will be rescheduled upon the resumption of government funding," Emily Liddel, an associate commissioner at BLS, said in a statement. "Due to the partial federal government shutdown, the Bureau of Labor Statistics will suspend data collection, processing, and dissemination."

The Bureau of Labor Statistics will announce new release dates once funding is restored.

Former U.S. President Donald Trump announced on Monday that he plans to lower tariffs on Indian goods following a conversation with Prime Minister Narendra Modi. According to Trump, the deal hinges on India agreeing to stop purchasing Russian oil and instead potentially buying it from Venezuela.

The announcement marks a potential shift in trade policy, following months of pressure from Trump on India to reduce its reliance on discounted Russian crude.

Trump detailed the arrangement on his Truth Social platform, outlining specific commitments from both sides. The core components of the deal include:

• U.S. Tariff Reduction: The United States would lower its reciprocal tariff rate on Indian products from 25% down to 18%.

• India's Concessions: India would reportedly stop buying Russian oil, reduce its own import taxes on U.S. goods to zero, and purchase $500 billion worth of American products.

Trump presented the agreement as a gesture of goodwill, citing his "friendship and respect" for Prime Minister Modi.

Trump framed the deal as a strategic move aimed at resolving the conflict in Ukraine. In his social media post, he claimed the agreement would have a direct impact on the war.

"This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!" Trump wrote.

Since Russia's invasion of Ukraine in February 2022, India has become a significant buyer of discounted Russian oil. As many Western nations sought to isolate Moscow financially, India capitalized on the lower prices to build up its energy supplies, providing Russia with a critical source of revenue to fund its war effort.

Historically, the India-Russia relationship has been more focused on defense than energy. Russia has long been the primary supplier of military hardware to India, while accounting for only a small fraction of its oil imports before the war.

The recent energy trade has been a point of contention. In June, Trump announced a 25% tariff on goods from India, along with an additional import tax, directly citing the country's continued purchasing of Russian oil. This new deal, if realized, would reverse that policy, despite Trump and Modi having maintained a historically warm relationship.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up