Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

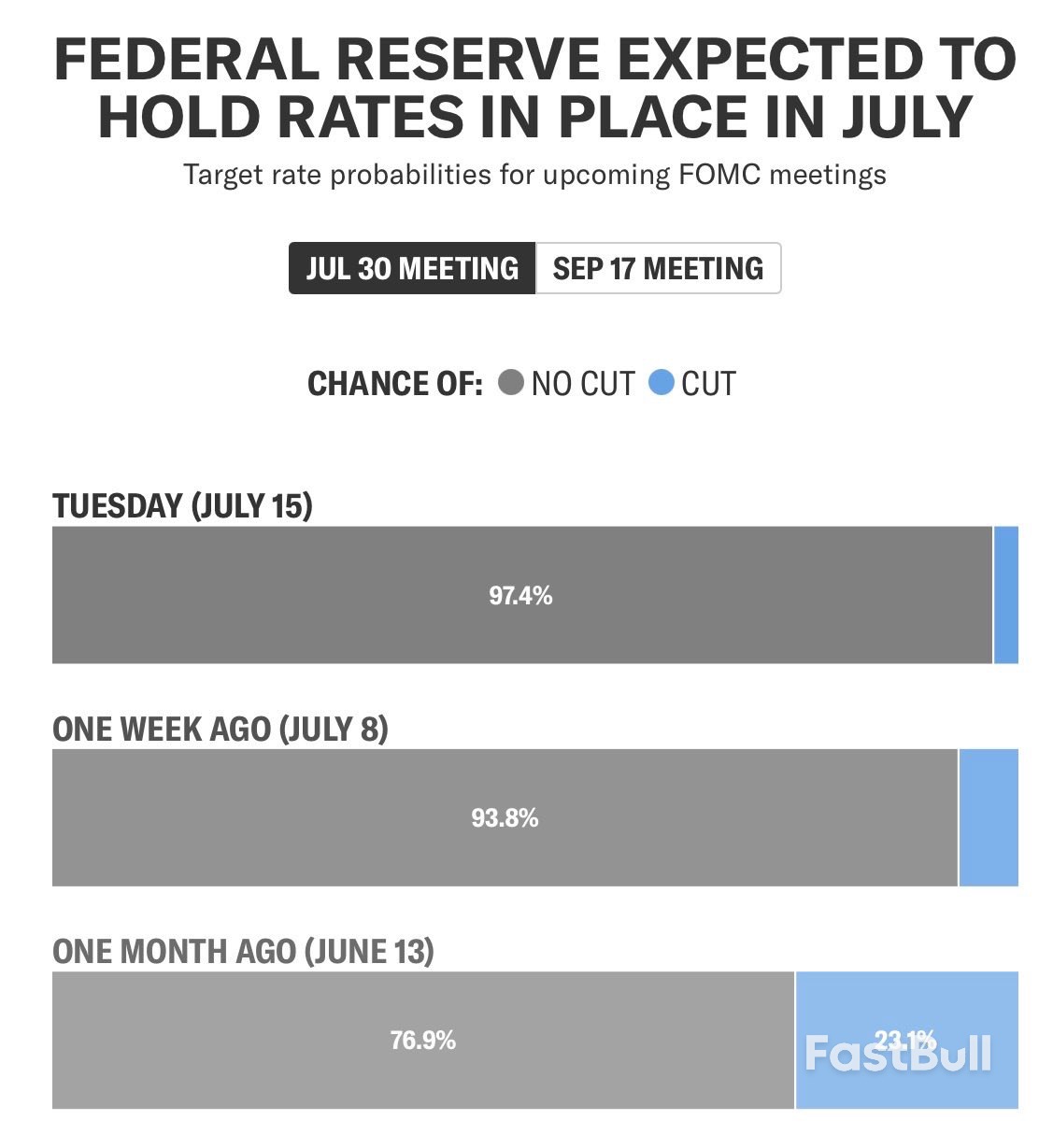

Minutes from its June policy meeting revealed a split committee, with "most" officials supporting at least one rate cut this year while "a couple" signaled they'd be open to moving as early as July.

U.S. Treasury Secretary Scott Bessent confirmed on Tuesday that a "formal process" is underway to find a potential successor to Federal Reserve Chairman Jerome Powell.

In an interview with Bloomberg Surveillance, Bessent remarked, "There are a lot of great candidates, and we’ll see how rapidly it progresses."

He also noted that it would be confusing for Powell to stay on at the Federal Reserve after his term as chair concludes.

Since last month President Donald Trump has intensified his criticism of Federal Reserve Chairman Jerome Powell, repeatedly accusing him of mismanaging monetary policy and calling for aggressive interest rate cuts.

Trump has argued that Powell is acting too slowly to respond to economic conditions and said, “Maybe I should go to the Fed… Am I allowed to appoint myself at the Fed? I'd do a much better job than these people.”

He has labeled Powell with a series of insults, calling him “stupid,” “too late,” “a numbskull,” and demanding the Fed slash rates by a full percentage point to stimulate the economy.

Trump’s attacks continued into July, growing even sharper. On July 8, he declared that Powell “should resign immediately.” A few days later, he criticized Powell over cost overruns tied to a $2.5 billion renovation project at the Federal Reserve, referring to him as a “knucklehead” and “stupid guy.”

Last week, Office of Management and Budget Director Russell Vought also criticized Federal Reserve Chair Jerome Powell for a renovation project he called “too lavish,” referring to it as “Versailles on the National Mall.”

On CNBC, Vought cited “fundamental mismanagement” at the Fed.

Meanwhile, National Economic Council Director Kevin Hassett, a potential successor to Powell, added, “If there is cause to fire Powell, Trump has the authority to do so.” The criticism appeared coordinated, with other figures like Fed candidate Kevin Warsh and Vice President J.D. Vance joining in.

Trump also reiterated his demand for rates to be cut to around 1%. Members of his team suggested they might review the renovation project as a possible justification to remove Powell “for cause.”

The “major statement” on Russia that Trump earlier hyped up turned out to be a clumsy attempt to thread the needle between radically escalating US involvement in the Ukrainian Conflict and walking away from it. His new three-pronged approach includes:

1) the rapid dispatch of up to 17 Patriot missile systems to Ukraine;

2) more arms sales to NATO countries who’ll in turn transfer them to Ukraine; and

3) up to 100% secondary sanctions on Russia’s trading partners if a peace deal isn’t reached in 50 days.

In the order that they were mentioned, each corresponding move is aimed at:

1) bolstering Ukraine’s air defenses in order to decelerate the pace of Russia’s continual on-the-ground gains;

2) helping Ukraine reconquer some of its lost land; and

3) coercing China and India into pressuring Russia into a ceasefire.

The first two goals are self-explanatory, with the second being unrealistic given the failure of Ukraine’s much more heavily armed counteroffensive in summer 2023, while the third requires some elaboration.

China and India’s large-scale imports of discounted Russian oil have served as crucial valves from Western sanctions pressure by helping to stabilize the ruble and thus Russia’s economy in general. Even though these imports also help their own economies, Trump is wagering that they’ll at the very least curtail them in order to avoid his threatened 100% secondary sanctions. He might make an exception for the Europeans and Turks, who also purchase Russian resources, on the pretext of them arming Ukraine.

By focusing on Russia’s two largest energy importers, Trump is trying to greatly reduce the budgetary revenue that the Kremlin receives from these sales while sowing further divisions within the RIC core of BRICS and the SCO, expecting as he is that at least China or India will partially comply at minimum. Prior to his deadline, he envisages that their leaders – who are years-long close friends with Putin – will try to pressure him into the ceasefire that the West wants, though it’s unknown whether they’d succeed.

In any case, Trump is poised to place himself in a dilemma entirely of his own making if one of them doesn’t comply with his demand to stop trading with Russia, or if one or both only do so in part. He’d either have to delay the imposition of his threatened 100% secondary sanctions on all their imports, lower the level, or reduce the scale to only apply to their companies that still trade with Russia otherwise there could be serious blowback, especially if China is the one that doesn’t fully comply.

His preliminary trade agreement with China, which he described in early May as a “total reset” in their ties, could collapse and thus raise prices across the board for Americans. As regards India, their ongoing trade talks could collapse too, which could create an opening for advancing the nascent Sino-Indo rapprochement whose existence was cautiously confirmed by its top diplomat on Monday. Each case of blowback, let alone both of them at the same time, could be very detrimental to American interests.

Trump’s attempt to thread the needle therefore isn’t just clumsy, but it could also majorly backfire, thus raising the question of why he agreed to do so.

It looks like he was misled into thinking that Putin would agree to a ceasefire that doesn’t resolve the root security-related causes of the conflict in exchange for a resource-centric strategic partnership.

When Putin declined, Trump took it personally and imagined that Putin was playing him, which led to Trump’s advisors manipulating him into this escalation as vengeance.

President Donald Trump has taken to routinely maligning Federal Reserve Chair Jerome Powell as “too late” because interest rates have been on hold at 4.25%-4.5% since he took office. On Tuesday alone, he characteristically took to social media to demand three percentage points of rate cuts — something that is never going to happen outside of a recession. Trump’s needling aside, the latest inflation data show that Powell’s wait-and-see approach is the exact right tack for today’s economic outlook.

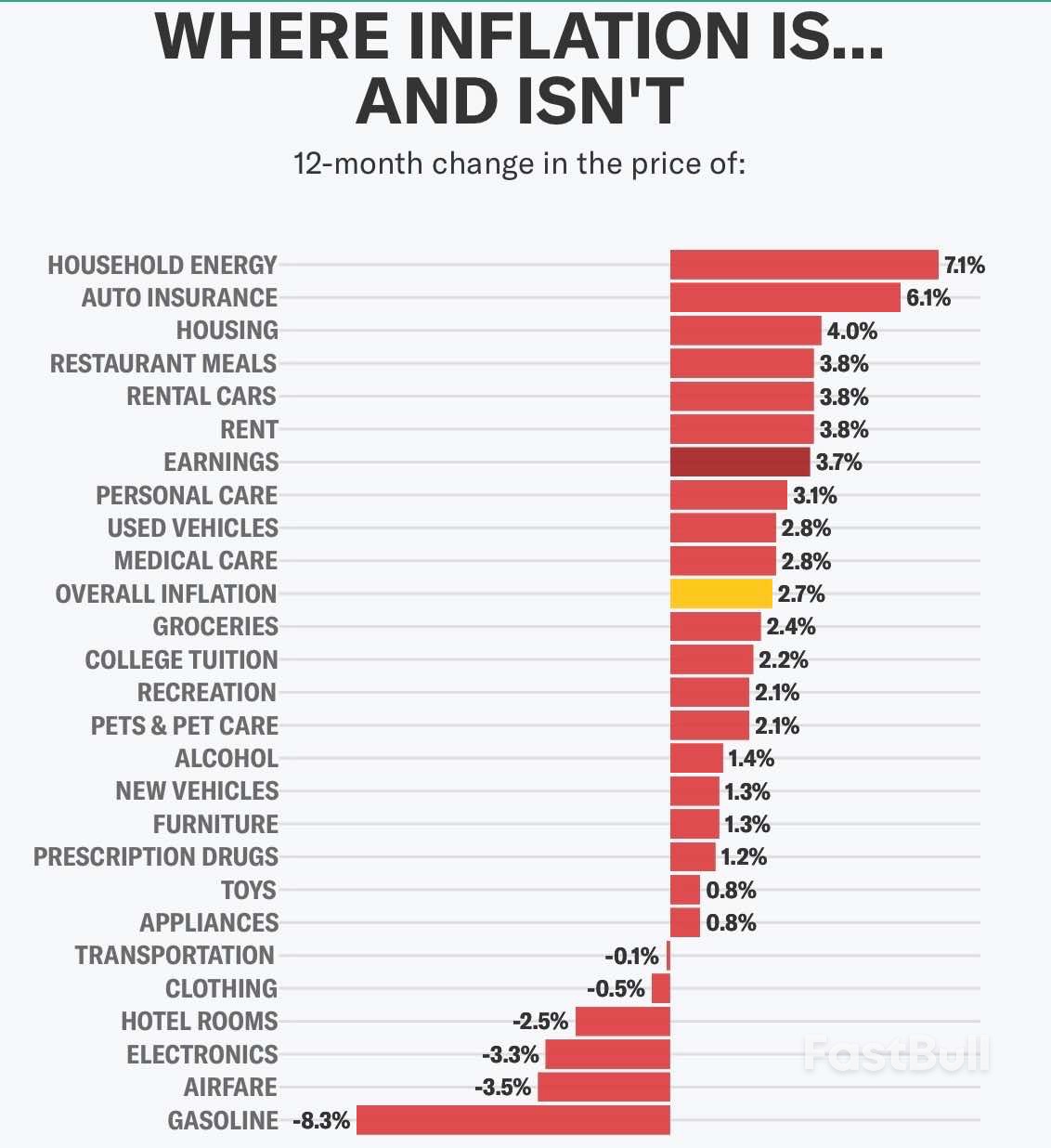

The Bureau of Labor Statistics said Tuesday that the core consumer price index rose 0.2% in June from a month earlier, a slightly encouraging surprise that leaves the year-over-year rate at 2.9%. But the reading remains well above the Fed’s 2% target, and the details of the report show that tariffs are starting to fan higher prices and that larger effects might start to feed through over the next couple of months.

More specifically, core goods rose 0.2% in June from a month earlier, the most brisk pace since February, driven in large part by a jump in household furnishings and supplies — a telltale sign of tariff passthrough. That category (think appliances, rugs, housekeeping supplies, etc.) jumped by 1% from the prior month, the biggest such increase since January 2022. Also notching the biggest month-on-month jump since 2022 were recreation commodities (sporting goods, toys, video equipment, etc.). Not only were tariff impacts undeniable this month, they appeared to be broadening out from what had been a very light and scattered influence in previous months’ data.

Still, this was neither a month to panic nor celebrate. With the backdrop of a steady unemployment rate, it’s time to do as the embattled Fed chair — whom Trump has committed to replacing when his term is up next year — has been advising all along: Wait for more data.

Among Fed policymakers and private sector economists, the general view of tariffs has been that they would hit sometime over the summer. For starters, Trump’s biggest and broadest tariff salvo didn’t come until April. Goldman Sachs Group Inc. economists estimate that it takes about a month for many imports to reach US shores, and goods were exempt if they were already on the ship at the time of the “Liberation Day” duties. What’s more, businesses stockpiled inventory in advance of the deadline and Customs and Border Protection allows many importers to delay payments for up to a month and a half. Hence, many forecasters expected June to be the start of a tariff-impact story that could become more evident in July and August.

Powell has been broadly in that camp. At the post-decision press conference in June, he said that he expected to learn more “over the summer” about tariffs. “We hadn’t expected them to show up much by now, and they haven’t,” he said. “And we will see the extent to which they do over coming months.” In markets, his comments have been broadly interpreted to mean that further rate cuts were possible (though hardly guaranteed) as soon September, and that still feels appropriate. By that time, the committee will have additional inflation data in hand for the months of July and August.

Unfortunately, Trump has used his social media platform to advocate for more immediate cuts, and his Council of Economic Advisers recently published an analysis that found no evidence that tariffs have caused “any economically meaningful inflation.” Inflation Insights President Omair Sharif wrote Monday that the CEA had gotten ahead of itself. “Setting aside the methodology for a moment, if the main point of the CEA’s analysis is to suggest that tariffs are not impacting inflation, then I think they’ve spiked the ball at the 50-yard line,” he said.

It’s entirely possible, of course, that tariff impacts could spread further and that the Fed will still lower policy rates. The central bank doesn’t have to wait for inflation to return to 2% to start lowering rates again; rates are clearly at a level that the median Fed policymaker would deem restrictive. Powell and his colleagues just need to gain confidence that it remains on the right trajectory.

Furthermore, tariffs are generally seen as a one-off increase in prices — the sort of supply shock that monetary policy orthodoxy would tell you to “look through.” The ultimate question as it pertains to trade policy is whether tariffs will shock expectations to such an extent that inflation gets back into the bones of the economy. That may depend on both the magnitude of the tariff impacts and their duration. And all of those variables depend, in turn, on whether Trump decides to temper the policies — as he’s occasionally proved willing to do, especially when financial markets react badly.

To some extent, monetary policy will also depend on what happens with other key categories in the inflation basket. Among major imported goods, the auto sector is a big question mark. While tariffs are driving up car prices and threatening profit margins, the government data showed that prices of both new and used vehicles fell in June from May — a reminder that the duties aren’t the only consideration. Dealers are also contending with high borrowing costs and a general affordability crunch that’s weighing on demand. Many are uncertain about whether they can increase prices without hitting customer traffic and market share.

What’s more, it’s important to remember that core services — which aren’t directly impacted by the tariffs — still constitute about three quarters of core CPI and about two thirds of inflation overall. As such, it’s plausible that services disinflation could mitigate the jumps in certain core goods prices, especially if shelter inflation remains as tame as it’s been for the better part of 2025. With all the crosscurrents, the responsible solution is for policymakers to wait for more evidence, and that’s exactly what the Fed is doing under Powell’s stewardship. No matter what the partisans around the White House say, the chairman is handling tariff uncertainty about as well as you could ask for.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up